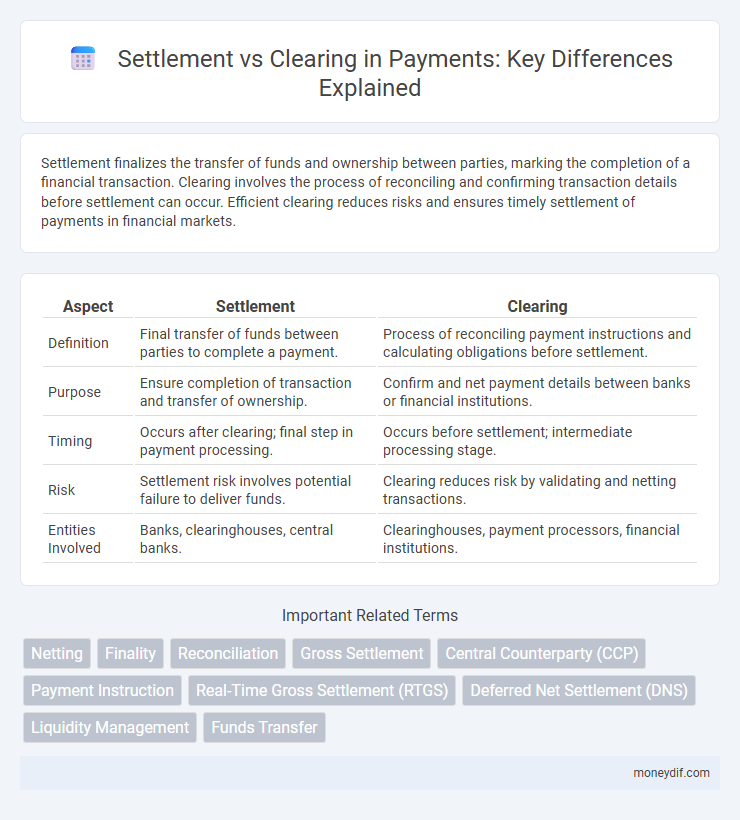

Settlement finalizes the transfer of funds and ownership between parties, marking the completion of a financial transaction. Clearing involves the process of reconciling and confirming transaction details before settlement can occur. Efficient clearing reduces risks and ensures timely settlement of payments in financial markets.

Table of Comparison

| Aspect | Settlement | Clearing |

|---|---|---|

| Definition | Final transfer of funds between parties to complete a payment. | Process of reconciling payment instructions and calculating obligations before settlement. |

| Purpose | Ensure completion of transaction and transfer of ownership. | Confirm and net payment details between banks or financial institutions. |

| Timing | Occurs after clearing; final step in payment processing. | Occurs before settlement; intermediate processing stage. |

| Risk | Settlement risk involves potential failure to deliver funds. | Clearing reduces risk by validating and netting transactions. |

| Entities Involved | Banks, clearinghouses, central banks. | Clearinghouses, payment processors, financial institutions. |

Introduction to Settlement and Clearing in Payments

Settlement in payments refers to the actual transfer of funds between the payer's and payee's financial institutions, finalizing the transaction. Clearing involves the process of transmitting, reconciling, and confirming payment instructions before settlement occurs. Efficient clearing and settlement systems reduce risks, ensure liquidity, and maintain trust in payment networks.

Defining Settlement in Payment Systems

Settlement in payment systems refers to the final transfer of funds between parties, ensuring that the payee receives the exact amount owed without further obligations. It represents the completion of a payment transaction where the financial institutions update their account balances to reflect the transfer. Unlike clearing, which involves the exchange and validation of payment instructions, settlement guarantees the irreversible fulfillment of payment obligations.

Understanding the Clearing Process

The clearing process in payment systems involves the transmission, reconfirmation, and settlement of payment instructions between financial institutions to ensure accurate fund transfers. It verifies transaction details, reconciles accounts, and calculates the net positions of participants before final settlement occurs. Effective clearing reduces settlement risk and enhances the efficiency and security of payment networks.

Key Differences Between Clearing and Settlement

Clearing involves the process of validating, matching, and confirming payment instructions between parties before the transaction is finalized. Settlement is the actual transfer of funds or securities between accounts, completing the transaction and ensuring ownership transfer. Key differences include that clearing focuses on transaction verification and risk management, while settlement executes the final exchange of value.

How Clearing Works in Electronic Payments

Clearing in electronic payments involves the process of transmitting, reconciling, and confirming payment instructions between financial institutions to ensure the accuracy and validity of transactions before settlement. It verifies account details, checks for sufficient funds, and matches transaction information to prevent errors and fraud. This pre-settlement phase is crucial for maintaining transactional integrity and enables the smooth transfer of funds during the final settlement stage.

Settlement Mechanisms in Modern Finance

Settlement mechanisms in modern finance ensure the final transfer of funds and ownership between parties, reducing counterparty risk and enhancing transaction security. These mechanisms involve the actual movement of cash or securities, often facilitated by central counterparties (CCPs) or real-time gross settlement (RTGS) systems that guarantee immediate and irrevocable settlement. Efficient settlement processes are crucial for maintaining liquidity, minimizing credit risk, and supporting the stability of financial markets.

