A virtual terminal enables merchants to process payments remotely by entering card details through a secure online interface, eliminating the need for physical hardware at the point of sale. Physical terminals, on the other hand, are dedicated devices that read cards in-store, often supporting chip, swipe, or contactless payments for immediate transaction processing. Choosing between a virtual terminal and a physical terminal depends on the nature of the business, with virtual terminals ideal for phone or mail orders and physical terminals suited for face-to-face retail environments.

Table of Comparison

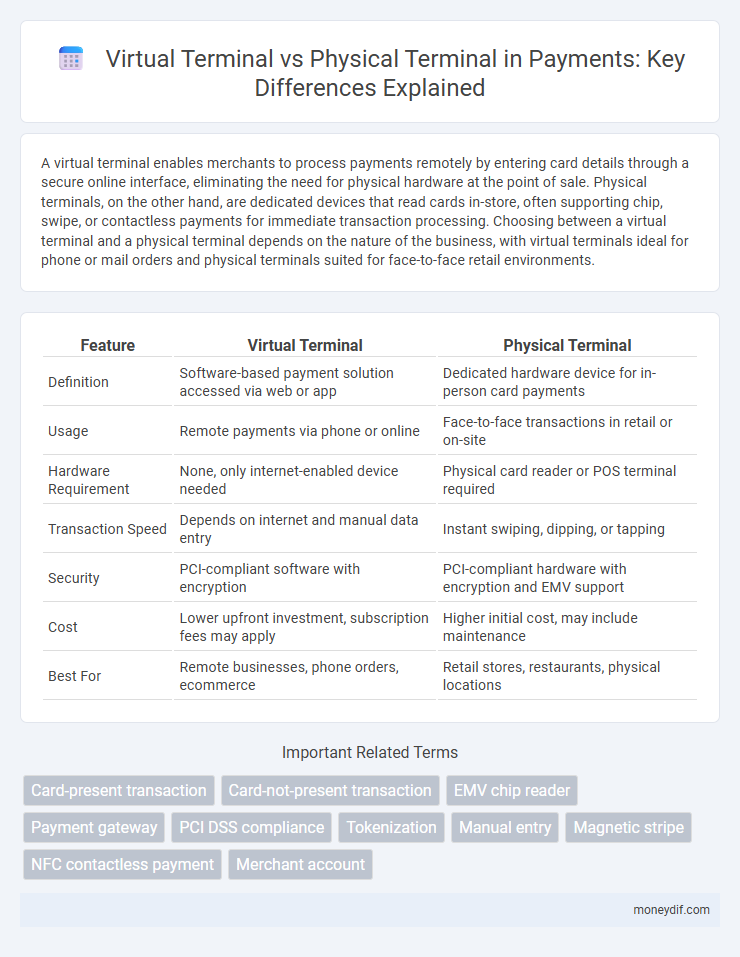

| Feature | Virtual Terminal | Physical Terminal |

|---|---|---|

| Definition | Software-based payment solution accessed via web or app | Dedicated hardware device for in-person card payments |

| Usage | Remote payments via phone or online | Face-to-face transactions in retail or on-site |

| Hardware Requirement | None, only internet-enabled device needed | Physical card reader or POS terminal required |

| Transaction Speed | Depends on internet and manual data entry | Instant swiping, dipping, or tapping |

| Security | PCI-compliant software with encryption | PCI-compliant hardware with encryption and EMV support |

| Cost | Lower upfront investment, subscription fees may apply | Higher initial cost, may include maintenance |

| Best For | Remote businesses, phone orders, ecommerce | Retail stores, restaurants, physical locations |

Introduction to Virtual and Physical Payment Terminals

Virtual payment terminals enable merchants to process transactions online through a web-based interface without needing physical hardware, offering flexibility for remote sales. Physical payment terminals, commonly used at brick-and-mortar stores, are hardware devices that securely accept card payments via magnetic stripe, chip, or contactless methods. Both virtual and physical terminals utilize encryption and PCI DSS compliance to ensure secure and efficient payment processing.

How Virtual Terminals Work

Virtual terminals process payments by allowing merchants to manually enter customer card details into an online platform, eliminating the need for physical card readers. These web-based applications securely transmit transaction data via HTTPS to payment gateways, which then communicate with acquiring banks for authorization. Virtual terminals support a wide range of payment methods, including credit and debit cards, enabling remote and phone-based transactions with real-time processing and reporting.

How Physical Terminals Work

Physical terminals process payments by reading card data through magnetic stripe readers, EMV chip scanners, or contactless NFC technology, securely transmitting transaction details to payment processors via wired or wireless networks. These devices authenticate and authorize payments in real-time, ensuring compliance with PCI-DSS standards to protect cardholder information. Integration with point-of-sale systems enables seamless transaction recording, receipt printing, and inventory management.

Key Differences Between Virtual and Physical Terminals

Virtual terminals process payments through web-based software, enabling merchants to accept card payments via a computer or mobile device without additional hardware. Physical terminals require dedicated card reader devices for swiping, inserting, or tapping cards on-site, offering faster transaction speeds and hardware-based security features. Virtual terminals provide flexibility for remote or phone orders, whereas physical terminals are essential for in-person transactions with immediate card interaction.

Security Features: Virtual vs. Physical Terminals

Virtual terminals utilize advanced encryption protocols like end-to-end encryption (E2EE) and tokenization to secure card data during online transactions, reducing the risk of data breaches. Physical terminals often incorporate EMV chip technology, PIN entry, and tamper-resistant hardware to protect against fraud and skimming attacks. Both systems comply with PCI DSS standards, but virtual terminals rely more heavily on software-based security measures, while physical terminals emphasize hardware-based protections.

