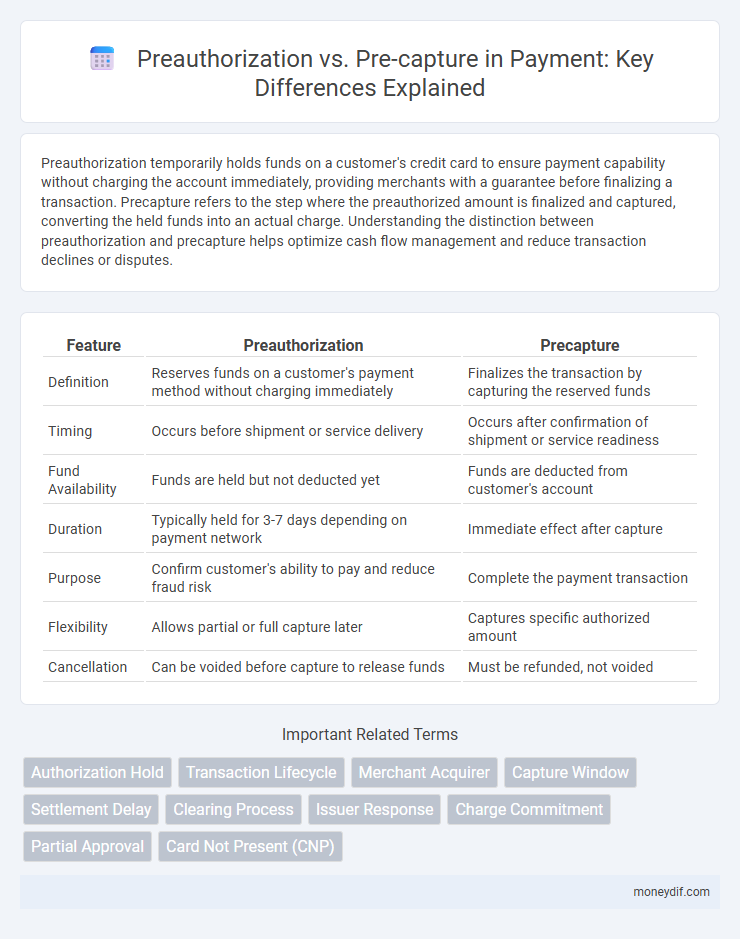

Preauthorization temporarily holds funds on a customer's credit card to ensure payment capability without charging the account immediately, providing merchants with a guarantee before finalizing a transaction. Precapture refers to the step where the preauthorized amount is finalized and captured, converting the held funds into an actual charge. Understanding the distinction between preauthorization and precapture helps optimize cash flow management and reduce transaction declines or disputes.

Table of Comparison

| Feature | Preauthorization | Precapture |

|---|---|---|

| Definition | Reserves funds on a customer's payment method without charging immediately | Finalizes the transaction by capturing the reserved funds |

| Timing | Occurs before shipment or service delivery | Occurs after confirmation of shipment or service readiness |

| Fund Availability | Funds are held but not deducted yet | Funds are deducted from customer's account |

| Duration | Typically held for 3-7 days depending on payment network | Immediate effect after capture |

| Purpose | Confirm customer's ability to pay and reduce fraud risk | Complete the payment transaction |

| Flexibility | Allows partial or full capture later | Captures specific authorized amount |

| Cancellation | Can be voided before capture to release funds | Must be refunded, not voided |

Understanding Preauthorization in Payment Processing

Preauthorization in payment processing involves verifying the availability of funds on a customer's account without immediately capturing the amount, securing the transaction for a future capture. It ensures that the payment method is valid and funds are reserved, reducing the risk of declined transactions at the point of sale. Merchants often use preauthorization for scenarios like hotel bookings or car rentals, where the final amount may vary before capture.

What Is Payment Precapture?

Payment precapture is the process of securing funds on a customer's payment method before the final transaction settlement, ensuring the availability of the authorized amount without immediately completing the charge. It occurs after preauthorization but before full capture, providing merchants with flexibility to confirm order details or inventory before finalizing the payment. Precapture reduces the risk of payment declines at settlement and improves cash flow management in payment processing systems.

The Key Differences Between Preauthorization and Precapture

Preauthorization secures a specified amount on a cardholder's credit card to ensure funds are available before a transaction is completed, while precapture involves confirming or capturing the authorized amount to finalize the payment. Preauthorization places a hold without transferring funds, maintaining the reserved amount for a limited period, whereas precapture initiates the actual fund transfer to the merchant's account. Understanding these distinctions is crucial for businesses managing payment flows and avoiding declined transactions or delayed settlements.

Benefits of Preauthorization for Merchants

Preauthorization offers merchants enhanced control over transaction approvals by temporarily reserving funds without immediate capture, reducing the risk of chargebacks and fraud. This process improves cash flow management by verifying cardholder validity and available funds before fulfilling orders, particularly in e-commerce and high-value transactions. Merchants benefit from increased transaction security and customer trust while maintaining flexibility to adjust order details before finalizing payment capture.

Risks and Challenges of Payment Precapture

Payment precapture poses significant risks including potential overcharging if the final amount differs from the authorized hold, leading to customer disputes and chargebacks. Challenges arise from the timing gap between authorization and capture, increasing the risk of holds on funds that may expire or result in declined captures. Merchants must also manage inventory accuracy and synchronization with payment systems to avoid failed transactions and financial losses during the precapture process.

