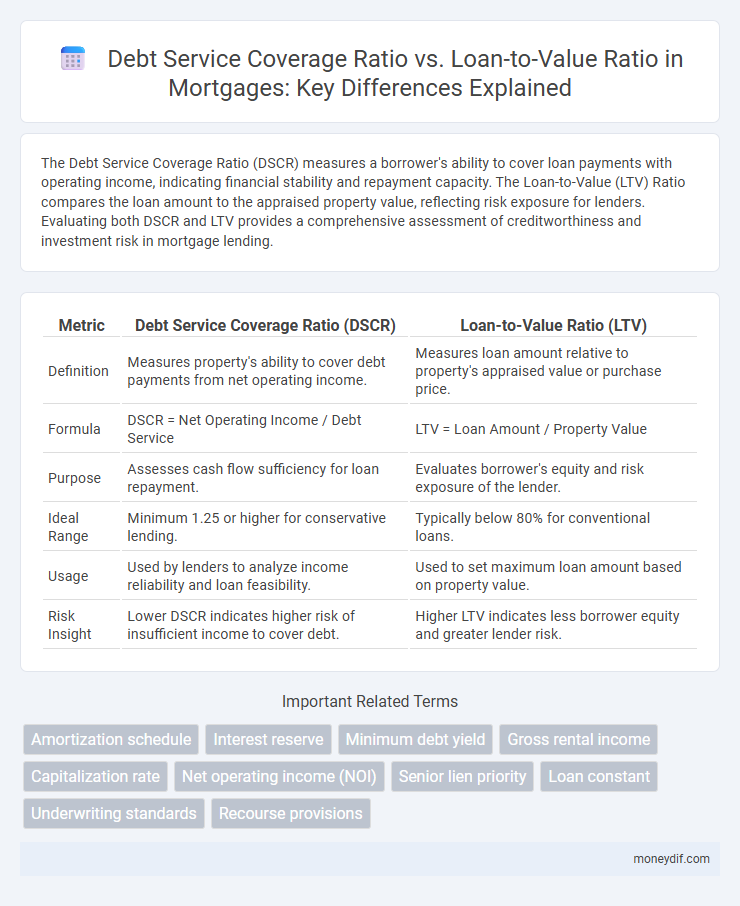

The Debt Service Coverage Ratio (DSCR) measures a borrower's ability to cover loan payments with operating income, indicating financial stability and repayment capacity. The Loan-to-Value (LTV) Ratio compares the loan amount to the appraised property value, reflecting risk exposure for lenders. Evaluating both DSCR and LTV provides a comprehensive assessment of creditworthiness and investment risk in mortgage lending.

Table of Comparison

| Metric | Debt Service Coverage Ratio (DSCR) | Loan-to-Value Ratio (LTV) |

|---|---|---|

| Definition | Measures property's ability to cover debt payments from net operating income. | Measures loan amount relative to property's appraised value or purchase price. |

| Formula | DSCR = Net Operating Income / Debt Service | LTV = Loan Amount / Property Value |

| Purpose | Assesses cash flow sufficiency for loan repayment. | Evaluates borrower's equity and risk exposure of the lender. |

| Ideal Range | Minimum 1.25 or higher for conservative lending. | Typically below 80% for conventional loans. |

| Usage | Used by lenders to analyze income reliability and loan feasibility. | Used to set maximum loan amount based on property value. |

| Risk Insight | Lower DSCR indicates higher risk of insufficient income to cover debt. | Higher LTV indicates less borrower equity and greater lender risk. |

Understanding Debt Service Coverage Ratio (DSCR)

Debt Service Coverage Ratio (DSCR) measures a property's ability to generate enough income to cover its mortgage payments, representing net operating income divided by total debt service. Unlike Loan-to-Value (LTV) ratio, which compares loan amount to property value, DSCR focuses on cash flow sufficiency for debt obligations. Lenders prioritize DSCR to assess borrower risk, requiring a ratio typically above 1.25 to ensure reliable mortgage repayment capacity.

What Is Loan-to-Value (LTV) Ratio?

