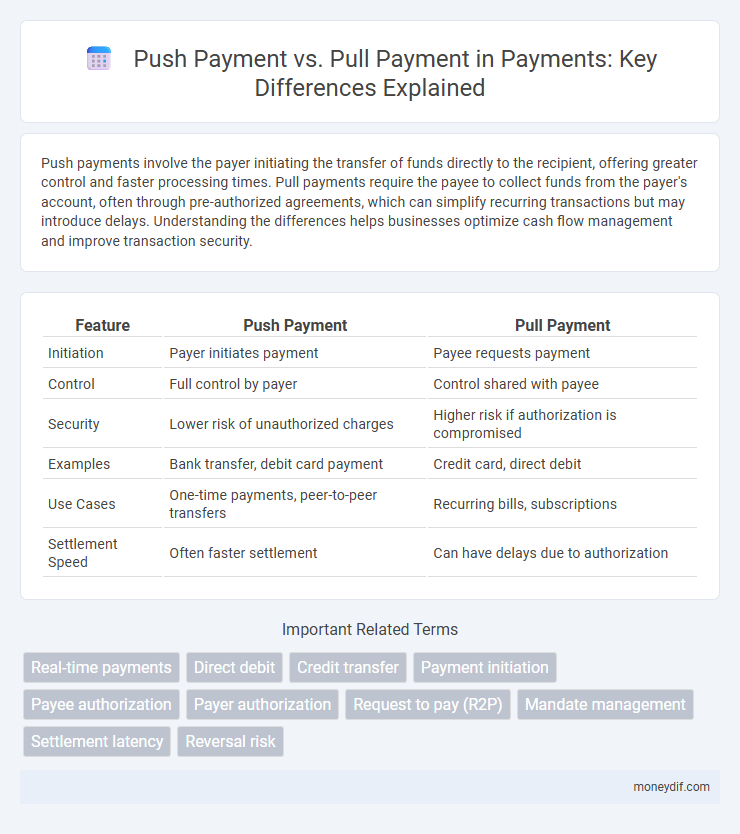

Push payments involve the payer initiating the transfer of funds directly to the recipient, offering greater control and faster processing times. Pull payments require the payee to collect funds from the payer's account, often through pre-authorized agreements, which can simplify recurring transactions but may introduce delays. Understanding the differences helps businesses optimize cash flow management and improve transaction security.

Table of Comparison

| Feature | Push Payment | Pull Payment |

|---|---|---|

| Initiation | Payer initiates payment | Payee requests payment |

| Control | Full control by payer | Control shared with payee |

| Security | Lower risk of unauthorized charges | Higher risk if authorization is compromised |

| Examples | Bank transfer, debit card payment | Credit card, direct debit |

| Use Cases | One-time payments, peer-to-peer transfers | Recurring bills, subscriptions |

| Settlement Speed | Often faster settlement | Can have delays due to authorization |

Understanding Push and Pull Payments

Push payments require the payer to initiate the transaction by sending funds directly to the payee, enhancing control and reducing fraud risk. Pull payments allow the payee to request and withdraw funds from the payer's account, commonly used for subscriptions and recurring billing. Understanding the operational differences helps businesses optimize payment flow, improve cash management, and enhance customer experience.

Key Differences Between Push and Pull Payments

Push payments initiate a transaction where the payer actively sends funds to the payee, commonly seen in wire transfers and online bank payments. Pull payments involve the payee requesting and collecting funds from the payer's account, often through subscriptions or direct debits. Key differences include control over the transaction initiation, with push payments granting more control to the payer, while pull payments simplify recurring billing for the payee.

How Push Payments Work

Push payments involve the payer initiating a direct transfer of funds to the payee's account, ensuring immediate transaction authorization and control. Using secure protocols like real-time payment networks or digital wallets, the payer triggers the payment by providing recipient details and amount, reducing fraud risk. This method enhances cash flow efficiency in sectors such as e-commerce and peer-to-peer transfers by enabling instant settlement without intermediary delays.

How Pull Payments Work

Pull payments require the payee to initiate a transaction by obtaining authorization from the payer, typically through direct debit or card payments. The payer provides prior consent for the payee to withdraw funds from their account, enabling automated, scheduled, or on-demand deductions. This method is widely used for subscription services, utility bills, and loan repayments due to its convenience and reliability in managing recurring payments.