Importance of Clearing Houses in Payment Chains

Clearing houses play a crucial role in payment chains by acting as intermediaries that manage the confirmation, matching, and validation of payment instructions between banks, reducing the risk of errors and fraud. They facilitate the efficient transfer of funds and settlement processes by netting transactions, which minimizes liquidity requirements and enhances the speed of payment settlements. Their function ensures the stability and reliability of financial markets by providing transparency and operational efficiency in clearing and settlement systems.

Risks Associated with Settlement and Clearing

Settlement and clearing processes in payment systems carry inherent risks such as counterparty risk, where one party may default before finalizing the transaction, and liquidity risk, impacting the availability of funds to complete settlements. Clearing risk includes operational risks like system failures and processing errors that delay transaction finality, while settlement risk often involves timing mismatches that can lead to financial loss. Effective risk management strategies, including collateral requirements and real-time monitoring, are essential to mitigate exposure during both clearing and settlement stages.

Technological Innovations in Clearing and Settlement

Technological innovations in clearing and settlement have transformed traditional payment systems by introducing blockchain, distributed ledger technology (DLT), and smart contracts, enabling real-time transaction validation and settlement finality. These advancements reduce counterparty risk and enhance transparency across financial networks while significantly lowering operational costs. Automated clearing houses (ACH) and instant payment platforms integrate AI and machine learning to optimize risk management and accelerate fund transfers, creating more efficient and secure payment ecosystems.

Future Trends: The Evolution of Settlement and Clearing

Emerging technologies like blockchain and distributed ledger systems are revolutionizing settlement and clearing processes by enhancing transparency, reducing settlement times, and minimizing counterparty risks. Integration of artificial intelligence enables smarter risk management and predictive analytics, streamlining post-trade operations. Continuous innovation in real-time gross settlement systems and cross-border payment infrastructures is shaping the future of efficient, secure financial transactions.

Important Terms

Netting

Netting in financial transactions reduces settlement risk by consolidating multiple obligations into a single payment amount, streamlining the settlement process. Unlike clearing, which involves validating and matching transactions, netting focuses on offsetting reciprocal obligations to minimize the total value exchanged between counterparties.

Finality

Finality in financial transactions ensures that once a trade is settled, the transfer of assets or funds is irrevocable and legally binding, eliminating settlement risk. Clearing involves the process of confirming and matching trade details before final settlement, but finality guarantees the conclusive transfer of ownership and payment.

Reconciliation

Reconciliation in financial transactions ensures accuracy by verifying that settlement records match clearing data to prevent discrepancies and financial risks. Effective reconciliation processes enable institutions to confirm that trades have been settled correctly after the clearing phase, reducing errors and enhancing operational efficiency.

Gross Settlement

Gross settlement refers to the immediate, final transfer of funds or securities on a transaction-by-transaction basis without netting, ensuring irrevocable settlement. Unlike clearing, which involves matching and netting multiple transactions before settlement, gross settlement systems minimize counterparty risk by finalizing each transaction individually.

Central Counterparty (CCP)

Central Counterparty (CCP) acts as an intermediary in the clearing process by becoming the buyer to every seller and the seller to every buyer, reducing counterparty risk and enhancing market stability. Settlement, however, refers to the final transfer of securities and funds between parties, which occurs after the clearing process is completed by the CCP.

Payment Instruction

Payment instruction initiates the transfer of funds by specifying payment details, while clearing involves the process of reconciling and validating these payment instructions between financial institutions before settlement. Settlement is the final step where the actual transfer of funds occurs, irrevocably completing the transaction after clearing has confirmed the obligations.

Real-Time Gross Settlement (RTGS)

Real-Time Gross Settlement (RTGS) systems facilitate the immediate transfer of funds on a transaction-by-transaction basis, ensuring the finality of settlement without netting debits and credits. Unlike clearing, which involves the aggregation and netting of multiple transactions before settlement, RTGS minimizes settlement risk by processing payments individually and instantly.

Deferred Net Settlement (DNS)

Deferred Net Settlement (DNS) consolidates multiple payment obligations between participants into a single net amount, optimizing liquidity by settling only the net difference at specified intervals rather than individual transactions. This contrasts with clearing, which involves the process of updating accounts and arranging for the transfer of funds before the final settlement occurs.

Liquidity Management

Liquidity management in settlement focuses on ensuring sufficient cash and assets are available to complete trade settlements on time, minimizing settlement risk and avoiding failed trades. Clearing involves netting obligations and optimizing collateral use to reduce liquidity demands, enhancing overall efficiency in the post-trade process.

Funds Transfer

Funds transfer involves the movement of money between accounts, where clearing refers to the process of updating the accounts and confirming transaction details, while settlement is the final step that involves the actual transfer of funds between financial institutions to complete the transaction. Efficient settlement reduces counterparty risk and ensures liquidity, whereas clearing facilitates accurate and timely transaction recording prior to settlement.

settlement vs clearing Infographic

moneydif.com

moneydif.com