Jumbo and Super jumbo mortgages both exceed conforming loan limits but differ primarily in loan size, with Super jumbo loans catering to borrowers seeking amounts significantly higher than Jumbo limits. Jumbo loans typically serve high-value properties that fall just above conventional loan thresholds, while Super jumbo loans accommodate luxury real estate and ultra-high-priced markets with greater underwriting scrutiny. Understanding the distinctions in down payment requirements, interest rates, and credit qualifications helps borrowers select the best financing option for large-scale property investments.

Table of Comparison

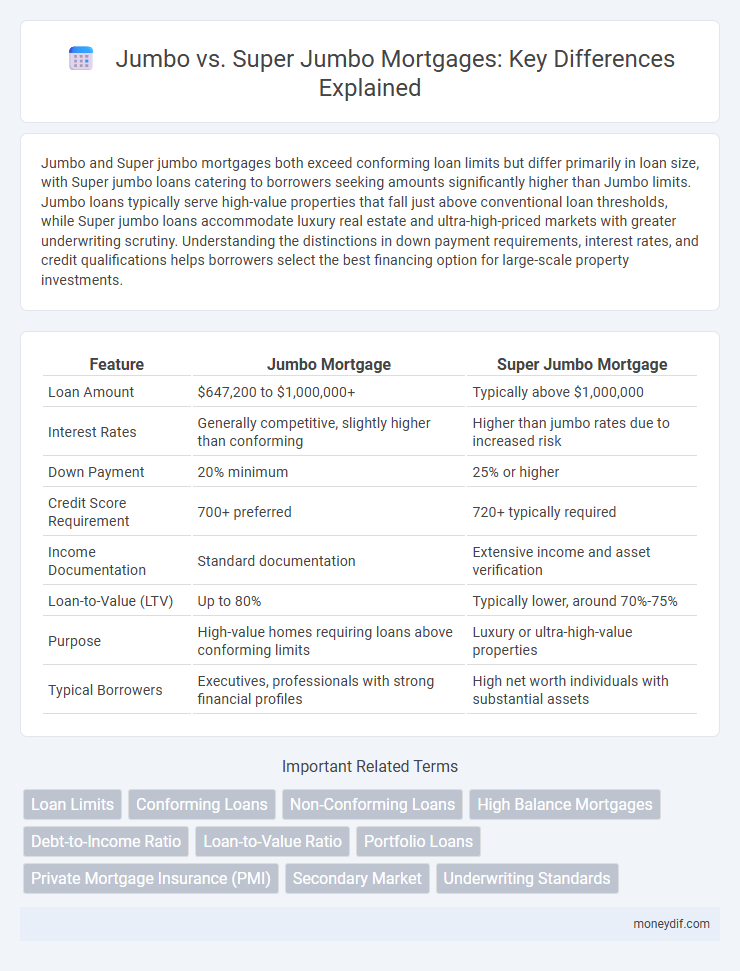

| Feature | Jumbo Mortgage | Super Jumbo Mortgage |

|---|---|---|

| Loan Amount | $647,200 to $1,000,000+ | Typically above $1,000,000 |

| Interest Rates | Generally competitive, slightly higher than conforming | Higher than jumbo rates due to increased risk |

| Down Payment | 20% minimum | 25% or higher |

| Credit Score Requirement | 700+ preferred | 720+ typically required |

| Income Documentation | Standard documentation | Extensive income and asset verification |

| Loan-to-Value (LTV) | Up to 80% | Typically lower, around 70%-75% |

| Purpose | High-value homes requiring loans above conforming limits | Luxury or ultra-high-value properties |

| Typical Borrowers | Executives, professionals with strong financial profiles | High net worth individuals with substantial assets |

Understanding Jumbo and Super Jumbo Mortgages

Jumbo mortgages exceed the conforming loan limits set by Fannie Mae and Freddie Mac, usually starting around $647,200 but varying by region, making them ideal for purchasing high-value properties. Super jumbo mortgages surpass standard jumbo loan limits, often starting at $1 million or more, catering to ultra-luxury real estate buyers needing larger financing amounts. Both loan types demand stricter credit requirements, higher down payments, and typically carry higher interest rates due to increased lending risks.

