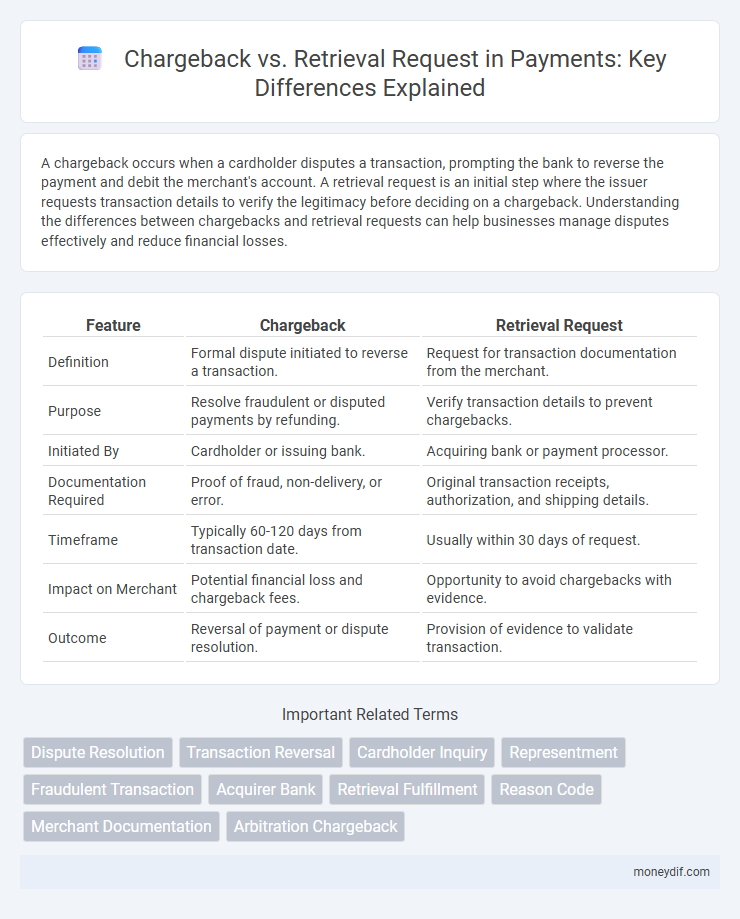

A chargeback occurs when a cardholder disputes a transaction, prompting the bank to reverse the payment and debit the merchant's account. A retrieval request is an initial step where the issuer requests transaction details to verify the legitimacy before deciding on a chargeback. Understanding the differences between chargebacks and retrieval requests can help businesses manage disputes effectively and reduce financial losses.

Table of Comparison

| Feature | Chargeback | Retrieval Request |

|---|---|---|

| Definition | Formal dispute initiated to reverse a transaction. | Request for transaction documentation from the merchant. |

| Purpose | Resolve fraudulent or disputed payments by refunding. | Verify transaction details to prevent chargebacks. |

| Initiated By | Cardholder or issuing bank. | Acquiring bank or payment processor. |

| Documentation Required | Proof of fraud, non-delivery, or error. | Original transaction receipts, authorization, and shipping details. |

| Timeframe | Typically 60-120 days from transaction date. | Usually within 30 days of request. |

| Impact on Merchant | Potential financial loss and chargeback fees. | Opportunity to avoid chargebacks with evidence. |

| Outcome | Reversal of payment or dispute resolution. | Provision of evidence to validate transaction. |

Understanding Chargebacks and Retrieval Requests

Chargebacks occur when a cardholder disputes a transaction, prompting the issuer to reverse the payment and withdraw funds from the merchant. Retrieval requests arise when the issuer requests transaction details from the merchant to verify the legitimacy of a transaction before initiating a chargeback. Understanding the differences helps merchants manage disputes effectively, reducing financial losses and enhancing transaction security.

Key Differences Between Chargebacks and Retrieval Requests

Chargebacks are consumer-initiated disputes leading to a reversal of a transaction and funds returned to the cardholder, often due to fraud or dissatisfaction. Retrieval requests involve the merchant or issuer requesting transaction details for review before deciding on further action, aiming to prevent unnecessary chargebacks. Key differences include the initiation source--chargebacks from cardholders versus retrieval requests from merchants or issuers--and their impact, with chargebacks directly affecting merchant revenue and retrieval requests serving as investigative tools.

Common Causes of Chargebacks

Chargebacks commonly result from unauthorized transactions, goods or services not received, and defective or significantly not as described products. Fraudulent activities, billing errors, and customer dissatisfaction also contribute to chargeback occurrences. Understanding these causes helps merchants implement effective transaction verification and dispute resolution strategies.

Common Reasons for Retrieval Requests

Common reasons for retrieval requests include disputes over transaction authenticity, suspicion of fraud, or inquiries about transaction details. Merchants often receive retrieval requests when customers question charges or seek clarity on payment amounts. These requests serve as a precursor to chargebacks, providing an opportunity to resolve issues before formal disputes arise.

Chargeback Process: Step-by-Step Overview

The chargeback process begins when a cardholder disputes a transaction by contacting their issuing bank, triggering an investigation. The issuer reviews evidence from both the cardholder and merchant, then issues a temporary credit or debit to the cardholder's account while further verification occurs. If the dispute is resolved in favor of the cardholder, the merchant must repay the transaction amount; otherwise, the temporary credit is reversed.

