Escrow and impound accounts both serve to manage property tax and insurance payments within a mortgage, ensuring timely disbursement and preventing borrower default. An escrow account is a neutral third-party held fund, while impound accounts are terms often used interchangeably but may vary by lender or region. Understanding these accounts helps borrowers budget effectively and avoid penalties associated with missed payments.

Table of Comparison

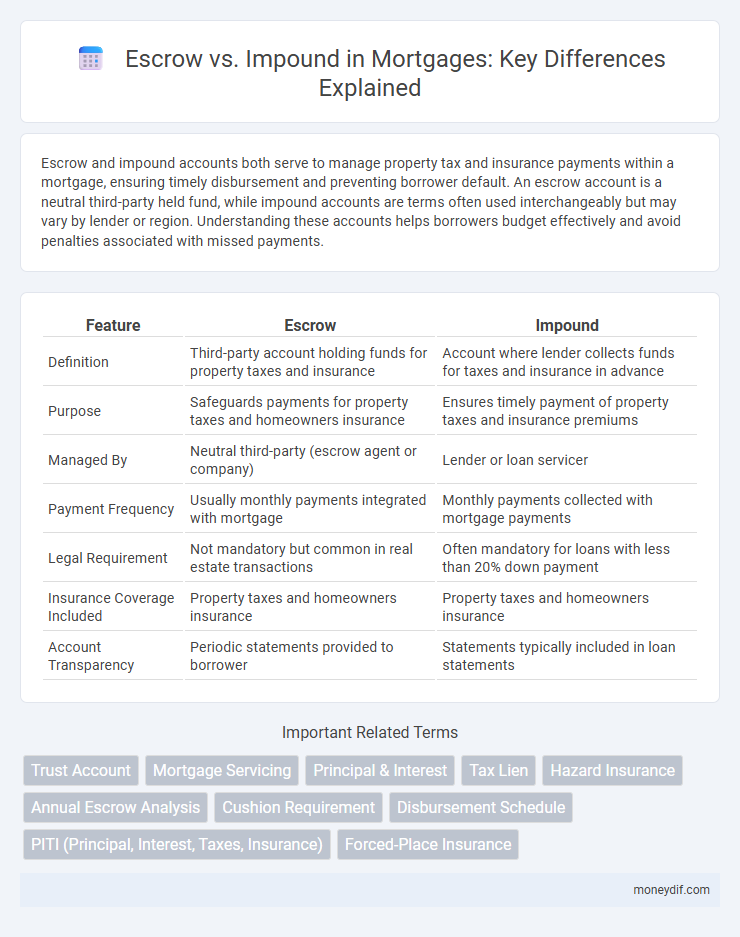

| Feature | Escrow | Impound |

|---|---|---|

| Definition | Third-party account holding funds for property taxes and insurance | Account where lender collects funds for taxes and insurance in advance |

| Purpose | Safeguards payments for property taxes and homeowners insurance | Ensures timely payment of property taxes and insurance premiums |

| Managed By | Neutral third-party (escrow agent or company) | Lender or loan servicer |

| Payment Frequency | Usually monthly payments integrated with mortgage | Monthly payments collected with mortgage payments |

| Legal Requirement | Not mandatory but common in real estate transactions | Often mandatory for loans with less than 20% down payment |

| Insurance Coverage Included | Property taxes and homeowners insurance | Property taxes and homeowners insurance |

| Account Transparency | Periodic statements provided to borrower | Statements typically included in loan statements |

Escrow vs Impound: Key Differences Explained

Escrow and impound accounts are both used in mortgage payments to manage property taxes and insurance, but escrow refers to a third-party account that holds funds until conditions are met, while impound is the lender's term for collecting and disbursing these payments on behalf of the borrower. An escrow account ensures that property tax and homeowners insurance premiums are paid on time by accumulating monthly payments from the borrower, whereas an impound account functions similarly but is mandated in some states and loan types for regulatory compliance. Understanding the distinctions between escrow and impound accounts helps homeowners manage their mortgage obligations and avoid tax or insurance payment lapses.

What is an Escrow Account in Mortgages?

An escrow account in mortgages is a separate account managed by the lender to hold funds for property taxes and insurance premiums, ensuring timely payments and protecting both borrower and lender. This account accumulates monthly contributions from the borrower as part of their mortgage payment, preventing large lump-sum expenses. Escrow accounts safeguard the mortgage investment by maintaining the property's financial obligations current, thereby lowering default risk.

Understanding Impound Accounts for Homeowners

Impound accounts, commonly referred to as escrow accounts, are used by mortgage lenders to collect and hold funds for property taxes and homeowners insurance. Homeowners benefit from impound accounts by spreading these large expenses into monthly payments, ensuring timely bills and reducing the risk of tax liens or insurance lapses. Understanding impound accounts helps homeowners manage cash flow and maintain compliance with mortgage loan requirements.

Pros and Cons of Escrow Accounts

Escrow accounts simplify mortgage payments by consolidating property taxes and insurance into monthly installments, reducing the risk of large, lump-sum expenses for homeowners. However, escrow accounts may limit flexibility since homeowners cannot control the timing of payments and sometimes face surplus or shortage adjustments. Despite this, escrow accounts provide peace of mind by ensuring bills are paid on time, avoiding penalties or lapses in coverage.

The Benefits of Using an Impound Account

Impound accounts streamline mortgage payments by consolidating property taxes and insurance premiums into one monthly payment, reducing the risk of missed bills or late fees. They provide financial predictability, helping homeowners budget more effectively by spreading large annual costs over 12 months. Lenders benefit from impound accounts by ensuring that essential expenses related to the mortgage property are paid on time, protecting their investment.

