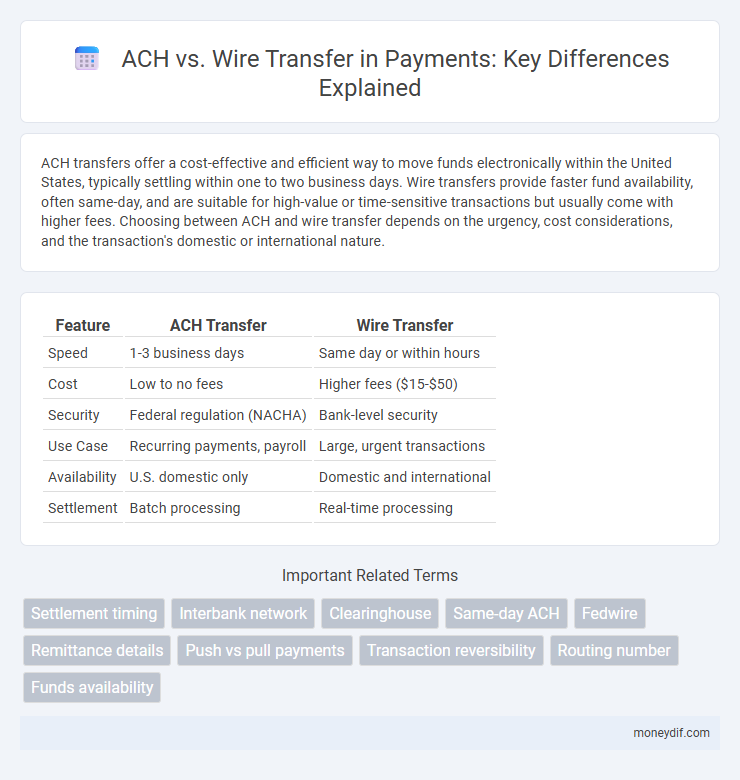

ACH transfers offer a cost-effective and efficient way to move funds electronically within the United States, typically settling within one to two business days. Wire transfers provide faster fund availability, often same-day, and are suitable for high-value or time-sensitive transactions but usually come with higher fees. Choosing between ACH and wire transfer depends on the urgency, cost considerations, and the transaction's domestic or international nature.

Table of Comparison

| Feature | ACH Transfer | Wire Transfer |

|---|---|---|

| Speed | 1-3 business days | Same day or within hours |

| Cost | Low to no fees | Higher fees ($15-$50) |

| Security | Federal regulation (NACHA) | Bank-level security |

| Use Case | Recurring payments, payroll | Large, urgent transactions |

| Availability | U.S. domestic only | Domestic and international |

| Settlement | Batch processing | Real-time processing |

Overview of ACH and Wire Transfers

ACH transfers utilize the Automated Clearing House network to electronically move funds between bank accounts, typically processing within 1-3 business days and favored for recurring payments and bill settlements. Wire transfers provide real-time, secure funds transfer directly between banks, often completed within minutes, making them ideal for urgent, high-value transactions. Both methods serve distinct purposes: ACH emphasizes cost-efficiency and batch processing, while wire transfers prioritize speed and immediacy.

Key Differences Between ACH and Wire Transfers

ACH transfers process payments electronically through the Automated Clearing House network, typically settling within 1-3 business days and incurring lower fees, making them ideal for recurring payments and payroll. Wire transfers provide faster, often same-day settlement by sending funds directly between banks via networks like SWIFT or Fedwire, but they usually involve higher fees and are preferred for urgent or high-value transactions. ACH offers batch processing with limits on transaction amounts, whereas wire transfers support individual, high-value payments with guaranteed immediate availability.

How ACH Transfers Work

ACH transfers operate through the Automated Clearing House network, which batches electronic payments for processing between banks. These transactions typically take one to two business days to clear, offering a cost-effective and secure alternative to wire transfers. ACH payments are commonly used for direct deposits, bill payments, and recurring transactions.

How Wire Transfers Work

Wire transfers electronically move funds directly between bank accounts using a secure network like SWIFT or Fedwire, ensuring near-instantaneous settlement. This method requires detailed recipient banking information, such as account number, routing number, and SWIFT code, to accurately route funds. Wire transfers are typically irreversible, making them a preferred option for urgent, high-value transactions.

Processing Times: ACH vs. Wire Transfer

ACH payments typically process within 1 to 3 business days, making them suitable for non-urgent transactions and recurring payments. Wire transfers offer faster processing times, often completed within the same day or a few hours, ideal for urgent or high-value transactions. The choice between ACH and wire transfer depends on the required speed, cost considerations, and transaction type.

Cost Comparison: ACH and Wire Transfers

ACH transfers typically cost between $0.20 and $1.50 per transaction, making them a cost-effective option for recurring or bulk payments. Wire transfers generally incur fees ranging from $15 to $50 per transfer, which can be significantly higher due to the speed and security provided. Businesses often choose ACH for lower costs and wire transfers for urgent, high-value payments despite the higher fees.

Security and Fraud Risks

ACH payments typically offer robust security features including multi-factor authentication and automated fraud detection systems that reduce the risk of unauthorized transactions. Wire transfers, while fast, can be more vulnerable to fraud due to their irrevocable nature and limited ability to reverse transactions once completed. Financial institutions often implement strict verification protocols for wire transfers, but ACH networks benefit from continuous monitoring and real-time alerts to detect suspicious activities effectively.

