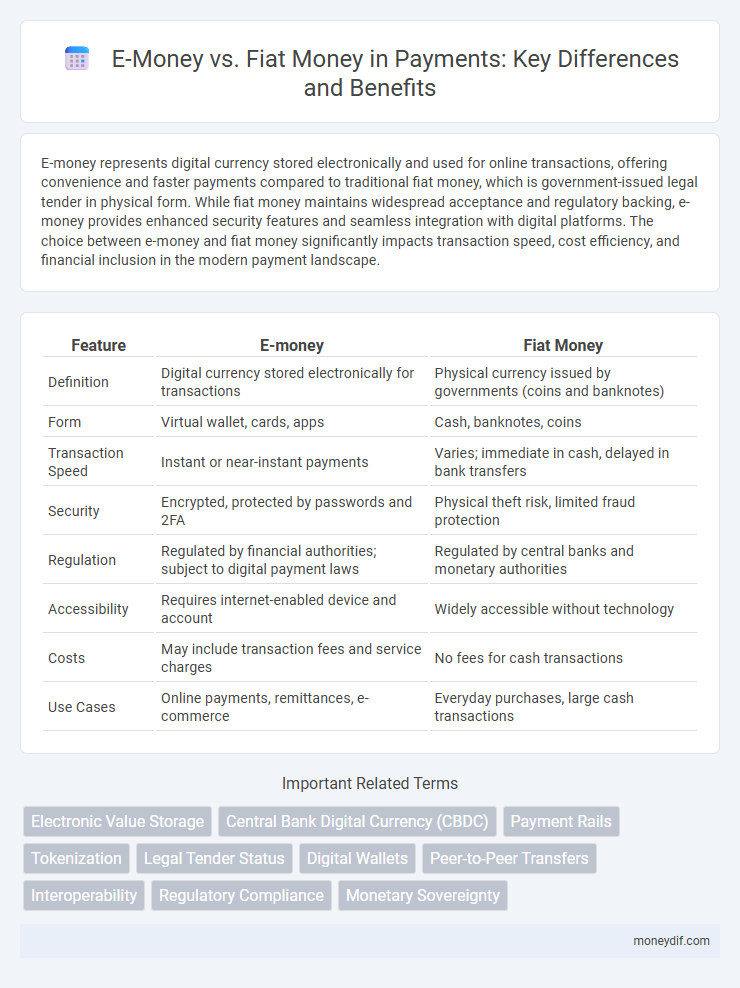

E-money represents digital currency stored electronically and used for online transactions, offering convenience and faster payments compared to traditional fiat money, which is government-issued legal tender in physical form. While fiat money maintains widespread acceptance and regulatory backing, e-money provides enhanced security features and seamless integration with digital platforms. The choice between e-money and fiat money significantly impacts transaction speed, cost efficiency, and financial inclusion in the modern payment landscape.

Table of Comparison

| Feature | E-money | Fiat Money |

|---|---|---|

| Definition | Digital currency stored electronically for transactions | Physical currency issued by governments (coins and banknotes) |

| Form | Virtual wallet, cards, apps | Cash, banknotes, coins |

| Transaction Speed | Instant or near-instant payments | Varies; immediate in cash, delayed in bank transfers |

| Security | Encrypted, protected by passwords and 2FA | Physical theft risk, limited fraud protection |

| Regulation | Regulated by financial authorities; subject to digital payment laws | Regulated by central banks and monetary authorities |

| Accessibility | Requires internet-enabled device and account | Widely accessible without technology |

| Costs | May include transaction fees and service charges | No fees for cash transactions |

| Use Cases | Online payments, remittances, e-commerce | Everyday purchases, large cash transactions |

Understanding E-Money and Fiat Money

E-money, or electronic money, represents digital currency stored electronically on devices or online accounts, facilitating fast and secure transactions without physical cash. Fiat money refers to government-issued currency, such as dollars or euros, recognized as legal tender and backed by state authority rather than intrinsic value. Understanding these distinctions clarifies how e-money enhances convenience and accessibility in digital payments while fiat money remains essential for everyday economic exchanges.

Key Differences Between E-Money and Fiat Money

E-money represents stored digital value used for online transactions, while fiat money is physical currency issued by governments and accepted as legal tender. E-money requires electronic devices and networks for transfer, whereas fiat money involves tangible cash exchange. The regulatory frameworks also differ; e-money falls under electronic payment laws, whereas fiat money is governed by monetary policies and central bank control.

How E-Money Works in Digital Payments

E-money operates through digital wallets and online accounts that store prepaid balances authorized by financial institutions, enabling instant, cashless transactions. It utilizes encrypted data transfer and secure authentication methods to facilitate payments between consumers, merchants, and service providers without physical currency exchange. This system relies on electronic networks and regulatory frameworks to ensure transparency, prevent fraud, and streamline settlement processes in digital commerce.

The Role of Fiat Money in Modern Economies

Fiat money serves as the primary legal tender issued by governments and central banks, enabling seamless transactions and facilitating economic stability in modern economies. Unlike e-money, fiat money's value is backed by government decree rather than physical commodities, ensuring widespread acceptance and trust within financial systems. Central banks utilize fiat currency as a critical tool for monetary policy, managing inflation, interest rates, and liquidity to promote sustainable economic growth.

Security Features: E-Money vs Fiat Money

E-money incorporates advanced encryption protocols and multi-factor authentication to enhance transaction security, reducing risks of fraud and unauthorized access compared to fiat money. Unlike physical cash, which is susceptible to theft and loss without recovery mechanisms, e-money transactions are recorded digitally, allowing for traceability and dispute resolution. Blockchain technology adoption in some e-money platforms further bolsters security by providing decentralized transaction verification, a feature absent in traditional fiat currency systems.

