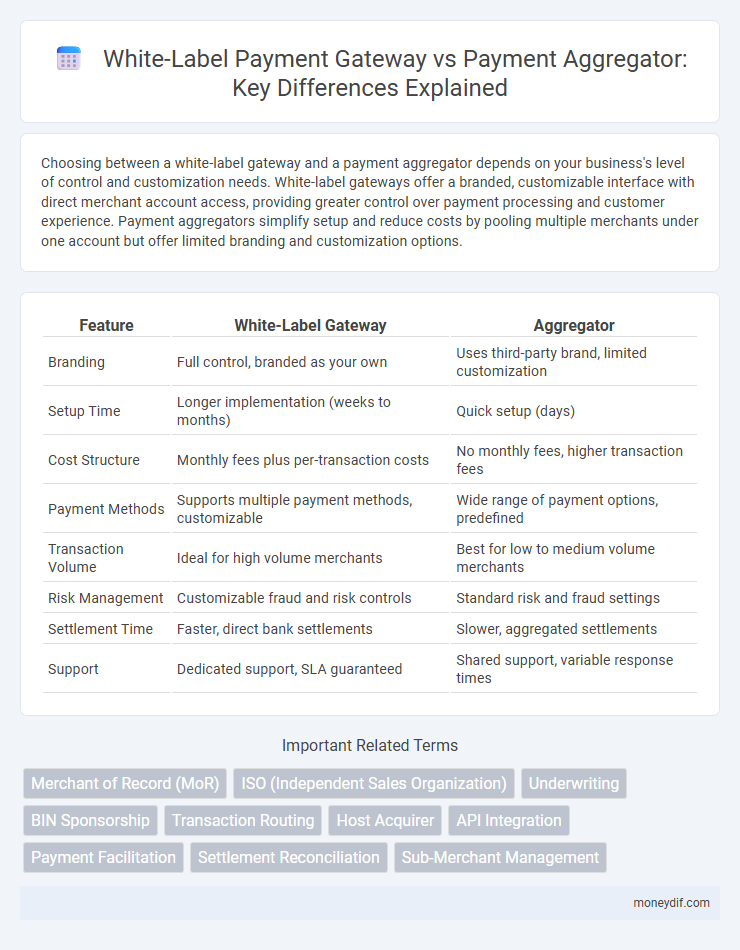

Choosing between a white-label gateway and a payment aggregator depends on your business's level of control and customization needs. White-label gateways offer a branded, customizable interface with direct merchant account access, providing greater control over payment processing and customer experience. Payment aggregators simplify setup and reduce costs by pooling multiple merchants under one account but offer limited branding and customization options.

Table of Comparison

| Feature | White-Label Gateway | Aggregator |

|---|---|---|

| Branding | Full control, branded as your own | Uses third-party brand, limited customization |

| Setup Time | Longer implementation (weeks to months) | Quick setup (days) |

| Cost Structure | Monthly fees plus per-transaction costs | No monthly fees, higher transaction fees |

| Payment Methods | Supports multiple payment methods, customizable | Wide range of payment options, predefined |

| Transaction Volume | Ideal for high volume merchants | Best for low to medium volume merchants |

| Risk Management | Customizable fraud and risk controls | Standard risk and fraud settings |

| Settlement Time | Faster, direct bank settlements | Slower, aggregated settlements |

| Support | Dedicated support, SLA guaranteed | Shared support, variable response times |

Understanding White-Label Payment Gateways

White-label payment gateways offer businesses the ability to customize and brand the payment interface as their own, providing a seamless user experience and greater control over payment processing. Unlike aggregators, which pool merchants under a single platform and share resources, white-label solutions grant direct merchant accounts and higher transaction transparency. This approach is ideal for enterprises aiming to maintain brand identity while managing fees, security protocols, and compliance independently.

What Is a Payment Aggregator?

A payment aggregator is a service provider that enables merchants to process multiple payment methods under a single account without the need to set up individual merchant accounts with each payment provider. By pooling transactions from various merchants, the aggregator simplifies payment acceptance and offers a streamlined onboarding process with lower setup costs. This model contrasts with white-label gateways, which require merchants to integrate directly with payment networks while maintaining greater control over the payment experience.

Key Differences: White-Label Gateway vs Aggregator

A white-label payment gateway offers businesses a customizable, branded transaction solution where the merchant has direct control over payment processing, providing enhanced fraud protection and data ownership. In contrast, a payment aggregator pools multiple merchants under a single merchant account, simplifying onboarding but limiting control over branding and payment data. Key differences include merchant account ownership, branding flexibility, and the level of control over transaction processing and reporting.

Integration and Customization Options

White-label gateways offer extensive customization options allowing businesses to fully brand and tailor the payment interface to their specific needs, ensuring seamless integration with existing systems. Aggregators provide quicker, plug-and-play integration with pre-built features but limit customization due to shared infrastructure and standardized user experiences. Businesses seeking full control over payment processes and branding typically prefer white-label solutions, while those prioritizing fast deployment lean towards aggregators.

Merchant Onboarding Process Comparison

White-label payment gateways provide merchants with a branded solution, requiring direct integration and a comprehensive onboarding process including extensive compliance checks and customized setup. Aggregators offer faster merchant onboarding by pooling multiple merchants under one master account, simplifying risk management and reducing individual underwriting requirements. While white-label gateways enable greater control and customization, aggregators prioritize speed and ease of access to payment processing services.

Fee Structures and Pricing Models

White-label payment gateways typically charge a fixed monthly fee plus a lower per-transaction rate, offering scalability and predictable costs for businesses with high transaction volumes. Aggregators operate on a pay-as-you-go model with higher per-transaction fees and no setup costs, ideal for startups or low-volume merchants seeking flexible pricing. Understanding the fee structures helps businesses optimize payment processing expenses and choose a solution aligned with their sales projections.

