3-D Secure (3DS) enhances online payment security by adding an authentication layer that verifies the cardholder's identity during transactions, reducing fraud risk effectively. In contrast, CVV (Card Verification Value) is a static security feature that confirms the card is in possession but does not authenticate the user beyond the physical card details. Merchants benefit from 3DS by lowering chargebacks and increasing transaction approval rates, while CVV serves primarily as a basic check during card-not-present payments.

Table of Comparison

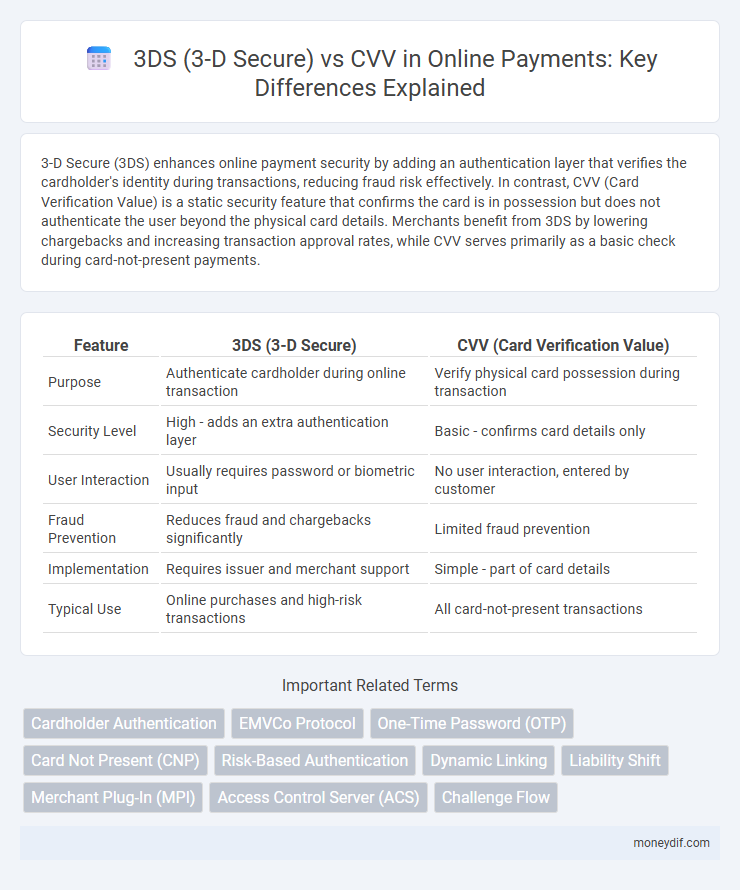

| Feature | 3DS (3-D Secure) | CVV (Card Verification Value) |

|---|---|---|

| Purpose | Authenticate cardholder during online transaction | Verify physical card possession during transaction |

| Security Level | High - adds an extra authentication layer | Basic - confirms card details only |

| User Interaction | Usually requires password or biometric input | No user interaction, entered by customer |

| Fraud Prevention | Reduces fraud and chargebacks significantly | Limited fraud prevention |

| Implementation | Requires issuer and merchant support | Simple - part of card details |

| Typical Use | Online purchases and high-risk transactions | All card-not-present transactions |

Overview of 3DS and CVV in Payment Security

3-D Secure (3DS) is an authentication protocol designed to enhance payment security by requiring cardholders to verify their identity during online transactions, reducing fraud risk. The Card Verification Value (CVV) is a three- or four-digit code on credit cards, used to confirm the physical possession of the card in card-not-present payments. While CVV offers basic verification against unauthorized use, 3DS provides dynamic multi-factor authentication for a higher level of protection in e-commerce environments.

How 3-D Secure (3DS) Works

3-D Secure (3DS) enhances payment security by adding an authentication layer during online card transactions, requiring cardholders to verify their identity through a password, biometric, or one-time code. Unlike CVV, which only confirms that the card details are present, 3DS reduces fraud by linking the transaction to the card issuer's authentication system, ensuring payment authorization in real-time. This process significantly lowers chargebacks and increases trust for e-commerce merchants and customers.

