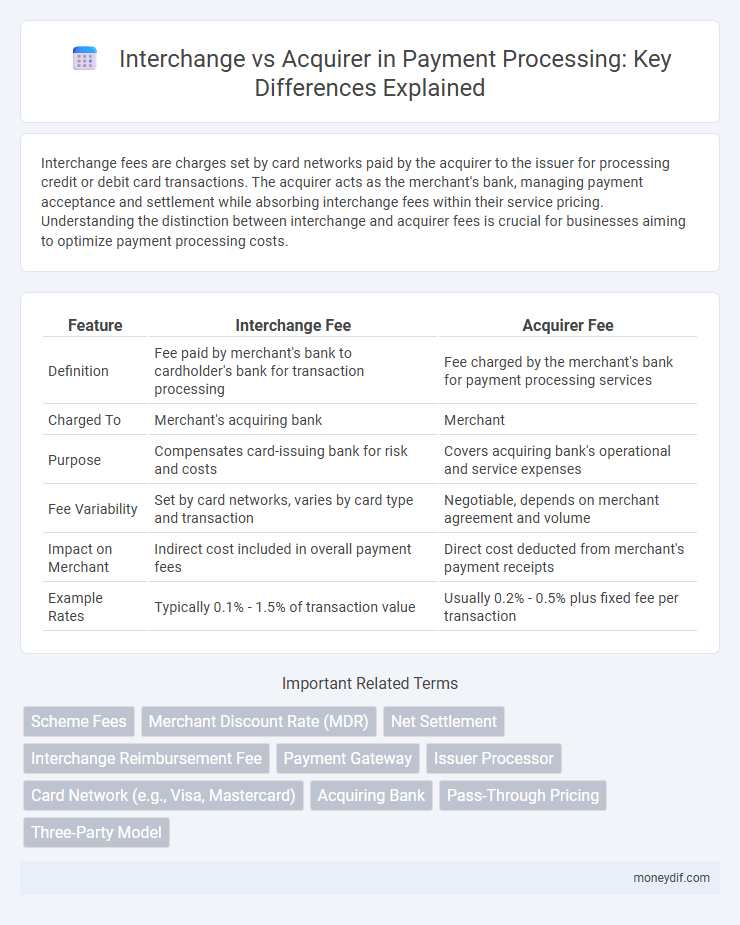

Interchange fees are charges set by card networks paid by the acquirer to the issuer for processing credit or debit card transactions. The acquirer acts as the merchant's bank, managing payment acceptance and settlement while absorbing interchange fees within their service pricing. Understanding the distinction between interchange and acquirer fees is crucial for businesses aiming to optimize payment processing costs.

Table of Comparison

| Feature | Interchange Fee | Acquirer Fee |

|---|---|---|

| Definition | Fee paid by merchant's bank to cardholder's bank for transaction processing | Fee charged by the merchant's bank for payment processing services |

| Charged To | Merchant's acquiring bank | Merchant |

| Purpose | Compensates card-issuing bank for risk and costs | Covers acquiring bank's operational and service expenses |

| Fee Variability | Set by card networks, varies by card type and transaction | Negotiable, depends on merchant agreement and volume |

| Impact on Merchant | Indirect cost included in overall payment fees | Direct cost deducted from merchant's payment receipts |

| Example Rates | Typically 0.1% - 1.5% of transaction value | Usually 0.2% - 0.5% plus fixed fee per transaction |

Understanding Interchange and Acquirer Fees

Interchange fees are charges set by card networks and paid to the card-issuing bank for each transaction, representing the largest component of overall payment processing costs. Acquirer fees, on the other hand, are fees charged by the acquiring bank or payment processor responsible for managing merchant accounts and facilitating transaction settlements. Understanding the distinction between interchange and acquirer fees is essential for merchants seeking to optimize payment processing expenses and improve profit margins.

Key Differences Between Interchange and Acquirer

Interchange fees are transaction costs set by card networks and paid by acquirers to issuers for processing payments, serving as a significant revenue source within the payment ecosystem. Acquirers, also known as merchant banks, are financial institutions that contract with merchants to process credit and debit card transactions, managing transaction authorization, settlement, and funding. The key difference lies in interchange being a fee structure dictated by card networks, while acquirers provide the operational infrastructure and merchant services necessary for payment acceptance.

How Interchange Fees Impact Merchant Costs

Interchange fees are charges set by card networks and paid to issuing banks for each card transaction, directly increasing the overall cost for merchants. Acquirers process payments and pass interchange fees to merchants as part of the transaction fees, influencing merchant pricing strategies. Higher interchange fees reduce merchant profit margins and can lead to increased prices for consumers to offset these costs.

The Role of Acquirers in Payment Processing

Acquirers act as the financial institutions that process credit and debit card payments on behalf of merchants, facilitating transaction authorization and settlement between the merchant and cardholder's issuing bank. They manage interchange fees, which are fees paid to the card issuer during a transaction, and ensure compliance with payment network rules to secure smooth payment processing. By assuming transaction risk and providing merchants with payment acceptance infrastructure, acquirers enable efficient and secure electronic payment flows.

Interchange vs Acquirer: Who Sets the Fees?

Interchange fees are set by card networks like Visa and Mastercard and paid by acquirers to issuers for processing card transactions. Acquirers, or merchant banks, add their own fees on top of interchange to cover transaction handling and risk management. The combined fees ultimately impact merchant costs and pricing strategies in payment processing.

