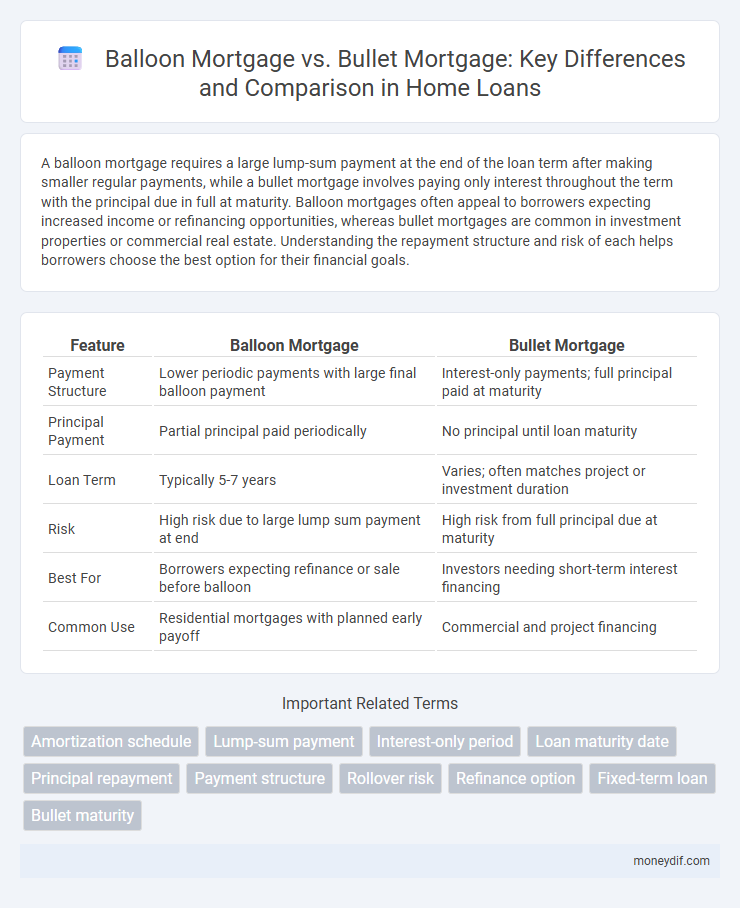

A balloon mortgage requires a large lump-sum payment at the end of the loan term after making smaller regular payments, while a bullet mortgage involves paying only interest throughout the term with the principal due in full at maturity. Balloon mortgages often appeal to borrowers expecting increased income or refinancing opportunities, whereas bullet mortgages are common in investment properties or commercial real estate. Understanding the repayment structure and risk of each helps borrowers choose the best option for their financial goals.

Table of Comparison

| Feature | Balloon Mortgage | Bullet Mortgage |

|---|---|---|

| Payment Structure | Lower periodic payments with large final balloon payment | Interest-only payments; full principal paid at maturity |

| Principal Payment | Partial principal paid periodically | No principal until loan maturity |

| Loan Term | Typically 5-7 years | Varies; often matches project or investment duration |

| Risk | High risk due to large lump sum payment at end | High risk from full principal due at maturity |

| Best For | Borrowers expecting refinance or sale before balloon | Investors needing short-term interest financing |

| Common Use | Residential mortgages with planned early payoff | Commercial and project financing |

Introduction to Balloon and Bullet Mortgages

Balloon mortgages require borrowers to make regular payments for a fixed term, followed by a large lump-sum payment of the remaining balance at maturity. Bullet mortgages involve interest-only payments during the loan term, with the entire principal amount due as a single payment at the end. These loan structures are commonly used for short-term financing or when borrowers anticipate refinancing or selling the property before the balloon or bullet payment is due.

Key Features of Balloon Mortgages

Balloon mortgages feature lower initial monthly payments due to smaller principal amortization over a fixed term, typically 5 to 7 years, ending with a large lump-sum payment called the balloon payment. These loans often require refinancing or full repayment of the outstanding balance at term maturity, posing a risk if property values decline or credit conditions tighten. Balloon mortgages are favored for short-term financing or when borrowers anticipate increased income or refinancing opportunities before the balloon payment is due.

Core Characteristics of Bullet Mortgages

Bullet mortgages feature a single lump-sum payment of the entire principal at the end of the loan term, with interest typically paid periodically throughout the loan period. These loans often have fixed interest rates and do not require principal amortization during the term, making them distinct from balloon mortgages, which may involve partial principal repayments before the final payment. Bullet mortgages are commonly used in commercial real estate and short-term financing due to their straightforward repayment structure and flexibility.

Comparison: Repayment Structures

Balloon mortgages require a large lump-sum payment at the end of the loan term after making smaller monthly payments, which reduces initial payment amounts but creates a significant final debt. Bullet mortgages involve interest-only payments during the loan term, with the entire principal paid in a single lump sum at maturity, making monthly costs predictable but necessitating a substantial final payment. Both repayment structures pose risks due to the large principal payment at the end, but balloon loans split the repayment into principal and interest, while bullet loans defer principal repayment entirely.

Interest Rate Differences Explained

Balloon mortgages typically feature lower initial interest rates compared to bullet mortgages, attracting borrowers seeking reduced early payments. Bullet mortgages, on the other hand, often carry higher interest rates since the principal is repaid entirely at the loan term's end, increasing lender risk. Interest rate differences reflect the distinct repayment structures, with balloon loans requiring partial principal repayment before maturity and bullet loans deferring full principal payment.

Pros and Cons of Balloon Mortgages

Balloon mortgages offer lower initial interest rates and smaller monthly payments, making them attractive for borrowers seeking short-term affordability. However, the large lump-sum payment due at the end of the term poses a significant risk, often requiring refinancing or sale of the property. Borrowers benefit from lower early costs but face uncertainty and potential financial strain when the balloon payment matures.

