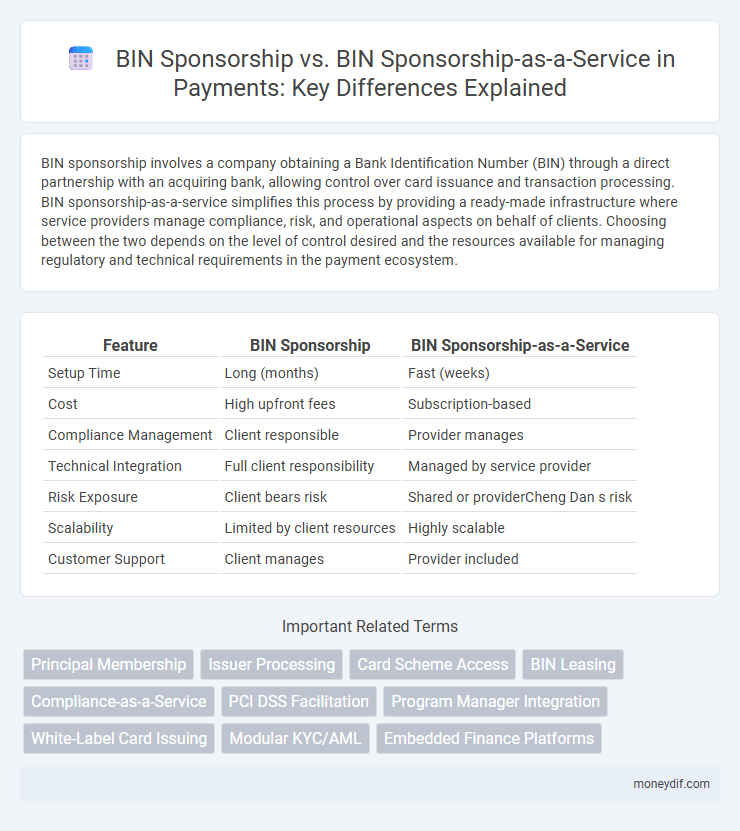

BIN sponsorship involves a company obtaining a Bank Identification Number (BIN) through a direct partnership with an acquiring bank, allowing control over card issuance and transaction processing. BIN sponsorship-as-a-service simplifies this process by providing a ready-made infrastructure where service providers manage compliance, risk, and operational aspects on behalf of clients. Choosing between the two depends on the level of control desired and the resources available for managing regulatory and technical requirements in the payment ecosystem.

Table of Comparison

| Feature | BIN Sponsorship | BIN Sponsorship-as-a-Service |

|---|---|---|

| Setup Time | Long (months) | Fast (weeks) |

| Cost | High upfront fees | Subscription-based |

| Compliance Management | Client responsible | Provider manages |

| Technical Integration | Full client responsibility | Managed by service provider |

| Risk Exposure | Client bears risk | Shared or providerCheng Dan s risk |

| Scalability | Limited by client resources | Highly scalable |

| Customer Support | Client manages | Provider included |

Understanding BIN Sponsorship in Payments

BIN sponsorship enables fintech companies to issue payment cards using a sponsor bank's Bank Identification Number (BIN), allowing access to established payment networks without direct membership. BIN sponsorship-as-a-service streamlines the process by providing turnkey solutions, compliance management, and faster time-to-market for card issuance and transaction processing. Understanding the distinction helps businesses choose between managing regulatory complexities internally or leveraging expert providers for seamless payment integration.

What is BIN Sponsorship-as-a-Service?

BIN Sponsorship-as-a-Service is a streamlined solution that enables fintech companies to access Bank Identification Numbers (BINs) without the traditional complexities of direct BIN sponsorship. This service provides scalable infrastructure, compliance management, and real-time transaction processing, allowing businesses to launch payment products faster and with reduced risk. By leveraging BIN Sponsorship-as-a-Service, companies can focus on innovation while relying on established financial institutions for regulatory and operational support.

