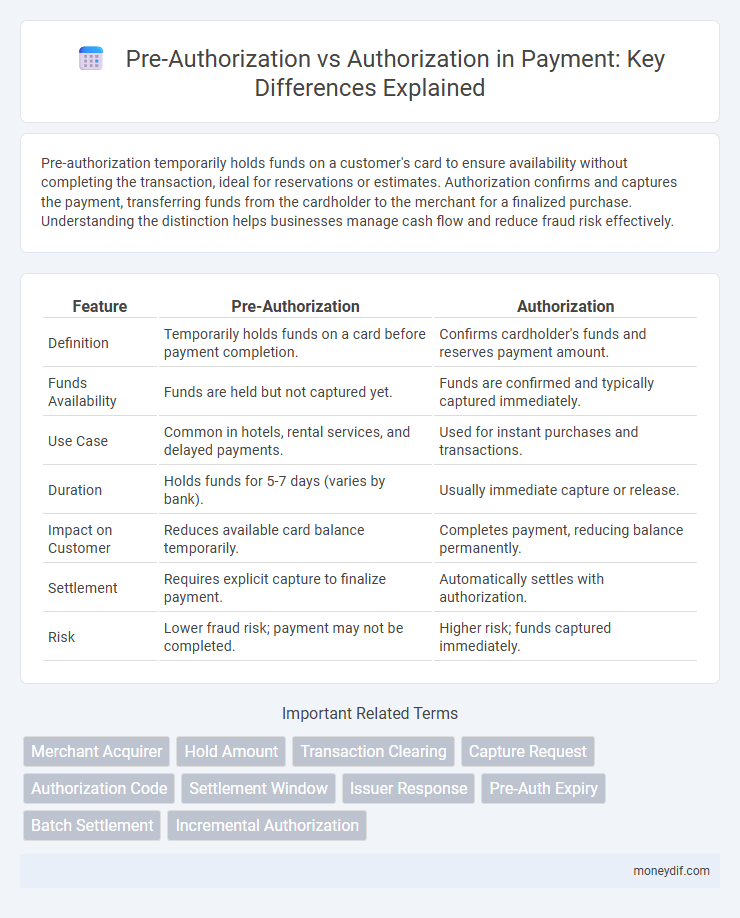

Pre-authorization temporarily holds funds on a customer's card to ensure availability without completing the transaction, ideal for reservations or estimates. Authorization confirms and captures the payment, transferring funds from the cardholder to the merchant for a finalized purchase. Understanding the distinction helps businesses manage cash flow and reduce fraud risk effectively.

Table of Comparison

| Feature | Pre-Authorization | Authorization |

|---|---|---|

| Definition | Temporarily holds funds on a card before payment completion. | Confirms cardholder's funds and reserves payment amount. |

| Funds Availability | Funds are held but not captured yet. | Funds are confirmed and typically captured immediately. |

| Use Case | Common in hotels, rental services, and delayed payments. | Used for instant purchases and transactions. |

| Duration | Holds funds for 5-7 days (varies by bank). | Usually immediate capture or release. |

| Impact on Customer | Reduces available card balance temporarily. | Completes payment, reducing balance permanently. |

| Settlement | Requires explicit capture to finalize payment. | Automatically settles with authorization. |

| Risk | Lower fraud risk; payment may not be completed. | Higher risk; funds captured immediately. |

Understanding Payment Authorization: Key Concepts

Payment authorization is the process of obtaining approval from the card issuer to ensure sufficient funds or credit for a transaction, while pre-authorization temporarily holds funds without completing the payment. Understanding these two phases is crucial for managing cash flow and reducing fraud risks in e-commerce and retail environments. Pre-authorization locks the amount before finalizing the sale, whereas authorization confirms the transaction's validity and initiates actual fund transfer.

What Is Pre-Authorization in Payment Processing?

Pre-authorization in payment processing is a temporary hold placed on a customer's credit card to verify available funds without completing the transaction. This hold ensures the merchant that the funds are reserved for a future payment, often used in industries like hospitality and car rentals. Unlike authorization, pre-authorization does not immediately charge the customer but secures the amount for a specified period until the final transaction is captured or released.

Defining Authorization in Payment Transactions

Authorization in payment transactions is the process where the issuer verifies the cardholder's account for sufficient funds or credit and places a hold on the specified amount to guarantee payment. This step confirms the card's validity and holds the funds without immediately transferring them, ensuring the merchant can safely complete the transaction. Unlike pre-authorization, which temporarily reserves funds before the final amount is known, authorization directly approves the transaction amount to proceed to settlement.

Pre-Authorization vs Authorization: Core Differences

Pre-authorization holds a temporary hold on a specific amount in a customer's account to verify fund availability without capturing funds, commonly used in industries like hospitality and car rentals. Authorization confirms the cardholder's bank approves the payment, enabling merchants to capture the transaction amount permanently. The core difference lies in that pre-authorization does not finalize the payment immediately, while authorization completes the payment process by transferring funds.

How Pre-Authorization Works in Credit Card Payments

Pre-authorization in credit card payments temporarily reserves funds on a customer's card without completing the transaction, ensuring sufficient credit is available. This hold typically lasts between 3 to 7 days, depending on the issuing bank, and prevents the cardholder from using these funds for other purchases. Merchants finalize the payment by submitting a capture request, converting the pre-authorization hold into a completed authorization and eventually a settlement.

