Split settlement and split payment both involve dividing financial transactions, but split settlement refers to the distribution of funds to multiple parties after a transaction is completed, while split payment divides the payment itself across different sources or accounts at the time of purchase. Split settlement is commonly used in marketplaces to allocate revenue to sellers and platform owners, whereas split payment allows customers to use multiple payment methods simultaneously. Understanding the distinction helps businesses optimize cash flow management and improve customer payment flexibility.

Table of Comparison

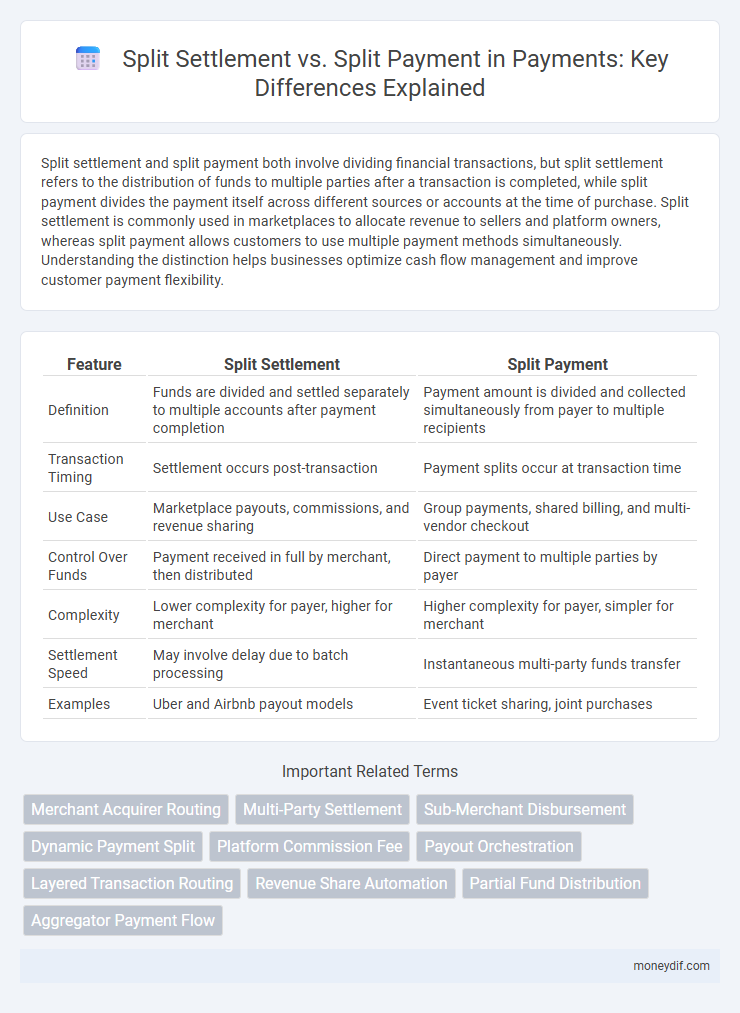

| Feature | Split Settlement | Split Payment |

|---|---|---|

| Definition | Funds are divided and settled separately to multiple accounts after payment completion | Payment amount is divided and collected simultaneously from payer to multiple recipients |

| Transaction Timing | Settlement occurs post-transaction | Payment splits occur at transaction time |

| Use Case | Marketplace payouts, commissions, and revenue sharing | Group payments, shared billing, and multi-vendor checkout |

| Control Over Funds | Payment received in full by merchant, then distributed | Direct payment to multiple parties by payer |

| Complexity | Lower complexity for payer, higher for merchant | Higher complexity for payer, simpler for merchant |

| Settlement Speed | May involve delay due to batch processing | Instantaneous multi-party funds transfer |

| Examples | Uber and Airbnb payout models | Event ticket sharing, joint purchases |

Understanding Split Settlement and Split Payment

Split settlement refers to the process where a single transaction amount is divided and distributed to multiple parties or accounts based on predefined rules, ensuring accurate revenue allocation among sellers or service providers. Split payment involves dividing the payment at the point of sale or checkout, allowing customers to pay using multiple sources or methods, enhancing payment flexibility and convenience. Both mechanisms streamline financial operations by managing multiple fund flows within a single transaction but serve distinct purposes in payment processing and settlement reconciliation.

Key Differences Between Split Settlement and Split Payment

Split settlement involves dividing transaction funds among multiple parties immediately after payment authorization, ensuring each beneficiary receives their share directly from the payment processor. Split payment refers to breaking down a single payment into multiple installments or portions, allowing a payer to distribute their payment over time or through various funding sources. The key difference lies in split settlement managing fund distribution to recipients instantly, while split payment manages how the payer allocates or schedules their payment obligations.

How Split Settlement Works in Payment Processing

Split settlement in payment processing distributes transaction funds directly to multiple recipient accounts based on predefined proportions, enabling streamlined revenue sharing among stakeholders. This mechanism reduces the need for manual fund transfers and accelerates cash flow by automating the allocation at the point of sale or transaction completion. Payment gateways or processors handle the routing of payments, ensuring compliance with financial regulations and accurate reconciliation.

The Mechanics of Split Payment Explained

Split payment involves dividing a single transaction amount among multiple parties at the point of sale, ensuring each beneficiary receives their portion immediately. Split settlement occurs after the transaction is completed, where the collected funds are distributed among various stakeholders based on predefined rules. Understanding these mechanics enables businesses to manage cash flow efficiently and maintain transparent financial records.

