ACH and EFT are electronic payment methods but serve different purposes; ACH (Automated Clearing House) is often used for direct deposits and bill payments within the United States, offering low-cost, batch-processed transactions. EFT (Electronic Funds Transfer) is a broader term encompassing any electronic transfer of money, including wire transfers, ATMs, and card payments, providing faster, real-time processing. Understanding the distinction between ACH and EFT helps businesses optimize transaction speed, cost, and payment security based on their financial needs.

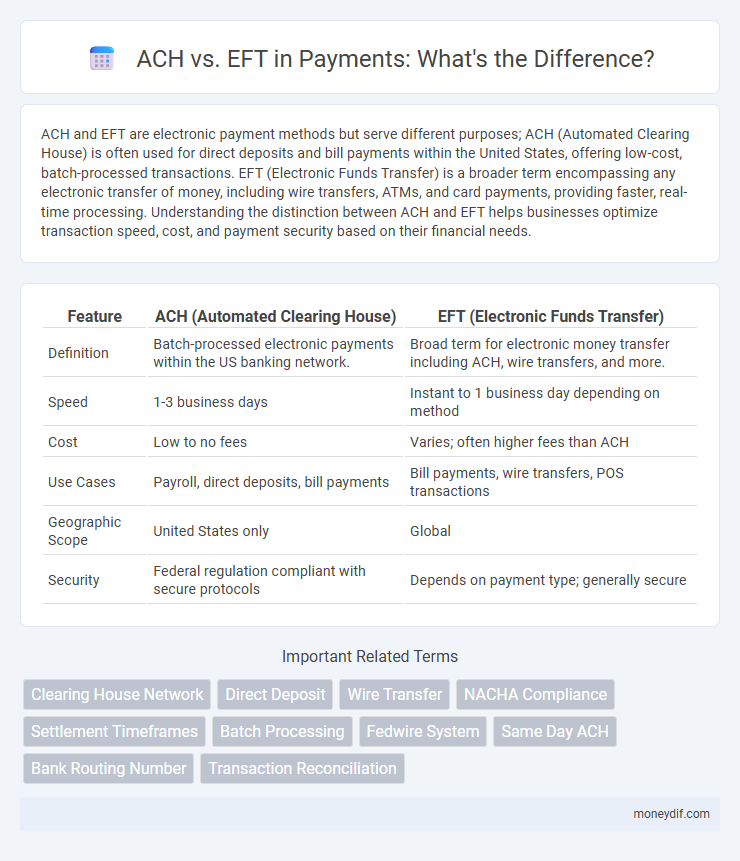

Table of Comparison

| Feature | ACH (Automated Clearing House) | EFT (Electronic Funds Transfer) |

|---|---|---|

| Definition | Batch-processed electronic payments within the US banking network. | Broad term for electronic money transfer including ACH, wire transfers, and more. |

| Speed | 1-3 business days | Instant to 1 business day depending on method |

| Cost | Low to no fees | Varies; often higher fees than ACH |

| Use Cases | Payroll, direct deposits, bill payments | Bill payments, wire transfers, POS transactions |

| Geographic Scope | United States only | Global |

| Security | Federal regulation compliant with secure protocols | Depends on payment type; generally secure |

Understanding ACH and EFT: Key Differences

ACH (Automated Clearing House) and EFT (Electronic Funds Transfer) are both electronic payment methods used to transfer money between bank accounts, but ACH specifically refers to batch-processed payments typically used for payroll, direct deposits, and bill payments. EFT is a broader term encompassing all electronic payments, including wire transfers, ATM transactions, and ACH transactions. Understanding that ACH transactions are generally slower but cost-effective, while other EFT types like wire transfers provide faster, real-time payments, is crucial for selecting the appropriate payment method.

