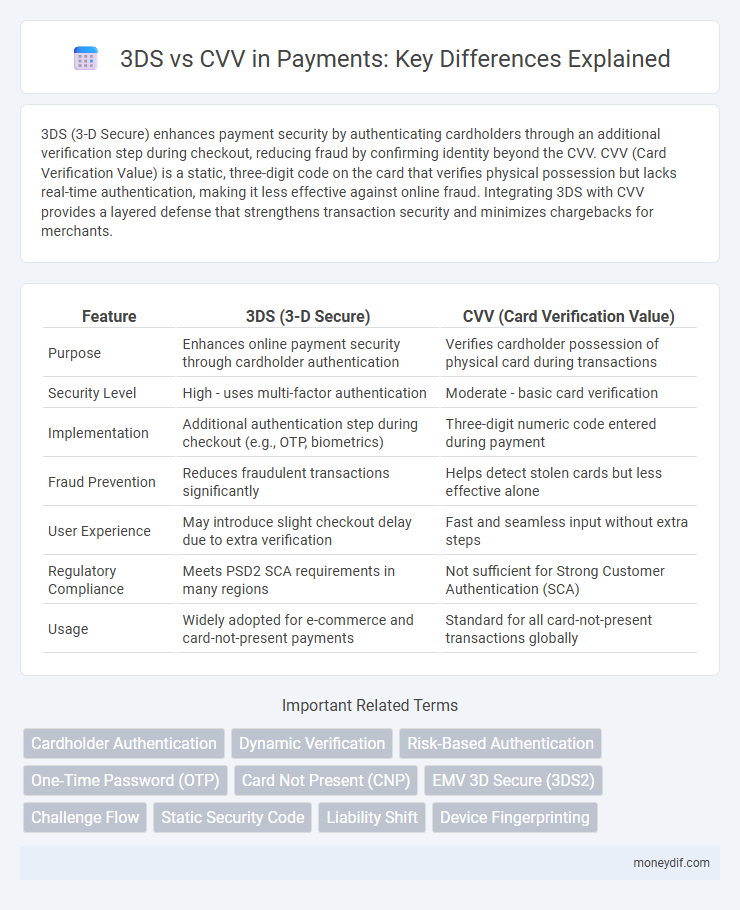

3DS (3-D Secure) enhances payment security by authenticating cardholders through an additional verification step during checkout, reducing fraud by confirming identity beyond the CVV. CVV (Card Verification Value) is a static, three-digit code on the card that verifies physical possession but lacks real-time authentication, making it less effective against online fraud. Integrating 3DS with CVV provides a layered defense that strengthens transaction security and minimizes chargebacks for merchants.

Table of Comparison

| Feature | 3DS (3-D Secure) | CVV (Card Verification Value) |

|---|---|---|

| Purpose | Enhances online payment security through cardholder authentication | Verifies cardholder possession of physical card during transactions |

| Security Level | High - uses multi-factor authentication | Moderate - basic card verification |

| Implementation | Additional authentication step during checkout (e.g., OTP, biometrics) | Three-digit numeric code entered during payment |

| Fraud Prevention | Reduces fraudulent transactions significantly | Helps detect stolen cards but less effective alone |

| User Experience | May introduce slight checkout delay due to extra verification | Fast and seamless input without extra steps |

| Regulatory Compliance | Meets PSD2 SCA requirements in many regions | Not sufficient for Strong Customer Authentication (SCA) |

| Usage | Widely adopted for e-commerce and card-not-present payments | Standard for all card-not-present transactions globally |

Understanding 3DS and CVV: Key Differences

3DS (Three-Domain Secure) enhances online payment security by requiring cardholder authentication through a password or biometric verification, significantly reducing fraudulent transactions. In contrast, CVV (Card Verification Value) is a three or four-digit code on the card used for verifying card-not-present transactions but does not provide real-time authentication. The primary difference lies in 3DS offering dynamic authentication during the transaction, while CVV serves as a static security feature to confirm card possession.

How 3DS Works in Payment Authentication

3DS (3-D Secure) enhances payment authentication by adding an extra layer of security through a two-step verification process during online transactions, requiring the cardholder to confirm their identity via a password, biometric verification, or one-time passcode. Unlike CVV, which only provides static information on the card's back used to verify card presence, 3DS actively prevents unauthorized use by communicating with the card issuer to authenticate the cardholder in real-time. This dynamic verification reduces fraud risk and increases transaction approval rates for merchants and payment processors.

The Role of CVV in Card Security

CVV (Card Verification Value) plays a critical role in card security by verifying that the cardholder possesses the physical card during online transactions, reducing the risk of fraudulent use of stolen card numbers. Unlike 3DS (3-D Secure), which adds an additional layer of authentication through password or biometric confirmation during checkout, CVV primarily serves as a static security code checked with every transaction. The combined use of CVV and 3DS significantly enhances payment security by addressing both possession and authentication aspects of cardholder verification.

