The Merchant Discount Rate (MDR) represents the total fee merchants pay to payment processors for each transaction, encompassing various charges involved in the payment processing ecosystem. The Interchange Reimbursement Fee (IRF) is a component of the MDR, set by card networks, which primarily compensates issuing banks for their role in authenticating and approving transactions. Understanding the distinction between MDR and IRF is crucial for merchants aiming to optimize payment processing costs and negotiate better rates with payment service providers.

Table of Comparison

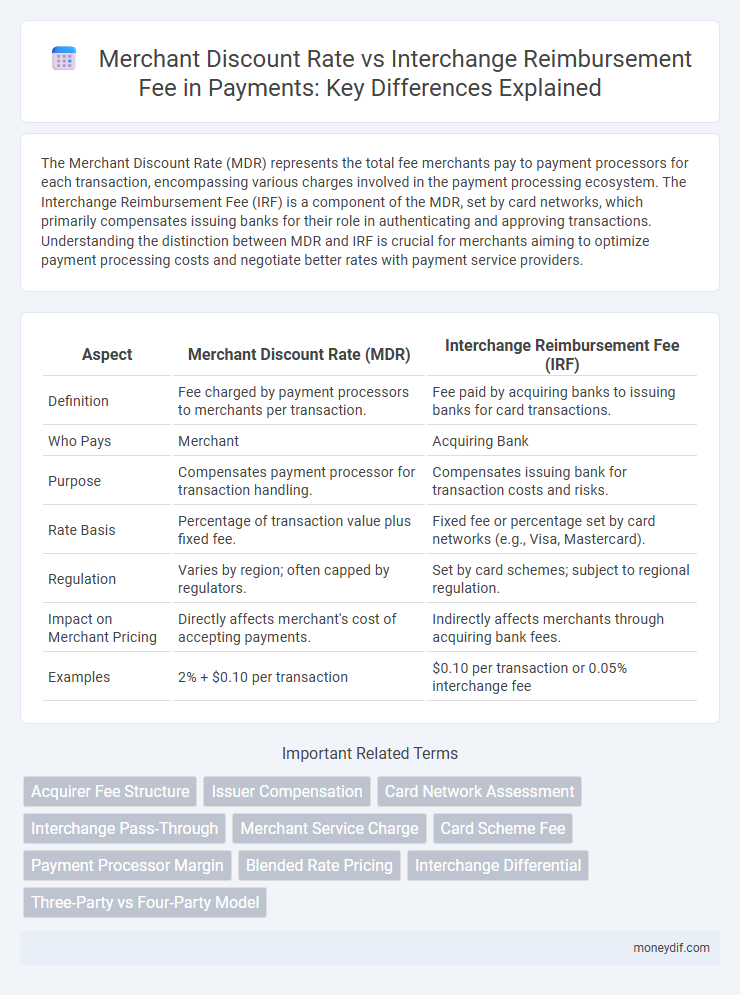

| Aspect | Merchant Discount Rate (MDR) | Interchange Reimbursement Fee (IRF) |

|---|---|---|

| Definition | Fee charged by payment processors to merchants per transaction. | Fee paid by acquiring banks to issuing banks for card transactions. |

| Who Pays | Merchant | Acquiring Bank |

| Purpose | Compensates payment processor for transaction handling. | Compensates issuing bank for transaction costs and risks. |

| Rate Basis | Percentage of transaction value plus fixed fee. | Fixed fee or percentage set by card networks (e.g., Visa, Mastercard). |

| Regulation | Varies by region; often capped by regulators. | Set by card schemes; subject to regional regulation. |

| Impact on Merchant Pricing | Directly affects merchant's cost of accepting payments. | Indirectly affects merchants through acquiring bank fees. |

| Examples | 2% + $0.10 per transaction | $0.10 per transaction or 0.05% interchange fee |

Understanding Merchant Discount Rate (MDR)

Merchant Discount Rate (MDR) represents the percentage fee charged to merchants on each card transaction, covering costs like processing, authorization, and settlement. It is influenced by the Interchange Reimbursement Fee (IRF), which is set by card networks and paid to issuing banks to cover the risk and handling of card payments. Understanding MDR is crucial for merchants to manage transaction costs and optimize pricing strategies effectively.