The Authorization Process: Step-by-Step Overview

The authorization process begins when the merchant submits a payment request to the issuing bank for verification of funds and fraud prevention. The issuing bank checks the cardholder's account status, available credit or balance, and potential fraud indicators before approving or declining the transaction. Upon approval, a hold is placed on the requested amount, ensuring funds are reserved without completing the actual charge until settlement.

Benefits of Pre-Authorization for Merchants and Customers

Pre-authorization secures funds on a customer's credit card, reducing the risk of payment defaults for merchants and ensuring order fulfillment confidence. It allows customers to verify available credit without immediate charge, enhancing their shopping experience and trust. This process minimizes chargebacks and streamlines transaction efficiency, benefiting both parties.

Common Use Cases: When to Use Pre-Authorization or Authorization

Pre-authorization is commonly used in hospitality and rental industries to secure funds temporarily before final payment, ensuring availability without immediate charge. Authorization is typically employed in retail and e-commerce transactions to confirm sufficient funds and complete payment instantly. Choosing between pre-authorization and authorization depends on business needs for fund capture timing and customer experience optimization.

Risks and Challenges in Pre-Authorization and Authorization

Pre-authorization carries risks such as potential holds on funds that may not guarantee final payment, leading to cash flow uncertainty for merchants. Authorization challenges include the possibility of declined transactions due to insufficient funds or cardholder verification issues, which can result in lost sales opportunities. Both processes face risks related to fraud detection accuracy and timing discrepancies between authorization and capture stages.

Choosing the Right Approach: Pre-Authorization or Authorization

Selecting between pre-authorization and authorization hinges on the transaction's nature and risk profile; pre-authorization holds funds temporarily to verify card validity and available credit without completing the payment, ideal for reservations or pending services. Authorization confirms and captures payment immediately, best suited for finalized sales where goods or services are delivered instantly. Businesses must evaluate factors like transaction timing, customer experience, and potential chargeback risks to optimize payment flow and reduce declined transactions.

Important Terms

Merchant Acquirer

Merchant acquirers facilitate transaction processing by distinguishing between pre-authorization, which reserves funds on a customer's card pending final approval, and authorization, which confirms the actual transfer of funds during payment completion. Efficient handling of both pre-authorization and authorization by merchant acquirers reduces chargeback risks and ensures accurate fund settlement in retail and e-commerce environments.

Hold Amount

Hold amount refers to the temporary reservation of funds on a credit or debit card during pre-authorization, ensuring cardholder credit availability without completing the transaction. Authorization finalizes the hold by confirming the payment and deducting the reserved amount from the cardholder's available balance.

Transaction Clearing

Transaction clearing involves the process of settling payments between banks and merchants, ensuring funds are accurately transferred after the initial authorization. Pre-authorization holds a specified amount on a card to guarantee funds availability, while authorization confirms the actual transfer of funds during the clearing phase.

Capture Request

Capture Request initiates the transfer of funds after a pre-authorization, confirming the hold on a specific amount without immediately charging the cardholder. Unlike a full authorization that processes the payment instantly, a capture request finalizes the transaction, enabling merchants to collect the pre-approved amount within a set timeframe.

Authorization Code

Authorization Code is a unique identifier generated during the pre-authorization phase, holding funds temporarily without completing the transaction. Full authorization finalizes the payment by confirming fund availability and capturing the amount, transitioning the pre-authorization code into a completed sale record.

Settlement Window

Settlement Window refers to the specific time frame during which a pre-authorized payment is captured and finalized as an authorized transaction. Proper management of the Settlement Window ensures accurate transaction processing by converting temporary holds from pre-authorization into completed charges within the cardholder's bank system.

Issuer Response

Issuer response to pre-authorization requests typically includes a hold on funds, confirming card validity and available credit without finalizing the transaction, whereas issuer response to authorization finalizes fund reservation and approval for payment completion. Understanding the distinction ensures accurate transaction processing and prevents discrepancies in cardholder accounts.

Pre-Auth Expiry

Pre-Auth Expiry occurs when a pre-authorization hold on a specified amount of funds expires before the actual authorization is completed, potentially releasing the held amount back to the cardholder. Unlike authorization, which immediately reserves and confirms funds for a transaction, pre-authorization merely places a temporary hold that must be converted to a final authorization within the issuer's expiry period to avoid transaction failure.

Batch Settlement

Batch settlement consolidates multiple pre-authorized transactions into a single authorization process, reducing the risk of duplicate charges and streamlining payment reconciliation. Unlike immediate authorization, pre-authorization holds funds temporarily, allowing merchants to finalize the actual charge during batch settlement once services are confirmed or goods shipped.

Incremental Authorization

Incremental authorization enhances security by granting access permissions progressively based on user interactions, differing from pre-authorization which grants all permissions upfront regardless of immediate need. This approach minimizes risk by limiting access scope initially and expanding it only when necessary, improving control over sensitive data and user actions.

pre-authorization vs authorization Infographic

moneydif.com

moneydif.com