Use Cases: When to Choose ACH or Wire Transfer

ACH transfers are ideal for recurring payments, payroll, and domestic, low-value transactions due to lower fees and processing times of 1-3 business days. Wire transfers suit urgent, high-value, or international payments requiring same-day or next-day settlement and direct bank-to-bank communication. Businesses select ACH for cost-efficiency and automation, while wire transfers provide immediacy and secure funds transfer for critical transactions.

International Transfers: ACH vs. Wire

Wire transfers offer faster international payment processing, typically completing within 1 to 2 business days, while ACH transfers are generally limited to domestic transactions and often face delays or restrictions when used internationally. Wire transfers provide enhanced security and guaranteed delivery, making them preferable for cross-border payments requiring reliability and speed. ACH transfers usually incur lower fees but lack the widespread acceptance and immediacy necessary for seamless global fund transfers.

ACH and Wire Transfers: Pros and Cons

ACH payments offer cost-effective, secure, and automated processing ideal for recurring transactions, but they usually have slower settlement times compared to wire transfers. Wire transfers provide faster, real-time fund transfers with higher transaction limits, making them suitable for urgent or large-value payments, though they often incur higher fees. Understanding the trade-offs between ACH's affordability and automation versus wire transfers' speed and immediacy helps optimize payment strategies for businesses and individuals.

Important Terms

Settlement timing

ACH transfers typically settle within 1 to 3 business days, making them cost-effective for non-urgent payments. Wire transfers offer same-day or next-day settlement, providing faster access to funds for time-sensitive transactions.

Interbank network

Interbank networks streamline electronic fund transfers through Automated Clearing House (ACH) systems, offering batch-processed, low-cost transactions ideal for payroll and direct deposits, while wire transfers provide real-time, high-value payments with immediate settlement across banks globally. ACH transactions typically settle within 1-2 business days, whereas wire transfers complete within minutes, making each suitable for different payment urgency and cost requirements.

Clearinghouse

Clearinghouse plays a crucial role in processing Automated Clearing House (ACH) transactions by batching thousands of electronic payments for settlement, offering a cost-effective and efficient alternative to wire transfers, which are processed individually and settle faster but at higher fees. ACH transfers, facilitated through clearinghouses, typically take 1-3 business days to complete, while wire transfers provide near-instant settlement, making them preferable for urgent payments despite their higher cost.

Same-day ACH

Same-day ACH enables electronic payments and transfers to be processed within the same business day, offering a faster and more cost-effective alternative to traditional ACH transfers that typically settle in one to three days. Compared to wire transfers, same-day ACH transactions are less expensive and suitable for lower-value payments, though wire transfers provide immediate availability and are preferred for high-value or time-sensitive transactions.

Fedwire

Fedwire is a real-time gross settlement system operated by the Federal Reserve that facilitates immediate, high-value wire transfers between banks, unlike ACH transfers which process batches and typically settle within one to two business days. While Fedwire transactions guarantee same-day finality and funds availability, ACH transfers are more cost-effective for lower-value, non-urgent payments such as payroll or recurring bill payments.

Remittance details

ACH transfers offer cost-effective, batch-processed payments typically settled within 1-3 business days, suitable for domestic remittances; wire transfers provide immediate, secure, and irrevocable funds transfer often used for high-value or international payments, with fees generally higher than ACH. Both methods require accurate beneficiary details, including account numbers and routing codes for ACH, or SWIFT/BIC codes for wire transfers, to ensure timely and successful transaction processing.

Push vs pull payments

Push payments require the payer to initiate the transaction, commonly used in ACH transfers where the sender's bank authorizes and sends funds directly to the recipient's account, offering lower fees and slower settlement times. Pull payments involve the payee initiating the withdrawal, often seen in wire transfers, which provide faster, irrevocable fund transfers with higher costs, suitable for urgent or high-value transactions.

Transaction reversibility

Transaction reversibility differs significantly between ACH and wire transfers, with ACH payments typically allowing reversal within a specified dispute window due to error or fraud, while wire transfers are generally irreversible once processed, offering limited recourse for sender recovery. The automated clearing house network electronically clears ACH transactions in batches, enabling automated error correction, whereas wire transfers clear in real-time through networks like SWIFT or Fedwire, providing immediate finality but minimal fraud protection.

Routing number

Routing numbers are essential for identifying financial institutions during ACH transfers, enabling batch processing of electronic payments like direct deposits and bill payments. In contrast, wire transfers use routing numbers along with specific transaction codes to facilitate real-time, high-value transfers that require immediate settlement between banks.

Funds availability

Funds availability for ACH transfers typically occurs within 1 to 2 business days, offering a cost-effective solution for routine transactions, while wire transfers provide near-instantaneous fund settlement, often within the same business day, making them ideal for urgent or high-value payments. Financial institutions emphasize wire transfers for time-sensitive liquidity due to their guaranteed availability and minimal settlement risk compared to the batch processing delays inherent in ACH systems.

ACH vs wire transfer Infographic

moneydif.com

moneydif.com