3DS vs CVV: Fraud Prevention Effectiveness

3DS (Three-Domain Secure) provides enhanced fraud prevention by adding an additional authentication step during online transactions, significantly reducing unauthorized payments compared to CVV alone. While CVV verifies card presence, it does not prevent account takeover or identity theft, making 3DS more effective in combating payment fraud. Merchants implementing 3DS experience lower chargeback rates and increased transaction security, highlighting its superiority over CVV-only verification.

User Experience: 3DS vs CVV Checkout Process

3DS enhances security by requiring users to authenticate transactions via a password or biometric verification during checkout, reducing fraud but adding extra steps that may slow the process. CVV requires only the card's security code, enabling faster, streamlined checkouts but providing less robust fraud protection. Balancing user experience and security, merchants often choose 3DS for higher-risk transactions while using CVV for quicker, low-risk purchases.

Regulatory Compliance: 3DS and CVV Standards

3DS (3-D Secure) and CVV (Card Verification Value) each serve distinct roles in regulatory compliance within payment security frameworks; 3DS enhances authentication processes by complying with PSD2's Strong Customer Authentication (SCA) requirements, while CVV primarily verifies card-not-present transactions to reduce fraud risks. Regulatory standards mandate 3DS for multi-factor authentication to strengthen cardholder verification, whereas CVV remains a critical data point for validating transaction legitimacy without accessing full card details. Ensuring compliance with EMVCo's 3DS protocols and PCI DSS regulations for CVV usage significantly mitigates fraud and aligns with global payment security mandates.

Adoption Rates: 3DS vs CVV in Global Payments

3DS adoption rates in global payments have surged, with over 70% of e-commerce transactions utilizing this protocol in regions like Europe and North America, driven by regulatory mandates such as PSD2's Strong Customer Authentication. In contrast, CVV remains a ubiquitous security measure globally but lacks the dynamic authentication sophistication of 3DS, leading to declining reliance as fraud prevention standards evolve. Merchants and payment providers increasingly favor 3DS integration to reduce chargebacks and comply with international security requirements, resulting in its accelerated adoption over traditional CVV-only methods.

Payment Success Rates: Impact of 3DS and CVV

3DS authentication significantly improves payment success rates by reducing fraud-related declines and chargebacks, providing an added layer of security during online transactions. CVV verification alone offers basic fraud protection but is less effective in preventing unauthorized transactions, leading to higher payment failure rates. Merchants implementing 3DS can expect increased authorization approvals and enhanced customer trust, ultimately boosting overall payment success.

Future Trends: The Evolution of 3DS and CVV

Future trends in payment security highlight the evolution of 3DS protocols toward biometric authentication and AI-driven risk assessment, enhancing fraud prevention without compromising user experience. CVV codes remain a vital layer of security but are increasingly supplemented by dynamic CVV technologies that generate time-sensitive codes to reduce unauthorized use. The integration of 3DS and advanced CVV solutions is expected to create a robust, multi-factor authentication framework in digital payments.

Choosing the Right Security Layer: 3DS vs CVV

Choosing the right security layer for payment authentication depends on transaction risk and user experience priorities. 3D Secure (3DS) offers robust fraud protection by adding an extra verification step, ideal for high-value or suspicious transactions, while CVV verification provides a quick but less secure method by confirming the card's physical presence. Merchants processing online payments should implement 3DS for enhanced security and reduced chargebacks, balancing convenience with fraud prevention.

Important Terms

Cardholder Authentication

Cardholder authentication via 3DS enhances transaction security by verifying user identity during online purchases, whereas CVV provides basic card verification without dynamic user validation.

Dynamic Verification

Dynamic Verification enhances 3DS authentication by generating unique CVV codes for each transaction, significantly reducing fraud compared to static CVV methods.

Risk-Based Authentication

Risk-Based Authentication enhances 3DS security by dynamically assessing transaction risk factors beyond static CVV verification to reduce fraud and improve user experience.

One-Time Password (OTP)

One-Time Password (OTP) enhances transaction security by providing dynamic, time-sensitive authentication in 3DS protocols, whereas CVV is a static, card-based security code used primarily for card-not-present verification.

Card Not Present (CNP)

Card Not Present (CNP) transactions rely on 3DS authentication for enhanced security and fraud prevention, whereas CVV verification alone offers basic validation but less protection against unauthorized use.

EMV 3D Secure (3DS2)

EMV 3D Secure (3DS2) enhances online transaction security by authenticating cardholders through dynamic verification methods, providing stronger fraud protection compared to static CVV codes.

Challenge Flow

Challenge Flow in 3DS Authentication enhances security by prompting cardholders for additional verification, such as CVV entry, to reduce fraud during online transactions.

Static Security Code

Static security codes like CVV provide fixed cardholder verification while 3DS adds dynamic authentication for enhanced transaction security.

Liability Shift

Liability shift in payment processing moves fraud liability from the merchant to the card issuer when 3DS authentication is used instead of CVV verification.

Device Fingerprinting

Device fingerprinting enhances 3DS authentication by providing unique device data for fraud detection, offering stronger security compared to relying solely on CVV verification.

3DS vs CVV Infographic

moneydif.com

moneydif.com