Multi-currency pricing allows merchants to display product prices in various currencies based on the shopper's location, providing transparency and localized shopping experiences. Dynamic currency conversion (DCC) enables customers to pay in their home currency at the point of sale, often with a marked-up exchange rate that benefits the merchant or payment provider. Understanding the differences between multi-currency pricing and DCC helps businesses optimize payment processing, reduce conversion fees, and enhance customer trust.

Table of Comparison

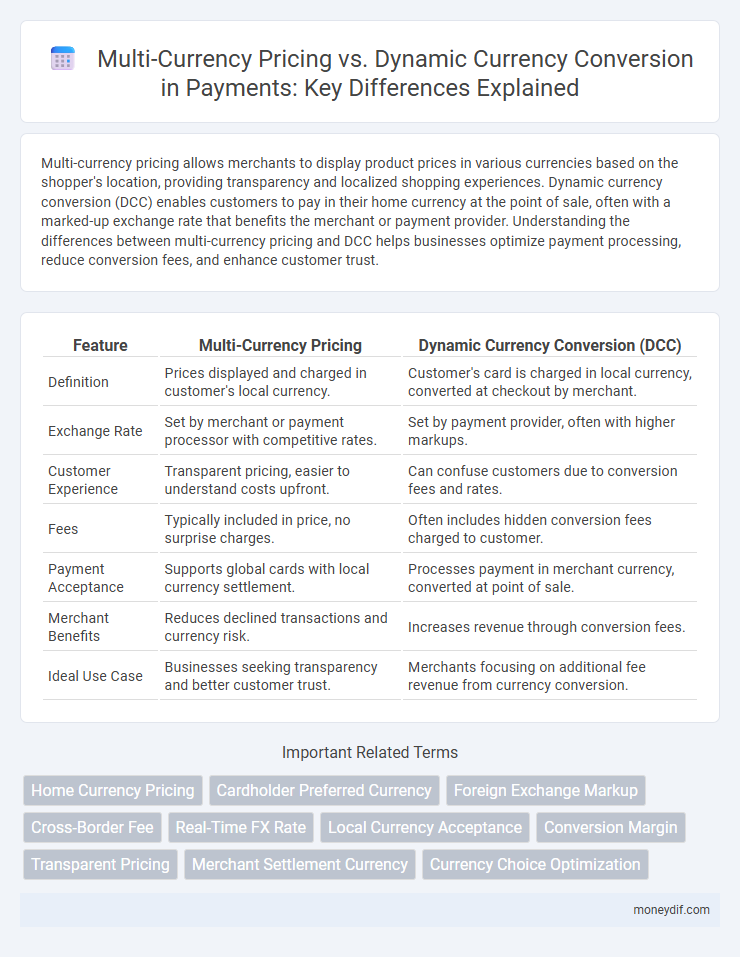

| Feature | Multi-Currency Pricing | Dynamic Currency Conversion (DCC) |

|---|---|---|

| Definition | Prices displayed and charged in customer's local currency. | Customer's card is charged in local currency, converted at checkout by merchant. |

| Exchange Rate | Set by merchant or payment processor with competitive rates. | Set by payment provider, often with higher markups. |

| Customer Experience | Transparent pricing, easier to understand costs upfront. | Can confuse customers due to conversion fees and rates. |

| Fees | Typically included in price, no surprise charges. | Often includes hidden conversion fees charged to customer. |

| Payment Acceptance | Supports global cards with local currency settlement. | Processes payment in merchant currency, converted at point of sale. |

| Merchant Benefits | Reduces declined transactions and currency risk. | Increases revenue through conversion fees. |

| Ideal Use Case | Businesses seeking transparency and better customer trust. | Merchants focusing on additional fee revenue from currency conversion. |

Understanding Multi-Currency Pricing: Key Concepts

Multi-currency pricing enables merchants to display product prices in various currencies directly on their platform, enhancing transparency and customer trust. This approach contrasts with dynamic currency conversion (DCC), where the transaction amount is converted at the point of sale, often with less favorable exchange rates and additional fees. Understanding multi-currency pricing involves recognizing its benefits such as improved user experience, reduced cart abandonment, and greater control over exchange rates for businesses.