Advantages of Push Payment Methods

Push payment methods offer enhanced security by requiring the payer to initiate transactions directly, reducing fraud risks associated with unauthorized access. These payments enable faster settlement times, as funds move quickly from the payer's account to the recipient without intermediary delays. Real-time transaction processing and improved control over outgoing payments make push payments ideal for businesses seeking efficiency and transparency.

Benefits of Pull Payment Systems

Pull payment systems enable consumers to initiate transactions by authorizing merchants to withdraw funds directly from their accounts, enhancing security through trusted authentication processes. This method reduces the risk of fraud and chargebacks while offering greater control over payment timing and amounts. Businesses benefit from improved cash flow predictability and lower transaction fees compared to push payment alternatives.

Use Cases for Push Payments

Push payments enable senders to initiate transfers directly from their accounts to recipients, making them ideal for instant person-to-person transfers, bill payments, and business-to-consumer disbursements. These payments reduce fraud risk by requiring sender authorization before funds are moved, enhancing security in scenarios like payroll distribution and emergency relief funds. Real-time settlement and transparency in push payments improve cash flow management for merchants and increase trust in high-value transactions.

Use Cases for Pull Payments

Pull payments are ideal for subscription services, utility bills, and recurring payments where merchants initiate charges based on customer authorization. This payment method ensures timely, automated transactions, reducing the risk of missed payments and improving cash flow. Businesses benefit from enhanced security and control, as customers approve transactions before funds are withdrawn from their accounts.

Security Considerations in Push vs Pull Payments

Push payments enhance security by requiring the payer to initiate the transaction, reducing fraud risks through direct control and authentication measures. Pull payments carry higher risks since merchants or third parties can initiate withdrawals, increasing vulnerability to unauthorized transactions and requiring robust oversight. Implementing multi-factor authentication and tokenization significantly strengthens security in both payment methods.

Choosing the Right Payment Method for Your Business

Push payments initiate transactions where the payer actively sends funds directly to the payee, offering enhanced control and typically faster settlement times. Pull payments allow the payee to request and withdraw funds from the payer's account with prior authorization, streamlining recurring billing and subscription services. Selecting the appropriate payment method depends on factors like transaction frequency, control preferences, risk management, and operational efficiency for your business.

Important Terms

Real-time payments

Real-time payments enable instant fund transfers through push payment methods where the payer initiates the transaction, contrasting with pull payments that allow the payee to request and withdraw funds.

Direct debit

Direct debit is a pull payment method allowing merchants to electronically withdraw funds from a payer's bank account with prior authorization, contrasting with push payments where the payer initiates the transfer to the payee.

Credit transfer

Credit transfer enables secure and efficient money movement by authorizing push payments where payers initiate transfers directly to recipients' accounts, contrasting with pull payments that require recipients to debit payers' accounts upon authorization.

Payment initiation

Push payment initiates transactions by the payer sending funds directly to the payee, while pull payment authorizes the payee to withdraw funds from the payer's account.

Payee authorization

Payee authorization is essential in pull payments to grant the payer access to initiate transactions, whereas push payments require payer authorization to directly transfer funds to the payee.

Payer authorization

Payer authorization for push payments requires explicit consent to initiate funds transfer, whereas pull payments involve pre-authorized access for the payee to withdraw funds directly from the payer's account.

Request to pay (R2P)

Request to Pay (R2P) enhances payment security and user control by enabling push payments initiated by payers, contrasting with pull payments where merchants directly debit funds from payer accounts.

Mandate management

Mandate management streamlines authorization processes by securely validating customer consent for recurring push payments, contrasting with pull payments that require continuous approval for each transaction.

Settlement latency

Settlement latency is typically lower in push payments due to immediate fund transfer authorization, whereas pull payments often experience higher latency because of delayed initiation and verification processes.

Reversal risk

Reversal risk is higher in push payments because funds are sent directly to the recipient without prior authorization, unlike pull payments where the payer initiates the transaction, allowing for greater control and dispute resolution.

Push payment vs Pull payment Infographic

moneydif.com

moneydif.com