Mortgage recasting involves making a lump-sum payment toward the principal balance, which lowers monthly payments without changing the interest rate or loan term, making it a cost-effective option for borrowers who have extra funds. Mortgage refinancing replaces the existing loan with a new one, often to secure a lower interest rate, change the loan term, or switch loan types, but typically includes closing costs and a credit check. Choosing between recasting and refinancing depends on a borrower's financial goals, current interest rates, and how long they plan to stay in the home.

Table of Comparison

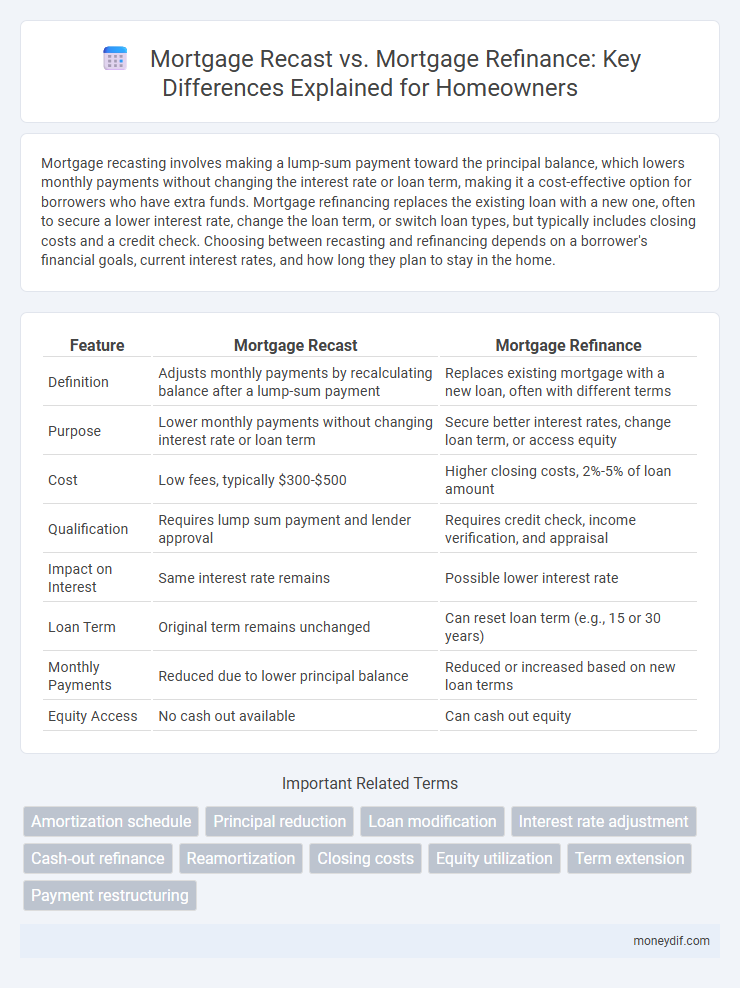

| Feature | Mortgage Recast | Mortgage Refinance |

|---|---|---|

| Definition | Adjusts monthly payments by recalculating balance after a lump-sum payment | Replaces existing mortgage with a new loan, often with different terms |

| Purpose | Lower monthly payments without changing interest rate or loan term | Secure better interest rates, change loan term, or access equity |

| Cost | Low fees, typically $300-$500 | Higher closing costs, 2%-5% of loan amount |

| Qualification | Requires lump sum payment and lender approval | Requires credit check, income verification, and appraisal |

| Impact on Interest | Same interest rate remains | Possible lower interest rate |

| Loan Term | Original term remains unchanged | Can reset loan term (e.g., 15 or 30 years) |

| Monthly Payments | Reduced due to lower principal balance | Reduced or increased based on new loan terms |

| Equity Access | No cash out available | Can cash out equity |

Understanding Mortgage Recast and Mortgage Refinance

Mortgage recast involves paying a lump sum toward the principal balance to reduce monthly payments without changing the interest rate or loan term, whereas mortgage refinance replaces the existing loan with a new one, often securing a lower interest rate or different loan terms. Recasting typically requires lower fees and retains the original loan's conditions, making it a cost-effective option for borrowers with extra cash. Refinancing offers more flexibility to adjust loan duration or switch between fixed and adjustable rates but involves closing costs and potential credit checks.