How Escrow Accounts Work in Mortgage Payments

Escrow accounts in mortgage payments hold funds for property taxes and insurance, ensuring timely payments on behalf of the borrower. Lenders collect a portion of these costs with each monthly mortgage payment, safeguarding against missed obligations that could lead to penalties or lapses in coverage. This system simplifies budgeting for homeowners while protecting the lender's interest in the property.

Who Manages Escrow vs Impound Accounts?

Escrow and impound accounts are both managed by the mortgage servicer or lender on behalf of the borrower to ensure timely payment of property taxes and insurance premiums. The escrow account holds funds specifically designated for these expenses, while the impound account is a broader term often used interchangeably, but may include additional charges such as flood insurance or mortgage insurance. Mortgage servicers are responsible for collecting monthly payments, managing disbursements, and maintaining accurate records to prevent shortages or surpluses in these accounts.

Escrow Account Fees vs Impound Account Fees

Escrow account fees typically cover property taxes and homeowners insurance, collected monthly as part of the mortgage payment, ensuring timely payments without lump-sum bills. Impound account fees function similarly but may vary by lender terminology and include additional costs, sometimes resulting in different fee structures or higher reserves. Comparing escrow and impound fees involves evaluating monthly payment consistency, lender requirements, and the potential for surplus or shortage adjustments during annual account reviews.

When Should You Choose Impound Over Escrow?

Choose impound accounts over escrow when lenders require consistent monthly payments for property taxes and insurance to prevent large lump-sum expenses. Impound accounts offer better budgeting by spreading these costs evenly throughout the year, minimizing financial strain. Homebuyers with variable income or those seeking to avoid unexpected large payments should prioritize impound accounts for financial stability.

Frequently Asked Questions: Escrow vs Impound

Escrow and impound accounts both hold funds for property taxes and insurance, but escrow is a broader term often used interchangeably with impound in mortgage contexts. Borrowers frequently ask if these accounts affect monthly mortgage payments, which they do by spreading out large tax and insurance bills into manageable installments. Understanding the differences can clarify payment expectations and aid in mortgage planning.

Important Terms

Trust Account

A trust account securely holds funds on behalf of parties during real estate transactions, ensuring legal compliance and protection against misuse. Escrow accounts temporarily hold buyer and seller funds until contract terms are met, while impound accounts collect monthly property tax and insurance payments through mortgage lenders to manage ongoing expenses.

Mortgage Servicing

Mortgage servicing includes managing escrow accounts, also known as impound accounts, which hold funds for property taxes and insurance. These accounts ensure timely payments by collecting monthly deposits from borrowers as part of their mortgage payments, reducing the risk of defaults and maintaining loan compliance.

Principal & Interest

Principal and interest represent the core components of a mortgage payment, covering the loan amount borrowed and the cost of borrowing. Escrow accounts, often used interchangeably with impound accounts, hold funds collected with monthly payments to cover property taxes and insurance, ensuring timely disbursement and preventing borrower default.

Tax Lien

Tax lien refers to a legal claim by the government on a property for unpaid taxes, often requiring resolution before the property can be sold or refinanced. Escrow accounts hold funds collected for property taxes and insurance, whereas impound accounts are specifically mandated by lenders to manage ongoing tax and insurance payments, reducing the risk of tax liens.

Hazard Insurance

Hazard insurance protects property owners against damages from natural disasters and is often required by lenders to safeguard their investment. Escrow accounts hold funds collected from borrowers to pay hazard insurance premiums, while impound accounts are a specific type of escrow used exclusively for this purpose and property taxes, ensuring timely payments and reducing lender risk.

Annual Escrow Analysis

An annual escrow analysis reviews the escrow account to ensure adequate funds are available for property taxes and insurance, preventing shortages or surpluses. Escrow accounts, sometimes called impound accounts, serve the same function of holding funds for future payments, though terminology varies by lender or region.

Cushion Requirement

A cushion requirement in escrow accounts involves maintaining an additional balance, typically ranging from two to six months of escrow payments, to protect lenders from fluctuations in property taxes and insurance costs, while impound accounts often do not require this extra buffer. This financial safety net helps prevent shortages that could lead to unexpected payment demands, ensuring consistent coverage of escrowed expenses throughout the year.

Disbursement Schedule

A disbursement schedule in escrow outlines the precise timing and conditions under which funds are released to sellers or service providers, ensuring secure transaction management. In contrast, impound accounts collect and hold funds for future expenses like taxes and insurance, with disbursements made periodically by the lender to cover these costs.

PITI (Principal, Interest, Taxes, Insurance)

PITI represents the total monthly mortgage payment including Principal, Interest, Taxes, and Insurance, where escrow accounts collect taxes and insurance funds held by the lender until payment is due. Escrow and impound accounts function similarly, securing property tax and insurance payments within the PITI structure to ensure timely disbursement and avoid borrower default.

Forced-Place Insurance

Forced-place insurance occurs when a lender purchases hazard insurance on a borrower's property due to the borrower's failure to maintain adequate coverage, often funded through escrow accounts. Escrow accounts collect funds from the borrower to pay property taxes and insurance, while impound accounts specifically refer to the portion reserved for insurance premiums, highlighting the lender's protective measures in mortgage agreements.

Escrow vs Impound Infographic

moneydif.com

moneydif.com