Key Differences: BIN Sponsorship vs BINaaS

BIN sponsorship involves financial institutions directly providing BINs to fintechs, requiring compliance management and regulatory oversight, while BIN-as-a-Service (BINaaS) offers a turnkey solution where third-party providers manage BIN-related infrastructure, compliance, and integration. BIN sponsorship demands significant resources for risk management and transaction processing, whereas BINaaS enables faster market entry with scalable, cloud-based platforms and streamlined regulatory adherence. Key differences include control level, operational responsibility, and speed to deployment, with BINaaS reducing complexity and cost compared to traditional BIN sponsorship.

Benefits of Traditional BIN Sponsorship

Traditional BIN sponsorship provides direct access to established card networks, enabling businesses to leverage the sponsor's regulatory approvals and compliance frameworks. This setup ensures lower operational complexity and greater control over transaction processing, allowing sponsors to tailor programs specific to their target markets. Businesses benefit from reduced setup time and cost compared to acquiring their own BIN while maintaining strong security and fraud prevention protocols.

Advantages of BIN Sponsorship-as-a-Service

BIN Sponsorship-as-a-Service offers streamlined integration with payment networks, reducing the complexity and cost of acquiring a BIN license directly. This model enables faster time-to-market by leveraging the sponsor's regulatory compliance and risk management infrastructure. Businesses benefit from scalable, flexible access to BINs, promoting innovation and expansion in payment solutions without upfront capital investment.

Choosing the Right BIN Solution for Fintechs

Fintech companies must evaluate whether traditional BIN sponsorship or BIN sponsorship-as-a-service best aligns with their strategic goals, compliance needs, and technological capabilities. BIN sponsorship-as-a-service offers scalable infrastructure, faster market entry, and enhanced regulatory support compared to conventional BIN sponsorship models. Prioritizing a solution that integrates seamlessly with payment processing, risk management, and customer onboarding can significantly accelerate product launch and reduce operational complexities.

Compliance and Regulatory Considerations

BIN sponsorship requires direct compliance management with card networks' regulations, placing the burden of regulatory adherence on the sponsor. BIN sponsorship-as-a-service offers specialized providers who handle compliance complexities, including PCI DSS standards and AML requirements, reducing risk exposure for clients. This service model ensures continuous monitoring and reporting aligned with evolving financial regulations, optimizing regulatory adherence efficiently.

Cost Implications: BIN Sponsorship vs BINaaS

BIN sponsorship typically involves higher upfront costs, including regulatory compliance, licensing fees, and establishing direct relationships with payment networks, making it a capital-intensive option for businesses. BIN Sponsorship-as-a-Service (BINaaS) reduces these financial burdens by offering a subscription-based model that covers infrastructure, compliance, and network access, enabling faster market entry with lower initial investment. The scalable, pay-as-you-grow pricing models of BINaaS provide significantly better cost efficiency for startups and fintechs compared to traditional BIN sponsorship agreements.

Impact on Time-to-Market for Payment Solutions

BIN sponsorship significantly reduces Time-to-Market by granting merchants immediate access to card issuers' BINs without the need for full licensing, enabling faster deployment of payment solutions. BIN sponsorship-as-a-service accelerates this process even further by providing turnkey integration, compliance management, and ongoing support, minimizing development and regulatory delays. This streamlined approach allows fintech startups and payment providers to launch products rapidly while maintaining regulatory adherence and operational efficiency.

Future Trends in BIN Sponsorship Models

Future trends in BIN sponsorship models emphasize the shift towards BIN Sponsorship-as-a-Service (BIN SaaS), which streamlines access to payment networks for fintechs and startups by eliminating traditional barriers like heavy capital requirements. This evolution leverages cloud-based platforms and API integrations, enabling faster onboarding, enhanced scalability, and improved compliance automation. Growing demand for flexible, cost-efficient solutions propels partnerships between banks and tech providers to innovate BIN utilization, fostering a more agile digital payments ecosystem.