How ACH Payments Work

ACH payments operate through the Automated Clearing House network, which electronically processes batches of debit and credit transactions between banks. When a payment is initiated, the payer's bank sends a request to the ACH network that routes funds to the recipient's bank account typically within one to two business days. This efficient, secure system is widely used for direct deposits, bill payments, and recurring transfers, reducing processing costs compared to traditional check payments.

How EFT Payments Work

EFT payments facilitate the electronic transfer of funds directly between bank accounts through secure networks such as the Automated Clearing House (ACH), wire transfers, or debit card transactions. This process involves authorization from the payer, verification by financial institutions, and settlement through interconnected banking systems, enabling faster and more efficient payment processing compared to traditional check payments. EFT supports a wide range of transactions, including bill payments, direct deposits, and business-to-business transfers, enhancing cash flow management and reducing the risk of errors or fraud.

ACH vs EFT: Processing Times

ACH payments typically take 1 to 3 business days to process, reflecting the batch processing system used by the Automated Clearing House network. EFT transactions, which encompass a broader range of electronic funds transfers including wire transfers and card payments, can vary significantly in processing speed, with some payments settling instantly or within a few hours. Understanding the processing times for ACH versus other EFT methods is crucial for businesses and individuals managing cash flow and payment schedules.

Security Measures: ACH vs EFT

ACH transactions incorporate multi-layered security protocols including encryption, multi-factor authentication, and real-time fraud detection systems to protect sensitive banking information. EFT payments also utilize encryption and secure networks but often rely on the security frameworks of individual financial institutions, which can vary widely in effectiveness. Both ACH and EFT implement compliance with federal regulations such as NACHA rules and the Electronic Fund Transfer Act, ensuring authorized and monitored fund transfers.

Cost Comparison: ACH and EFT Fees

ACH transactions typically incur lower fees compared to EFT payments, with ACH costs averaging between $0.20 to $1.50 per transaction depending on volume and provider. EFT fees can vary widely but often include higher processing charges and potential setup or maintenance costs. Businesses favor ACH for cost-effective, batch-processed payments, while EFT is preferred for faster, individual transfers despite higher expenses.

Use Cases: When to Use ACH vs EFT

ACH payments are ideal for recurring transactions such as payroll, subscriptions, and bill payments due to their low cost and batch processing efficiency. EFT encompasses a broader range of electronic transactions, including wire transfers and debit card payments, making it suitable for urgent or one-time payments requiring faster settlement. Businesses should choose ACH for cost-effective, scheduled transfers and EFT when speed and transaction variety are critical factors.

ACH vs EFT: Advantages and Disadvantages

ACH payments offer cost efficiency and standardized processing, making them ideal for recurring transactions and payroll, but they can have slower settlement times compared to other methods. EFT provides broader payment options, including wire transfers and electronic checks, enabling faster transfers and greater flexibility, though it often incurs higher fees and requires more complex setup. Businesses must weigh ACH's affordability and reliability against EFT's speed and versatility to choose the optimal electronic payment solution.

ACH and EFT for Businesses: Which is Better?

ACH and EFT are essential payment methods for businesses, with ACH (Automated Clearing House) offering cost-effective, batch-processed transactions ideal for payroll and vendor payments, while EFT (Electronic Funds Transfer) encompasses a broader range of electronic payments including wire transfers and card transactions. Businesses benefit from ACH's lower fees, enhanced security, and reliability for recurring payments compared to other EFT options, which are typically faster but more expensive. Choosing between ACH and EFT depends on the business's transaction volume, speed requirements, and cost sensitivity.

Choosing Between ACH and EFT: Key Factors to Consider

Choosing between ACH and EFT depends on transaction speed, cost, and network reach; ACH transfers often provide cost-effective batch processing suitable for payroll and bill payments, while EFT covers a broader range of electronic fund transfers including wire transfers and card payments with faster settlement times. Evaluating the required processing time, security features, and specific financial institution policies is crucial when selecting the optimal payment method. Businesses should also consider regulatory compliance and the nature of payees to ensure seamless and secure payment execution.