What is an Interchange Reimbursement Fee?

The Interchange Reimbursement Fee (IRF) is a transaction fee set by card-issuing banks, paid to them by acquiring banks to cover handling costs, fraud risk, and authorization expenses. It serves as the primary component of the overall Merchant Discount Rate (MDR), which merchants pay to process card payments. Understanding the IRF is essential for merchants aiming to optimize transaction costs and navigate payment processing fees effectively.

Key Differences Between MDR and Interchange Fee

Merchant Discount Rate (MDR) is the total fee merchants pay to acquire payment services, encompassing the Interchange Reimbursement Fee (IRF) paid to card-issuing banks. Interchange Fee specifically compensates the issuing bank for transaction risk and operational costs, typically set by payment networks and represents the largest component within MDR. While MDR impacts the merchant's cost of acceptance, the Interchange Fee directly influences pricing structures between banks and card networks, highlighting their distinct roles in the payment ecosystem.

How MDR Impacts Merchants’ Payment Costs

Merchant Discount Rate (MDR) directly affects merchants' payment costs by encompassing fees charged by payment processors for handling card transactions, typically ranging from 1% to 3% per transaction. Unlike the Interchange Reimbursement Fee (IRF), which is set by card networks and paid to issuing banks, MDR includes the IRF plus additional charges such as processing fees and profit margins of acquiring banks. Higher MDR rates increase the overall cost burden on merchants, impacting their profit margins and pricing strategies.

The Role of Interchange Fees in Payment Networks

Interchange reimbursement fees are transaction fees paid by the acquiring bank to the issuing bank, forming a critical component of the merchant discount rate (MDR) in card payment systems. These fees compensate issuing banks for risks and costs associated with credit and debit card transactions, influencing the overall cost merchants incur for card acceptance. Payment networks regulate interchange fees to balance incentives for banks while maintaining efficient and secure transaction processing.

Factors Influencing Merchant Discount Rates

Merchant Discount Rates (MDR) are influenced by several factors including the Interchange Reimbursement Fee (IRF) set by card networks to compensate issuing banks, which represents a significant component of MDR. Other key factors include the type of card used (credit, debit, or prepaid), transaction volume, merchant's industry sector, and the risk profile associated with the transaction. Payment processors may also adjust MDR based on regional regulations and the level of fraud protection services provided to merchants.

Who Sets the Interchange Reimbursement Fee?

The Interchange Reimbursement Fee is set by card networks such as Visa and Mastercard, determined to compensate issuing banks for transaction-processing costs and fraud risk. Merchant Discount Rate (MDR), however, is established by acquiring banks and includes the interchange fee plus additional charges. Understanding that interchange fees are network-driven clarifies why MDR can vary between merchants and payment processors.

MDR and Interchange Fee: Effect on Consumer Pricing

Merchant Discount Rate (MDR) represents the percentage fee merchants pay to acquire payment services, while the Interchange Reimbursement Fee is a component passed from merchants' banks to card-issuing banks. Higher MDR directly increases costs for merchants, which can be transferred to consumers through higher product prices, whereas interchange fees set a baseline for MDR levels, influencing the competitive pricing among payment service providers. Understanding the balance between MDR and interchange fees is essential for controlling the final pricing structure faced by consumers in card-based transactions.

Recent Trends in MDR and Interchange Fee Regulations

Recent trends in Merchant Discount Rate (MDR) and Interchange Reimbursement Fee regulations show a marked shift towards greater transparency and fee reduction mandates by regulatory bodies globally. Governments are increasingly capping MDR to alleviate costs for merchants, while simultaneously scrutinizing interchange fees to prevent excessive charges passed on to consumers. This regulatory evolution aims to balance the interests of merchants, issuers, and card networks, fostering competitive, fair payment ecosystems.