What Is Dynamic Currency Conversion?

Dynamic Currency Conversion (DCC) allows cardholders to pay in their home currency when making international transactions, providing real-time currency conversion at the point of sale. This service offers transparency by displaying the exact amount in the cardholder's currency, although it often includes higher fees compared to multi-currency pricing options. Merchants benefit from DCC by potentially earning commissions on currency conversion, while customers gain clarity but may face less favorable exchange rates.

Multi-Currency Pricing vs Dynamic Currency Conversion: Core Differences

Multi-currency pricing allows merchants to display and charge payments in the customer's home currency at checkout, providing transparency and enhancing buyer confidence. Dynamic currency conversion (DCC) offers customers the option to pay in their native currency by converting the amount at the point of sale, often with higher fees and less favorable exchange rates. Key differences lie in control and cost: multi-currency pricing benefits merchants and customers with standardized rates, while DCC shifts exchange rate risk and fees to consumers, impacting payment acceptance and satisfaction.

Customer Experience: Transparent Pricing vs On-the-Spot Conversion

Multi-currency pricing offers customers transparent pricing by displaying product costs in their native currency before purchase, reducing surprises and building trust. Dynamic currency conversion provides on-the-spot conversion at the point of sale but often carries higher fees and less favorable exchange rates, leading to potential customer dissatisfaction. Transparent pricing enhances customer experience by allowing informed decisions and eliminating unexpected costs during payment.

Payment Processing Fees: Comparing Cost Structures

Multi-currency pricing typically involves transparent payment processing fees based on the merchant's acquirer rates and foreign exchange markups, often leading to lower overall costs for international transactions. Dynamic currency conversion (DCC) imposes additional fees as it allows customers to pay in their home currency, but these fees, often shared between merchants and providers, can increase the total charge. Merchants benefit from multi-currency pricing by avoiding the unpredictable fees and reduced revenue margins associated with DCC's higher processing costs.

Impact on International Sales and Conversion Rates

Multi-currency pricing allows merchants to display prices in customers' local currencies, enhancing transparency and trust, which can significantly increase international sales and conversion rates. Dynamic currency conversion (DCC) offers real-time currency conversion at checkout but often involves higher fees and unfavorable rates, potentially deterring customers and reducing purchase completion. Implementing multi-currency pricing is generally more effective in boosting global revenue by minimizing friction and promoting a seamless buying experience.

Risks and Security Considerations in Currency Handling

Multi-currency pricing reduces exchange rate risk by charging customers in their local currency, enhancing transparency and customer trust, but requires robust integration with local payment systems and compliance with regional regulations. Dynamic Currency Conversion (DCC) exposes merchants and customers to higher fraud risks and hidden fees due to real-time conversion by third parties, impacting transaction security and dispute resolution. Implementing strong encryption, PCI DSS compliance, and clear communication on currency handling are critical to mitigating risks and ensuring secure and compliant payment processing.

Revenue Implications for Merchants

Multi-currency pricing enables merchants to set fixed prices in the customer's local currency, increasing transparency and reducing cart abandonment, which can lead to higher revenue. Dynamic currency conversion (DCC) allows customers to pay in their home currency at the point of sale, often resulting in higher fees and lower acceptance rates, potentially diminishing merchant revenue. Merchants using multi-currency pricing benefit from better customer trust and fewer disputes, enhancing overall profitability compared to those relying on DCC.

Technological Requirements for Implementation

Multi-currency pricing requires robust payment gateway support and real-time exchange rate integration through APIs to present accurate prices in multiple currencies at checkout. Dynamic currency conversion demands secure integration with acquiring banks and card networks to authorize transactions in the cardholder's currency while ensuring compliance with PCI DSS standards. Both methods necessitate scalable backend infrastructure and sophisticated fraud detection algorithms to handle currency fluctuations and mitigate transaction risks effectively.