Key Differences: Jumbo vs. Super Jumbo Loans

Jumbo loans typically exceed conforming loan limits, ranging from $647,200 to about $750,000, while super jumbo loans start around $750,000 and can surpass $3 million. Key differences include stricter credit score requirements, lower debt-to-income ratios, and higher down payment thresholds for super jumbo loans due to increased lender risk. Interest rates on super jumbo loans often fluctuate more compared to jumbo loans, reflecting their higher risk and loan amount.

Qualification Requirements for Jumbo and Super Jumbo Loans

Jumbo loans typically require a credit score of at least 700, a debt-to-income ratio below 43%, and a down payment of 20% or more, while super jumbo loans demand even higher credit scores, often above 720, stricter debt-to-income limits around 40%, and down payments starting at 25%. Lenders scrutinize income documentation, employment stability, and asset reserves more rigorously for super jumbo loans due to the increased risk associated with loan amounts exceeding $1.5 million. Borrowers seeking super jumbo loans must meet these heightened qualification requirements to secure approval and favorable interest rates in high-value real estate markets.

Loan Limits: What Sets Super Jumbo Apart?

Jumbo loans typically exceed conforming loan limits set by the Federal Housing Finance Agency (FHFA) and often range between $647,200 and $1 million, depending on the region. Super jumbo loans surpass standard jumbo limits, generally starting around $1.5 million and going significantly higher to accommodate luxury property purchases. The higher loan limits for super jumbo mortgages reflect greater lender risk, resulting in more stringent credit criteria and higher interest rates.

Interest Rates: Jumbo vs. Super Jumbo Mortgages

Jumbo mortgage interest rates typically range from 0.25% to 0.50% higher than conforming loans, reflecting the increased risk lenders assume with larger loan amounts, often between $726,200 and $2 million. Super jumbo mortgages, which exceed $2 million, generally carry even higher interest rates, sometimes up to 0.75% more than jumbo loans, due to their greater lending risk and limited secondary market options. Borrowers' credit scores, down payment sizes, and debt-to-income ratios significantly influence the final interest rate offered on both jumbo and super jumbo mortgages.

Down Payment Expectations for High-Value Loans

Jumbo loans typically require a down payment of 20% or more, while super jumbo loans often demand higher down payments, ranging from 25% to 30%, due to their increased loan amounts exceeding $1.5 million. Lenders impose these stricter down payment expectations to mitigate risk associated with high-value properties. Borrowers seeking super jumbo loans should be prepared for more substantial upfront capital requirements compared to standard jumbo loan thresholds.

Credit Score and Income Criteria Comparison

Jumbo loans generally require a credit score of at least 700, while super jumbo loans often demand higher scores, typically 720 or above, reflecting increased lender risk in high-value financing. Income verification criteria for jumbo loans focus on stable, documented income sources that support monthly payments, whereas super jumbo loans scrutinize income with greater rigor, including extensive documentation and higher debt-to-income ratio standards. lenders differentiate between these loan types to mitigate risk on larger principal balances, ensuring borrowers demonstrate robust financial stability.

Pros and Cons of Jumbo and Super Jumbo Mortgages

Jumbo mortgages offer competitive interest rates and greater purchasing power for high-value properties but often require larger down payments and stricter credit criteria. Super jumbo loans accommodate ultra-high loan amounts exceeding typical jumbo limits, providing access to luxury real estate, yet they carry higher interest rates and more stringent underwriting standards. Both types of loans demand robust financial documentation, with super jumbo mortgages typically involving more complex qualification processes and increased lender risk.

Choosing the Right Mortgage for Luxury Homebuyers

Luxury homebuyers often face the decision between jumbo and super jumbo mortgages, where jumbo loans typically exceed conforming loan limits up to $726,200, while super jumbo loans cover amounts exceeding $1 million. Selecting the right mortgage depends on the property's price, borrower's credit profile, and down payment capacity, with super jumbo loans often requiring more stringent underwriting and larger reserves. Evaluating interest rates, loan terms, and lender experience with high-value properties ensures optimal financing for purchasing luxury real estate.

Frequently Asked Questions: Jumbo vs. Super Jumbo Loans

Jumbo loans typically cover amounts above conforming loan limits set by Fannie Mae and Freddie Mac, usually starting at $726,200 but varying by location, while super jumbo loans exceed $1 million or more. Borrowers seeking jumbo or super jumbo loans must demonstrate stronger credit profiles, higher income, and larger down payments due to increased lender risk. Interest rates on super jumbo loans often carry a premium compared to standard jumbo loans, reflecting the larger loan size and investor appetite.

