NSF (Non-Sufficient Funds) occurs when a payment is attempted but there are not enough funds in the payer's account, causing the transaction to be declined. Revocation refers to the act of canceling or withdrawing a payment authorization after it has been given but before the funds are fully processed. Understanding the difference between NSF and revocation is crucial for managing payment disputes and avoiding financial penalties.

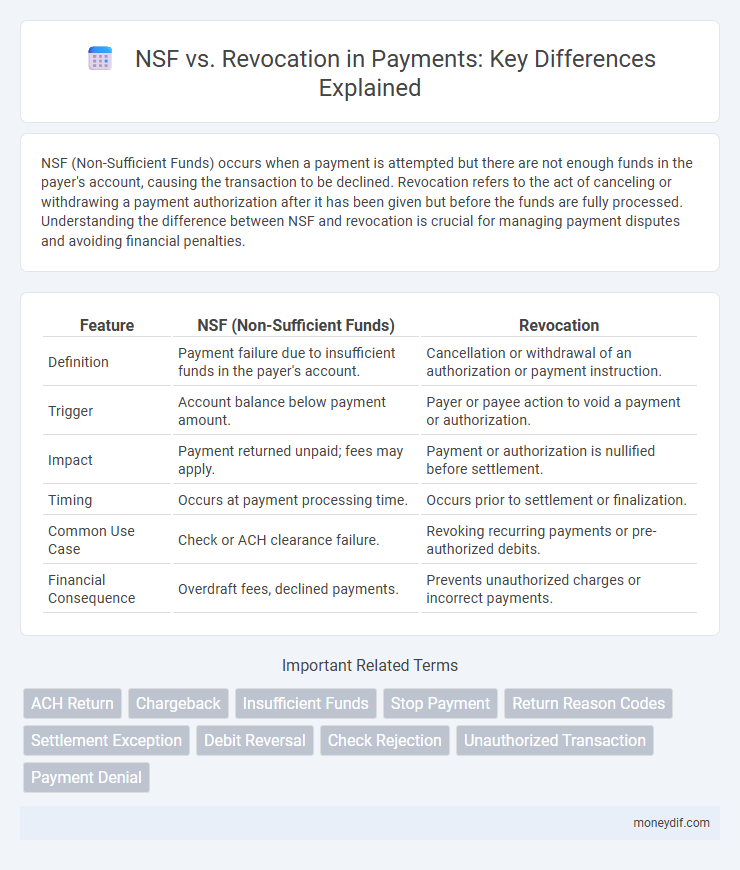

Table of Comparison

| Feature | NSF (Non-Sufficient Funds) | Revocation |

|---|---|---|

| Definition | Payment failure due to insufficient funds in the payer's account. | Cancellation or withdrawal of an authorization or payment instruction. |

| Trigger | Account balance below payment amount. | Payer or payee action to void a payment or authorization. |

| Impact | Payment returned unpaid; fees may apply. | Payment or authorization is nullified before settlement. |

| Timing | Occurs at payment processing time. | Occurs prior to settlement or finalization. |

| Common Use Case | Check or ACH clearance failure. | Revoking recurring payments or pre-authorized debits. |

| Financial Consequence | Overdraft fees, declined payments. | Prevents unauthorized charges or incorrect payments. |

Understanding NSF (Non-Sufficient Funds) in Payment Processing

NSF (Non-Sufficient Funds) occurs when a payment is attempted but the payer's bank account lacks the necessary funds to cover the transaction, leading to a declined payment. This can result in fees from both the bank and the payee, as well as delayed processing times that affect cash flow management. Recognizing NSF helps businesses implement better risk controls and improve payment reconciliation processes.

What is Payment Revocation? Key Differences Explained

Payment revocation refers to the cancellation or reversal of a payment transaction after it has been authorized but before settlement is completed. Unlike Non-Sufficient Funds (NSF) which occurs when an account lacks the necessary balance to cover a payment, payment revocation is initiated by the payer or financial institution to halt or reverse the transaction for reasons such as fraud or error. The key difference lies in NSF being a result of insufficient account balance, whereas payment revocation is an active withdrawal of the payment authorization.

NSF vs Revocation: Core Definitions and Examples

Non-Sufficient Funds (NSF) occurs when a payment is attempted but the account lacks the necessary balance, triggering a bank rejection and potential fees for the account holder. Revocation refers to the formal withdrawal or cancellation of a payment authorization or agreement before the transaction completes, often used in cases of unauthorized or disputed payments. For example, an NSF situation arises when a check bounces due to insufficient funds, while revocation happens when a customer cancels a previously authorized debit transaction.

Common Causes of NSF Payments

Non-sufficient funds (NSF) payments commonly occur due to insufficient account balances, unexpected automatic withdrawals, or errors in recording deposits. These situations often arise from overdrafts caused by timing differences between transactions and available funds. Understanding these causes helps businesses minimize NSF fees and improve payment processing efficiency.