Important Terms

Principal Membership

Principal Membership involves direct control and liability over BIN sponsorship, allowing members to issue payment cards under their own brand with full regulatory compliance. In contrast, BIN sponsorship-as-a-service outsources this responsibility to a sponsor bank, enabling companies to leverage established payment infrastructures without holding a principal membership or direct regulatory burden.

Issuer Processing

Issuer processing involves managing cardholder transactions and authorizations under a BIN sponsorship model, where a financial institution provides access to its BIN (Bank Identification Number) for licensed entities to issue cards. BIN sponsorship-as-a-service enhances this by offering a fully managed platform that streamlines compliance, risk management, and transaction processing, enabling faster market entry and scalability for fintechs and non-bank issuers.

Card Scheme Access

Card Scheme Access enables financial institutions to process card transactions by obtaining Bank Identification Numbers (BINs), where traditional BIN sponsorship involves a direct partnership with an acquiring bank holding the BIN license. BIN Sponsorship-as-a-Service offers a flexible, scalable model allowing fintechs and merchants to access BIN capabilities without owning a BIN, streamlining compliance and operational overhead through third-party providers.

BIN Leasing

BIN Leasing involves the practice where businesses rent Bank Identification Numbers (BINs) from card issuers to facilitate payment processing without owning the BIN outright. BIN sponsorship provides direct access under a sponsor's BIN for transaction processing, while BIN sponsorship-as-a-service offers a managed solution that includes regulatory compliance, risk management, and technical support.

Compliance-as-a-Service

Compliance-as-a-Service (CaaS) streamlines regulatory adherence for businesses by providing expert monitoring and reporting solutions, often integrated with BIN sponsorship to facilitate payment processing under a licensed bank identification number. BIN sponsorship-as-a-service offers a specialized model where fintech companies or payment providers gain access to a sponsor's BIN, enabling card issuance and transaction processing without direct banking licenses, while leveraging CaaS to maintain compliance with financial regulations.

PCI DSS Facilitation

PCI DSS facilitation ensures payment card data security compliance by managing sensitive cardholder information through BIN sponsorship or BIN sponsorship-as-a-service. BIN sponsorship provides direct access to card networks via a sponsoring bank, while BIN sponsorship-as-a-service offers a streamlined, hosted solution that accelerates PCI DSS compliance by offloading infrastructure and security responsibilities.

Program Manager Integration

Program Manager Integration streamlines BIN sponsorship by automating compliance and transaction monitoring processes, enhancing efficiency and reducing operational risks. BIN sponsorship-as-a-service offers flexible access to sponsor BINs with turnkey solutions, enabling faster market entry and scalability for fintech and payment programs.

White-Label Card Issuing

White-Label Card Issuing enables businesses to offer custom-branded payment cards by leveraging BIN sponsorship, where a licensed financial institution provides access to Bank Identification Numbers (BINs) and regulatory compliance. BIN sponsorship-as-a-service expands this model by offering fully managed BIN leasing, transaction processing, and compliance solutions, allowing companies to quickly launch card programs without owning a banking license.

Modular KYC/AML

Modular KYC/AML solutions integrate compliance workflows with BIN sponsorship, enabling financial institutions to onboard customers efficiently while adhering to regulatory standards. BIN sponsorship-as-a-service enhances this model by offering scalable, outsourced management of BIN registration and processing, reducing operational overhead and accelerating time-to-market for payment services.

Embedded Finance Platforms

Embedded finance platforms integrate banking capabilities into non-financial services, leveraging BIN sponsorship to access card networks through direct partnerships with licensed issuers. BIN sponsorship-as-a-service offers a more scalable and flexible approach by outsourcing BIN management and compliance to specialized providers, accelerating time-to-market and reducing operational complexity.

BIN sponsorship vs BIN sponsorship-as-a-service Infographic

moneydif.com

moneydif.com