Chargebacks occur when a cardholder disputes a transaction, prompting the payment processor to return funds and investigate the claim, often protecting consumers from fraud or unauthorized charges. Reversals happen when a merchant or payment processor cancels a transaction before settlement, quickly returning funds without the lengthy dispute process. Understanding the distinction helps businesses manage transaction risks and maintain cash flow efficiently.

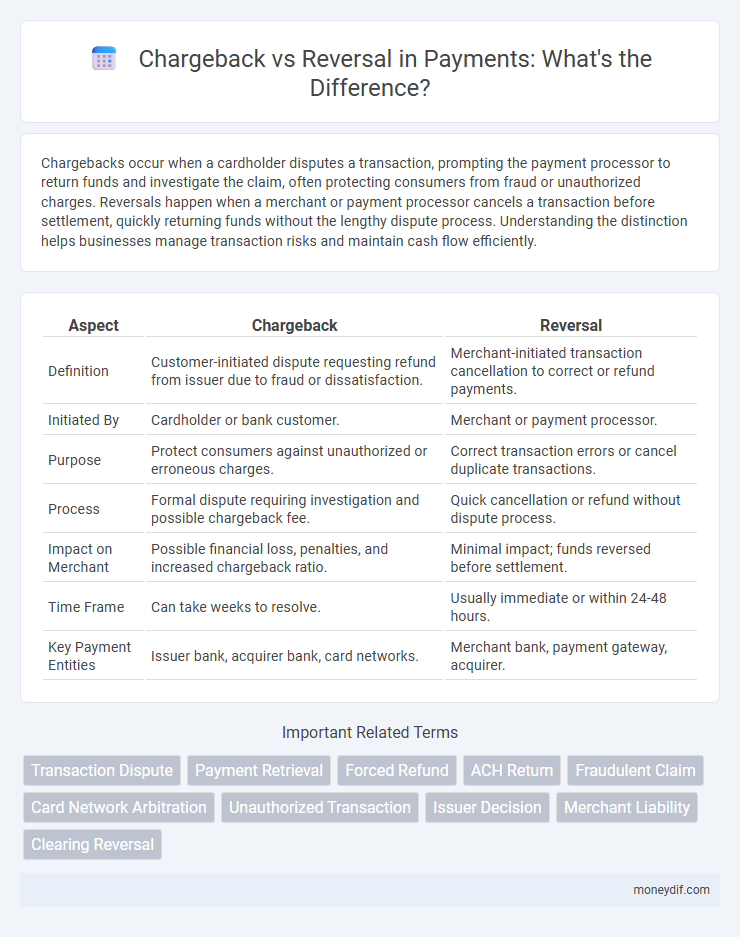

Table of Comparison

| Aspect | Chargeback | Reversal |

|---|---|---|

| Definition | Customer-initiated dispute requesting refund from issuer due to fraud or dissatisfaction. | Merchant-initiated transaction cancellation to correct or refund payments. |

| Initiated By | Cardholder or bank customer. | Merchant or payment processor. |

| Purpose | Protect consumers against unauthorized or erroneous charges. | Correct transaction errors or cancel duplicate transactions. |

| Process | Formal dispute requiring investigation and possible chargeback fee. | Quick cancellation or refund without dispute process. |

| Impact on Merchant | Possible financial loss, penalties, and increased chargeback ratio. | Minimal impact; funds reversed before settlement. |

| Time Frame | Can take weeks to resolve. | Usually immediate or within 24-48 hours. |

| Key Payment Entities | Issuer bank, acquirer bank, card networks. | Merchant bank, payment gateway, acquirer. |

Understanding Chargebacks and Reversals

Chargebacks occur when a cardholder disputes a transaction, prompting the issuing bank to reverse the payment and withdraw funds from the merchant's account, often leading to added fees and potential penalties for the merchant. Reversals involve the merchant or payment processor proactively canceling or refunding a transaction before a dispute arises, typically resulting in a smoother resolution with fewer financial repercussions. Understanding the distinction between chargebacks and reversals is crucial for optimizing payment dispute management and reducing revenue loss.

Key Differences Between Chargebacks and Reversals

Chargebacks occur when a cardholder disputes a transaction directly with their bank, leading to a forced withdrawal of funds from the merchant's account and often resulting in additional fees and investigation. Reversals are typically initiated by the merchant or payment processor to correct or cancel a transaction before being finalized, usually without the need for dispute resolution. Key differences include who initiates the process, the potential financial impact on merchants, and the procedures for resolution.

Common Causes of Chargebacks and Reversals

Chargebacks commonly result from unauthorized transactions, merchant errors, or customer disputes over product quality or non-receipt, while reversals often occur due to bank-initiated corrections or duplicate payments. Fraudulent activity and billing inaccuracies are leading triggers for chargebacks, whereas reversals typically address processing mistakes or technical glitches within payment systems. Understanding these causes can help merchants implement effective fraud prevention and transaction verification measures to reduce financial losses.

How Chargeback Processes Work

Chargeback processes involve a cardholder disputing a transaction with their bank, which then investigates the claim before debiting the merchant's account if the dispute is valid. The bank typically notifies the merchant, who has an opportunity to provide evidence to contest the chargeback. This process protects consumers from fraudulent or incorrect charges while posing financial risks to merchants due to lost revenue and potential fees.

The Reversal Procedure Explained

The reversal procedure involves returning funds to a customer after a transaction error or dispute is resolved in favor of the cardholder, typically initiated by the merchant or payment processor before chargeback escalation. This process requires verification of the original transaction and confirmation that the reversal complies with card network rules and regulations. Reversals help prevent the lengthy chargeback process by correcting billing mistakes quickly and preserving merchant-customer relationships.

