PCI DSS sets comprehensive security standards for organizations that handle cardholder data to prevent data breaches and fraud. PA-DSS specifically targets software developers to ensure payment applications comply with PCI DSS requirements, promoting secure payment processing. Understanding the distinction helps businesses maintain compliance and protect sensitive payment information effectively.

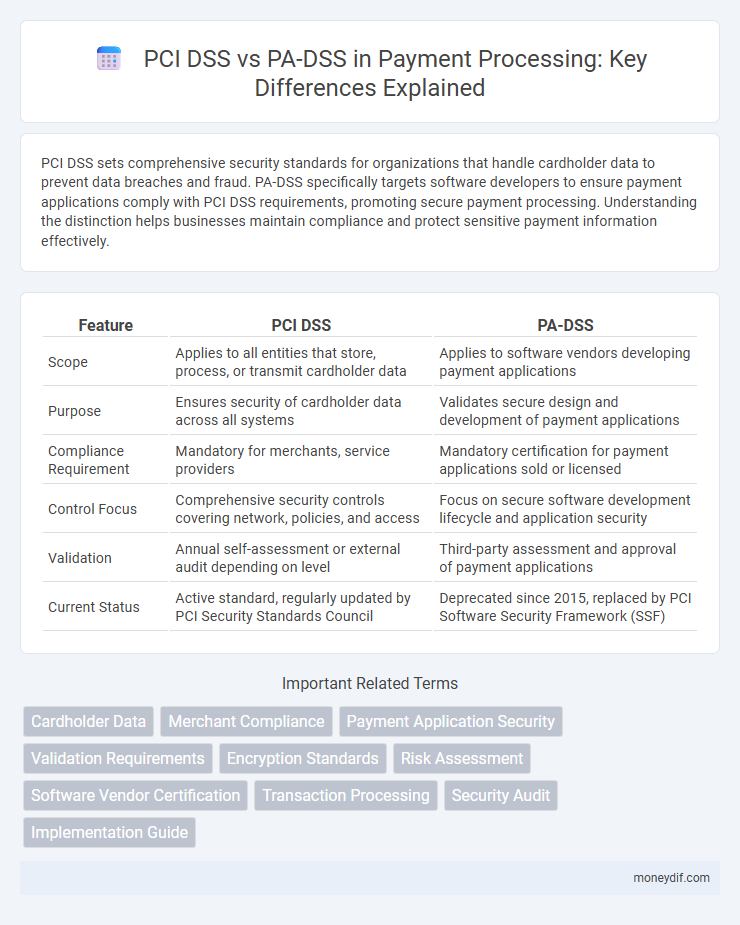

Table of Comparison

| Feature | PCI DSS | PA-DSS |

|---|---|---|

| Scope | Applies to all entities that store, process, or transmit cardholder data | Applies to software vendors developing payment applications |

| Purpose | Ensures security of cardholder data across all systems | Validates secure design and development of payment applications |

| Compliance Requirement | Mandatory for merchants, service providers | Mandatory certification for payment applications sold or licensed |

| Control Focus | Comprehensive security controls covering network, policies, and access | Focus on secure software development lifecycle and application security |

| Validation | Annual self-assessment or external audit depending on level | Third-party assessment and approval of payment applications |

| Current Status | Active standard, regularly updated by PCI Security Standards Council | Deprecated since 2015, replaced by PCI Software Security Framework (SSF) |

Understanding PCI DSS and PA-DSS: Key Differences

PCI DSS (Payment Card Industry Data Security Standard) sets security requirements for organizations that handle cardholder data, ensuring the protection of payment data across all systems and processes. PA-DSS (Payment Application Data Security Standard) specifically targets software developers and vendors, guiding the development of secure payment applications to prevent vulnerabilities in payment environments. Understanding the distinction between PCI DSS's broad security scope and PA-DSS's application-focused standards is essential for effective payment data protection compliance.

Core Objectives of PCI DSS vs PA-DSS

PCI DSS focuses on securing the overall payment card environment by establishing requirements for protecting cardholder data, maintaining a secure network, and implementing strong access control measures. PA-DSS aims specifically at software vendors to ensure payment applications support PCI DSS compliance by addressing secure development, transmission, and storage of payment data. While PCI DSS covers broad organizational security controls, PA-DSS targets secure software design to minimize risks in payment application vulnerabilities.

Applicability: Who Needs PCI DSS vs PA-DSS Compliance?

PCI DSS compliance is mandatory for all organizations that store, process, or transmit credit card data, including merchants, processors, acquirers, issuers, and service providers. PA-DSS compliance specifically targets software vendors and developers who create payment applications that store, process, or transmit cardholder data as part of authorization or settlement. Businesses handling payment card information must adhere to PCI DSS, while software vendors must validate their payment applications under PA-DSS to ensure security standards are met.

Compliance Requirements: A Comparative Overview

PCI DSS mandates comprehensive security controls to protect cardholder data, including network security, vulnerability management, and access control requirements. PA-DSS targets software vendors, ensuring payment applications adhere to secure development practices and do not store prohibited data, thus complementing PCI DSS compliance. Both standards emphasize encryption, secure authentication, and regular security assessments to mitigate payment card fraud risks.

Security Controls: PCI DSS and PA-DSS Compared

PCI DSS (Payment Card Industry Data Security Standard) mandates comprehensive security controls for organizations handling cardholder data, including network security, encryption, access control, and regular monitoring to prevent data breaches. PA-DSS (Payment Application Data Security Standard) specifically targets payment applications, ensuring they are developed to meet PCI DSS requirements by integrating secure coding practices, data protection, and proper authentication mechanisms. Both standards emphasize protecting cardholder data, but PCI DSS applies broadly to the entire payment environment while PA-DSS focuses on the software used in payment processing.