Best Practices for Choosing the Right Currency Strategy

Selecting the optimal currency strategy requires balancing cost-efficiency and customer experience, with multi-currency pricing offering transparent local currency options and reduced exchange fees. Dynamic currency conversion provides real-time foreign exchange rates at the point of sale but may involve higher conversion costs and customer confusion. Best practices include analyzing transaction volumes by region, assessing exchange rate volatility, and prioritizing payment system compatibility to ensure seamless and cost-effective payments.

Important Terms

Home Currency Pricing

Home Currency Pricing simplifies international payments by displaying prices in the customer's local currency, enhancing transparency and trust. Compared to Dynamic Currency Conversion, which converts charges at the point of sale often with higher fees and unfavorable rates, Home Currency Pricing offers more stable exchange rates and reduces conversion costs for both merchants and consumers.

Cardholder Preferred Currency

Cardholder Preferred Currency (CPC) allows transactions to be processed and billed in the cardholder's home currency, enhancing transparency and reducing currency conversion fees compared to Dynamic Currency Conversion (DCC), which offers real-time currency conversion at the point of sale but often includes higher merchant margins. Multi-currency pricing systems leverage CPC by enabling merchants to display prices and accept payments in multiple currencies, empowering customers with currency choice while maintaining competitive exchange rates and minimizing disputes.

Foreign Exchange Markup

Foreign Exchange Markup refers to the additional fee applied to currency conversion rates during international transactions, impacting multi-currency pricing where merchants display prices in various currencies directly. Dynamic Currency Conversion allows cardholders to pay in their home currency at the point of sale but often includes higher Foreign Exchange Markup fees, making multi-currency pricing a more transparent and cost-effective option for consumers.

Cross-Border Fee

Cross-border fee applies when transactions involve different countries' currencies and is often higher with dynamic currency conversion (DCC) since it converts payments at point-of-sale using merchant-set rates. Multi-currency pricing offers transparent exchange rates by allowing customers to pay in their home currency, minimizing unexpected fees compared to DCC's potentially inflated currency conversions.

Real-Time FX Rate

Real-Time FX Rate enables accurate multi-currency pricing by providing up-to-the-minute foreign exchange values, ensuring transparent and consistent pricing across different currencies. Dynamic currency conversion leverages these real-time rates to offer consumers the choice to pay in their home currency at the point of sale, enhancing convenience but often involving additional fees.

Local Currency Acceptance

Local currency acceptance enhances customer confidence by allowing payments in their native currency, reducing exchange rate anxiety compared to dynamic currency conversion, which often includes hidden fees and less favorable rates. Multi-currency pricing enables merchants to list prices in various currencies upfront, improving transparency and customer experience without incurring the additional processing costs associated with dynamic currency conversion.

Conversion Margin

Conversion margin represents the difference between the exchange rate offered by a merchant in multi-currency pricing and the actual interbank rate, often leading to hidden costs for consumers. Dynamic currency conversion typically includes higher conversion margins as third-party providers apply their own rates, resulting in less favorable exchange rates compared to transparent multi-currency pricing systems.

Transparent Pricing

Transparent pricing enhances customer trust by clearly displaying costs in the buyer's local currency without hidden fees, contrasting with dynamic currency conversion that often includes undisclosed markup fees. Multi-currency pricing provides straightforward exchange rates set by the merchant, enabling accurate cost comparison and eliminating unexpected expenses commonly associated with dynamic currency conversion services.

Merchant Settlement Currency

Merchant settlement currency determines the currency in which a merchant receives payment, impacting reconciliation and foreign exchange costs. Multi-currency pricing allows customers to pay in their preferred currency at checkout, while dynamic currency conversion offers real-time currency conversion at the point of sale, often resulting in higher fees for the consumer.

Currency Choice Optimization

Currency Choice Optimization enhances revenue by allowing businesses to select the most advantageous currency for pricing, balancing multi-currency pricing--which sets fixed local prices in multiple currencies--with dynamic currency conversion that offers real-time exchange rates at checkout. Implementing an optimized currency strategy improves customer experience, reduces payment friction, and maximizes profit margins by minimizing exchange rate risks and conversion fees.

multi-currency pricing vs dynamic currency conversion Infographic

moneydif.com

moneydif.com