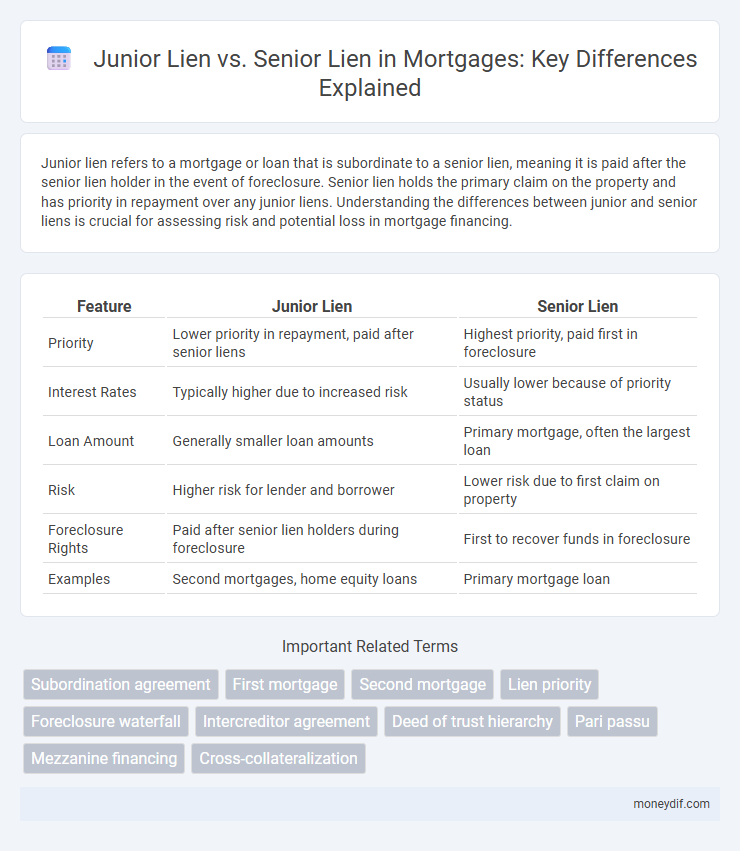

Junior lien refers to a mortgage or loan that is subordinate to a senior lien, meaning it is paid after the senior lien holder in the event of foreclosure. Senior lien holds the primary claim on the property and has priority in repayment over any junior liens. Understanding the differences between junior and senior liens is crucial for assessing risk and potential loss in mortgage financing.

Table of Comparison

| Feature | Junior Lien | Senior Lien |

|---|---|---|

| Priority | Lower priority in repayment, paid after senior liens | Highest priority, paid first in foreclosure |

| Interest Rates | Typically higher due to increased risk | Usually lower because of priority status |

| Loan Amount | Generally smaller loan amounts | Primary mortgage, often the largest loan |

| Risk | Higher risk for lender and borrower | Lower risk due to first claim on property |

| Foreclosure Rights | Paid after senior lien holders during foreclosure | First to recover funds in foreclosure |

| Examples | Second mortgages, home equity loans | Primary mortgage loan |

Understanding Liens in Mortgage Lending

In mortgage lending, a senior lien holds the primary claim on a property in the event of default or foreclosure, meaning it gets paid off before any junior liens. Junior liens, such as second mortgages or home equity lines of credit, are subordinate and carry higher risk, often resulting in higher interest rates. Understanding the priority of these liens is crucial for borrowers and lenders to assess risk and repayment order accurately.

What is a Senior Lien?

A senior lien is the primary mortgage or loan that holds the highest priority on a property, meaning it must be fully paid off before any junior liens receive payment in the event of foreclosure. This lien secures the lender's interest by ensuring repayment takes precedence over secondary claims, which affects the order of debt settlement. Understanding the priority of a senior lien is crucial for both borrowers and lenders in managing risks and protecting assets during the lending process.

Defining Junior Liens

Junior liens are secondary claims on a property that rank below senior liens in priority for repayment during foreclosure. They typically include second mortgages, home equity lines of credit (HELOCs), and other subordinate loans that are recorded after the primary mortgage. The risk associated with junior liens is higher due to their lower priority status, affecting interest rates and lending terms.

Key Differences Between Senior and Junior Liens

Senior liens have priority over junior liens in case of borrower default, meaning they are paid first from foreclosure proceeds. Junior liens typically carry higher interest rates due to increased risk and are subordinate to senior liens in repayment hierarchy. The priority status of liens significantly impacts loan terms, recovery chances, and borrower credit risk.

Priority of Payment in Foreclosure

Senior liens hold priority over junior liens in foreclosure, meaning the senior lien is paid first from the proceeds of the property sale. Junior liens only receive payment after the senior lien is satisfied in full, increasing the risk for junior lienholders. Understanding the priority of payment is crucial for lenders and borrowers to assess risk and potential recovery in foreclosure situations.

