A recourse loan allows lenders to pursue the borrower's other assets if the collateral property's sale does not cover the outstanding mortgage balance. In contrast, a non-recourse loan limits the lender's recovery to the collateral property alone, protecting the borrower's additional assets from claims. Understanding the distinction between recourse and non-recourse loans is crucial for managing financial risk in mortgage agreements.

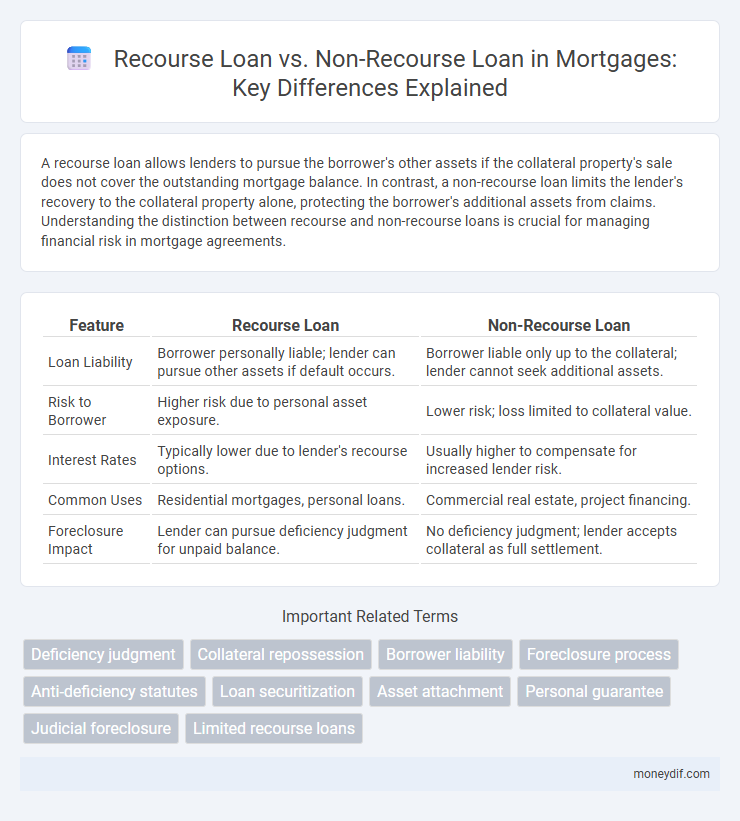

Table of Comparison

| Feature | Recourse Loan | Non-Recourse Loan |

|---|---|---|

| Loan Liability | Borrower personally liable; lender can pursue other assets if default occurs. | Borrower liable only up to the collateral; lender cannot seek additional assets. |

| Risk to Borrower | Higher risk due to personal asset exposure. | Lower risk; loss limited to collateral value. |

| Interest Rates | Typically lower due to lender's recourse options. | Usually higher to compensate for increased lender risk. |

| Common Uses | Residential mortgages, personal loans. | Commercial real estate, project financing. |

| Foreclosure Impact | Lender can pursue deficiency judgment for unpaid balance. | No deficiency judgment; lender accepts collateral as full settlement. |

Understanding Recourse Loans: Key Features

Recourse loans allow lenders to pursue the borrower's other assets beyond the collateral if the loan defaults, providing greater security for lenders. Key features include personal liability, enabling lenders to seek deficiency judgments to recover unpaid balances. Borrowers face increased financial risk due to potential asset seizure beyond the mortgage property.

What Is a Non-Recourse Loan?

A non-recourse loan is a type of mortgage where the lender's recovery is limited to the collateral securing the loan, typically the property itself, without the borrower being personally liable for any shortfall. If the borrower defaults, the lender can seize and sell the property but cannot pursue the borrower's other assets or income for repayment. This loan structure is common in commercial real estate and offers borrowers protection from personal financial risk beyond the pledged collateral.

Major Differences Between Recourse and Non-Recourse Loans

Recourse loans allow lenders to pursue a borrower's other assets beyond the collateral if the loan defaults, making the borrower personally liable for repayment. Non-recourse loans limit the lender's recovery to the collateral itself, protecting the borrower's other assets from claims. The major difference lies in the risk exposure to the borrower, with recourse loans presenting higher personal financial risk compared to non-recourse loans.

How Recourse Loans Impact Borrower Liability

Recourse loans hold borrowers personally liable, meaning lenders can pursue assets beyond the collateral property if the loan defaults. This increased liability risk motivates borrowers to maintain timely payments and carefully evaluate loan terms before agreement. In contrast, non-recourse loans limit lender recovery strictly to the property, reducing borrower risk but often resulting in higher interest rates.

Protections Offered by Non-Recourse Loans

Non-recourse loans protect borrowers by limiting lender recovery solely to the collateral property, shielding personal assets from deficiency judgments if the borrower defaults. This type of loan offers significant financial security by eliminating the risk of personal liability beyond the secured property's value. Non-recourse loans are often preferred in real estate investments where asset protection is crucial.