Accessibility and Convenience Compared

E-money offers enhanced accessibility through digital platforms, enabling instant transactions and seamless integration with mobile wallets, unlike fiat money, which requires physical handling and in-person exchanges. The convenience of e-money supports 24/7 payments, cross-border transfers, and instant balance updates, while fiat money often involves slower processes and geographical limitations. Consumers increasingly prefer e-money for its efficiency in daily transactions and reduced dependency on physical cash infrastructure.

Regulatory Frameworks: E-Money vs Fiat Money

Regulatory frameworks for e-money typically require issuers to obtain specific licenses and comply with anti-money laundering (AML) and consumer protection rules, ensuring digital transactions are secure and transparent. Fiat money regulation is governed by central banks, with strict control over issuance, monetary policy, and banking regulation to maintain financial stability. E-money regulations emphasize technology-driven safeguards, while fiat money regulation prioritizes sovereign control and macroeconomic oversight.

Costs and Transaction Fees Analysis

E-money transactions generally incur lower costs and reduced transaction fees compared to fiat money, primarily due to digital processing efficiencies and the elimination of physical handling expenses. Centralized electronic payment systems streamline settlement processes, significantly decreasing intermediary fees and delivery overheads associated with traditional fiat cash transactions. While fiat money requires infrastructure maintenance such as currency printing and security, e-money leverages digital platforms that scale cost-effectively across global networks, optimizing payment economics for both consumers and businesses.

User Adoption and Trust Factors

User adoption of e-money continues to rise due to its convenience, speed, and seamless integration with digital platforms, surpassing traditional fiat money in many demographics. Trust factors influencing user preference include the perceived security of transactions, regulatory oversight, and the assurance of liquidity for e-money providers compared to central bank guarantees backing fiat currencies. Enhanced encryption methods, transparent compliance with financial regulations, and widespread acceptance by merchants contribute significantly to building user confidence in e-money systems.

Future Trends in E-Money and Fiat Money

Future trends in e-money emphasize increased adoption of blockchain technology and central bank digital currencies (CBDCs), enhancing transaction security and reducing processing times. Fiat money is expected to coexist with digital currencies, supported by regulatory frameworks that aim to stabilize economies while promoting cashless payments. Innovations in e-money platforms, such as smart contracts and instant settlements, will drive financial inclusivity and reshape global payment ecosystems.

Important Terms

Electronic Value Storage

Electronic value storage enables secure digital representation of monetary value, primarily through e-money, which is a digital equivalent of fiat money stored electronically on devices or accounts. Unlike traditional fiat money issued by central banks, e-money facilitates instant, cashless transactions, enhancing convenience and accessibility while maintaining regulatory frameworks for consumer protection.

Central Bank Digital Currency (CBDC)

Central Bank Digital Currency (CBDC) represents a digital form of fiat money issued and regulated by a country's central bank, offering the same legal tender status as physical currency but with enhanced traceability and security features. Unlike e-money, which is privately issued and backed by fiat currency deposits, CBDC provides direct claims on the central bank, ensuring greater stability and reduced counterparty risks in digital transactions.

Payment Rails

Payment Rails facilitates seamless cross-border transactions by integrating both e-money and fiat money payment systems, enabling efficient conversion and transfer processes. This platform supports regulatory compliance for electronic money providers while maintaining compatibility with traditional fiat currency networks to optimize global financial operations.

Tokenization

Tokenization in e-money involves converting fiat money into digital tokens on a blockchain, enabling faster and more secure transactions compared to traditional fiat currency systems controlled by central banks. These digital tokens represent equivalent value and enhance transparency, traceability, and accessibility in financial services.

Legal Tender Status

Legal tender status determines the official acceptance of money for settling debts and financial obligations, with fiat money universally recognized by governments as legal tender, whereas e-money typically lacks this status and functions as a digital representation of fiat currency. The legal tender designation impacts the enforceability of payments, influencing the acceptance and regulatory treatment of e-money compared to fiat money in commercial and legal transactions.

Digital Wallets

Digital wallets enable seamless transactions by storing e-money, a form of electronic currency representing digital value, which contrasts with fiat money issued and regulated by governments in physical or non-digital formats. Unlike fiat money, e-money within digital wallets facilitates instant payments and cross-border transfers without the need for traditional banking intermediaries.

Peer-to-Peer Transfers

Peer-to-peer transfers enable direct digital transactions between users, utilizing e-money stored in electronic wallets or accounts, contrasting with fiat money which requires traditional banking intermediaries for physical currency exchanges. E-money facilitates instant, borderless payments with increased convenience and lower fees, while fiat money transactions often involve slower processes and regulatory constraints.

Interoperability

Interoperability between e-money and fiat money enables seamless transactions across digital wallets and traditional banking systems, enhancing user accessibility and payment efficiency. Standards such as ISO 20022 facilitate data exchange and integration, supporting seamless conversion and acceptance between electronic funds and government-issued currency.

Regulatory Compliance

Regulatory compliance in e-money involves stringent adherence to anti-money laundering (AML) and know your customer (KYC) regulations, contrasting with traditional fiat money governed primarily by central bank policies and government-issued legal tender laws. E-money issuers must secure licenses and ensure digital transaction transparency, while fiat currency regulation focuses on monetary policy and physical currency issuance controls.

Monetary Sovereignty

Monetary sovereignty defines a nation's exclusive authority to issue and regulate its currency, impacting the legal standing and control of fiat money versus electronic money (e-money). Central banks maintain fiat money as legal tender under sovereign monetary policies, whereas e-money, often issued by private entities, relies on fiat currency backing but operates within regulatory frameworks to complement traditional money without undermining sovereign control.

E-money vs Fiat Money Infographic

moneydif.com

moneydif.com