Impacts of Chargebacks vs. Reversals on Merchants

Chargebacks result in higher financial losses and increased processing fees for merchants compared to reversals, often leading to stricter merchant account terms or even account termination. Reversals typically involve fewer penalties and faster resolution, minimizing disruptions to cash flow and protecting merchant reputation. Understanding the distinction helps merchants implement effective fraud prevention and dispute management strategies to reduce chargeback rates.

Preventing Chargebacks and Reversals

Preventing chargebacks and reversals requires thorough transaction verification through address verification systems (AVS) and card verification value (CVV) checks to reduce fraud risk. Maintaining clear communication with customers and providing detailed receipts can significantly lower disputes and increase transaction transparency. Implementing advanced fraud detection tools and monitoring chargeback ratios help merchants identify and address potential issues proactively.

Dispute Resolution: Chargebacks vs. Reversals

Chargebacks involve a formal dispute process initiated by the cardholder's bank to recover funds from a merchant due to unauthorized or fraudulent transactions, often resulting in a temporary hold on the merchant's account. Reversals are merchant-initiated corrections that typically occur when an error is identified post-transaction, allowing funds to be returned without involving the cardholder's bank dispute process. Chargebacks often lead to higher fees and potential penalties for merchants, while reversals are generally faster and less costly solutions for resolving transaction issues.

Legal and Regulatory Considerations

Chargebacks involve a consumer disputing a transaction, triggering regulatory oversight from entities like the Consumer Financial Protection Bureau (CFPB) in the U.S., which enforces strict guidelines to protect cardholders under the Electronic Fund Transfer Act. Reversals, often initiated by merchants or payment processors, must comply with payment network rules such as Visa's and Mastercard's Operating Regulations to avoid legal penalties and maintain transaction integrity. Understanding these distinctions is crucial for adherence to financial industry regulations, minimizing legal risks, and ensuring compliance with anti-fraud statutes.

Best Practices for Managing Chargebacks and Reversals

Effective management of chargebacks and reversals involves promptly responding to disputes by providing clear transaction documentation and maintaining transparent communication with payment processors. Utilizing robust fraud detection tools helps reduce chargeback occurrences, while thorough record-keeping enables quick dispute resolution. Implementing clear refund and return policies supports reversal requests and minimizes financial losses.

Important Terms

Transaction Dispute

Transaction disputes occur when a cardholder challenges a charge, initiating a chargeback that reverses the transaction and debits funds from the merchant's account. Unlike reversals, which are merchant-initiated refunds directly credited back to the customer without involving the card issuer, chargebacks involve a formal dispute process managed by the card networks and issuing banks.

Payment Retrieval

Payment retrieval involves obtaining transaction details to address disputes, often preceding chargebacks that occur when a customer disputes a payment with their bank. Unlike reversals, which are immediate corrections made by the merchant or processor, chargebacks initiate a formal investigation that can result in the funds being returned to the cardholder if the dispute is resolved in their favor.

Forced Refund

Forced refund occurs when a merchant initiates a refund without customer authorization, often triggered by chargebacks or disputes, contrasting with reversals which are initiated by the payment processor or card issuer to correct transaction errors. Chargebacks represent consumer protection mechanisms allowing cardholders to dispute unauthorized or faulty transactions, whereas reversals typically address technical or processing mistakes in payment settlement.

ACH Return

ACH returns occur when a payment is declined by the bank due to issues like insufficient funds, account closure, or unauthorized transactions, whereas chargebacks involve disputes initiated by the cardholder through their credit card issuer. Reversals refer to the correction of a previous transaction error within the ACH network, differing from chargebacks which are formal contests of payment validity.

Fraudulent Claim

Fraudulent claims often arise when customers dispute legitimate transactions, leading to chargebacks that force merchants to return funds and incur additional fees, whereas reversals are corrections initiated by the merchant or payment processor to rectify errors without customer involvement. Understanding the distinction between chargebacks and reversals helps businesses better manage fraud risks and streamline dispute resolution processes.

Card Network Arbitration

Card network arbitration resolves disputes between merchants and cardholders when chargebacks and reversals conflict, using evidence from both parties to determine liability. This process ensures fair outcomes by enforcing card scheme rules and protecting the integrity of payment transactions.

Unauthorized Transaction

Unauthorized transactions often prompt chargebacks, where the cardholder disputes the payment through their bank, leading to a temporary refund while investigation occurs. Reversals, in contrast, are merchant-initiated corrections that refund a transaction without involving the cardholder or dispute process, typically for processing errors or refunds.

Issuer Decision

Issuer decision in chargeback cases involves evaluating the validity of the cardholder's dispute and either accepting or rejecting the chargeback, while a reversal reinstates a previously disputed transaction by the issuer upon merchant evidence. This process impacts chargeback ratios, merchant liability, and overall transaction dispute resolution efficiency in payment processing systems.

Merchant Liability

Merchant liability in chargebacks arises when a customer disputes a transaction, leading to the merchant potentially losing both the product and the transaction amount if the chargeback is upheld by the card issuer. Reversals occur when a previously granted chargeback is overturned due to evidence provided by the merchant, thereby restoring the transaction amount to the merchant's account and relieving them of the financial loss.

Clearing Reversal

Clearing reversal refers to the process of undoing a previously settled transaction before final settlement, distinguishing it from a chargeback, which is a dispute initiated by the cardholder after settlement. While reversals typically occur during the clearing cycle to correct errors or cancellations, chargebacks involve formal investigations and potential financial penalties for merchants.

chargeback vs reversal Infographic

moneydif.com

moneydif.com