Important Terms

Clearing House Network

Clearing House Network (CHIPS) processes high-value electronic funds transfers (EFT) primarily for large-scale international and domestic transactions, distinct from the Automated Clearing House (ACH) system, which handles lower-value, batch-processed payments within the United States. CHIPS offers real-time settlement and finality of payments, whereas ACH transactions typically involve delayed settlement and focus on domestic automated billing, payroll, and direct deposit.

Direct Deposit

Direct Deposit is an electronic payment method that transfers funds directly into a recipient's bank account, primarily utilizing the Automated Clearing House (ACH) network, which processes batch payments securely and efficiently across the United States. Electronic Funds Transfer (EFT) is a broader term encompassing various electronic payment systems, including ACH, wire transfers, and debit card transactions, but ACH remains the predominant network for direct deposit payroll and government benefits due to its standardized clearing procedures and cost-effectiveness.

Wire Transfer

Wire transfers provide instant, secure funds transfer between banks, differing from ACH (Automated Clearing House) which processes batched electronic payments with slower settlement times; EFT (Electronic Funds Transfer) serves as an umbrella term encompassing both wire transfers and ACH transactions in digital banking. Wire transfers typically offer same-day delivery for high-value payments, while ACH transfers prioritize cost-efficiency for recurring, low-value transactions.

NACHA Compliance

NACHA Compliance ensures secure and standardized processing of Automated Clearing House (ACH) payments, which differ from Electronic Funds Transfers (EFT) by focusing specifically on batch-processed, standardized transactions within the U.S. banking system. Adhering to NACHA rules reduces fraud risk and enhances the efficiency of ACH payments compared to the broader category of EFTs encompassing various transfer methods.

Settlement Timeframes

Settlement timeframes for ACH transactions typically range from one to two business days, offering a reliable but slower transfer method, while EFT transactions often settle faster, sometimes within the same business day, providing quicker access to funds. The difference in processing speed impacts cash flow management and transaction efficiency for businesses and individuals.

Batch Processing

Batch processing in ACH (Automated Clearing House) systems enables the grouped handling of multiple transactions, optimizing settlement efficiency and reducing processing costs compared to individual EFT (Electronic Funds Transfer) transactions. ACH batch processing is especially effective for high-volume, recurring payments such as payroll, utility bills, and merchant settlements, whereas EFT often supports more immediate, single-payment transfers.

Fedwire System

The Fedwire System is a real-time gross settlement network operated by the Federal Reserve that processes large-value, time-critical payments, contrasting with ACH (Automated Clearing House) transactions which batch process smaller payments on a delayed schedule. While Fedwire facilitates immediate funds transfer with finality, ACH primarily handles bulk electronic payments like payroll and bill payments in a cost-effective, deferred manner, making each system optimized for different transaction types and speeds within the electronic funds transfer (EFT) ecosystem.

Same Day ACH

Same Day ACH enhances traditional ACH by enabling faster electronic fund transfers within the Automated Clearing House network, reducing transaction settlement times from days to hours. Unlike general EFT methods, Same Day ACH specifically accelerates batch processing for payroll, payments, and B2B transactions, improving cash flow and operational efficiency.

Bank Routing Number

Bank routing numbers are essential for identifying financial institutions in ACH transactions, which are standardized electronic payments processed through the Automated Clearing House network. While ACH transfers use routing numbers for batch processing of payments like direct deposits and bill payments, EFT (Electronic Funds Transfer) is a broader term encompassing all electronic money transfers, including wire transfers that may require different routing information.

Transaction Reconciliation

Transaction reconciliation involves matching Automated Clearing House (ACH) payments with corresponding Electronic Funds Transfers (EFT) to ensure accuracy and prevent discrepancies in financial records. Efficient ACH vs EFT reconciliation reduces errors, improves cash flow visibility, and supports compliance with banking regulations.

ACH vs EFT Infographic

moneydif.com

moneydif.com