Security and Compliance Considerations

White-label payment gateways offer higher control over security protocols and compliance management, allowing businesses to implement customized fraud prevention measures and maintain PCI DSS certification independently. Aggregators streamline compliance by managing security standards across multiple merchants under a single master account, reducing individual liability but potentially exposing businesses to shared risk. Choosing between white-label gateways and aggregators requires evaluating the trade-off between tailored security governance versus simplified, outsourced compliance oversight.

Scalability and Business Growth Potential

White-label payment gateways offer greater scalability by allowing businesses to fully customize and brand their payment solutions, which supports long-term growth and customer loyalty. Aggregators provide a quicker setup with lower upfront costs but often limit scalability due to shared infrastructure and transaction restrictions. Businesses aiming for substantial growth typically benefit more from white-label solutions that accommodate increasing transaction volumes and diverse payment methods.

Ideal Use Cases: Which Solution Suits Your Business?

White-label payment gateways are ideal for businesses seeking full control over the payment experience, such as large enterprises or e-commerce platforms requiring customized branding and seamless integration. Aggregators suit startups and small businesses prioritizing quick setup and minimal technical overhead, offering shared merchant accounts and simplified onboarding. Choosing between these depends on your business scale, technical capabilities, and branding needs.

Choosing Between White-Label Gateway and Payment Aggregator

Choosing between a white-label gateway and a payment aggregator depends on business control and customization needs. White-label gateways offer complete branding control, seamless integration, and direct merchant accounts, ideal for enterprises seeking tailored payment solutions. Payment aggregators provide faster setup, lower upfront costs, and simplified compliance by pooling multiple merchants under one account, suitable for startups and small businesses prioritizing ease of use.

Important Terms

Merchant of Record (MoR)

A Merchant of Record (MoR) assumes full legal and financial responsibility for processing payments, managing tax compliance, and handling chargebacks, which is essential when comparing White-Label Gateways and Aggregators. White-Label Gateways offer branded payment processing solutions controlled by the business, while Aggregators simplify onboarding by pooling multiple merchants under a single MoR, enabling faster activation but often with less control and potentially higher fees.

ISO (Independent Sales Organization)

Independent Sales Organizations (ISOs) partner with white-label payment gateways to offer customizable, branded transaction processing solutions, enhancing merchant control and customer experience. In contrast, aggregators consolidate multiple merchants under a single account, providing simplified onboarding but less flexibility and individual branding opportunities for businesses.

Underwriting

Underwriting in the context of payment processing involves evaluating the risk and compliance of merchants before approving their access to a White-Label Gateway or Aggregator platform. White-Label Gateways typically perform more stringent underwriting to maintain brand reputation, while Aggregators streamline the process by underwriting multiple sub-merchants under a single master account, balancing risk management with faster onboarding.

BIN Sponsorship

BIN sponsorship enables businesses to issue payment cards under their own brand by partnering with a bank holding the Bank Identification Number, essential for white-label gateway solutions that offer customized payment processing without direct card issuance. Aggregators, in contrast, facilitate transactions for multiple merchants under a shared BIN, simplifying onboarding but limiting branding control and customization compared to dedicated BIN sponsorship in white-label gateways.

Transaction Routing

Transaction routing in payment processing involves directing transactions through optimal payment gateways to maximize approval rates and minimize fees. White-label gateways offer merchants branded payment solutions with full gateway control, while aggregators provide simplified integration by pooling multiple payment methods under a single interface, but with less customization and higher dependency on the aggregator's policies.

Host Acquirer

Host Acquirers provide essential payment processing infrastructure for merchants, offering direct control and streamlined transaction handling in white-label gateway solutions, unlike aggregators who pool multiple merchants under a single processing account, often resulting in less customization and higher fees. White-label gateways through host acquirers enable bespoke branding and enhanced data security, whereas aggregators prioritize rapid onboarding and simplified merchant services but with limited scalability and restricted risk management capabilities.

API Integration

API integration in white-label gateway solutions enables businesses to customize payment processing under their own brand while maintaining direct control over transaction flows, enhancing user experience and security. In contrast, aggregators utilize API integration to connect multiple payment providers through a single interface, simplifying setup but potentially limiting customization and direct merchant-banking relationships.

Payment Facilitation

Payment facilitation enables merchants to accept payments efficiently by leveraging a white-label gateway, which offers customizable branding and direct merchant onboarding under a single master account, enhancing control and customer experience. In contrast, aggregators consolidate multiple merchants under one account, simplifying setup but limiting branding options and individual transaction insights, often resulting in higher fees and less autonomy.

Settlement Reconciliation

Settlement reconciliation in payment systems involves accurately matching transactions between merchants and financial institutions to ensure all funds are correctly accounted for. White-label gateways offer direct control over settlement cycles and reporting, enhancing reconciliation accuracy, while aggregators simplify processing but may introduce delays and less granular settlement data, potentially complicating reconciliation efforts.

Sub-Merchant Management

Sub-merchant management involves overseeing individual merchants under a primary account, which varies significantly between white-label gateways and payment aggregators; white-label gateways offer complete customization and branding control to the primary merchant, while aggregators provide shared infrastructure with simplified onboarding but less branding flexibility. Effective sub-merchant management in white-label gateways enhances transaction transparency and risk allocation, whereas aggregators focus on rapid scalability and consolidated payment processing for diverse merchants.

White-Label Gateway vs Aggregator Infographic

moneydif.com

moneydif.com