Recourse vs Non-Recourse: Risk Analysis for Borrowers

Recourse loans expose borrowers to personal liability, meaning lenders can pursue assets beyond the collateral if the loan defaults, increasing financial risk. Non-recourse loans limit lender recovery strictly to the collateral, shielding borrowers' other assets but often resulting in higher interest rates and stricter qualification criteria. Understanding this key distinction helps borrowers assess potential personal financial exposure and tailor mortgage choices to their risk tolerance.

Common Use Cases: When Each Loan Type is Preferred

Recourse loans are commonly preferred by lenders and borrowers in residential mortgages where borrower accountability for full debt repayment encourages higher loan approval chances and lower interest rates. Non-recourse loans are often used in commercial real estate and investment properties, limiting borrower liability to the collateral and reducing personal financial risk if property value drops. Real estate investors favor non-recourse loans to protect personal assets, while homeowners typically choose recourse loans for better loan terms and credit-building opportunities.

Lender Perspectives: Assessing Risk in Both Loan Types

Lenders view recourse loans as lower risk due to the borrower's personal liability, enabling pursuit of assets beyond collateral in case of default, which increases loan recovery potential. Non-recourse loans limit lender recovery strictly to the collateral, elevating default risk but often come with higher interest rates to offset potential losses. Risk assessment in these loan types involves analyzing borrower creditworthiness, collateral value, and market conditions to balance potential return against default exposure.

Impact on Foreclosure and Debt Recovery

Recourse loans allow lenders to pursue the borrower's other assets beyond the foreclosed property if the sale does not cover the outstanding debt, increasing the risk for borrowers. Non-recourse loans limit the lender's recovery to the collateral property only, protecting borrowers from further financial liability after foreclosure. This distinction heavily influences borrower risk exposure and lender strategy in debt recovery during foreclosure proceedings.

Choosing the Right Loan Type for Your Mortgage Needs

Choosing the right loan type for your mortgage involves understanding the key differences between recourse and non-recourse loans. Recourse loans allow lenders to pursue your other assets if you default, offering lower interest rates but higher personal risk, while non-recourse loans limit lender claims to the collateral property, reducing personal liability but often carrying higher interest rates. Analyzing your financial stability, risk tolerance, and long-term investment goals helps determine whether the security of a non-recourse loan or the cost-effectiveness of a recourse loan best fits your mortgage needs.

Important Terms

Deficiency judgment

A deficiency judgment arises when the foreclosure sale proceeds on a recourse loan are insufficient to cover the outstanding debt, allowing the lender to pursue the borrower for the remaining balance. Non-recourse loans limit the lender's recovery to the collateral only, preventing any deficiency judgments against the borrower.

Collateral repossession

Collateral repossession occurs when a borrower defaults on a recourse loan, allowing the lender to seize assets and pursue remaining debt, whereas in a non-recourse loan, the lender can only claim the collateral without seeking further compensation.

Borrower liability

Borrower liability in recourse loans involves personal responsibility for outstanding debt, allowing lenders to pursue borrower assets beyond collateral in case of default, whereas non-recourse loans limit lender recovery strictly to the collateral, shielding the borrower from further financial obligation. Understanding the distinction is essential for risk assessment and financial planning in real estate and commercial lending.

Foreclosure process

The foreclosure process varies significantly between recourse loans and non-recourse loans, as recourse loans allow lenders to pursue the borrower's other assets beyond the collateral to recover the full debt, while non-recourse loans limit recovery strictly to the collateral property. This distinction impacts the borrower's financial liability and the lender's collection strategy during default and foreclosure proceedings.

Anti-deficiency statutes

Anti-deficiency statutes limit lenders' ability to pursue borrowers for remaining loan balances after foreclosure in non-recourse loans, whereas recourse loans allow lenders to seek deficiency judgments beyond the collateral.

Loan securitization

Loan securitization transforms pools of recourse loans, which hold borrowers personally liable, and non-recourse loans, limited to collateral claims, into marketable securities to distribute risk and enhance liquidity.

Asset attachment

Asset attachment in recourse loans allows lenders to pursue borrower's personal assets beyond collateral, whereas non-recourse loans limit lender claims strictly to the attached asset securing the loan.

Personal guarantee

A personal guarantee typically applies to recourse loans, making the borrower personally liable for repayment, whereas non-recourse loans limit the lender's recovery to the collateral without involving the borrower's personal assets.

Judicial foreclosure

Judicial foreclosure typically involves recourse loans, allowing lenders to pursue borrowers' personal assets beyond the collateral, whereas non-recourse loans limit recovery strictly to the foreclosed property.

Limited recourse loans

Limited recourse loans restrict lender claims to specific collateral, offering less borrower liability than recourse loans but more than non-recourse loans that limit repayment solely to the pledged assets.

Recourse Loan vs Non-Recourse Loan Infographic

moneydif.com

moneydif.com