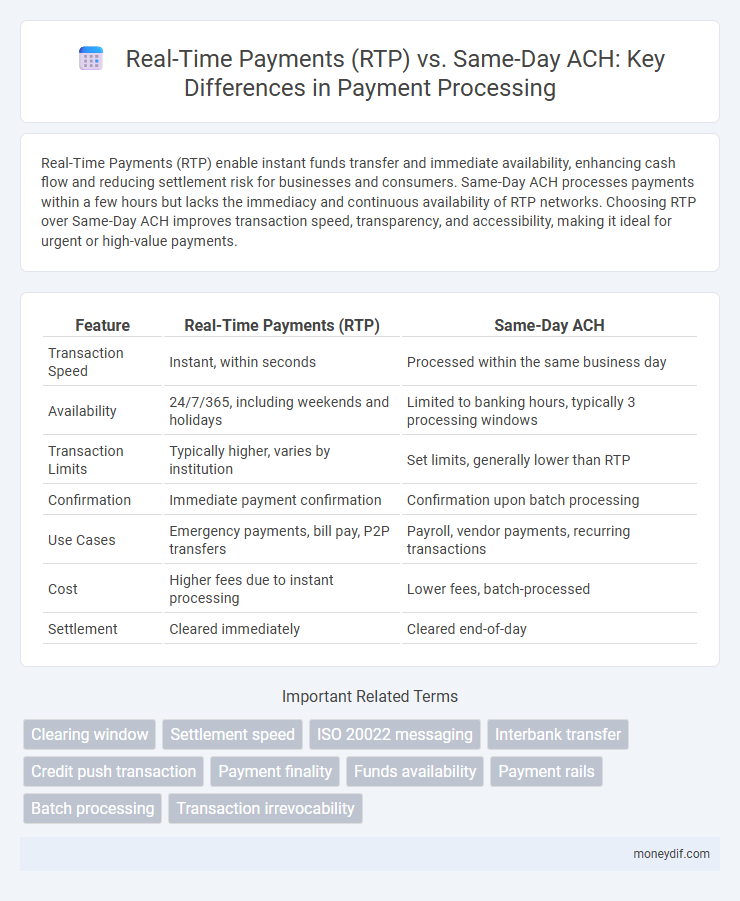

Real-Time Payments (RTP) enable instant funds transfer and immediate availability, enhancing cash flow and reducing settlement risk for businesses and consumers. Same-Day ACH processes payments within a few hours but lacks the immediacy and continuous availability of RTP networks. Choosing RTP over Same-Day ACH improves transaction speed, transparency, and accessibility, making it ideal for urgent or high-value payments.

Table of Comparison

| Feature | Real-Time Payments (RTP) | Same-Day ACH |

|---|---|---|

| Transaction Speed | Instant, within seconds | Processed within the same business day |

| Availability | 24/7/365, including weekends and holidays | Limited to banking hours, typically 3 processing windows |

| Transaction Limits | Typically higher, varies by institution | Set limits, generally lower than RTP |

| Confirmation | Immediate payment confirmation | Confirmation upon batch processing |

| Use Cases | Emergency payments, bill pay, P2P transfers | Payroll, vendor payments, recurring transactions |

| Cost | Higher fees due to instant processing | Lower fees, batch-processed |

| Settlement | Cleared immediately | Cleared end-of-day |

Understanding Real-Time Payments (RTP)

Real-Time Payments (RTP) enable instant fund transfers and confirmation, enhancing transaction speed compared to Same-Day ACH, which processes payments in batches throughout the day. RTP operates 24/7, providing continuous availability and immediate clearing, whereas Same-Day ACH has cutoff times and limited daily windows. Financial institutions leverage RTP to improve cash flow management and customer experience with real-time transaction visibility and settlement.

Overview of Same-Day ACH

Same-Day ACH enables faster clearing and settlement of Automated Clearing House transactions within the same business day, significantly improving cash flow efficiency for businesses and consumers. Governed by Nacha, it supports transaction limits up to $1 million per payment, making it suitable for high-value transfers. Its widespread adoption across U.S. financial institutions enhances payment speed while maintaining security protocols typical of ACH networks.

