BIN sponsorship involves a partnership where a payment service provider uses the Bank Identification Number (BIN) of a sponsoring bank to process transactions, enabling quicker market entry and reducing compliance burdens. BIN leasing allows businesses to rent a BIN directly from a bank or issuer, granting more control over transaction routing and branding but requires adherence to stricter regulatory standards. Understanding the differences between BIN sponsorship and BIN leasing is crucial for businesses to select the appropriate payment infrastructure that balances control, compliance, and operational efficiency.

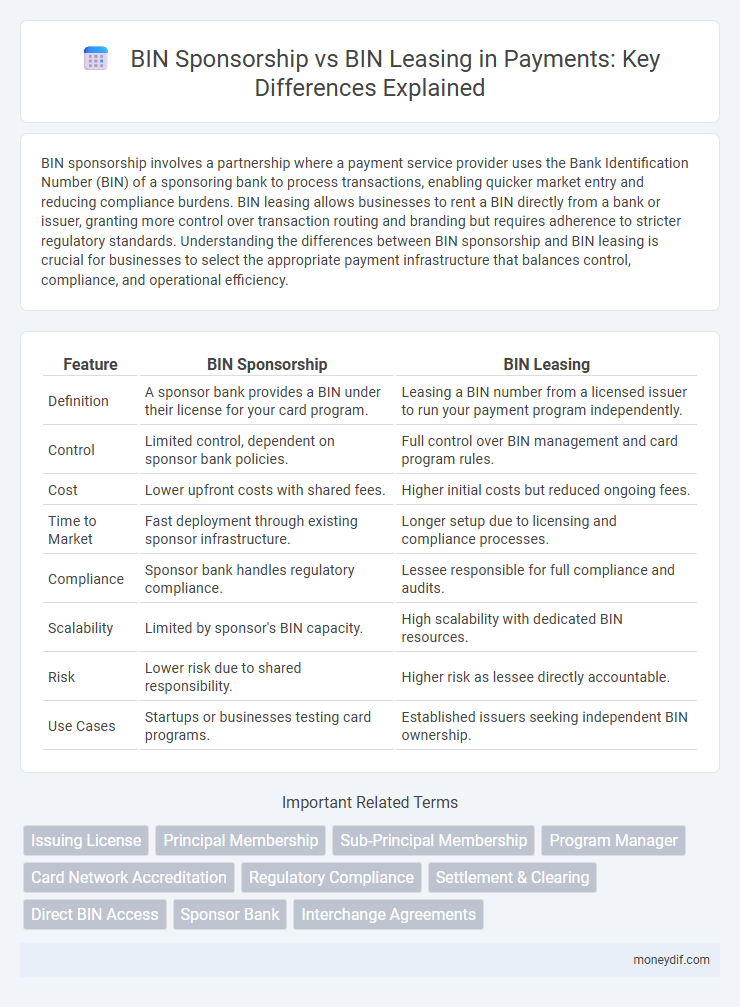

Table of Comparison

| Feature | BIN Sponsorship | BIN Leasing |

|---|---|---|

| Definition | A sponsor bank provides a BIN under their license for your card program. | Leasing a BIN number from a licensed issuer to run your payment program independently. |

| Control | Limited control, dependent on sponsor bank policies. | Full control over BIN management and card program rules. |

| Cost | Lower upfront costs with shared fees. | Higher initial costs but reduced ongoing fees. |

| Time to Market | Fast deployment through existing sponsor infrastructure. | Longer setup due to licensing and compliance processes. |

| Compliance | Sponsor bank handles regulatory compliance. | Lessee responsible for full compliance and audits. |

| Scalability | Limited by sponsor's BIN capacity. | High scalability with dedicated BIN resources. |

| Risk | Lower risk due to shared responsibility. | Higher risk as lessee directly accountable. |

| Use Cases | Startups or businesses testing card programs. | Established issuers seeking independent BIN ownership. |

Understanding BIN Sponsorship and BIN Leasing

BIN Sponsorship involves a financial institution providing access to its Bank Identification Number (BIN) to a third-party payment service provider, enabling transaction processing under the sponsor's regulatory framework. BIN Leasing, on the other hand, allows businesses to rent BINs directly from issuing banks or third parties, granting greater control over payment operations but requiring compliance with strict regulatory standards. Understanding the differences between BIN Sponsorship and BIN Leasing is crucial for selecting the appropriate payment infrastructure based on control, compliance, and operational capabilities.