Advantages and Disadvantages of Bullet Mortgages

Bullet mortgages require a lump-sum payment of the entire principal at maturity, offering lower initial monthly payments compared to traditional loans. The advantage lies in improved cash flow during the loan term, making it suitable for borrowers expecting large future income or refinancing options. However, the significant risk is the need for a substantial payment at the end, which can cause financial strain if the borrower's situation changes or refinancing is unavailable.

Suitability: Who Should Consider Each Option?

Balloon mortgages suit borrowers with short-term financial plans or anticipated income increases, allowing lower initial payments with a large lump sum due at the end. Bullet mortgages fit investors or borrowers expecting a significant, one-time payment, often used for commercial property with interest-only payments and full principal due on maturity. Both require careful planning to manage refinancing risks and ensure the lump sum can be paid without financial strain.

Risks and Financial Implications

Balloon mortgages carry the risk of a large lump-sum payment at the end of the term, potentially causing financial strain if the borrower cannot refinance or sell the property. Bullet mortgages also require a significant final payment but often lack periodic principal reduction, increasing the borrower's repayment burden and interest costs over the loan term. Both loan types expose borrowers to interest rate fluctuations and market value uncertainties, necessitating careful financial planning and risk assessment.

Choosing Between Balloon and Bullet Mortgages

Choosing between balloon and bullet mortgages depends on your financial goals and repayment capacity. Balloon mortgages require smaller monthly payments with a large lump sum due at the end, suitable for borrowers expecting increased future income or refinancing options. Bullet mortgages demand interest-only payments throughout the loan term with the principal paid entirely at maturity, ideal for investors with short-term liquidity planning or those anticipating asset liquidation.

Important Terms

Amortization schedule

An amortization schedule for a balloon mortgage outlines periodic payments that primarily cover interest with a large principal balance due at the end of the term, while a bullet mortgage schedule defers all principal repayment to a single lump sum at maturity. Understanding these schedules helps borrowers anticipate payment timing and manage cash flow risks associated with the substantial final payment characteristic of both loan types.

Lump-sum payment

A lump-sum payment in a Balloon mortgage typically covers the remaining principal balance at the end of the loan term, requiring refinancing or full repayment, whereas in a Bullet mortgage, the lump-sum payment is the entire principal paid only at maturity without periodic principal amortization. Balloon mortgages often have lower monthly payments compared to Bullet mortgages, which defer the entire principal repayment until the loan's conclusion.

Interest-only period

The interest-only period in a balloon mortgage requires borrowers to pay only interest for a set term before repaying the entire principal in a lump sum, whereas a bullet mortgage involves interest-only payments with the principal due entirely at maturity without intermediate principal reductions. Balloon mortgages often feature shorter terms with variable repayment options, while bullet mortgages typically have fixed terms and rely on a single, final principal payment.

Loan maturity date

Balloon mortgage loans have a loan maturity date where a large lump-sum payment is due after a series of smaller periodic payments, typically shorter than the amortization period, while bullet mortgage loans require the entire principal to be paid in full at maturity without interim principal payments. The loan maturity date critically affects refinancing strategies and borrower risk exposure in both balloon and bullet mortgage structures.

Principal repayment

Principal repayment in a Balloon mortgage involves periodic payments with a large lump sum due at maturity, whereas a Bullet mortgage requires no regular principal payments and the entire principal is repaid at the loan's end. Balloon mortgages reduce monthly payment amounts but carry refinancing risk, while Bullet mortgages maintain interest-only payments until full principal repayment, often preferred in short-term financing scenarios.

Payment structure

Balloon mortgages require smaller periodic payments with a large lump-sum balloon payment at the end of the term, while bullet mortgages involve interest-only payments throughout the loan term followed by a full principal repayment at maturity. This distinction impacts cash flow management, risk exposure, and refinancing strategies for borrowers.

Rollover risk

Rollover risk in balloon mortgages arises from the need to refinance the outstanding principal at maturity, exposing borrowers to potential interest rate increases or credit tightening, whereas bullet mortgages mitigate this risk by requiring full principal repayment at loan end without interim refinancing. Borrowers facing balloon mortgages must strategically manage market conditions to avoid refinancing difficulties, while bullet mortgage holders concentrate on securing funds for lump-sum payment, reducing the cyclical refinancing uncertainty inherent in balloon structures.

Refinance option

Refinancing a balloon mortgage allows borrowers to replace a short-term, large lump-sum payment with a more manageable loan, reducing default risk, while bullet mortgage refinancing focuses on restructuring a single principal repayment at maturity, often to achieve better interest rates or extended terms. Understanding the timing and repayment structure of balloon versus bullet mortgages is critical for selecting the optimal refinance strategy that aligns with cash flow and financial goals.

Fixed-term loan

Fixed-term loans with balloon mortgages feature large, lump-sum payments at the end of the term, reducing monthly installments but increasing refinancing risk, whereas bullet mortgages require full principal repayment in one final payment, often used in commercial real estate financing. Balloon mortgages provide greater payment flexibility during the term, while bullet loans demand substantial liquidity or refinancing capacity at maturity, influencing borrower strategy and risk management.

Bullet maturity

Bullet maturity in bullet mortgages involves repaying the entire principal at loan term end, typically resulting in higher final payment but lower periodic installments, contrasting with balloon mortgages where the balloon payment is a large lump sum due before or at maturity, often preceded by principal reductions during the loan period. Balloon mortgages combine amortizing payments and a substantial payment at maturity, whereas bullet mortgages delay all principal repayment until a single lump sum at maturity, impacting cash flow and refinancing considerations distinctly.

Balloon mortgage vs Bullet mortgage Infographic

moneydif.com

moneydif.com