Speed: RTP vs Same-Day ACH

Real-Time Payments (RTP) provide immediate fund transfers, processing transactions within seconds, enhancing cash flow and liquidity management for businesses and consumers. In contrast, Same-Day ACH processes payments in batches, typically settling funds by the end of the business day, which may introduce delays compared to RTP. The instantaneous nature of RTP offers significant advantages for time-sensitive payments, such as emergency disbursements and instant bill settlement.

Settlement Processes Compared

Real-Time Payments (RTP) offer instant settlement, allowing funds to be available to recipients within seconds, while Same-Day ACH processes transactions in batches with settlement typically completed by the end of the business day. RTP uses a continuous, real-time clearing network minimizing settlement risk, contrasting with the Same-Day ACH's traditional ACH system that relies on predetermined processing windows. The immediacy of RTP supports time-sensitive transactions better than Same-Day ACH, which is more suitable for non-urgent payments requiring same-day confirmation.

Cost Differences: RTP and Same-Day ACH

Real-Time Payments (RTP) typically incur higher transaction fees compared to Same-Day ACH due to their instant processing and 24/7 availability, appealing to businesses needing immediate fund transfers. Same-Day ACH offers lower costs by batching payments and limiting processing to specific windows, which reduces operational expenses for banks and payment providers. Companies must weigh the premium RTP fees against faster access to funds when choosing between the two payment methods for cost efficiency.

Availability and Operating Hours

Real-Time Payments (RTP) offer 24/7/365 availability, enabling instantaneous fund transfers at any time, including weekends and holidays. Same-Day ACH operates within limited processing windows on business days, typically concluding by 5 PM ET, restricting fund availability outside standard banking hours. The continuous operating hours of RTP provide superior flexibility and immediacy compared to the scheduled batch processing of Same-Day ACH.

Security Features and Fraud Prevention

Real-Time Payments (RTP) offer enhanced security features such as tokenization and end-to-end encryption, significantly reducing fraud risks compared to Same-Day ACH, which relies on traditional batch processing with limited real-time verification. RTP supports instant transaction confirmation and monitoring, enabling quicker fraud detection and response, whereas Same-Day ACH transactions settle within hours, increasing exposure to potential fraudulent activities. Financial institutions increasingly prefer RTP for its robust authentication protocols and continuous transaction validation to strengthen fraud prevention.

Use Cases: When to Choose RTP or Same-Day ACH

Real-Time Payments (RTP) are ideal for urgent transactions requiring immediate funds availability, such as emergency bill payments, person-to-person transfers, and instant business-to-business settlements. Same-Day ACH suits high-volume payroll processing, vendor payments, and recurring transactions where same-day clearing is sufficient. Businesses prioritize RTP for speed and immediacy, while Same-Day ACH is preferred for cost efficiency and handling large batches within the same business day.

Adoption Trends in RTP and Same-Day ACH

Real-Time Payments (RTP) adoption is accelerating rapidly, with transaction volumes growing by over 40% year-over-year as businesses prioritize immediacy and continuous availability. Same-Day ACH shows steady growth but lags behind RTP due to cut-off times limiting transaction windows, with a 15% annual volume increase mostly from payroll and bill payments. Financial institutions and corporations increasingly favor RTP for its instant settlement and extended operational hours, driving higher implementation rates across diverse industries.

Future Outlook for RTP and Same-Day ACH

Real-Time Payments (RTP) are projected to dominate the payment landscape with increasing adoption driven by instant settlement and 24/7 availability, supporting growing demands for faster liquidity and improved cash flow management. Same-Day ACH continues to enhance its processing windows and transaction limits, aiming to bridge the gap between traditional ACH and RTP, but it may face challenges competing with RTP's near-instantaneous clearing capabilities. Financial institutions and businesses are expected to integrate both systems strategically, leveraging RTP for high-value, time-sensitive payments and Same-Day ACH for bulk, lower-cost transactions, fostering a more efficient and versatile payment ecosystem by 2025 and beyond.