Factors Influencing Interchange and Acquirer Pricing

Interchange fees are primarily influenced by card network rules, transaction type, and risk levels, while acquirer pricing incorporates operational costs, merchant category, and transaction volume. Factors such as fraud risk, card type (credit vs. debit), and geographic location significantly impact interchange rates, whereas acquirer fees adjust based on service levels, settlement speed, and competitive market conditions. Understanding these elements allows merchants to negotiate better rates and optimize payment processing expenses.

Transparency in Interchange and Acquirer Fee Structures

Transparency in interchange and acquirer fee structures is essential for merchants to accurately assess the total cost of payment processing. Interchange fees, set by card networks, represent the largest portion of costs and vary based on transaction type, card brand, and merchant category, while acquirer fees are charged by banks for transaction handling and settlement services. Clear disclosure of these fees enables businesses to negotiate better rates, optimize payment strategies, and improve profitability by understanding how each component impacts the overall expense.

Managing Interchange and Acquirer Expenses for Merchants

Managing interchange fees and acquirer expenses is crucial for merchants aiming to optimize payment processing costs. Interchange fees, set by card networks, represent the largest portion of transaction costs, while acquirer fees cover the services of payment processors handling merchant accounts. Implementing strategies such as negotiating acquirer rates, leveraging tiered pricing models, and analyzing transaction data can help merchants reduce overall expenses and improve profit margins.

Regulatory Perspectives on Interchange and Acquirer Fees

Regulatory perspectives on interchange and acquirer fees emphasize transparency and fairness to protect merchants and consumers. Regulators often impose caps on interchange fees to prevent excessive costs, while acquirer fees are scrutinized for clarity and reasonableness in billing practices. Compliance with regional regulations such as PSD2 in Europe and the Durbin Amendment in the United States remains critical to ensure balanced financial ecosystem and reduce payment friction.

Future Trends in Interchange and Acquirer Relationships

Future trends in interchange and acquirer relationships highlight the growing integration of artificial intelligence and machine learning to optimize transaction processing and fraud detection. Emerging blockchain technology promises increased transparency and security, reshaping how interchange fees are managed and distributed among acquirers. Enhanced data sharing and collaborative platforms between issuers and acquirers aim to streamline settlement processes and reduce operational costs.

Important Terms

Scheme Fees

Scheme fees, charged by card networks like Visa and Mastercard, are calculated based on transaction volume and value, distinct from acquirer fees which cover processing and risk management. Interchange fees, set by issuing banks, compensate issuers for transaction costs and affect acquirer pricing structures, influencing overall merchant fees.

Merchant Discount Rate (MDR)

Merchant Discount Rate (MDR) represents the fee charged to merchants for processing card payments, typically comprising both interchange fees paid to card-issuing banks and acquirer fees collected by payment processors. The interchange fee is set by card networks and compensates issuing banks, while acquirer fees cover the operational costs incurred by acquiring banks, together determining the total MDR impacting merchant profitability.

Net Settlement

Net settlement between interchange and acquirer represents the final amount transferred after deducting interchange fees from the gross transaction value. This process ensures that the acquirer receives the correct net funds while the interchange fees compensate the issuing bank for processing the payment.

Interchange Reimbursement Fee

The Interchange Reimbursement Fee is a transaction fee paid by the acquirer to the issuer as compensation for processing card payments, reflecting costs such as fraud risk and handling expenses. This fee, set by card networks like Visa and MasterCard, directly impacts the interchange income for issuers and represents a significant portion of the acquirer's processing costs.

Payment Gateway

Payment gateways facilitate transactions by securely transmitting cardholder data to the acquirer, who then processes payments through the interchange network connecting issuing banks. The interchange fee, a critical cost component, is set by card networks and paid by the acquirer, influencing merchant fees and transaction approval rates.

Issuer Processor

Issuer processors manage cardholder data, authorization, and transaction processing on behalf of issuing banks, ensuring accurate communication between card networks and acquiring institutions. They play a critical role in interchange fee calculations by validating transactions before submitting them to acquirers, who handle merchant settlements and payment acceptance.

Card Network (e.g., Visa, Mastercard)

Card networks like Visa and Mastercard establish interchange fees, which are charges paid by the acquirer to the card issuer for processing credit and debit card transactions. These interchange fees influence the cost structure for acquirers, impacting merchant fees and overall transaction pricing within the payments ecosystem.

Acquiring Bank

An acquiring bank processes credit and debit card payments for merchants, bearing the responsibility for transaction approval and settlement, while interchange fees represent the costs paid by the acquirer to issuing banks for each transaction. The acquirer manages these interchange fees as part of the merchant's overall processing costs and ensures compliance with card network regulations.

Pass-Through Pricing

Pass-through pricing directly links interchange fees paid to card networks with the acquirer's processing costs, ensuring merchants are billed only for the exact interchange rates plus a fixed acquirer markup. This transparent pricing model enables clearer cost visibility by separating interchange fees, which are set by card issuers, from acquirer fees, allowing merchants to accurately track transaction-related expenses.

Three-Party Model

The Three-Party Model in payment processing involves the cardholder, merchant, and issuer, where interchange fees are typically paid by the acquirer to the issuer as compensation for transaction authorization and risk management. This model contrasts with the Four-Party Model, where interchange fees are explicitly transferred between acquirers and issuers, influencing overall card acceptance and merchant costs.

interchange vs acquirer Infographic

moneydif.com

moneydif.com