How Retrieval Requests Work in Payments

Retrieval requests in payments involve an acquirer requesting transaction details from the issuer to clarify disputes or verify transaction authenticity before a chargeback occurs. This process helps merchants and cardholders resolve issues by providing additional information, which can prevent unnecessary chargeback fees and disputes. Typically initiated within a specific time frame post-transaction, retrieval requests serve as a proactive measure in payment dispute management.

Impact of Chargebacks on Merchants

Chargebacks significantly impact merchants by causing direct financial losses, including the disputed transaction amount and associated chargeback fees, which can total hundreds of dollars per incident. High chargeback rates may lead to increased processing fees, account holds, or even termination by payment processors, severely affecting a merchant's ability to operate. Additionally, merchants face administrative burdens and potential reputational damage, as disputes often require extensive documentation and can erode customer trust.

Responding to Retrieval Requests Effectively

Responding to retrieval requests effectively involves providing thorough documentation and transaction details promptly to prevent escalation into chargebacks. Clear communication with the cardholder's bank and adherence to network deadlines reduce the risk of disputes and protect merchant revenue. Leveraging transaction data and supporting evidence helps validate the legitimacy of the charge, improving response success rates.

Preventing Chargebacks and Retrieval Requests

Preventing chargebacks and retrieval requests requires implementing robust fraud detection tools, such as AVS (Address Verification System) and CVV verification, to authenticate transactions effectively. Maintaining clear communication with customers by providing detailed receipts and prompt dispute resolution helps reduce misunderstandings that lead to chargebacks. Monitoring transaction patterns through advanced analytics enables early detection of suspicious activities, minimizing the incidence of both chargebacks and retrieval requests.

Best Practices for Managing Payment Disputes

Implement clear documentation and prompt communication with payment processors to effectively manage chargebacks and retrieval requests, reducing dispute resolution time and financial losses. Use detailed transaction records and timely customer service responses to support retrieval requests before they escalate into chargebacks. Implement fraud detection tools and maintain transparent refund policies to minimize chargeback occurrences and improve overall payment dispute management.

Important Terms

Dispute Resolution

Chargebacks allow cardholders to dispute fraudulent or unauthorized transactions directly with their bank, often resulting in automatic reversal of funds, whereas retrieval requests involve merchants obtaining transaction details to verify and resolve potential disputes before chargebacks occur. Efficient chargeback management reduces financial losses and maintains merchant reputation, while proactive retrieval requests facilitate faster resolution by providing necessary evidence to card issuers.

Transaction Reversal

Transaction reversal involves refunding a payment due to disputes or errors, with chargebacks initiated by the cardholder's issuing bank as a formal dispute process, while retrieval requests seek transaction details to clarify or verify charges before escalating to a chargeback. Chargebacks often result in funds being removed from the merchant's account, whereas retrieval requests primarily aim to gather information to prevent unnecessary disputes.

Cardholder Inquiry

Cardholder Inquiry involves the cardholder requesting detailed transaction information, often preceding a Retrieval Request which is a formal demand by the issuer for documentation to verify a disputed charge. Unlike Chargebacks, which result in the immediate reversal of funds, Retrieval Requests aim to gather evidence before any dispute escalation, reducing premature chargeback occurrences.

Representment

Representment involves the merchant resubmitting transaction evidence to dispute a chargeback, aiming to prove the charge's legitimacy and recover funds. Unlike a retrieval request, which simply seeks transaction details for review, representment actively challenges the chargeback decision through documented proof.

Fraudulent Transaction

A fraudulent transaction often triggers a chargeback, where the cardholder disputes the unauthorized charge directly with their bank, forcing the merchant to refund the amount. Retrieval requests, in contrast, involve the bank requesting transaction documentation from the merchant to verify the legitimacy of the disputed charge before initiating a chargeback.

Acquirer Bank

Acquirer banks play a critical role in managing chargebacks and retrieval requests by facilitating communication between merchants and card issuers during transaction disputes. While retrieval requests serve as preliminary inquiries for transaction information, chargebacks represent formal disputes that result in funds being temporarily removed from the merchant's account until resolution.

Retrieval Fulfillment

Retrieval fulfillment involves providing transaction documentation to banks during retrieval requests, which differ from chargebacks as they do not immediately result in a financial dispute but serve to verify transaction legitimacy. Effective management of retrieval requests reduces the likelihood of chargebacks by resolving potential issues early through accurate and timely data submission.

Reason Code

Reason Code identifies the specific cause for a chargeback or retrieval request, enabling precise dispute categorization and resolution. Chargebacks involve reversing a transaction due to fraud or customer dissatisfaction, while retrieval requests seek transaction documentation for verification without immediate fund reversal.

Merchant Documentation

Merchant documentation plays a critical role in differentiating between chargebacks and retrieval requests, as chargebacks result from disputed transactions requiring formal evidence submission, while retrieval requests involve preliminary data gathering to verify transaction authenticity. Detailed transaction records, proof of delivery, and communication logs provide essential support in resolving disputes efficiently and minimizing financial losses.

Arbitration Chargeback

Arbitration chargeback occurs when a merchant disputes a chargeback decision by escalating the case to the card network for final resolution, unlike a retrieval request which simply involves the merchant requesting transaction details from the issuer to clarify or prevent a chargeback. Effective handling of arbitration chargebacks requires understanding the differences in documentation and timelines compared to retrieval requests, which do not impact merchant liability but serve as a preliminary step in the chargeback process.

Chargeback vs Retrieval Request Infographic

moneydif.com

moneydif.com