Key Differences Between Recasting and Refinancing

Mortgage recasting involves making a lump-sum payment toward the loan principal to reduce monthly payments without changing the interest rate, while refinancing replaces the existing mortgage with a new loan, often to secure a lower interest rate or change loan terms. Recasting typically has lower fees and keeps the original loan terms intact, whereas refinancing may involve closing costs, credit checks, and can alter loan duration. Homeowners seeking immediate payment reduction without qualifying for a new loan often prefer recasting, while those aiming for long-term interest savings or cash-out options select refinancing.

Pros and Cons of Mortgage Recast

Mortgage recast lowers monthly payments by applying a lump sum toward the principal without changing the loan terms, making it beneficial for borrowers seeking lower payments without refinancing costs. It has the advantage of typically lower fees and no need for credit checks, but it does not reduce the interest rate or shorten the loan term. The main drawback is the requirement of a substantial principal payment upfront, limiting its suitability for borrowers without extra cash reserves.

Advantages and Disadvantages of Mortgage Refinance

Mortgage refinance offers the advantage of potentially lowering interest rates, reducing monthly payments, and tapping into home equity for cash, which can improve overall financial flexibility. However, refinancing often involves closing costs, extended loan terms, and the risk of resetting the amortization schedule, which may increase total interest paid over time. Homeowners should weigh these factors against their current mortgage conditions and long-term financial goals before deciding.

Eligibility Requirements for Recast vs Refinance

Mortgage recast eligibility typically requires a minimum payment amount, often $5,000 or more, applied to the principal, with the borrower maintaining a good payment history and having a conventional loan type; it is not available for government-backed loans like FHA or VA. Refinancing eligibility involves credit score thresholds, debt-to-income ratio limits usually below 43%, and appraisal requirements, with options for cash-out or rate-and-term refinances. Understanding these distinct criteria helps borrowers choose between recasting to reduce monthly payments without new underwriting or refinancing to potentially lower interest rates or change loan terms.

Cost Comparison: Recasting vs Refinancing

Mortgage recasting typically involves a one-time fee ranging from $300 to $500, significantly lower than refinancing costs, which can exceed 2% to 5% of the loan amount due to closing fees, appraisal, and underwriting expenses. Recasting reduces monthly payments by recalculating the mortgage balance after a lump-sum principal payment without changing the interest rate, while refinancing replaces the existing loan, potentially lowering the rate but incurring higher upfront costs. Homeowners seeking to lower payments with minimal expense often prefer recasting, whereas refinancing offers long-term savings when interest rates have dropped considerably.

How Each Option Impacts Monthly Payments

Mortgage recast reduces monthly payments by applying a lump sum toward the principal balance, lowering the loan amount while keeping the original interest rate and term unchanged. Mortgage refinance replaces the existing loan with a new one, potentially with a different interest rate and term, which can significantly lower or occasionally increase monthly payments depending on the new loan terms. Homeowners seeking quick payment relief with lower fees might favor recasting, whereas those aiming for lower interest rates or adjusted loan terms often choose refinancing.

Impact on Loan Term and Interest Paid

Mortgage recast reduces monthly payments by applying a lump sum to the principal without changing the original loan term, resulting in lower interest paid over time due to the reduced principal balance. Mortgage refinance replaces the existing loan with a new one, often extending or shortening the loan term, which can significantly alter total interest paid depending on the new rate and term length. Choosing between recast and refinance impacts how quickly the loan is paid off and the total cost of borrowing, with recast maintaining the original amortization schedule and refinance customizing it.

Situations Where Recasting Makes Sense

Mortgage recasting makes sense when a borrower has a lump sum of money to apply toward their principal without changing the loan terms or interest rate, offering lower monthly payments while avoiding refinancing costs and fees. This strategy is ideal for those with stable interest rates who want to reduce payments but keep their existing mortgage structure. Mortgage refinancing is more advantageous when seeking a better interest rate, shorter loan term, or different loan type despite higher closing costs.

When to Choose Mortgage Refinance Over Recast

Mortgage refinance is ideal when borrowers seek to secure a lower interest rate or change loan terms, potentially reducing monthly payments and overall interest costs. Choosing refinance makes sense if you want to switch from an adjustable-rate mortgage (ARM) to a fixed-rate or shorten the loan term for faster equity buildup. Recast is less beneficial when interest rates drop significantly or when altering the loan type, making refinancing the better option for long-term savings.