Cost Comparison: Virtual Terminal vs. Physical Terminal

Virtual terminals typically incur lower costs compared to physical terminals due to the absence of hardware purchase or maintenance fees, relying primarily on software subscriptions or transaction-based pricing. Physical terminals require upfront investment in devices, regular servicing, and potential leasing fees, which increase the overall expenses for merchants. For businesses processing payments remotely or occasionally, virtual terminals offer a cost-efficient solution with scalable fees, whereas physical terminals are more cost-justifiable for high-volume, in-person transactions.

Use Cases: When to Choose Virtual or Physical Terminals

Virtual terminals excel in remote payment scenarios such as phone or mail orders, enabling merchants to process transactions without physical card readers. Physical terminals are ideal for in-person retail environments requiring quick, secure, contactless, or chip card payments. Businesses handling frequent face-to-face interactions benefit from physical terminals, while service providers, phone sales, and small online retailers gain flexibility and lower overhead with virtual terminals.

Integration with Business Systems

Virtual terminals offer seamless integration with business systems such as CRM and accounting software, enabling real-time transaction data synchronization. Physical terminals generally require separate middleware or manual data entry, leading to potential delays and errors in financial reporting. Streamlined integration of virtual terminals enhances operational efficiency and provides a unified view of payment activities within business workflows.

User Experience and Accessibility

Virtual terminals enable merchants to process payments remotely through web browsers, enhancing accessibility for businesses without physical storefronts or point-of-sale hardware. Physical terminals offer tactile feedback and intuitive interfaces, which benefit users with limited digital skills or unstable internet connections. User experience is often more seamless on physical terminals due to dedicated hardware, while virtual terminals provide flexibility by supporting payments from any location or device.

Future Trends in Payment Terminal Technology

Virtual terminals are rapidly advancing with AI-driven fraud detection and cloud-based payment processing, enabling merchants to handle transactions remotely with enhanced security. Physical terminals are evolving to support contactless payments, biometrics, and integration with IoT devices, providing seamless and personalized customer experiences. Future payment terminal technology emphasizes hybrid models combining virtual and physical capabilities to offer flexibility, speed, and improved data analytics for merchants.

Important Terms

Card-present transaction

Card-present transactions occur when the cardholder physically presents the payment card at a point of sale, typically using a physical terminal equipped with card readers and security features like EMV chips. In contrast, virtual terminals enable merchants to manually enter card details remotely through software interfaces, simulating a card-present environment digitally but often with higher fraud risks due to the lack of physical card verification.

Card-not-present transaction

Card-not-present transactions occur when payment details are entered manually via a virtual terminal, enabling secure remote processing without the physical card. Physical terminals, used for card-present transactions, require the card's chip or magnetic stripe for in-person authentication, reducing fraud risk compared to virtual terminal transactions.

EMV chip reader

EMV chip readers integrated into virtual terminals enable secure card-present transaction processing over online platforms, reducing the need for physical hardware while maintaining PCI compliance and encryption standards. Physical terminals with EMV chip readers provide direct card interaction, ensuring enhanced fraud detection through real-time chip authentication and offline data processing capabilities.

Payment gateway

A payment gateway enables secure online transactions by processing card details through virtual terminals, which function on web browsers without requiring physical hardware; physical terminals are traditional point-of-sale devices used in retail environments to capture card payments in-person. Virtual terminals offer flexibility for remote payments and e-commerce, while physical terminals provide reliable processing for brick-and-mortar stores.

PCI DSS compliance

PCI DSS compliance mandates that both virtual terminals and physical terminals adhere to stringent security standards, but virtual terminals require enhanced encryption protocols and secure authentication measures due to their reliance on internet connectivity. Physical terminals, while protected by secure hardware and network isolation, still demand regular firmware updates and tamper-resistant features to maintain PCI DSS compliance and prevent data breaches.

Tokenization

Tokenization enhances security in both virtual and physical terminals by replacing sensitive card information with unique tokens, reducing the risk of data breaches during transactions. Virtual terminals utilize tokenization to securely process online or phone payments without storing raw card data, while physical terminals apply it during in-person card swipes or EMV chip transactions to protect cardholder information at the point of sale.

Manual entry

Manual entry in a virtual terminal involves typing card details directly into a software interface, enabling remote payment processing without requiring a physical card reader. In contrast, physical terminals read card data through swiping, dipping, or tapping, providing enhanced security and faster transaction times by capturing encrypted card information.

Magnetic stripe

Magnetic stripe technology stores cardholder data on a physical terminal, enabling direct swiping and immediate transaction processing, while a virtual terminal relies on manual data entry of card information typically obtained from the magnetic stripe, facilitating remote payments without physical card presence. This distinction impacts transaction security, as virtual terminals may require enhanced verification methods to mitigate fraud due to the absence of physical card interaction.

NFC contactless payment

NFC contactless payment technology enables secure transactions by transmitting payment data through radio waves, allowing both virtual terminals and physical terminals to process payments efficiently. Virtual terminals facilitate remote payments without requiring physical card readers, while physical terminals use dedicated NFC hardware to authenticate and complete in-person transactions instantly.

Merchant account

A merchant account enables businesses to accept electronic payments through virtual terminals, which process transactions online without physical card readers, while physical terminals require card-present interactions using devices like POS systems. Virtual terminals offer flexibility for remote payments and phone orders, whereas physical terminals provide faster processing and increased security for in-person sales.

virtual terminal vs physical terminal Infographic

moneydif.com

moneydif.com