Important Terms

Clearing window

Clearing windows for Real-Time Payments (RTP) enable instant settlement typically within seconds, contrasting with Same-Day ACH, which processes transactions in multiple batches throughout the business day, completing settlement by the end of the banking day. RTP offers 24/7 availability with immediate funds availability, while Same-Day ACH is limited to specific clearing windows aligned with standard ACH processing timelines.

Settlement speed

Settlement speed for Real-Time Payments (RTP) occurs within seconds, enabling immediate transfer and availability of funds, while Same-Day ACH processes transactions in batches, settling funds within the same business day but not instantaneously. RTP offers enhanced transaction finality and liquidity compared to the typically slower Same-Day ACH system.

ISO 20022 messaging

ISO 20022 messaging enhances Real-Time Payments (RTP) by enabling rich, structured data exchange that supports immediate transaction processing and improved payment transparency, while Same-Day ACH benefits from ISO 20022 through standardized formats that accelerate batch processing within the same business day. The adoption of ISO 20022 in both RTP and Same-Day ACH systems facilitates interoperability, compliance with global payment standards, and better reconciliation across financial institutions.

Interbank transfer

Interbank transfers via Real-Time Payments (RTP) enable instant, 24/7 settlement of funds between financial institutions, enhancing liquidity and transaction speed compared to Same-Day ACH, which processes payments in batches with settlement typically completed within a few hours on business days. RTP supports immediate confirmation and higher transaction limits, while Same-Day ACH offers cost-effective clearing for lower-value transactions but lacks real-time finality and operates under stricter timing constraints.

Credit push transaction

Credit push transactions in Real-Time Payments (RTP) enable immediate fund transfers with confirmation within seconds, offering enhanced speed and transparency compared to Same-Day ACH, which processes bulk payments with settlement typically occurring within hours on the same business day. RTP supports transaction-level messaging and improved end-to-end visibility, while Same-Day ACH is limited to batch processing with cutoff times impacting transaction finality.

Payment finality

Payment finality in Real-Time Payments (RTP) is achieved within seconds, providing immediate and irrevocable settlement, while Same-Day ACH processes transactions in batches with settlement occurring up to three times per business day, resulting in delayed finality. RTP's instant confirmation reduces counterparty risk and enhances liquidity management compared to the time-bound finality of Same-Day ACH.

Funds availability

Funds availability in Real-Time Payments (RTP) occurs instantly, providing immediate access to transferred funds 24/7, while Same-Day ACH transactions settle by the end of the business day, typically within hours but only during banking cutoffs. RTP leverages a constant payment infrastructure, ensuring rapid clearing and settlement, whereas Same-Day ACH adheres to batch processing with predefined processing windows, impacting the timing of fund accessibility.

Payment rails

Payment rails such as Real-Time Payments (RTP) offer instantaneous fund transfers with 24/7 availability, reducing settlement times compared to Same-Day ACH, which processes payments within the same business day but lacks immediate confirmation. RTP networks enhance liquidity management and fraud detection by providing real-time transaction reporting, whereas Same-Day ACH supports higher transaction volumes at a lower cost but with delayed finality.

Batch processing

Batch processing in Same-Day ACH consolidates multiple transactions for settlement within the same business day, optimizing efficiency but introducing slight delays compared to Real-Time Payments (RTP), which enable instantaneous fund transfers and settlement 24/7. RTP systems utilize advanced APIs and network infrastructure to deliver immediate transaction confirmation and enhanced liquidity management, contrasting with the periodic batch intervals inherent in ACH processing.

Transaction irrevocability

Transaction irrevocability in Real-Time Payments (RTP) ensures immediate, final settlement with no reversal options, contrasting Same-Day ACH transactions that, while processed within one business day, allow limited windows for return or correction due to settlement timing and regulatory guidelines. RTP's instant clearing mechanism enhances payment certainty and reduces fraud risk compared to Same-Day ACH's batch processing and potential for transaction disputes.

Real-Time Payments (RTP) vs Same-Day ACH Infographic

moneydif.com

moneydif.com