Lien position determines the priority of a mortgage lender's claim on a property in case of default, with the first lien holder having the highest priority. Subordination occurs when a lender agrees to move their lien position behind another lien, often to facilitate refinancing or a new loan. Understanding lien position and subordination is crucial for both borrowers and lenders to manage risks and ensure proper loan hierarchy.

Table of Comparison

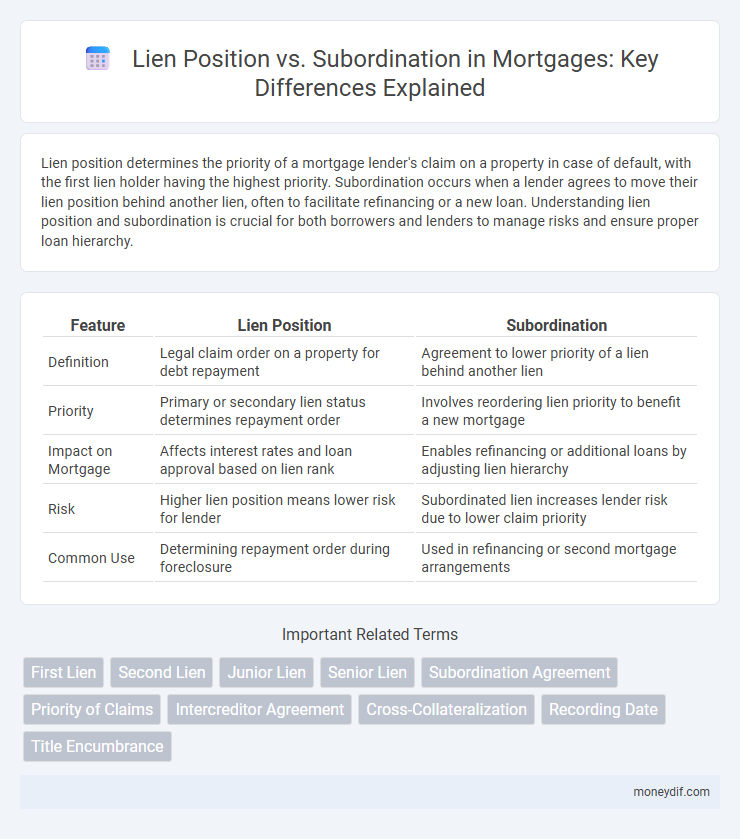

| Feature | Lien Position | Subordination |

|---|---|---|

| Definition | Legal claim order on a property for debt repayment | Agreement to lower priority of a lien behind another lien |

| Priority | Primary or secondary lien status determines repayment order | Involves reordering lien priority to benefit a new mortgage |

| Impact on Mortgage | Affects interest rates and loan approval based on lien rank | Enables refinancing or additional loans by adjusting lien hierarchy |

| Risk | Higher lien position means lower risk for lender | Subordinated lien increases lender risk due to lower claim priority |

| Common Use | Determining repayment order during foreclosure | Used in refinancing or second mortgage arrangements |

Understanding Lien Position in Mortgages

Lien position in mortgages determines the priority order in which creditors are paid if the property is sold or foreclosed. The first lien holder has the primary claim on the property's proceeds, making their mortgage the most secure and typically carrying lower interest rates. Subordination agreements allow later liens to take priority, but understanding the initial lien position is crucial for assessing risk and loan terms.

What Is Subordination in Mortgage Lending?

Subordination in mortgage lending refers to the process where a lien holder agrees to place their claim behind another lien in priority order. This typically occurs when a borrower takes out a second mortgage or home equity loan, and the new lender requires the existing lien to be subordinate to their loan. Understanding subordination is crucial as it affects the risk and repayment priority in the event of foreclosure.

Primary vs. Secondary Lien: Key Differences

Primary liens hold the first position on a property title, giving lenders superior claim priority in case of default or foreclosure, whereas secondary liens, often referred to as subordinate liens, are held after the primary lien and carry increased risk. Subordination agreements may shift lien priority but typically, primary liens impact loan terms, interest rates, and borrower risk more significantly. Understanding the lien position is crucial for mortgage lenders and borrowers to manage risk, loan approval, and repayment hierarchy effectively.