Important Terms

Amortization schedule

An amortization schedule details each mortgage payment's allocation between principal and interest over time, crucial for comparing mortgage recast and refinance options; a recast reduces monthly payments by recalculating the amortization schedule after a lump sum principal payment without changing the loan terms, while refinancing creates a new amortization schedule based on new loan terms and interest rates, potentially lowering payments or loan duration. Understanding how each option affects the amortization schedule helps homeowners decide between saving on interest or reducing monthly payments efficiently.

Principal reduction

Principal reduction lowers the outstanding loan balance by directly decreasing the mortgage principal, often achieved through a mortgage refinance or a recast. Mortgage recasts reduce monthly payments by recalculating amortization on the remaining principal without changing the interest rate, while mortgage refinancing replaces the original loan with a new one, possibly with a lower rate, term, and principal balance.

Loan modification

Loan modification adjusts the original mortgage terms to make payments more affordable without replacing the loan, whereas mortgage recast involves paying a lump sum toward the principal to lower monthly payments while keeping the original loan terms intact. Mortgage refinance replaces the existing loan with a new one, often to secure a lower interest rate or change the loan duration, potentially resetting the amortization schedule.

Interest rate adjustment

Mortgage recast adjusts the loan balance by applying a lump sum payment towards the principal, lowering monthly payments without changing the interest rate or loan term, whereas mortgage refinance replaces the existing loan with a new one that often features a different interest rate and loan conditions. Interest rate adjustments in refinance can lead to significant savings or costs depending on market rates, while recast primarily benefits borrowers looking to reduce payments without undergoing credit checks or closing costs.

Cash-out refinance

Cash-out refinance allows homeowners to tap into their home's equity by replacing their existing mortgage with a new, larger loan, providing immediate funds while potentially resetting the interest rate and term, unlike a mortgage recast which only adjusts the monthly payments by applying a lump sum to the principal without changing the loan terms. Mortgage refinance typically replaces the original loan with a new one, possibly offering better rates or terms, but only cash-out refinance provides access to extra cash beyond the remaining mortgage balance.

Reamortization

Reamortization adjusts the remaining mortgage balance by recalculating payments over the original term after a principal prepayment, often used in mortgage recast to lower monthly payments without changing interest rates or loan terms. Mortgage refinance replaces the existing loan with a new one, possibly with different interest rates and terms, allowing borrowers to potentially reduce rates, change loan duration, or tap into equity, typically involving higher upfront costs compared to reamortization.

Closing costs

Mortgage recast typically involves lower closing costs, usually limited to a fee ranging from $300 to $500, whereas mortgage refinance closing costs can reach 2% to 5% of the loan amount due to appraisal, credit report, and lender fees. Choosing a recast helps reduce upfront expenses while maintaining the original loan terms, in contrast to refinancing which resets the loan with potentially new interest rates and terms but incurs higher closing costs.

Equity utilization

Equity utilization in mortgage recasting allows homeowners to reduce monthly payments by adjusting the loan term without increasing debt, preserving existing interest rates and avoiding closing costs. Conversely, mortgage refinancing leverages home equity to obtain a new loan with potentially lower rates or different terms, often increasing debt but providing cash-out options and long-term savings.

Term extension

Term extension modifies the loan duration without altering the principal balance, often lowering monthly payments by spreading them over a longer period, while mortgage recast keeps the original interest rate and loan term but reduces payments by applying a lump sum to principal. Mortgage refinance replaces the existing loan with a new one, typically with different interest rates and terms, potentially offering lower rates or cash-out options, unlike term extension or recasting which maintain the original loan framework.

Payment restructuring

Payment restructuring through mortgage recast involves making a lump sum payment toward the principal, reducing monthly mortgage payments without changing the loan term or interest rate, offering lower costs and faster approval compared to mortgage refinance. Mortgage refinance replaces the existing loan with a new one, potentially changing the interest rate, loan term, and monthly payments, which may lead to higher closing costs but can provide better long-term savings or adjusted loan conditions.

Mortgage recast vs Mortgage refinance Infographic

moneydif.com

moneydif.com