Important Terms

Loan Limits

Jumbo loans exceed conforming loan limits set by the Federal Housing Finance Agency, typically surpassing $726,200 in high-cost areas, while super jumbo loans represent an even higher tier, often starting around $1.5 million or more. These elevated loan limits require stricter underwriting criteria and larger down payments due to increased risk for lenders.

Conforming Loans

Conforming loans adhere to Fannie Mae and Freddie Mac limits, typically maxing out around $726,200 in most U.S. counties, while jumbo loans exceed these limits and generally range up to $1 million. Super jumbo loans surpass the jumbo loan threshold, often starting above $1.5 million, catering to high-net-worth borrowers requiring larger financing for luxury properties or investments.

Non-Conforming Loans

Non-conforming loans exceed conventional loan limits set by Fannie Mae and Freddie Mac, with jumbo loans typically ranging from $726,200 to $1 million, while super jumbo loans surpass $1 million, often reaching $2 million or more. These loans carry higher interest rates and stricter underwriting criteria due to increased risk and require substantial borrower qualifications, including strong credit scores and significant income verification.

High Balance Mortgages

High balance mortgages typically refer to loan amounts that exceed conforming loan limits but remain below jumbo loan thresholds, whereas jumbo loans surpass those standard limits and super jumbo mortgages extend even higher, often exceeding $1.5 million. Borrowers opting for super jumbo loans face more stringent underwriting criteria, higher interest rates, and larger down payment requirements compared to high balance and standard jumbo mortgages.

Debt-to-Income Ratio

Debt-to-Income (DTI) ratio plays a crucial role in determining eligibility for Jumbo and Super Jumbo loans, with lenders typically requiring a lower DTI for Super Jumbo loans due to the higher loan amounts exceeding $1.5 million. Jumbo loans usually permit a DTI up to 43%, while Super Jumbo loans often demand stricter ratios, commonly below 38%, reflecting the increased risk associated with larger mortgage balances.

Loan-to-Value Ratio

Loan-to-Value (LTV) ratios for jumbo loans typically range up to 80%, while super jumbo loans often have stricter LTV limits, usually around 70% to 75%, due to higher risk associated with larger loan amounts. Lenders require lower LTV ratios for super jumbo loans to mitigate default risk and protect their investment in high-value properties.

Portfolio Loans

Portfolio loans are mortgage loans held by lenders instead of being sold on the secondary market, allowing for more flexible underwriting standards. Jumbo loans typically exceed conforming loan limits up to around $1 million, whereas super jumbo loans surpass this threshold, often starting at $1.5 million or higher, catering to high-net-worth borrowers requiring larger loan amounts.

Private Mortgage Insurance (PMI)

Private Mortgage Insurance (PMI) is typically required for conventional loans when the down payment is less than 20%, but Jumbo loans, which exceed conforming loan limits set by the Federal Housing Finance Agency, often have higher PMI requirements or may require lender-paid mortgage insurance due to increased risk. Super Jumbo loans, which surpass standard Jumbo loan limits, generally involve even stricter PMI criteria or alternative risk mitigation strategies, resulting in higher premiums or the necessity for substantial borrower equity.

Secondary Market

The secondary market for mortgage-backed securities categorizes loans as Jumbo or Super Jumbo based on loan size, impacting liquidity and investor demand. Super Jumbo loans typically exceed $1 million, attracting specialized investors due to higher risk and return profiles compared to Jumbo loans below this threshold.

Underwriting Standards

Underwriting standards for jumbo loans typically require a minimum credit score of 700, a debt-to-income ratio below 43%, and reserves covering at least six months of mortgage payments, while super jumbo loans--often exceeding $1.5 million--demand even stricter criteria including credit scores above 720, lower debt-to-income ratios below 36%, and substantial liquid assets reflecting higher risk. Loan-to-value ratios for jumbo loans generally max out at 80%, whereas super jumbo loans often require lower LTVs of 70% or less to mitigate potential default risks.

Jumbo vs Super jumbo Infographic

moneydif.com

moneydif.com