Loan-to-Value (LTV) ratio measures the loan amount compared to the appraised value of the property and is expressed as a percentage, indicating the borrower's equity stake. This metric plays a crucial role in mortgage underwriting by assessing risk, where a lower LTV typically signals less risk and may qualify the borrower for better loan terms. Lenders use LTV alongside Debt Service Coverage Ratio (DSCR), which evaluates income against debt obligations, to determine overall loan eligibility.

Key Differences Between DSCR and LTV

Debt Service Coverage Ratio (DSCR) measures a borrower's ability to cover debt payments with net operating income, reflecting cash flow strength, while Loan-to-Value (LTV) ratio compares the loan amount to the property's appraised value, indicating collateral risk. DSCR emphasizes income stability and repayment capacity, crucial for lenders assessing cash flow adequacy. LTV focuses on loan risk relative to asset value, impacting loan approval and interest rates based on property equity levels.

Role of DSCR in Mortgage Approval

Debt Service Coverage Ratio (DSCR) plays a crucial role in mortgage approval by measuring a borrower's ability to generate sufficient cash flow to cover debt payments, typically requiring a DSCR greater than 1 to ensure financial stability. Unlike Loan-to-Value (LTV) ratio, which compares loan amount to property value, DSCR assesses income relative to debt obligations, providing lenders with a clear understanding of repayment capacity. High DSCR values reduce default risk, influencing underwriting decisions and interest rates more significantly than LTV in income-sensitive mortgage evaluations.

Importance of LTV in Mortgage Lending

Loan-to-value (LTV) ratio measures the loan amount relative to the property's appraised value, serving as a crucial risk indicator for lenders by determining borrower equity and potential loss in foreclosure. A lower LTV ratio generally signifies less risk, often resulting in better loan terms and higher approval chances. While Debt Service Coverage Ratio (DSCR) evaluates the borrower's cash flow ability to cover debt payments, LTV remains a primary metric in mortgage lending for assessing collateral adequacy and safeguarding lender interests.

How Lenders Use DSCR and LTV Ratios

Lenders use the Debt Service Coverage Ratio (DSCR) to evaluate a borrower's ability to generate sufficient income to cover mortgage payments, focusing on the property's net operating income relative to debt obligations. The Loan-to-Value (LTV) ratio helps assess risk by comparing the loan amount to the appraised value of the property, ensuring the loan is adequately secured. Combining DSCR and LTV ratios allows lenders to balance income stability with collateral value, optimizing risk management in mortgage approvals.

Impact of DSCR and LTV on Loan Terms

Debt Service Coverage Ratio (DSCR) measures a borrower's ability to cover debt payments, directly influencing interest rates and loan approval thresholds in mortgage underwriting. Loan-to-Value Ratio (LTV) assesses the loan amount against the property's appraised value, impacting down payment requirements and loan-to-value limits. Higher DSCR and lower LTV ratios typically result in more favorable loan terms, including reduced interest rates and increased borrowing capacity.

DSCR vs LTV: Which Matters More?

Debt Service Coverage Ratio (DSCR) measures the cash flow available to cover debt payments, directly reflecting a borrower's ability to service the loan, making it crucial for lenders assessing risk and repayment capacity. Loan-to-Value (LTV) ratio evaluates the loan amount relative to the property's appraised value, emphasizing collateral security and influencing loan approval and interest rates. While both DSCR and LTV are essential in mortgage underwriting, DSCR holds greater importance for income-producing properties by ensuring sustainable debt repayment.

Tips to Improve Your DSCR and LTV Ratios

Improving your Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) ratios can enhance mortgage approval chances and secure better loan terms. Increase DSCR by boosting rental income or reducing operating expenses to show stronger debt repayment capacity. Lower LTV by making a larger down payment or increasing property value through renovations, strengthening your equity position and reducing lender risk.

Common Mistakes in Evaluating DSCR and LTV

Misinterpreting the Debt Service Coverage Ratio (DSCR) often leads to overestimating a borrower's ability to cover loan payments, as failing to account for variable expenses like maintenance and vacancies skews cash flow projections. Confusing DSCR with Loan-to-Value (LTV) ratio risks ignoring collateral risk, where high LTV indicates potential under-collateralization despite sound income coverage. Relying solely on either DSCR or LTV without a comprehensive analysis of both metrics can result in inaccurate risk assessment and suboptimal mortgage lending decisions.