Step-by-Step Workflow: Preauthorization vs. Precapture

Preauthorization involves verifying a cardholder's funds and reserving the transaction amount without immediately capturing the payment, securing the funds for a future capture. Precapture occurs after preauthorization, where the reserved funds are finalized and transferred from the cardholder to the merchant, completing the payment process. This step-by-step workflow ensures secure, controlled payment handling, reducing the risk of declined transactions and fraud.

Impact on Customer Experience and Satisfaction

Preauthorization holds funds temporarily, ensuring payment validity and reducing transaction failures, which enhances customer trust and satisfaction by providing clear spending limits during checkout. Precapture confirms the exact charge amount post-service or product delivery, aligning payment with actual customer usage and preventing disputes over overcharges. Balancing preauthorization with timely precapture reduces delays and unexpected holds, leading to a smoother, more transparent payment experience that boosts overall customer confidence and loyalty.

Security Implications: Preauthorization vs. Precapture

Preauthorization holds funds on a customer's payment method without immediate capture, reducing fraud risk by verifying card validity before finalizing transactions. Precapture involves finalizing the transaction after preauthorization, requiring secure handling to prevent unauthorized charges or data breaches. Implementing robust encryption and compliance with PCI DSS standards is critical to maintaining security throughout both stages of the payment process.

Use Cases: When to Choose Preauthorization or Precapture

Preauthorization is ideal for industries like hospitality and car rentals where payment confirmation is required before the final amount is known, ensuring funds availability without immediate capture. Precapture suits e-commerce and retail scenarios where the transaction amount is fixed and immediate payment confirmation is necessary to secure inventory. Choosing between preauthorization and precapture depends on whether the final charge amount or timing of capture requires flexibility or immediacy.

Best Practices for Managing Preauthorization and Precapture

Effective management of preauthorization and precapture involves maintaining accurate transaction records to avoid duplicate charges and improve cash flow visibility. Implementing clear expiration policies and regular monitoring of preauthorized amounts ensures timely capture or release, minimizing retained funds and customer disputes. Leveraging automated alerts and reconciliation tools optimizes authorization lifecycle management and compliance with payment network regulations.

Important Terms

Authorization Hold

Authorization hold secures funds during a preauthorization phase by temporarily reserving the transaction amount on the cardholder's account without capturing the funds, ensuring the merchant can later finalize the transaction through a precapture process. In contrast, precapture involves confirming and capturing the authorized funds before completing the payment, transitioning the held amount into a settled transaction.

Transaction Lifecycle

Transaction lifecycle stages include preauthorization, where the payment is verified and funds are reserved without capturing, and precapture, the interim step ensuring transaction details are accurate before final capture. Understanding the distinction between preauthorization and precapture optimizes payment processing by reducing errors and enhancing authorization management.

Merchant Acquirer

A Merchant Acquirer processes payment transactions and plays a critical role in managing preauthorization and precapture stages; preauthorization secures a hold on the customer's funds without completing the transaction, while precapture confirms the merchant's intent to finalize the payment before settlement. Efficient handling of preauthorization versus precapture optimizes cash flow, reduces chargeback risks, and ensures compliance with payment network regulations for merchants.

Capture Window

Capture Window defines the authorized time frame during which a preauthorized transaction can be completed via precapture; transactions processed outside this window may require a new authorization. Understanding the Capture Window ensures compliance with payment processor requirements and helps prevent declined transactions or disputes.

Settlement Delay

Settlement delay often occurs when discrepancies arise between preauthorization and precapture processes, affecting transaction timelines and fund availability. Efficient synchronization of preauthorization holds and prompt precapture submissions minimizes delays, ensuring faster settlement and improved cash flow management.

Clearing Process

The clearing process involves finalizing a transaction after preauthorization, where funds are reserved but not yet transferred, while precapture refers to the step of confirming and initiating the capture of those reserved funds before the actual clearing occurs. Effective management of preauthorization and precapture ensures accurate fund availability and seamless transaction settlement within payment processing systems.

Issuer Response

Issuer response during preauthorization includes real-time approval or decline messages that validate cardholder funds availability, while precapture involves finalizing the transaction amount before settlement, often adjusting the initially authorized amount. Effective management of issuer responses ensures accurate fund verification and optimal capture amounts, reducing declined transactions and chargebacks.

Charge Commitment

Charge Commitment ensures funds are reserved on a customer's card, linking preauthorization as the initial hold and precapture as the subsequent step to finalize the transaction before settlement. Optimizing payment flow with preauthorization and precapture enhances transaction accuracy and reduces declines by confirming fund availability prior to charge completion.

Partial Approval

Partial approval occurs when a preauthorization request for a transaction is approved for less than the full amount, often due to available credit limits or card restrictions. Precapture refers to the process where the authorized amount is captured or settled, and in cases of partial approval, only the approved portion can be precaptured, requiring adjustments to ensure correct settlement.

Card Not Present (CNP)

Card Not Present (CNP) transactions require secure handling of preauthorization to verify cardholder funds without physical card interaction, reducing fraud risk in e-commerce. Precapture follows preauthorization by confirming funds availability just before transaction completion, ensuring payment validity while minimizing declines during fulfillment.

Preauthorization vs Precapture Infographic

moneydif.com

moneydif.com