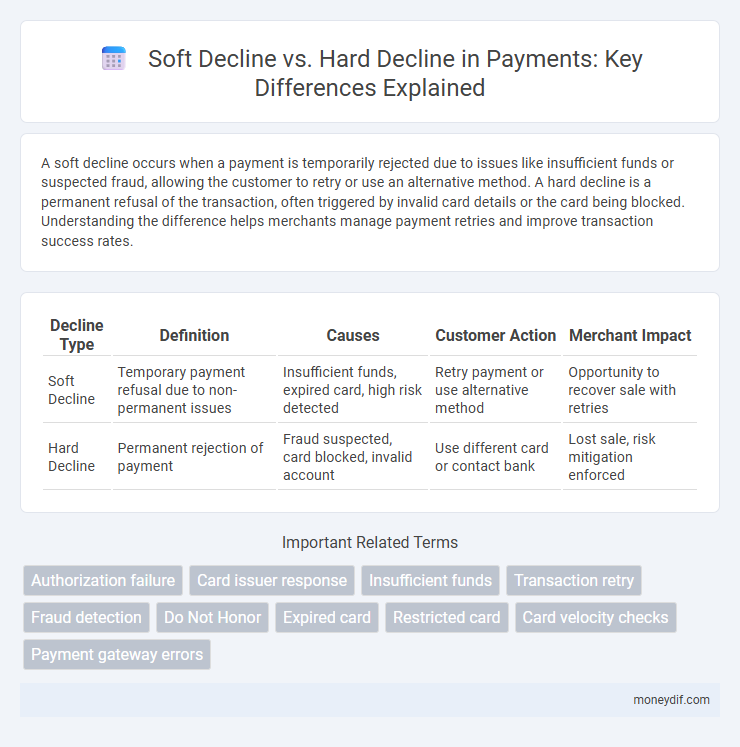

A soft decline occurs when a payment is temporarily rejected due to issues like insufficient funds or suspected fraud, allowing the customer to retry or use an alternative method. A hard decline is a permanent refusal of the transaction, often triggered by invalid card details or the card being blocked. Understanding the difference helps merchants manage payment retries and improve transaction success rates.

Table of Comparison

| Decline Type | Definition | Causes | Customer Action | Merchant Impact |

|---|---|---|---|---|

| Soft Decline | Temporary payment refusal due to non-permanent issues | Insufficient funds, expired card, high risk detected | Retry payment or use alternative method | Opportunity to recover sale with retries |

| Hard Decline | Permanent rejection of payment | Fraud suspected, card blocked, invalid account | Use different card or contact bank | Lost sale, risk mitigation enforced |

Understanding Soft Decline vs Hard Decline in Payments

Soft decline in payments occurs when a transaction is temporarily rejected due to issues like insufficient funds, suspected fraud, or exceeded credit limits, allowing the customer to retry or use another payment method. Hard decline refers to a permanent transaction rejection triggered by factors such as invalid card details, closed accounts, or card restrictions, requiring the customer to resolve the underlying issue before attempting payment again. Understanding the distinction helps merchants optimize payment processing strategies and improve customer experience by managing retries and declines effectively.

Key Differences Between Soft and Hard Payment Declines

Soft declines occur when a payment transaction is temporarily rejected due to issues like insufficient funds or incorrect billing information, allowing for retries or corrections. Hard declines indicate permanent rejection caused by factors such as fraud suspicion or invalid card status, preventing further attempts with the same credentials. Understanding these distinctions is critical for optimizing transaction handling and improving payment success rates.

Common Causes of Soft Payment Declines

Soft payment declines commonly occur due to insufficient funds, expired credit cards, or temporary holds placed by the issuing bank for security reasons. These declines often indicate that the transaction can be retried without significant changes, distinguishing them from hard declines, which result from permanent issues like stolen cards or fraudulent activity. Understanding these causes helps merchants optimize payment retry strategies and reduce friction in the checkout process.

Typical Reasons for Hard Payment Declines

Hard payment declines often occur due to insufficient funds, expired or blocked cards, and suspected fraudulent activity flagged by the payment processor. Other typical reasons include incorrect card details, account restrictions, and processor-specific security rules. These declines require immediate resolution before attempting the transaction again.

Impact of Declines on Merchant Revenue

Soft declines occur when payment transactions are temporarily rejected due to issues like insufficient funds or suspect fraud, allowing customers to retry or use alternative methods, which helps minimize lost sales and supports higher merchant revenue. Hard declines, caused by permanent reasons such as invalid card details or closed accounts, lead to immediate transaction failure with no retry options, significantly impacting merchant revenue by increasing cart abandonment rates. Understanding the distinction between soft and hard declines enables merchants to implement targeted strategies that recover potentially recoverable payments, thereby optimizing transaction completion and maximizing revenue flow.

