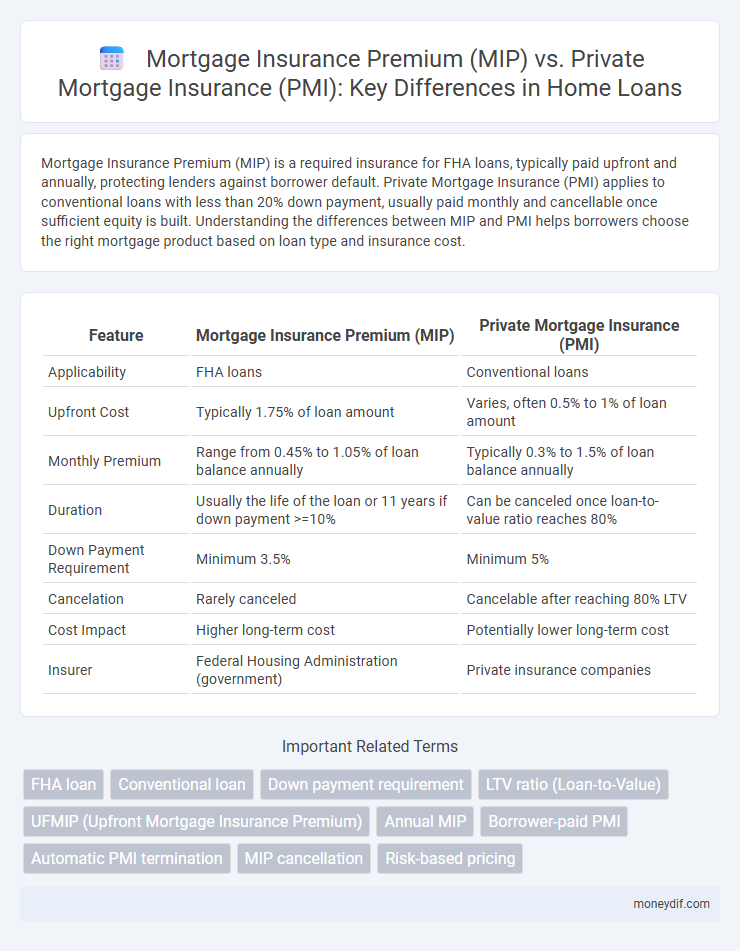

Mortgage Insurance Premium (MIP) is a required insurance for FHA loans, typically paid upfront and annually, protecting lenders against borrower default. Private Mortgage Insurance (PMI) applies to conventional loans with less than 20% down payment, usually paid monthly and cancellable once sufficient equity is built. Understanding the differences between MIP and PMI helps borrowers choose the right mortgage product based on loan type and insurance cost.

Table of Comparison

| Feature | Mortgage Insurance Premium (MIP) | Private Mortgage Insurance (PMI) |

|---|---|---|

| Applicability | FHA loans | Conventional loans |

| Upfront Cost | Typically 1.75% of loan amount | Varies, often 0.5% to 1% of loan amount |

| Monthly Premium | Range from 0.45% to 1.05% of loan balance annually | Typically 0.3% to 1.5% of loan balance annually |

| Duration | Usually the life of the loan or 11 years if down payment >=10% | Can be canceled once loan-to-value ratio reaches 80% |

| Down Payment Requirement | Minimum 3.5% | Minimum 5% |

| Cancelation | Rarely canceled | Cancelable after reaching 80% LTV |

| Cost Impact | Higher long-term cost | Potentially lower long-term cost |

| Insurer | Federal Housing Administration (government) | Private insurance companies |

Understanding Mortgage Insurance: MIP vs. PMI

Mortgage Insurance Premium (MIP) is required for FHA loans and involves an upfront fee plus monthly payments, protecting lenders against borrower default. Private Mortgage Insurance (PMI) applies to conventional loans with less than 20% down payment and typically only requires monthly premiums that can be canceled once sufficient home equity is built. Understanding the differences between MIP and PMI helps borrowers choose the best mortgage insurance option based on loan type, down payment, and long-term cost efficiency.