Impact of Liens on Mortgage Risk

Senior liens hold priority over junior liens in mortgage repayment, significantly influencing foreclosure outcomes and recovery rates for lenders. Junior liens increase mortgage risk by diluting collateral value, which may lead to limited loss recovery if foreclosure occurs. Understanding lien hierarchy is critical for lenders to assess credit exposure and structure risk mitigation strategies effectively.

Common Types of Junior and Senior Liens

Senior liens typically include first mortgages and property tax liens, holding priority in repayment during foreclosure due to their earlier recording dates. Common junior liens consist of second mortgages, home equity lines of credit (HELOCs), and mechanic's liens, which are subordinate and riskier for lenders. Understanding the distinction between lien types is crucial for borrowers managing multiple encumbrances and for lenders assessing lien priority and associated risks.

How Liens Affect Property Sales

Senior liens take priority over junior liens in property sales, meaning the senior lien holder must be paid first from the proceeds. Junior liens, such as second mortgages or home equity lines of credit, are subordinate and are only paid after the senior lien is satisfied, increasing the risk for junior lien holders in foreclosure situations. The presence of multiple liens can complicate or delay property sales, as all lienholders need resolution before the transfer of clear title.

Protecting Your Interest as a Lienholder

Senior liens hold priority over junior liens, meaning they are paid first from proceeds in a foreclosure or sale, directly impacting a junior lienholder's ability to recover debt. Protecting your interest as a lienholder requires understanding lien priority, ensuring timely payments, and negotiating terms to mitigate risk of loss. Monitoring the borrower's financial status and recording lien documents promptly strengthens your position in case of default or refinance.

Navigating Multiple Liens in Real Estate Transactions

Senior liens hold priority over junior liens in real estate transactions, meaning they are paid first in the event of foreclosure or sale. Navigating multiple liens requires careful assessment of lien positions to determine the risk and potential payout for each creditor. Understanding the hierarchy of liens protects buyers and lenders by clarifying financial obligations and foreclosure rights.

Important Terms

Subordination agreement

A subordination agreement legally establishes the priority of liens by ranking a junior lien behind a senior lien, ensuring the senior lienholder's claim is paid first in case of default. This agreement is crucial in real estate financing to clarify lien positions and protect senior lenders' interests.

First mortgage

A first mortgage holds senior lien status, granting it primary claim over property assets in foreclosure or debt repayment, whereas junior liens, such as second mortgages or home equity lines of credit, are subordinate and paid only after the senior liens are satisfied. This hierarchical lien structure significantly impacts risk assessment and interest rates, with first mortgages generally carrying lower rates due to their reduced risk profile.

Second mortgage

A second mortgage is a type of junior lien that ranks behind the primary or senior lien in priority on a property, meaning the senior lien holder gets paid first in the event of a foreclosure. Junior liens typically carry higher interest rates and risk due to their subordinate position, influencing loan terms and borrower qualifications.

Lien priority

Senior liens hold priority over junior liens, ensuring the senior lien is paid first in the event of foreclosure or liquidation. Junior liens are secondary claims and only receive payment after the senior lien obligations are fully satisfied.

Foreclosure waterfall

In a foreclosure waterfall, senior liens are prioritized and paid first from the proceeds of a property sale, with junior liens only receiving payment after all senior obligations are fully satisfied. This hierarchy ensures that junior lienholders face a higher risk of loss, as their claims are subordinate to senior lienholders in the distribution of foreclosure funds.

Intercreditor agreement

An intercreditor agreement establishes the rights and priorities between junior lienholders and senior lienholders, ensuring clear guidelines for repayment, enforcement, and collateral claims in secured lending. This agreement mitigates conflicts by defining subordination terms, voting rights, and default procedures specific to each lien position.

Deed of trust hierarchy

A deed of trust hierarchy establishes the priority of liens on a property, where senior liens take precedence over junior liens in the event of foreclosure. Senior liens, typically recorded first, have superior legal claims compared to junior liens, which are subordinate and only enforceable after satisfaction of senior lien obligations.

Pari passu

Pari passu refers to the equal ranking of claims where Junior lien holders receive payment only after Senior lien holders are fully satisfied, creating a hierarchy in debt repayment priority. Senior liens have priority over Junior liens, ensuring senior creditors are paid first in the event of borrower default or asset liquidation.

Mezzanine financing

Mezzanine financing typically occupies a position between senior debt and equity, often secured by a junior lien that ranks below the senior lien in claim priority during default scenarios. This subordinate status results in higher interest rates to compensate for increased risk, while senior liens maintain first priority over collateral and repayment.

Cross-collateralization

Cross-collateralization involves using the same collateral to secure multiple loans, creating a hierarchy between junior liens and senior liens where the senior lien holds priority in claim over the collateral in case of default, while the junior lien remains subordinate and is only repaid after the senior lien is fully satisfied. This priority structure impacts risk exposure and recovery rates, influencing lending decisions and borrower obligations within secured financing arrangements.

Junior lien vs Senior lien Infographic

moneydif.com

moneydif.com