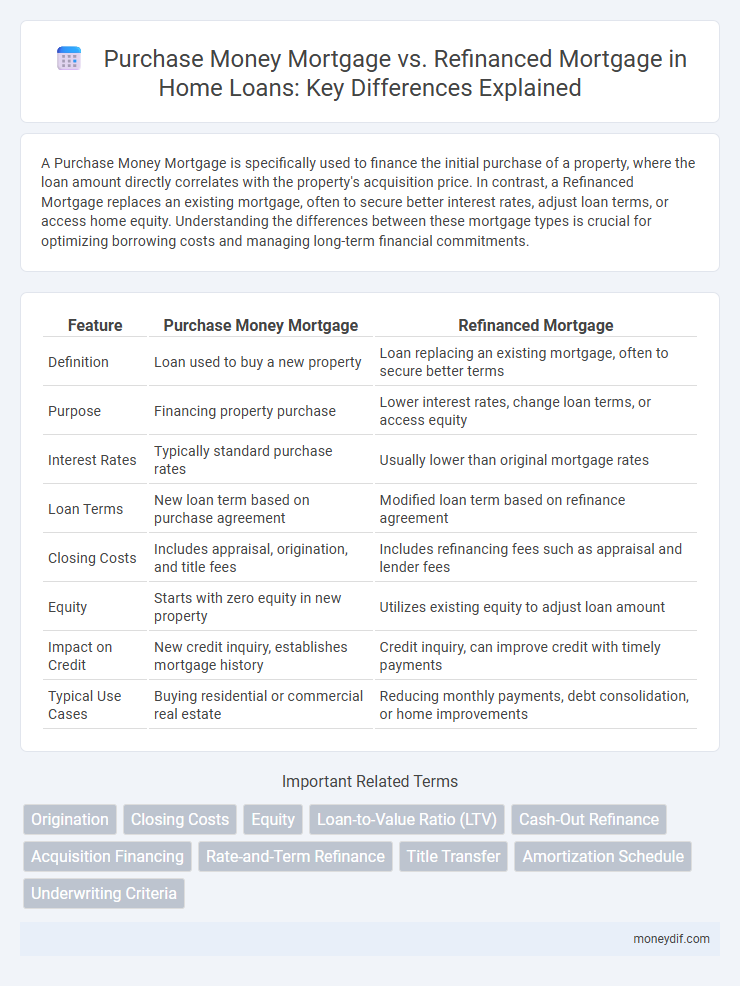

A Purchase Money Mortgage is specifically used to finance the initial purchase of a property, where the loan amount directly correlates with the property's acquisition price. In contrast, a Refinanced Mortgage replaces an existing mortgage, often to secure better interest rates, adjust loan terms, or access home equity. Understanding the differences between these mortgage types is crucial for optimizing borrowing costs and managing long-term financial commitments.

Table of Comparison

| Feature | Purchase Money Mortgage | Refinanced Mortgage |

|---|---|---|

| Definition | Loan used to buy a new property | Loan replacing an existing mortgage, often to secure better terms |

| Purpose | Financing property purchase | Lower interest rates, change loan terms, or access equity |

| Interest Rates | Typically standard purchase rates | Usually lower than original mortgage rates |

| Loan Terms | New loan term based on purchase agreement | Modified loan term based on refinance agreement |

| Closing Costs | Includes appraisal, origination, and title fees | Includes refinancing fees such as appraisal and lender fees |

| Equity | Starts with zero equity in new property | Utilizes existing equity to adjust loan amount |

| Impact on Credit | New credit inquiry, establishes mortgage history | Credit inquiry, can improve credit with timely payments |

| Typical Use Cases | Buying residential or commercial real estate | Reducing monthly payments, debt consolidation, or home improvements |

Understanding Purchase Money Mortgage

A Purchase Money Mortgage is a loan used by buyers to finance the purchase of a property directly from the seller, often serving as the primary source of funds for the transaction. This type of mortgage is distinct from a refinanced mortgage, which replaces an existing loan on the property to secure better terms or access equity. Understanding the key features of purchase money mortgages, including down payment requirements and interest rates, is essential for navigating real estate transactions effectively.