Optimizing Payment Strategies: MDR vs Interchange Fees

Optimizing payment strategies requires a clear understanding of the Merchant Discount Rate (MDR) and the Interchange Reimbursement Fee, both key components in card transaction costs. The MDR, charged to merchants by payment processors, typically includes the interchange fee that is paid to card-issuing banks, with interchange fees accounting for the largest share of the MDR. Reducing MDR through strategic negotiation and choosing payment networks with lower interchange fees can significantly enhance cost-efficiency for businesses processing high volumes of card payments.

Important Terms

Acquirer Fee Structure

The Acquirer Fee Structure primarily comprises the Merchant Discount Rate (MDR), which covers the interchange reimbursement fee paid to card-issuing banks and additional processing costs incurred by the acquiring bank. Differences in MDR reflect variations in interchange fees, transaction types, and risk assessments associated with merchant categories and payment methods.

Issuer Compensation

Issuer compensation primarily derives from the Interchange Reimbursement Fee (IRF), which represents a fixed percentage or flat fee paid by the merchant's acquirer to the card issuer for each transaction. The Merchant Discount Rate (MDR) encompasses the total fees charged to merchants, including the IRF, acquirer fees, and other charges, with the IRF constituting the key component that directly compensates the issuer.

Card Network Assessment

The Card Network Assessment is a fee imposed by card networks on merchants, typically calculated as a percentage of the transaction amount and distinct from the Interchange Reimbursement Fee, which is paid to issuing banks to cover their costs and risks. Merchant Discount Rate (MDR) includes both the Card Network Assessment and the Interchange Reimbursement Fee, combining these costs to determine the total fee merchants pay for accepting card payments.

Interchange Pass-Through

Interchange pass-through involves merchants paying the Interchange Reimbursement Fee (IRF) directly, rather than a bundled Merchant Discount Rate (MDR) that includes additional fees from payment processors. This pricing model enhances transparency by separating the IRF set by card networks from acquirer fees, allowing merchants to understand and control their true card acceptance costs.

Merchant Service Charge

Merchant Service Charge (MSC) primarily consists of the Merchant Discount Rate (MDR) paid by merchants for payment processing, which includes the Interchange Reimbursement Fee (IRF) reimbursed to card-issuing banks. The MDR covers the IRF along with acquirer fees and other operational costs, where the IRF is regulated by payment networks and varies by card type and transaction category.

Card Scheme Fee

Card Scheme Fee is a component of the Merchant Discount Rate (MDR) that covers the operational and infrastructural costs imposed by card networks, distinct from the Interchange Reimbursement Fee (IRF) which is a separate charge paid to issuing banks. While MDR combines Card Scheme Fees, IRF, and acquirer margins to determine the total fee merchants pay for card transactions, the Card Scheme Fee specifically funds network maintenance, security, and innovation initiatives.

Payment Processor Margin

Payment processor margin is the difference between the Merchant Discount Rate (MDR) charged to merchants and the Interchange Reimbursement Fee paid to card-issuing banks. Optimizing this margin involves negotiating lower interchange fees while maintaining competitive MDR rates to maximize profitability for payment processors.

Blended Rate Pricing

Blended Rate Pricing combines the Merchant Discount Rate (MDR) and the Interchange Reimbursement Fee into a single, simplified fee structure for merchants, streamlining payment processing costs. By consolidating these fees, merchants can more easily predict expenses while payment processors manage the distribution between interchange fees paid to card issuers and their own service margins.

Interchange Differential

The Interchange Differential represents the margin between the Merchant Discount Rate (MDR) charged by acquirers and the Interchange Reimbursement Fee paid to issuing banks during card transactions. Optimizing this differential is crucial for payment processors to balance merchant costs against issuer compensation and maintain profitability in card payment ecosystems.

Three-Party vs Four-Party Model

The Three-Party Model consolidates the Merchant Discount Rate (MDR) into a single fee paid directly to the card issuer, whereas the Four-Party Model separates the MDR into the Interchange Reimbursement Fee (paid to the card issuer) and additional fees retained by the acquirer. This structural difference impacts how costs are distributed between merchants, acquirers, and issuers, influencing pricing transparency and competitive dynamics in payment processing.

Merchant Discount Rate vs Interchange Reimbursement Fee Infographic

moneydif.com

moneydif.com