Key Differences Between MIP and PMI

Mortgage Insurance Premium (MIP) is specific to FHA loans and requires upfront and annual premiums regardless of the down payment size, while Private Mortgage Insurance (PMI) applies to conventional loans and is typically required only when the down payment is less than 20%. MIP payments are made to the Federal Housing Administration and often last for the life of the loan unless the borrower refinances, whereas PMI payments go to private insurers and can be canceled once the homeowner reaches 20% equity. The cost structure and cancellation policies of MIP and PMI significantly impact the overall loan affordability and long-term mortgage expenses.

Who Needs Mortgage Insurance: FHA vs. Conventional Loans

Mortgage insurance is required for FHA loans through Mortgage Insurance Premium (MIP), which applies to all borrowers regardless of down payment size, whereas Private Mortgage Insurance (PMI) is typically needed for conventional loans with a down payment less than 20%. FHA borrowers face upfront and annual MIP payments for the life of the loan if their down payment is under 10%, while PMI on conventional loans can be canceled once the borrower reaches 20% equity. Conventional loan borrowers with higher credit scores and larger down payments may avoid PMI, but FHA loan borrowers must pay MIP to insure lenders against default risk.

How MIP Works: Requirements and Costs

Mortgage Insurance Premium (MIP) is required for FHA loans and involves both an upfront fee and monthly payments, calculated based on the loan amount, term, and down payment size. Borrowers must pay an upfront MIP of 1.75% of the loan amount at closing, while monthly MIP payments range from 0.45% to 1.05% of the loan balance annually, depending on the loan-to-value ratio and loan term. MIP is mandatory for the life of the loan if the down payment is less than 10%, but it can be canceled after 11 years if the down payment is 10% or more.

How PMI Works: Eligibility and Premium Structure

Private Mortgage Insurance (PMI) is typically required for conventional loans when the borrower's down payment is less than 20%, protecting lenders from default risk. PMI premiums vary based on credit score, loan-to-value ratio, and loan term, with monthly costs usually calculated as a percentage of the original loan amount divided into monthly payments. Eligibility for PMI depends on factors such as creditworthiness, property type, and loan-to-value ratio, with the option to request cancellation once a certain equity threshold is reached, commonly 20%.

Upfront and Ongoing Costs: MIP vs. PMI Comparison

Mortgage Insurance Premium (MIP) typically requires an upfront cost, often 1.75% of the loan amount, alongside ongoing monthly payments that can last the life of the loan. Private Mortgage Insurance (PMI) usually has a lower upfront fee or none at all, with monthly premiums ranging from 0.3% to 1.5% of the original loan balance and can be canceled once the loan-to-value ratio reaches 80%. The total cost of MIP often exceeds PMI over time due to its mandatory duration and upfront fee structure, making PMI potentially more affordable for borrowers aiming to eliminate insurance costs sooner.

How to Cancel MIP and PMI: Rules and Timelines

To cancel Private Mortgage Insurance (PMI), borrowers typically need to reach 20% equity based on the original purchase price or current appraisal, triggering automatic termination at 22% equity per the Homeowners Protection Act. Mortgage Insurance Premium (MIP) cancellation rules differ for FHA loans; MIP may be canceled after 11 years if the loan-to-value ratio is 78% or less at origination, while loans with less than 10% down require MIP for the entire loan term. Understanding agency-specific guidelines and requesting cancellation through the loan servicer allows timely removal of PMI or MIP, potentially reducing monthly mortgage costs.

Impact on Monthly Payments: MIP vs. PMI

Mortgage Insurance Premium (MIP) typically applies to FHA loans and often results in higher monthly payments compared to Private Mortgage Insurance (PMI), which is used with conventional loans. MIP payments are generally required for the life of the loan if the down payment is less than 10%, while PMI can be canceled once the homeowner reaches 20% equity, reducing monthly costs. Understanding the differences in MIP and PMI impact on monthly payments helps borrowers choose the most cost-effective mortgage insurance option.

