ACH transfers offer a cost-effective and secure method for moving funds electronically within the United States, typically settling within one to two business days. Wire transfers provide faster access to funds, often within the same day or hours, making them ideal for urgent or international payments despite higher fees. Choosing between ACH and wire depends on factors like transaction speed, cost sensitivity, and payment destination.

Table of Comparison

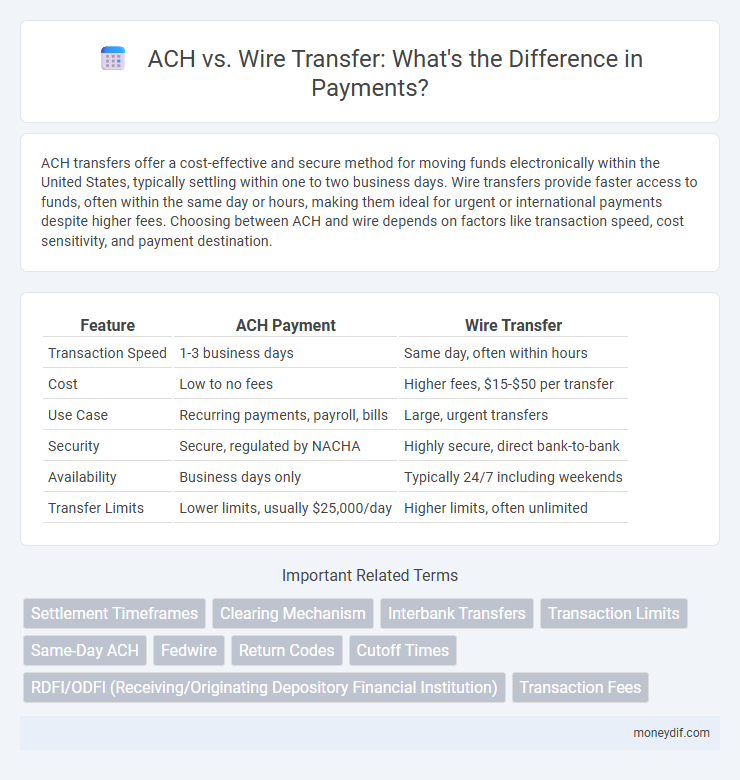

| Feature | ACH Payment | Wire Transfer |

|---|---|---|

| Transaction Speed | 1-3 business days | Same day, often within hours |

| Cost | Low to no fees | Higher fees, $15-$50 per transfer |

| Use Case | Recurring payments, payroll, bills | Large, urgent transfers |

| Security | Secure, regulated by NACHA | Highly secure, direct bank-to-bank |

| Availability | Business days only | Typically 24/7 including weekends |

| Transfer Limits | Lower limits, usually $25,000/day | Higher limits, often unlimited |

Introduction to ACH and Wire Transfers

ACH transfers use the Automated Clearing House network to electronically move funds between bank accounts in the U.S., offering a secure and cost-effective solution for payroll, bill payments, and recurring transactions. Wire transfers provide a faster way to send large sums internationally or domestically, ensuring immediate availability of funds but often with higher fees and manual processing. Understanding the differences between ACH and wire transfers helps businesses and individuals choose the most efficient payment method based on speed, cost, and transaction type.

Key Differences Between ACH and Wire Transfers

ACH transfers process electronic payments in batches, typically taking 1-3 business days and incurring lower fees, making them ideal for recurring transactions like payroll and bill payments. Wire transfers offer near-instant settlement, higher security, and are preferred for large, urgent payments despite higher costs and strict authentication requirements. ACH networks operate under NACHA rules, while wire transfers use systems like Fedwire or SWIFT, highlighting differences in speed, cost, and use cases.

Speed of ACH vs Wire Payments

ACH payments typically take 1 to 3 business days to process, making them slower compared to wire transfers, which are usually completed within the same day, often within hours. Wire transfers offer near-instantaneous settlement and are preferred for urgent or high-value transactions requiring immediate availability of funds. The speed advantage of wire payments comes at higher fees, while ACH provides a more cost-effective solution for less time-sensitive transfers.

Security Features in ACH and Wire Transactions

ACH transactions use multiple layers of authentication and encryption protocols, including NACHA operating rules that require robust identity verification and fraud detection systems. Wire transfers rely on secure networks like the SWIFT system, offering real-time tracking and strict access controls to prevent unauthorized access. Both methods incorporate advanced cybersecurity measures, but ACH transactions benefit from automated fraud filters, while wires provide immediate irrevocable fund transfer with high transactional security.