Understanding CVV: Card Verification Value Explained

CVV (Card Verification Value) is a three- or four-digit security code printed on credit and debit cards, used to verify the cardholder's identity during online or card-not-present transactions. Unlike 3-D Secure (3DS), which adds an additional authentication step by redirecting users to the issuer's verification page, CVV provides a simple, instant validation that confirms the card is physically in the user's possession. CVV helps prevent fraud by ensuring the payment details required for the transaction are accurate, reducing the likelihood of unauthorized use without the need for a separate authentication process.

Key Differences Between 3DS and CVV

3-D Secure (3DS) provides an additional authentication layer by prompting cardholders to verify their identity during online transactions, enhancing security beyond static data. CVV (Card Verification Value) is a three- or four-digit code on the card used to confirm possession of the physical card during payment. Unlike CVV, which validates the card itself, 3DS authenticates the cardholder, significantly reducing fraudulent activities in e-commerce payments.

Advantages of 3DS Authentication

3-D Secure (3DS) authentication enhances payment security by adding an extra layer of verification through the cardholder's bank, reducing fraud and chargebacks more effectively than CVV alone. Unlike CVV, which only verifies card possession, 3DS confirms the identity of the user during the transaction, enabling merchants to shift liability and increase buyer confidence. This improved authentication process supports compliance with regulations like PSD2 and improves approval rates for legitimate transactions.

Benefits and Limitations of CVV

CVV (Card Verification Value) enhances online payment security by verifying the cardholder possesses the physical card, reducing fraud risk during transactions without requiring additional authentication steps. However, CVV is limited in its protection scope as it lacks dynamic verification and does not prevent unauthorized use if the CVV code is obtained illicitly. Compared to 3DS (3-D Secure), CVV offers a simpler, faster checkout experience but provides less robust defense against sophisticated fraud attempts.

3DS vs CVV: Use Cases in Online Transactions

3-D Secure (3DS) enhances online payment security by requiring cardholder authentication during transactions, significantly reducing fraud compared to CVV verification, which only checks the card's physical security code without additional identity confirmation. While CVV is effective for simple card-not-present transactions, 3DS is crucial for high-risk purchases as it involves dynamic authentication methods like passwords or biometric verification. Merchants handling sensitive or high-value online sales benefit from 3DS by minimizing chargebacks and ensuring compliance with payment regulations like PSD2.

Impact on Fraud Prevention: 3DS vs CVV

3-D Secure (3DS) significantly enhances fraud prevention by adding an authentication layer verifying cardholder identity during online transactions, reducing unauthorized use more effectively than CVV alone. CVV provides a basic security check but lacks the dynamic verification capabilities of 3DS, making it more susceptible to compromised card data misuse. Implementing 3DS decreases chargebacks and fraud rates by authenticating transactions in real-time, offering superior protection for merchants and customers.

User Experience: 3DS Challenges vs CVV Simplicity

3-D Secure (3DS) enhances payment security by requiring multi-factor authentication, often leading to additional steps that can frustrate users and cause cart abandonment. In contrast, the CVV code offers a simpler, faster user experience by verifying card legitimacy without interrupting the checkout flow. Balancing 3DS's robust fraud protection with the streamlined convenience of CVV remains a critical challenge for optimizing payment user experience.

Choosing the Right Security Layer: 3DS or CVV

Choosing the right security layer between 3-D Secure (3DS) and CVV depends on the desired level of fraud protection and user experience. 3DS provides an additional authentication step that significantly reduces chargebacks by verifying the cardholder's identity during the transaction, making it ideal for high-risk or international payments. CVV verification offers a basic, quick security check by confirming the physical card possession but lacks the dynamic authentication capabilities of 3DS, making it suitable for lower-risk transactions.