Key Differences Between BIN Sponsorship and BIN Leasing

BIN Sponsorship involves a sponsor bank allowing a fintech or payment service provider to operate under its BIN, leveraging the bank's regulatory licenses and compliance infrastructure. BIN Leasing grants direct access to a BIN number, enabling the lessee to issue cards and process payments independently but requires them to manage their own compliance and operational risks. The key differences lie in regulatory responsibility, operational control, compliance burden, and the level of independence each arrangement offers in the payment ecosystem.

How BIN Sponsorship Works in Payment Processing

BIN Sponsorship in payment processing allows smaller payment facilitators or fintech companies to access issuing and acquiring networks by partnering with a larger, licensed bank that owns the BIN (Bank Identification Number). This arrangement enables sponsors to manage transaction authorization, clearing, and settlement without needing to obtain their own BIN, reducing regulatory burdens and speeding market entry. The sponsoring bank maintains compliance and risk management responsibilities while the sponsored entity handles customer-facing operations and product offerings.

What is BIN Leasing? A Detailed Overview

BIN leasing is a financial arrangement where a company rents Bank Identification Numbers (BINs) from a licensed BIN sponsor to process payment card transactions without obtaining its own BIN directly from card networks like Visa or Mastercard. This method allows businesses to issue cards and accept payments quickly while leveraging the sponsor's established banking infrastructure and compliance protocols. BIN leasing offers a scalable solution for fintech startups and smaller payment processors seeking market entry without the extensive regulatory burden of acquiring BIN ownership.

Pros and Cons of BIN Sponsorship

BIN Sponsorship offers quicker market entry and reduced upfront costs by leveraging an existing bank's BIN, but it limits control over transaction processing and compliance responsibilities. While BIN Sponsorship provides a lower barrier to entry for fintechs and smaller businesses, the sponsor bank retains most regulatory risks and may impose restrictions on merchant categories. Dependency on the sponsor can lead to less flexibility in branding and limited customization of payment solutions compared to BIN Leasing.

Advantages and Disadvantages of BIN Leasing

BIN leasing allows businesses to access Bank Identification Numbers without owning a BIN range, enabling faster market entry and reduced regulatory burdens. However, disadvantages include limited control over BIN management, potential compliance risks due to reliance on the BIN sponsor, and higher long-term costs compared to owning a BIN outright. Companies must weigh the trade-offs between flexibility and operational control when choosing BIN leasing for payment processing.

Regulatory Considerations for BIN Sponsorship vs BIN Leasing

BIN sponsorship involves partnering with a bank that holds the BIN, transferring regulatory compliance responsibilities to the sponsor. BIN leasing requires the lessee to directly comply with payment network rules, PCI DSS standards, and local financial regulations. Regulatory scrutiny differs as BIN leasing demands more active management of risk, transaction monitoring, and anti-money laundering controls by the lessee compared to BIN sponsorship.

Cost Implications: BIN Sponsorship Compared to BIN Leasing

BIN sponsorship typically incurs lower upfront costs as the sponsor bank shoulders regulatory and infrastructure expenses, while BIN leasing often requires higher fees due to direct leasing agreements with the card network. Cost implications of BIN sponsorship include reduced compliance burdens and operational overhead, making it more cost-effective for smaller issuers. In contrast, BIN leasing demands ongoing lease payments and potential network fees, driving up long-term expenses despite quicker market entry.

Choosing the Right Model: BIN Sponsorship or BIN Leasing?

Choosing the right BIN model depends on factors such as control, compliance, and cost. BIN sponsorship offers quicker market entry and lower upfront costs by partnering with an existing BIN owner, while BIN leasing provides more autonomy and brand control at a higher investment and regulatory responsibility. Evaluating business goals, operational capacity, and risk tolerance is crucial to determine whether BIN sponsorship or BIN leasing aligns best with your payment strategy.