Pros and Cons of MIP and PMI

Mortgage Insurance Premium (MIP) is required for FHA loans, offering lower credit score requirements and smaller down payments but often results in higher overall insurance costs and mandatory coverage duration. Private Mortgage Insurance (PMI) applies to conventional loans with down payments under 20%, typically offering lower premiums and the ability to cancel coverage once equity reaches 20%, though it requires stricter credit qualifications. Choosing between MIP and PMI depends on borrower credit profile, down payment size, and long-term cost considerations in mortgage financing.

Choosing the Right Loan: Minimizing Mortgage Insurance Costs

Choosing the right loan significantly impacts mortgage insurance costs, with FHA loans requiring Mortgage Insurance Premiums (MIP) that apply for the life of the loan unless refinanced, while conventional loans often require Private Mortgage Insurance (PMI) that can be canceled once the loan-to-value ratio reaches 80%. Borrowers considering FHA loans should weigh upfront and annual MIP costs against the potential benefits of lower credit score requirements and down payments. Opting for a conventional loan with PMI can minimize long-term insurance expenses if financial circumstances allow for timely cancellation of PMI through equity buildup or refinancing.

Important Terms

FHA loan

FHA loans require Mortgage Insurance Premium (MIP) that includes an upfront fee and monthly premiums, offering protection to lenders regardless of the borrower's down payment size. Private Mortgage Insurance (PMI) applies to conventional loans with less than 20% down and can be canceled once sufficient equity is built, typically making PMI potentially less costly over time compared to FHA's MIP.

Conventional loan

Conventional loans typically require Private Mortgage Insurance (PMI) when the down payment is less than 20%, whereas Mortgage Insurance Premium (MIP) is associated with FHA loans and paid regardless of down payment size. PMI is cancelable once the loan-to-value ratio drops below 80%, while MIP often requires payment for the life of the loan or a minimum period, impacting overall mortgage costs.

Down payment requirement

Down payment requirements for loans with Mortgage Insurance Premium (MIP) typically start as low as 3.5% for FHA loans, whereas Private Mortgage Insurance (PMI) generally requires a minimum down payment of 5% to 20% depending on lender and loan type.

LTV ratio (Loan-to-Value)

LTV ratios above 80% typically require Mortgage Insurance Premium (MIP) for FHA loans or Private Mortgage Insurance (PMI) for conventional loans to protect lenders against default risk.

UFMIP (Upfront Mortgage Insurance Premium)

UFMIP is a one-time fee paid on FHA loans as part of the Mortgage Insurance Premium (MIP), whereas Private Mortgage Insurance (PMI) is a monthly premium required on conventional loans with less than 20% down payment.

Annual MIP

Annual MIP is a government-backed mortgage insurance premium required for FHA loans, while PMI is private insurance typically required for conventional loans with less than 20% down payment.

Borrower-paid PMI

Borrower-paid PMI refers specifically to Private Mortgage Insurance required for conventional loans, whereas Mortgage Insurance Premium (MIP) is the government-mandated insurance for FHA loans.

Automatic PMI termination

Automatic PMI termination occurs when a borrower's loan-to-value ratio reaches 78% based on the original property value, while Mortgage Insurance Premium (MIP) for FHA loans typically requires coverage for the loan's life unless refinanced or specific conditions are met.

MIP cancellation

MIP cancellation for FHA loans occurs when the loan-to-value ratio reaches 78% after 11 years, while PMI for conventional loans can be canceled once the homeowner reaches 20% equity through payments or home appreciation.

Risk-based pricing

Risk-based pricing for Mortgage Insurance Premium (MIP) and Private Mortgage Insurance (PMI) adjusts rates according to borrower credit scores, loan-to-value ratios, and loan types, impacting overall mortgage costs. MIP, typically associated with FHA loans, charged through fixed upfront and annual premiums, contrasts with PMI on conventional loans, where premiums vary dynamically based on risk profiles and lender criteria.

Mortgage Insurance Premium (MIP) vs Private Mortgage Insurance (PMI) Infographic

moneydif.com

moneydif.com