Cost Comparison: ACH vs Wire Transfer Fees

ACH transfers typically incur lower fees, often ranging from $0.20 to $1.50 per transaction, making them cost-effective for domestic payments. Wire transfers generally have higher costs, with fees between $15 and $50 for outgoing domestic transfers, and even higher rates for international wires. Businesses seeking affordable payment methods prefer ACH for routine transactions due to its lower expense and batch processing capabilities.

Use Cases: When to Choose ACH or Wire

ACH transfers are ideal for recurring payments, payroll deposits, and low-cost transactions within the United States due to their affordability and batch processing efficiency. Wire transfers are preferred for high-value, time-sensitive payments such as real estate closings, international transfers, and urgent business transactions requiring same-day settlement. Businesses use ACH for automated clearing house benefits, while wire transfers offer immediacy and enhanced security for critical funds transfers.

Limits and Restrictions: ACH vs Wire

ACH payments typically have lower transaction limits, often capped at $25,000 to $50,000 per day depending on the bank, making them suitable for recurring or smaller payments. Wire transfers generally have higher or no set limits, allowing for large, one-time transactions, but they can be subject to stricter regulations and require more detailed recipient information. ACH transfers may experience delays due to processing windows and batch settlements, while wire transfers offer faster, same-day settlement but often come with higher fees.

International Transfers: ACH and Wire Options

International transfers through wire payments are faster, often completed within one to two business days, and provide wide global reach with guaranteed delivery. ACH transfers, while more cost-effective, are primarily domestic and slower, taking several business days, and are generally limited in availability for international transactions. Selecting wire transfers is essential for urgent cross-border payments, whereas ACH is suitable for lower-cost, non-urgent transfers within supported countries.

ACH and Wire Processing Times Explained

ACH payments typically take 1 to 3 business days to process due to batch processing and banking network schedules, making them ideal for non-urgent transactions. Wire transfers are processed on the same day, often within a few hours, providing faster settlement for high-value or time-sensitive payments. Understanding these processing times helps businesses choose the appropriate payment method for efficiency and cash flow management.

Future Trends in Digital Payments: ACH vs Wire

Future trends in digital payments highlight increased adoption of ACH transfers due to lower processing costs and enhanced real-time transaction capabilities driven by initiatives like the Federal Reserve's FedNow Service. Wire transfers continue to dominate for high-value, time-sensitive international payments, benefiting from advancements in blockchain integration and improved cross-border settlement speeds. Emerging technologies prioritize seamless interoperability between ACH and wire systems to optimize efficiency, security, and consumer convenience in digital payment ecosystems.

Important Terms

Settlement Timeframes

ACH transfers typically settle within 1 to 3 business days, while wire transfers usually settle on the same day, offering faster transaction completion.

Clearing Mechanism

The clearing mechanism for ACH transactions typically involves batch processing and settlement delays of one to two business days, while wire transfers use real-time gross settlement systems enabling immediate fund availability and finality.

Interbank Transfers

ACH transfers offer cost-effective, batch-processed interbank payments with slower settlement times, while wire transfers provide faster, real-time fund delivery at higher fees.

Transaction Limits

ACH transactions typically have lower daily and monthly limits compared to wire transfers, which offer higher maximum amounts for faster, same-day processing.

Same-Day ACH

Same-Day ACH processes electronic payments within the same business day, offering a faster and more cost-effective alternative to wire transfers for ACH transactions.

Fedwire

Fedwire processes real-time, high-value wire transfers with immediate settlement, contrasting with ACH's batch-processed, lower-cost transactions that typically settle within one to two business days.

Return Codes

Return codes for ACH transactions provide specific reasons for transaction rejections, enabling efficient error resolution, while wire transfer return codes typically indicate transaction failures with standardized banking error codes ensuring swift corrective actions.

Cutoff Times

ACH transfers typically have cutoff times between 3:00 PM and 5:00 PM ET, while wire transfers often have earlier cutoff times around 2:00 PM ET for same-day processing.

RDFI/ODFI (Receiving/Originating Depository Financial Institution)

RDFI processes ACH payments by receiving funds into the depositor's account, while ODFI initiates ACH transactions, whereas wire transfers bypass RDFI/ODFI roles by directly moving funds between banks with faster settlement times.

Transaction Fees

ACH transactions typically incur lower fees ranging from $0.20 to $1.50 per transaction, while wire transfers often cost between $15 and $50, making ACH more cost-effective for domestic payments.

ACH vs Wire Infographic

moneydif.com

moneydif.com