Future Trends in BIN Management: Sponsorship and Leasing

Future trends in BIN management highlight a growing shift towards flexible BIN sponsorship models that enable fintechs to launch payment solutions quickly without heavy infrastructure investment. BIN leasing remains relevant for institutions seeking temporary access to BIN resources but faces challenges from evolving regulatory frameworks emphasizing data security and compliance. The integration of AI-driven analytics and cloud-based platforms is expected to optimize BIN utilization, accelerating innovation in payment ecosystems.

Important Terms

Issuing License

Issuing license holders manage BIN sponsorship by partnering with banks to utilize existing BINs for card issuance, ensuring compliance and operational control, whereas BIN leasing involves renting BINs from third-party providers for quicker market entry but often with higher dependency risks. Understanding the differences in regulatory obligations, cost structures, and risk management is essential for optimizing payment processing strategies under either BIN sponsorship or leasing models.

Principal Membership

Principal Membership provides direct access to card networks, enabling institutions to issue and process payment cards under their own Bank Identification Number (BIN). BIN Sponsorship allows smaller entities to operate under a sponsor's BIN, while BIN Leasing offers temporary use of BIN ranges without full principal status, impacting control, compliance responsibilities, and transaction processing capabilities.

Sub-Principal Membership

Sub-principal membership under BIN Sponsorship allows smaller entities to leverage the sponsor's bank identification number without obtaining their own, enabling quicker market entry and simplified compliance. In contrast, BIN leasing provides direct access to the BIN but requires more regulatory oversight and operational responsibilities, offering greater control over card programs.

Program Manager

A Program Manager overseeing BIN sponsorship ensures direct access to card network resources by managing relationships between sponsors and sub-issuers, whereas BIN leasing involves temporarily acquiring BINs from third-party providers to enable payment processing without full program ownership. Strategic BIN sponsorship offers greater control and compliance oversight while BIN leasing provides faster market entry and reduced operational complexity.

Card Network Accreditation

Card Network Accreditation involves obtaining authorization from payment networks to issue cards under specific BIN Sponsorship or BIN Leasing models, where BIN Sponsorship allows a sponsoring bank to lend their BIN to a third party, while BIN Leasing enables direct leasing of BIN ranges without full sponsorship. Understanding these models is crucial for compliance with PCI DSS, card scheme rules, and ensuring seamless transaction processing within Visa, Mastercard, or other card networks.

Regulatory Compliance

Regulatory compliance in BIN Sponsorship requires the sponsoring bank to maintain full control and responsibility over the BINs, ensuring adherence to card network rules and anti-money laundering regulations. In contrast, BIN Leasing transfers certain regulatory obligations to the lessee, who must independently manage compliance aspects while benefiting from the leasing institution's BIN infrastructure.

Settlement & Clearing

Settlement and clearing processes in BIN sponsorship involve a sponsor bank authorizing third parties to access its BIN, facilitating transaction processing without transferring ownership, while BIN leasing grants temporary usage rights of a BIN from a BIN bank to a card issuer or processor, allowing independent transaction clearing and settlement. BIN sponsorship enables faster market entry with reliance on the sponsor's infrastructure, whereas BIN leasing offers greater control over settlement and clearing operations at the cost of increased operational complexity.

Direct BIN Access

Direct BIN Access allows financial institutions to process card transactions using their own Bank Identification Number, enabling greater control and lower costs compared to BIN Leasing, where access is rented from a third party. BIN Sponsorship offers a middle ground by partnering with a licensed sponsor bank to use its BIN while maintaining compliance and operational oversight without full ownership.

Sponsor Bank

Sponsor Bank facilitates BIN Sponsorship by allowing fintechs or smaller financial institutions to issue payment cards under the bank's existing BIN, reducing regulatory burdens and enabling faster market entry. In contrast, BIN Leasing involves temporarily renting BIN numbers from a provider without full banking partnership, often offering less regulatory support but increased flexibility for non-bank entities.

Interchange Agreements

Interchange agreements define the terms and fees for processing card transactions between issuers and acquirers, impacting BIN sponsorship and BIN leasing arrangements where BIN sponsorship involves a financial institution authorizing another entity to issue cards under its BIN, while BIN leasing allows non-bank entities to rent a BIN from banks to access card networks without a full banking license. Both models rely on the interchange fee structure set by card networks like Visa and Mastercard to facilitate secure and compliant payment processing.

BIN Sponsorship vs BIN Leasing Infographic

moneydif.com

moneydif.com