What Is a Refinanced Mortgage?

A refinanced mortgage replaces an existing loan with a new one, often to secure better interest rates, reduce monthly payments, or access home equity. This process involves paying off the original mortgage and establishing new terms based on current financial conditions and credit profiles. Refinanced mortgages can be cash-out or rate-and-term, offering homeowners flexibility to adjust their financial strategy.

Key Differences Between Purchase Money and Refinance Loan

Purchase money mortgages are loans taken out to buy a new property, often involving a smaller initial loan amount and higher interest rates compared to refinance loans. Refinance mortgages replace an existing loan to secure better terms, such as lower interest rates or changing loan duration, without involving a new property purchase. Key differences include the loan purpose, cost structure, and eligibility criteria, with purchase money loans requiring a property transaction and refinance loans focusing on financial restructuring.

Pros and Cons of Purchase Money Mortgage

Purchase money mortgages offer buyers the advantage of facilitating homeownership by allowing the seller to finance part of the purchase price, often resulting in easier qualification and potentially lower closing costs compared to traditional financing. However, purchase money mortgages can carry higher interest rates and less favorable loan terms, which may increase long-term costs and reduce refinancing flexibility. This type of financing also typically requires the buyer to negotiate directly with the seller, potentially leading to less standardized agreements and increased risk if the seller lacks financial stability.

Advantages and Drawbacks of Refinanced Mortgage

Refinanced mortgages offer the advantage of potentially lower interest rates, which can reduce monthly payments and overall loan costs, enhancing financial flexibility. However, drawbacks include closing costs, fees, and the risk of extending the loan term that may increase total interest paid over time. Homeowners should weigh the benefits of immediate savings against the potential for higher long-term expenses when considering mortgage refinancing.

Qualification Criteria: Purchase Money vs Refinancing

Purchase money mortgage qualification criteria emphasize borrower income, credit score, and property value with the primary goal of financing a new home purchase. Refinanced mortgage qualifications require assessment of current home equity, updated credit score, debt-to-income ratio, and potential appraisal to determine eligibility for improved loan terms or cash-out options. Lenders prioritize employment stability and repayment history more rigorously in refinancing to mitigate increased risk.

Interest Rates: How They Differ for Each Option

Purchase money mortgages typically offer lower interest rates as they are associated with first-time property acquisitions, reflecting less risk for lenders. Refinanced mortgages often have higher interest rates due to additional factors such as credit adjustments, home equity changes, and market fluctuations. Understanding the difference in interest rates between purchase money and refinanced mortgages is crucial for borrowers seeking cost-effective financing strategies.

Closing Costs: Purchase Money Mortgage vs Refinance

Closing costs for a purchase money mortgage typically include appraisal fees, loan origination fees, title insurance, and escrow fees, which can range from 2% to 5% of the home's purchase price. Refinance closing costs often mirror purchase costs but may also include mortgage insurance premiums, prepayment penalties, and specific lender fees, usually totaling 2% to 6% of the loan amount. Understanding these cost differences helps borrowers evaluate the financial impact of each mortgage type before closing.

When Should You Choose Purchase Money Mortgage?

Choose a Purchase Money Mortgage when buying a new property to secure financing directly tied to the purchase price, offering typically lower interest rates and streamlined approval processes. This mortgage type is ideal for first-time buyers or those upgrading homes, ensuring clarity in ownership and loan terms. Opting for a Purchase Money Mortgage helps avoid complexities linked to refinancing, making it a straightforward option during property acquisition.

Is Refinancing the Right Move for You?

Refinancing a mortgage involves replacing an existing loan with a new one, often to secure a lower interest rate, reduce monthly payments, or access home equity, whereas a purchase money mortgage is the original loan used to buy a home. Evaluating if refinancing is the right move depends on factors such as current interest rates, remaining loan term, closing costs, and your long-term financial goals. Homeowners should calculate the break-even point and consider potential credit score impacts before committing to refinance.