How Lien Position Affects Loan Priority

Lien position determines the priority of claims on a property during loan repayment, with the first lien holding the highest priority and subsequent liens ranked accordingly. When a borrower defaults, lenders with superior lien positions are paid before those with subordinate liens, affecting the risk and terms of the loans. Subordination agreements can alter lien order, impacting which lender is prioritized in foreclosure or payoff scenarios.

The Importance of Subordination Agreements

Subordination agreements are crucial in determining lien priority when multiple mortgages or liens exist on a property, ensuring that the primary lender maintains priority over subsequent creditors. Without a subordination agreement, later loans or liens could potentially take precedence, complicating foreclosure processes and loan recovery. Properly executed subordination agreements protect senior lienholders' interests and facilitate smoother refinancing or additional borrowing arrangements.

Steps in the Subordination Process

The subordination process requires the primary lienholder to agree to hold a lower lien position behind a new loan, typically involving a detailed review of current loan terms and verification of the new loan's legitimacy. This process starts with a formal subordination request submitted to the senior lienholder, followed by legal documentation preparation to amend the original lien priority. Final approval hinges on ensuring the new lien does not violate the original loan agreement or pose undue risk, thereby preserving the senior lienholder's security interest.

Impact of Lien Position on Foreclosure

Lien position determines the order in which creditors are paid during a foreclosure, with first lien holders having the highest priority to recover owed amounts. Subordination agreements can alter the lien priority, potentially affecting the risk exposure and recovery rate for subordinate lien holders. Understanding lien position is crucial for investors and borrowers because it directly influences foreclosure outcomes and financial losses.

Common Scenarios for Subordination Requests

Common scenarios for subordination requests in mortgage lending include refinancing an existing first mortgage while retaining a second lien, home equity line of credit (HELOC) establishment after primary loan origination, and property tax or mechanics' liens placed after the initial mortgage. Subordination agreements ensure the original lien maintains priority, which is critical for lenders to protect their security interest. These requests are prevalent when borrowers seek to improve loan terms or access additional funds without triggering lien restructuring.

Protecting Your Interests: Lien Position Strategies

Securing the primary lien position is crucial for protecting your interests in mortgage transactions, as it ensures priority in repayment over other claims. Subordination agreements can alter this hierarchy by allowing a subsequent lien to take precedence, potentially increasing risk for the original lender. Understanding and negotiating lien position strategies helps mitigate financial exposure and safeguard investment returns.

Lien Position vs. Subordination: Which Matters More?

Lien position determines the priority of claims on a property, impacting which lender gets paid first in foreclosure, making it a critical factor in risk assessment. Subordination agreements alter this priority by allowing a later lien to take precedence, often used to facilitate refinancing or new loans. Understanding lien position versus subordination is essential for borrowers and lenders to navigate loan hierarchies and minimize financial risk effectively.

Important Terms

First Lien

First lien holds the highest lien position, ensuring primary claim on assets and priority repayment over any subordinate liens in the capital structure.

Second Lien

Second lien loans hold a lower lien position than first liens, resulting in subordination that places them behind primary liens in priority for repayment during default.

Junior Lien

A junior lien holds a subordinate position compared to the senior lien, meaning it is paid after the senior lien in the event of foreclosure.

Senior Lien

Senior lien holds a higher lien position than subordinate liens, ensuring priority claim on assets and repayment before any subordination occurs.

Subordination Agreement

A Subordination Agreement legally ranks a creditor's lien position below another lien, ensuring priority of payment and enforcement rights in case of borrower default.

Priority of Claims

Lien position determines the priority of claims, with superior liens receiving payment before subordinated liens during asset liquidation.

Intercreditor Agreement

An Intercreditor Agreement establishes the priority of claims between multiple creditors, clearly defining lien positions to avoid conflicts during borrower default or liquidation. It outlines subordination terms by specifying which lender holds senior or junior status, ensuring enforceable rights and repayment order based on agreed security interests.

Cross-Collateralization

Cross-collateralization affects lien position by potentially subordinating existing liens as multiple assets secure a single loan, which can alter priority and risk for creditors.

Recording Date

Recording date determines the lien priority by establishing the chronological order in which liens are officially recorded, directly impacting lien position in property claims. Subordination agreements alter this priority by contractually ranking one lien below another despite the initial recording date, affecting the enforceability and payment order during foreclosure.

Title Encumbrance

Title encumbrance affects lien position by prioritizing claims on a property, where subordination agreements can alter the original order of liens to change the priority hierarchy.

Lien Position vs Subordination Infographic

moneydif.com

moneydif.com