Typical Scenarios Leading to Payment Revocation

Payment revocation typically occurs when the payee disputes the transaction due to unauthorized charges, incorrect amounts, or goods and services not delivered as promised. Unlike Non-Sufficient Funds (NSF), which arises from inadequate balances in the payer's account causing payment failure, revocation involves active challenge or cancellation by the payee post-authorization. Common scenarios include fraudulent transactions, billing errors, or contract cancellations prompting immediate reversal requests within stipulated time frames.

Impact of NSF and Revocation on Merchants and Payees

NSF (Non-Sufficient Funds) fees result in immediate payment failures, causing merchants to face increased processing costs and delayed revenue recognition. Revocation of payments, often linked to chargebacks or disputes, can severely impact payees by reversing funds after settlement, leading to potential cash flow disruptions and increased fraud risk. Both NSF occurrences and payment revocations necessitate robust risk management strategies to minimize financial losses and maintain transaction integrity.

Prevention Strategies for NSF and Payment Revocation

Implementing real-time payment monitoring systems and verifying account balances before transaction approval significantly reduces the risk of Non-Sufficient Funds (NSF) occurrences. Utilizing multi-factor authentication and secure authorization protocols helps prevent payment revocation by ensuring that only authorized parties can alter or cancel transactions. Regularly updating fraud detection algorithms and conducting customer education on payment processes further enhance prevention strategies for both NSF and payment revocation.

Legal and Regulatory Implications: NSF vs Revocation

Non-Sufficient Funds (NSF) occur when an account lacks adequate balance to cover a payment, triggering legal obligations related to bank fees, consumer protection laws, and potential contract breaches. Revocation involves the withdrawal of authorization for a payment or transaction, regulated under laws such as the Uniform Commercial Code (UCC) and electronic payment regulations, impacting dispute resolutions and liability. Both NSF and revocation carry distinct legal consequences, influencing financial compliance, risk management, and enforcement mechanisms in payment processing.

Fee Structures: NSF Fees vs Revocation Charges

NSF fees typically range from $25 to $40 per transaction due to insufficient funds in the payer's account, reflecting the bank's cost for handling returned payments. Revocation charges vary widely but often exceed $50, as they cover administrative costs and potential penalties when a payment authorization is withdrawn after processing. Comparing fee structures highlights that NSF fees are primarily penalties for failed payments, while revocation charges address the operational impact of payment cancellations.

Best Practices for Managing NSF and Revoked Payments

Implement rigorous verification processes to detect Non-Sufficient Funds (NSF) before transaction approval, reducing the risk of payment failures. Maintain clear communication channels with customers to promptly address revoked payments and establish transparent refund or resubmission policies. Leverage automated payment monitoring tools to track NSF occurrences and revoked transactions, enhancing cash flow management and minimizing financial losses.

Important Terms

ACH Return

ACH returns due to NSF (Non-Sufficient Funds) occur when the payer's account lacks sufficient balance to cover the transaction, whereas returns due to Revocation result from the receiver canceling the authorization after the debit has been initiated.

Chargeback

Chargeback disputes often arise from Non-Sufficient Funds (NSF) transactions or customer revocation requests, requiring merchants to provide clear evidence of authorization and delivery to resolve the claim.

Insufficient Funds

Insufficient funds occur when an account balance is too low to cover a transaction, often leading to a Non-Sufficient Funds (NSF) fee imposed by banks. Revocation refers to the cancellation of authorization for a transaction, which can happen before or after an NSF event, impacting payment processing and account reconciliation.

Stop Payment

Stop payment is a bank instruction to withhold funds on a check, differing from NSF (Non-Sufficient Funds) which occurs when an account lacks funds to cover a payment, and revocation which involves canceling an authorization before payment processing.

Return Reason Codes

Return Reason Codes such as NSF (Non-Sufficient Funds) indicate payment failures due to insufficient account balance, while Revocation codes specify cancellations authorized by the account holder or issuer.

Settlement Exception

Settlement exceptions arise when NSF (Non-Sufficient Funds) triggers transaction failures, contrasting revocation which involves the formal cancellation of prior authorizations or agreements.

Debit Reversal

Debit reversal occurs when a non-sufficient funds (NSF) transaction is corrected by revoking the original debit to restore the account balance.

Check Rejection

Check rejection due to NSF (Non-Sufficient Funds) occurs when the account balance is insufficient to cover the check amount, whereas revocation involves the account holder canceling the check authorization before payment.

Unauthorized Transaction

Unauthorized transactions often result in NSF (Non-Sufficient Funds) fees when revocation of payment authorization occurs after the transaction is processed.

Payment Denial

Payment denial occurs when a transaction is refused due to Non-Sufficient Funds (NSF) or when the payer revokes authorization for the payment.

NSF vs Revocation Infographic

moneydif.com

moneydif.com