Validation and Assessment Processes

PCI DSS validation involves a comprehensive assessment of an organization's entire payment card environment to ensure adherence to security standards, typically requiring annual internal audits or external Qualified Security Assessor (QSA) reviews. PA-DSS validation focuses specifically on software applications that store, process, or transmit cardholder data, with assessments conducted by approved PA-DSS assessors through a detailed secure software development lifecycle evaluation. Both processes aim to mitigate payment data breaches but differ in scope, with PCI DSS encompassing overall infrastructure security and PA-DSS targeting application-level security validation.

Impact on Payment Application Development

PCI DSS sets security standards for organizations handling cardholder data, while PA-DSS specifically targets software vendors developing payment applications. Compliance with PA-DSS ensures payment applications do not store prohibited data and support PCI DSS requirements effectively. Developers integrating PA-DSS guidelines reduce vulnerabilities and enhance secure data processing in payment application development.

Transition from PA-DSS to PCI Secure Software Standard

The transition from PA-DSS to the PCI Secure Software Standard marks a significant shift in payment security, emphasizing comprehensive software lifecycle security beyond payment applications. PCI Secure Software Standard addresses evolving threats by incorporating modern development practices and continuous assessment, replacing the narrowly focused PA-DSS. Organizations managing payment software must adapt to this standard to ensure robust protection of cardholder data and compliance with PCI Security Standards Council mandates.

Consequences of Non-Compliance

Non-compliance with PCI DSS can result in severe penalties including hefty fines, increased transaction fees, and potential suspension of payment processing privileges. Failure to adhere to PA-DSS standards leaves software vulnerable to security breaches, leading to data theft, reputational damage, and costly remediation efforts. Both standards' violations expose businesses to increased risk of financial loss and erosion of customer trust.

Choosing the Right Compliance Standard for Your Business

Choosing the right compliance standard for your business involves understanding that PCI DSS (Payment Card Industry Data Security Standard) applies to organizations handling credit card transactions, ensuring comprehensive security measures across all systems. PA-DSS (Payment Application Data Security Standard) is designed specifically for software vendors developing payment applications to prevent storing prohibited data and to facilitate PCI DSS compliance by users. Evaluating your role--whether as a merchant, service provider, or software developer--helps determine if PCI DSS or PA-DSS compliance best suits your operational and security needs.

Important Terms

Cardholder Data

Cardholder Data under PCI DSS encompasses sensitive information such as the primary account number (PAN), cardholder name, expiration date, and service code, which must be protected through comprehensive security controls. PA-DSS focuses specifically on validating and securing payment applications that store, process, or transmit cardholder data, ensuring they facilitate PCI DSS compliance without introducing vulnerabilities.

Merchant Compliance

Merchant compliance with PCI DSS ensures that businesses securely process, store, and transmit cardholder data, minimizing the risk of data breaches and fraud. PA-DSS focuses on validating payment applications that support compliance by adhering to security standards developed by the PCI Security Standards Council.

Payment Application Security

Payment Application Security focuses on safeguarding software that processes, stores, or transmits cardholder data to comply with PCI DSS requirements, ensuring protection against data breaches. PA-DSS, as a validation program for payment applications, guides developers to build secure applications that meet PCI DSS standards and support merchants in maintaining compliance.

Validation Requirements

Validation requirements under PCI DSS mandate rigorous assessment of an organization's cardholder data environment to ensure ongoing compliance through regular scans and audits. PA-DSS validation focuses specifically on software vendors, requiring that payment applications are tested and certified to meet security standards before deployment.

Encryption Standards

Encryption standards such as AES-256 are critical in complying with PCI DSS requirements for protecting cardholder data during transmission and storage, ensuring data confidentiality and integrity. PA-DSS mandates encryption of payment applications to prevent unauthorized access and data breaches, aligning application security with PCI DSS encryption protocols.

Risk Assessment

Risk assessment for PCI DSS focuses on identifying and mitigating threats to cardholder data within an organization's entire card payment environment, ensuring compliance with security standards across networks, applications, and processes. In contrast, PA-DSS emphasizes risk evaluation of payment application software to ensure secure design, development, and deployment, minimizing vulnerabilities before integration into PCI-compliant systems.

Software Vendor Certification

Software Vendor Certification ensures that payment applications comply with PCI DSS requirements, focusing on secure software development and vulnerability management. PA-DSS, replaced by PCI SSF, specifically validated payment software to prevent sensitive cardholder data exposure and facilitate PCI DSS compliance.

Transaction Processing

Transaction processing systems must comply with PCI DSS to protect cardholder data during transmission, storage, and processing, ensuring secure payment environments. PA-DSS specifically targets software developers, requiring payment applications to meet security standards that prevent compromised transaction data within PCI DSS-regulated frameworks.

Security Audit

Security audits for PCI DSS focus on ensuring compliance with comprehensive payment card industry standards to protect cardholder data across all systems. PA-DSS audits specifically evaluate payment applications to confirm they meet PCI security requirements, preventing vulnerabilities in software used by merchants and service providers.

Implementation Guide

The Implementation Guide for PCI DSS provides detailed instructions to secure payment card data by adhering to comprehensive security standards, while PA-DSS focuses specifically on software development compliant with PCI requirements to prevent vulnerabilities. Both frameworks aim to protect cardholder data but differ in scope, with PCI DSS addressing overall organizational controls and PA-DSS targeting payment application security.

PCI DSS vs PA-DSS Infographic

moneydif.com

moneydif.com