Important Terms

Origination

Purchase Money Mortgages are loans used specifically to buy real estate, often featuring lower interest rates and favorable terms since the loan is tied directly to the property's acquisition. Refinanced Mortgages involve replacing an existing mortgage with a new loan to secure better interest rates, alter loan terms, or access home equity, often requiring appraisal, credit evaluation, and underwriting for origination approval.

Closing Costs

Closing costs for a purchase money mortgage typically include lender fees, appraisal, title insurance, and recording fees, often ranging from 2% to 5% of the loan amount. Refinanced mortgage closing costs may also include these fees, but often involve additional costs like loan origination fees, prepayment penalties, and potential escrow adjustments, which can vary based on the lender and loan terms.

Equity

Equity in a Purchase Money Mortgage represents the borrower's initial ownership stake acquired during home purchase, typically higher due to original property value. In contrast, equity in a Refinanced Mortgage may fluctuate based on current market value and outstanding loan balance, often used to access additional funds or reduce interest rates.

Loan-to-Value Ratio (LTV)

The Loan-to-Value Ratio (LTV) in a Purchase Money Mortgage typically reflects the percentage of the property's purchase price financed by the loan, while in a Refinanced Mortgage, LTV is based on the current appraised property value. Lenders often require a lower LTV for refinancing to mitigate risk, which can impact interest rates and loan approval.

Cash-Out Refinance

Cash-out refinance allows homeowners to replace an existing purchase money mortgage with a new refinanced mortgage that exceeds the outstanding loan balance, providing access to home equity as cash. Unlike the original purchase money mortgage used primarily for buying the property, the refinanced mortgage restructures debt and can reduce interest rates or change loan terms while extracting available equity.

Acquisition Financing

Acquisition financing often involves purchase money mortgages, which are loans specifically used to acquire property and are secured by the purchased asset itself, contrasting with refinanced mortgages that replace existing loans to modify terms or access equity. Purchase money mortgages are critical in enabling buyers to leverage financing directly tied to the property transaction, whereas refinancing restructures debt to optimize loan conditions or cash flow.

Rate-and-Term Refinance

Rate-and-term refinance modifies the interest rate or loan term of an existing mortgage without increasing the loan amount, contrasting with purchase money mortgages used to finance home acquisitions. This refinancing option enables borrowers to secure lower interest rates or shorten loan terms on refinanced mortgages, improving monthly payments and overall loan cost efficiency.

Title Transfer

Title transfer in a purchase money mortgage occurs when the buyer receives property ownership as part of the initial sale agreement secured by the mortgage loan, while in a refinanced mortgage, the title transfer is generally not involved since the existing owner replaces an old loan with a new one to modify loan terms or access equity. Purchase money mortgages link title transfer directly to the sale transaction, whereas refinanced mortgages focus on restructuring debt without altering property ownership.

Amortization Schedule

An amortization schedule for a purchase money mortgage typically outlines fixed monthly payments over the loan term that combine principal and interest, reflecting the original property's purchase price and loan amount. In contrast, a refinanced mortgage amortization schedule adjusts to the new loan balance, which may include additional fees or cash-out amounts, potentially altering payment amounts and loan duration.

Underwriting Criteria

Underwriting criteria for purchase money mortgages typically emphasize borrower creditworthiness, property appraisal, and loan-to-value (LTV) ratios based on the home's purchase price, while refinanced mortgages focus more on the current property value, existing lien positions, and the borrower's debt-to-income (DTI) ratio to assess repayment ability. Both mortgage types require thorough verification of income, employment, and credit history, but refinanced mortgages often demand stricter appraisal standards due to potential changes in property value since the original purchase.

Purchase Money Mortgage vs Refinanced Mortgage Infographic

moneydif.com

moneydif.com