Use Cases for Split Settlement in Business

Split Settlement is ideal for marketplaces and platforms facilitating multiple vendors in a single transaction, enabling immediate distribution of funds to each party involved. This method ensures accurate commission handling and streamlines vendor payouts without manual intervention. Businesses leveraging subscription services with tiered revenue sharing benefit from split settlement to automate recurring payments efficiently.

When to Choose Split Payment Over Split Settlement

Split Payment is ideal when managing multiple payees directly from a single transaction, ensuring each party receives their exact share simultaneously, which improves cash flow accuracy. Split Settlement suits scenarios where the merchant wants to handle funds first and distribute payments later, offering more control over timing and reconciliation. Choose Split Payment over Split Settlement to streamline real-time fund allocation, reduce administrative overhead, and enhance transparency in multi-party transactions.

Advantages and Disadvantages of Split Settlement

Split settlement offers advantages such as improved cash flow management by allocating funds directly to multiple parties, reducing the need for manual reconciliation and minimizing payment errors. However, disadvantages include increased complexity in transaction processing, potential delays in fund distribution, and higher administrative overhead for businesses managing multiple accounts. Proper integration with financial systems is essential to mitigate risks and maximize the efficiency of split settlements.

Benefits and Risks Associated with Split Payment

Split payments enhance cash flow management by allowing businesses to allocate funds directly across multiple parties, reducing processing time and errors. However, risks include potential delays in reconciling accounts and increased complexity in tracking transactions. This method improves transparency but requires advanced systems to mitigate fraud and ensure accurate fund distribution.

Regulatory Considerations for Split Settlement and Split Payment

Regulatory considerations for split settlement and split payment differ based on jurisdictional compliance and financial transparency requirements. Split settlement often requires adherence to anti-money laundering (AML) regulations and accurate reporting of transaction allocations to multiple parties. Split payment must comply with tax regulations, ensure proper invoicing, and align with consumer protection laws to prevent unauthorized fund distribution.

Choosing the Right Payment Method for Your Business Needs

Split settlement divides funds from a single transaction among multiple parties, streamlining revenue distribution for marketplaces and platforms. Split payment involves dividing a customer's payment into several parts, often used for installment plans or partial payments. Selecting the appropriate method depends on your business model: opt for split settlement to efficiently manage payouts to vendors, or choose split payment to offer flexible payment options to customers.

Important Terms

Merchant Acquirer Routing

Merchant acquirer routing optimizes transaction processing by directing payments to multiple acquirers, enhancing authorization rates and reducing fees. Split settlement distributes funds from a single transaction to different accounts, while split payment divides the payment amount at the point of sale, enabling precise allocation among multiple recipients.

Multi-Party Settlement

Multi-Party Settlement streamlines financial transactions by distributing funds among multiple parties, optimizing cash flow management and reducing reconciliation complexities. Compared to Split Payment, which allocates payments based on invoices, Split Settlement focuses on dividing proceeds from a single payment event, enhancing transparency and settlement efficiency across involved stakeholders.

Sub-Merchant Disbursement

Sub-merchant disbursement involves distributing funds directly to multiple merchants in a marketplace, optimizing cash flow management through split settlement by allocating revenues after the transaction clears, whereas split payment divides the customer's payment at the point of sale into portions for each sub-merchant. Split settlement focuses on backend reconciliation and timing of payouts, while split payment streamlines upfront transaction processing for multiple parties.

Dynamic Payment Split

Dynamic Payment Split enables merchants to automatically divide transaction amounts among multiple parties, optimizing revenue distribution and reducing reconciliation complexities. Unlike Split Payment, which processes payments as separate transactions, Split Settlement finalizes the allocation post-authorization, ensuring seamless fund distribution aligned with contractual agreements.

Platform Commission Fee

Platform commission fee varies significantly between split settlement and split payment models, with split settlement allowing the platform to deduct fees directly from the transaction before funds reach sellers, ensuring transparent and automated fee collection. In contrast, split payment requires separate processing where the platform must manage commission fees post-transaction, potentially increasing operational complexity and settlement time.

Payout Orchestration

Payout orchestration streamlines complex financial workflows by managing multiple payment methods and partners, enhancing efficiency in both split settlement and split payment processes. Split settlement focuses on distributing collected funds among various stakeholders, while split payment involves dividing a single payment at the point of transaction, allowing precise revenue allocation in real-time.

Layered Transaction Routing

Layered Transaction Routing enhances payment processing by directing transactions through multiple payment providers or accounts to optimize authorization and settlement outcomes. This method enables Split Settlement to allocate funds across multiple parties, while Split Payment focuses on dividing a single payment amount among different recipients, improving transactional efficiency and financial management in complex commerce environments.

Revenue Share Automation

Revenue share automation enhances financial workflows by enabling precise split settlement, where transaction amounts are divided among stakeholders at the point of sale. Unlike split payment, which allocates funds post-transaction, split settlement ensures immediate distribution of revenue shares, reducing reconciliation errors and accelerating cash flow management.

Partial Fund Distribution

Partial fund distribution allows for dividing payments across multiple parties, optimizing cash flow and financial management. Split settlement allocates funds directly to recipients during transaction processing, while split payment involves separating payments post-transaction, enhancing flexibility and control in complex payment scenarios.

Aggregator Payment Flow

Aggregator Payment Flow streamlines transaction processing by directing funds through a centralized platform before distributing payments to multiple parties. Split Settlement allocates funds post-transaction to stakeholders, whereas Split Payment divides the payment amount upfront during the transaction, optimizing cash flow and reconciliation.

Split Settlement vs Split Payment Infographic

moneydif.com

moneydif.com