How to Reduce Soft Payment Declines

Soft payment declines occur due to temporary issues like insufficient funds or network errors, while hard declines result from permanent issues such as invalid card details or stolen cards. To reduce soft payment declines, optimize retry logic by spacing out additional attempts, update cardholder information regularly through account updater services, and implement real-time fraud detection tools to minimize unwarranted declines. Improving communication with customers using clear decline notifications and offering alternative payment methods also enhances transaction success rates.

Strategies for Addressing Hard Declines

Hard declines in payment processing indicate permanent rejection due to issues such as invalid card details or insufficient funds, requiring immediate strategic actions to recover the transaction. Strategies for addressing hard declines include contacting the customer for updated payment information, offering alternative payment methods, and implementing real-time fraud detection tools to minimize false declines. Efficiently managing hard declines improves payment success rates and enhances customer experience by reducing transaction friction.

Best Practices for Handling Payment Declines

Effective handling of soft declines involves retrying the transaction after a brief delay or prompting the customer to verify payment details, which helps reduce false declines and improve authorization rates. For hard declines, best practices include immediately notifying the customer with clear, actionable information and suggesting alternative payment methods to prevent frustration and potential loss of sales. Implementing robust decline management strategies, such as automated retry logic and meaningful customer communication, optimizes payment success and enhances customer experience.

Role of Issuing Banks in Decline Decisions

Issuing banks play a crucial role in payment declines by evaluating transaction risk and verifying cardholder information before authorization. Soft declines occur when the bank temporarily refuses a transaction due to reasons like insufficient funds or suspected fraud, allowing the cardholder to retry. Hard declines indicate permanent rejection, often due to invalid card details or blocked accounts, requiring cardholder intervention or use of an alternative payment method.

Future Trends in Payment Decline Management

Future trends in payment decline management emphasize advanced machine learning algorithms that distinguish between soft decline and hard decline scenarios to reduce transaction friction and improve authorization rates. Real-time data analytics and AI-driven decision-making enable dynamic retry strategies and adaptive authentication workflows, minimizing revenue loss from false declines. Enhanced collaboration between payment gateways, issuers, and merchants is driving standardized protocols for seamless handling of decline reasons, fostering more effective recovery mechanisms and customer retention.

Important Terms

Authorization failure

Authorization failure occurs when a transaction is rejected, with soft declines indicating temporary issues like insufficient funds or incorrect information, and hard declines signaling permanent problems such as stolen cards or blocked accounts.

Card issuer response

Card issuer response differentiates between soft decline and hard decline based on transaction reversibility; a soft decline indicates a temporary issue such as insufficient funds or suspected fraud allowing for retry or alternative payment, whereas a hard decline denotes a permanent denial like expired card or blocked account requiring cardholder action or a new card issuance. Understanding these responses helps merchants optimize payment success rates and customer experience by implementing appropriate retry or fallback strategies.

Insufficient funds

Insufficient funds cause a soft decline by temporarily rejecting transactions due to low balance, while a hard decline permanently denies transactions for reasons like account closure or fraud suspicion.

Transaction retry

Transaction retry strategies improve payment success rates by attempting retries after soft declines, which indicate temporary issues, while hard declines signal permanent failures requiring alternative payment methods.

Fraud detection

Fraud detection systems use soft decline to flag suspicious but uncertain transactions for further review, while hard decline immediately blocks definitively fraudulent activities to prevent financial losses.

Do Not Honor

Do Not Honor indicates a hard decline from the issuer, rejecting the transaction outright, while soft declines suggest temporary issues allowing for potential retries or alternative payment methods.

Expired card

An expired card typically results in a hard decline as the transaction is permanently rejected, unlike a soft decline which indicates a temporary issue or retry opportunity.

Restricted card

A restricted card triggers a soft decline by temporarily blocking transactions for security reasons, while a hard decline permanently denies the transaction due to factors like insufficient funds or fraud detection.

Card velocity checks

Card velocity checks measure transaction frequency and amounts to distinguish soft declines, which indicate temporary holds or risk flags, from hard declines, which signify permanent transaction refusals due to exceeding preset thresholds or suspected fraud.

Payment gateway errors

Soft declines indicate temporary payment gateway errors like insufficient funds or suspected fraud, while hard declines represent permanent failures such as invalid card details or blocked accounts.

Soft decline vs Hard decline Infographic

moneydif.com

moneydif.com