Important Terms

Amortization schedule

An amortization schedule details the periodic loan payments, breaking down principal and interest components, which directly influence the Debt Service Coverage Ratio (DSCR) by reflecting the borrower's ability to cover debt obligations with net operating income. The Loan-to-Value (LTV) ratio compares the loan amount to the appraised property value, affecting loan risk assessment and terms, and when combined with DSCR, provides a comprehensive analysis of loan feasibility and borrower creditworthiness.

Interest reserve

Interest reserve impacts Debt Service Coverage Ratio (DSCR) by temporarily increasing available cash flow to cover debt payments, enhancing short-term DSCR during loan terms, whereas Loan-to-Value (LTV) ratio focuses on loan amount relative to property value, unaffected by interest reserves. Maintaining a healthy DSCR through interest reserves reduces default risk, while a balanced LTV ratio ensures sufficient collateral, both crucial for lender risk assessment in real estate financing.

Minimum debt yield

Minimum debt yield serves as a critical baseline risk metric, ensuring that the property's net operating income sufficiently covers debt obligations independent of valuation fluctuations. It complements the Debt Service Coverage Ratio (DSCR), which measures income against debt payments, and the Loan-to-Value (LTV) ratio, reflecting loan risk based on property value, together providing a comprehensive assessment of lending risk.

Gross rental income

Gross rental income directly impacts the Debt Service Coverage Ratio (DSCR), as higher rental income increases the ability to cover debt payments, indicating better loan repayment capacity. In contrast, the Loan-to-Value (LTV) ratio measures loan amount relative to property value without factoring income, making DSCR a more comprehensive metric for assessing rental property cash flow and financing risk.

Capitalization rate

The Capitalization rate reflects a property's expected return and influences the Debt Service Coverage Ratio (DSCR), which measures cash flow against debt obligations to ensure loan viability, while the Loan-to-Value (LTV) ratio assesses loan amount relative to property value, balancing risk and leverage. Investors use DSCR and LTV ratios alongside Cap rates to evaluate investment stability, lending risk, and portfolio performance effectively.

Net operating income (NOI)

Net operating income (NOI) directly influences the Debt Service Coverage Ratio (DSCR) by measuring a property's ability to cover its debt payments, while the Loan-to-Value (LTV) ratio assesses risk based on the loan amount relative to the property's appraised value. High NOI improves DSCR, indicating strong debt repayment capacity, whereas a lower LTV ratio reflects reduced lender risk and greater equity cushion.

Senior lien priority

Senior lien priority ensures the primary claim on assets or cash flows in debt repayment, directly impacting Debt Service Coverage Ratio (DSCR) by prioritizing senior debt obligations before subordinate debts; this hierarchy often allows higher Loan-to-Value (LTV) ratios for senior lenders due to reduced risk exposure. A stronger DSCR indicates better ability to meet debt service from operating income, while LTV measures loan amount against asset value, both metrics are crucial in assessing risk and structuring senior lien debt within capital stacks.

Loan constant

The loan constant measures the annual debt service as a percentage of the loan amount, serving as a key factor in evaluating the Debt Service Coverage Ratio (DSCR), which compares net operating income to debt obligations. A higher Loan-to-Value (LTV) ratio often increases risk, requiring a stronger DSCR to ensure sufficient income covers the loan constant and meet repayment demands.

Underwriting standards

Underwriting standards rigorously assess Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) ratio to evaluate a borrower's ability to repay a loan and the collateral risk. A higher DSCR indicates stronger cash flow to cover debt payments, while a lower LTV ratio reflects lower loan risk relative to property value, both critical for loan approval and risk mitigation.

Recourse provisions

Recourse provisions impact lender recovery options when debt service coverage ratio (DSCR) falls below thresholds, intensifying scrutiny on cash flow sufficiency for debt repayment. Loan-to-value (LTV) ratio complements DSCR by measuring collateral risk, where higher LTV increases default risk and potential lender exposure under recourse agreements.

Debt service coverage ratio vs Loan-to-value ratio Infographic

moneydif.com

moneydif.com