Important Terms

Cardholder Authentication

Cardholder Authentication leverages 3-D Secure (3DS) as a dynamic, real-time verification method by requiring consumers to confirm their identity through biometric or password-based challenges during online transactions, enhancing fraud prevention beyond static CVV data. Unlike CVV, which is a fixed, three-digit security code on payment cards used for basic card-not-present verification, 3DS adds an additional authentication layer that significantly reduces the risk of unauthorized card use and chargebacks.

EMVCo Protocol

EMVCo Protocol for 3-D Secure (3DS) enhances online transaction security by authenticating cardholders through dynamic cryptographic methods, reducing fraud compared to static CVV codes that only verify card presence. While CVV confirms card data validity, 3DS leverages EMVCo standards to enable real-time identity verification, improving payment authorization accuracy and customer trust.

One-Time Password (OTP)

One-Time Password (OTP) enhances 3-D Secure (3DS) authentication by providing dynamic, time-sensitive verification codes that confirm cardholder identity during online transactions, reducing fraud risk beyond the static Card Verification Value (CVV). While CVV verifies physical card possession, OTP delivers robust real-time authentication aligned with 3DS protocols, significantly improving e-commerce security.

Card Not Present (CNP)

Card Not Present (CNP) transactions rely on authentication methods like 3-D Secure (3DS) and CVV to reduce fraud risk; 3DS adds a dynamic, multi-factor verification layer by requiring user authentication through the card issuer, whereas CVV provides a static, three- or four-digit code verification. 3DS improves security by confirming cardholder identity in real-time during online purchases, while CVV primarily validates that the buyer has physical access to the card data.

Risk-Based Authentication

Risk-Based Authentication enhances payment security by analyzing transaction risk factors to decide when additional verification, like 3-D Secure (3DS), is necessary, improving fraud prevention beyond static credentials such as CVV. Unlike CVV, which is a fixed card detail used for verification, 3DS integrates dynamic authentication methods tailored to transaction risk, thereby reducing false declines and increasing secure approval rates.

Dynamic Linking

Dynamic linking in 3-D Secure (3DS) enhances transaction security by cryptographically tying authentication data to specific transaction details, such as amount and merchant, preventing replay attacks and reducing fraud. Unlike static CVV, which provides a fixed card verification value, dynamic linking ensures that authentication codes are unique per transaction, significantly improving fraud detection and authorization accuracy.

Liability Shift

Liability Shift in payment processing occurs when fraud liability transfers from merchants to card issuers once 3-D Secure (3DS) authentication is successfully completed, reducing merchant risk compared to relying solely on CVV verification. Unlike CVV, which only validates card-not-present transactions, 3DS provides an extra layer of authentication that enhances security and fraud prevention while enabling merchants to benefit from this liability protection.

Merchant Plug-In (MPI)

Merchant Plug-In (MPI) is a critical software component in the 3-D Secure (3DS) authentication framework that verifies cardholder identity during online transactions by enabling communication between the merchant and the card issuer's Access Control Server (ACS). Unlike CVV (Card Verification Value), which provides static card security, MPI facilitates dynamic authentication in 3DS, significantly reducing fraud by verifying the cardholder's presence in real-time during checkout.

Access Control Server (ACS)

Access Control Server (ACS) is a key component in the 3-D Secure (3DS) authentication protocol, facilitating real-time verification of cardholder identity during online transactions to prevent fraud. Unlike CVV, which is a static cardholder verification value used for basic card-not-present security, ACS leverages dynamic authentication methods to enhance transaction security through multi-factor verification and risk assessment.

Challenge Flow

Challenge Flow in 3DS (3-D Secure) enhances transaction security by prompting cardholders to authenticate via dynamic verification methods beyond static CVV checks, reducing fraud risk. Unlike CVV, which only verifies card data at the point of sale, 3DS Challenge Flow involves real-time identity confirmation through biometric, OTP, or password inputs, improving compliance with PSD2 regulations and minimizing chargebacks.

3DS (3-D Secure) vs CVV Infographic

moneydif.com

moneydif.com