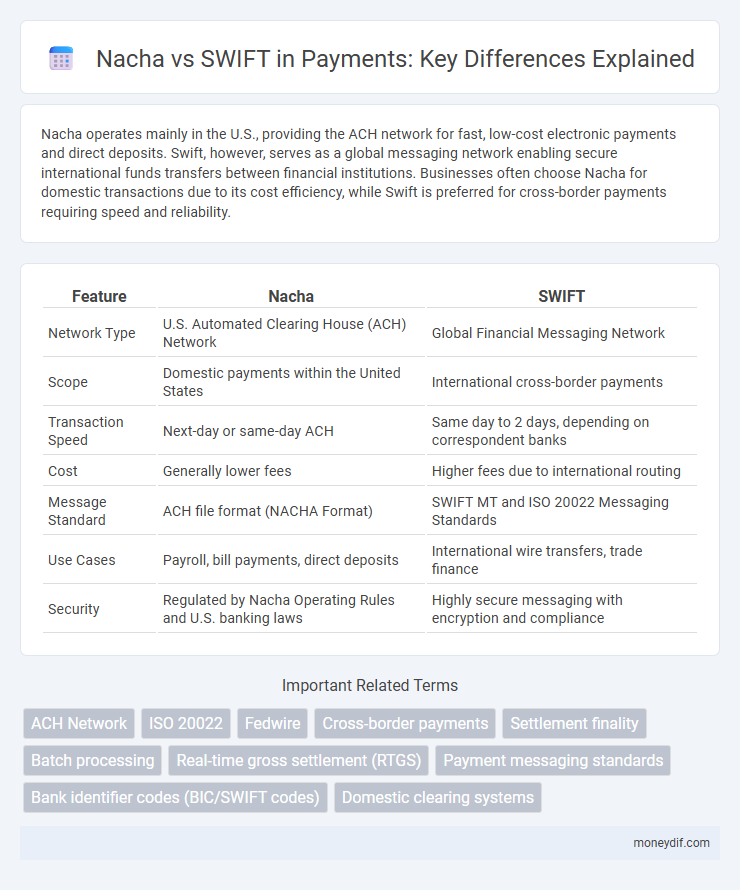

Nacha operates mainly in the U.S., providing the ACH network for fast, low-cost electronic payments and direct deposits. Swift, however, serves as a global messaging network enabling secure international funds transfers between financial institutions. Businesses often choose Nacha for domestic transactions due to its cost efficiency, while Swift is preferred for cross-border payments requiring speed and reliability.

Table of Comparison

| Feature | Nacha | SWIFT |

|---|---|---|

| Network Type | U.S. Automated Clearing House (ACH) Network | Global Financial Messaging Network |

| Scope | Domestic payments within the United States | International cross-border payments |

| Transaction Speed | Next-day or same-day ACH | Same day to 2 days, depending on correspondent banks |

| Cost | Generally lower fees | Higher fees due to international routing |

| Message Standard | ACH file format (NACHA Format) | SWIFT MT and ISO 20022 Messaging Standards |

| Use Cases | Payroll, bill payments, direct deposits | International wire transfers, trade finance |

| Security | Regulated by Nacha Operating Rules and U.S. banking laws | Highly secure messaging with encryption and compliance |

Nacha vs SWIFT: Key Differences Explained

NACHA and SWIFT serve distinct roles in global payment ecosystems, with NACHA managing the ACH network primarily in the United States for domestic electronic payments, while SWIFT facilitates international bank-to-bank messaging for cross-border transactions. NACHA transactions are typically lower cost and slower, designed for payroll, bill payments, and direct deposits, whereas SWIFT enables secure, real-time communication for large-value and multi-currency transfers worldwide. Understanding these differences is crucial for businesses choosing between domestic ACH payments and international wire transfers to optimize speed, cost, and geographic reach.

Overview: What are Nacha and SWIFT?

NACHA, also known as the Electronic Payments Association, governs the Automated Clearing House (ACH) network in the United States, facilitating domestic electronic payments such as direct deposits and bill payments. SWIFT (Society for Worldwide Interbank Financial Telecommunication) provides a global messaging network enabling secure international financial transactions and communication among banks. Both NACHA and SWIFT play critical roles in payment processing, with NACHA focusing on U.S. automated clearing and SWIFT specializing in cross-border payment messaging.

Global vs Domestic: Where Nacha and SWIFT Operate

Nacha operates primarily within the United States, facilitating domestic electronic payments through the Automated Clearing House (ACH) network for businesses and consumers. SWIFT offers a global messaging network that connects over 11,000 financial institutions worldwide, enabling cross-border international payments and secure financial communication. The distinction between Nacha's U.S.-focused ACH system and SWIFT's extensive global reach highlights their complementary roles in domestic versus international payment processing.

Transaction Speed: Nacha vs SWIFT Processing Times

Nacha transactions typically settle within one to two business days, leveraging the ACH network for efficient domestic payment processing. SWIFT payments vary widely depending on the correspondent banks involved but generally take one to five business days for international transfers. Faster settlements in Nacha are ideal for U.S.-based payments, while SWIFT is preferred for secure, global fund transfers despite longer processing times.

Security and Compliance in Nacha and SWIFT Payments

Nacha payments prioritize security through strict compliance with NACHA Operating Rules, requiring multifactor authentication and rigorous encryption standards to protect sensitive data during ACH transactions. SWIFT payments emphasize global security by implementing SWIFT Customer Security Programme (CSP) controls, including mandatory cybersecurity frameworks and cross-border compliance with international financial regulations like FINRA and GDPR. Both systems uphold high security standards, but NACHA's focus is primarily on U.S.-based ACH network regulations, whereas SWIFT targets comprehensive global regulatory compliance and anti-money laundering protocols.

Cost Comparison: Nacha vs SWIFT Fees

NACHA payment fees typically include fixed per-transaction costs ranging from $0.20 to $0.50, making it a cost-effective option for domestic ACH transfers within the United States. SWIFT fees are significantly higher due to international processing charges, correspondent banking fees, and currency conversion costs, often totaling $30 to $50 or more per transaction. Businesses seeking low-cost domestic payment solutions usually prefer NACHA, while SWIFT serves better for global, high-value cross-border transactions despite its higher fees.

User Experience: Ease of Use in Nacha and SWIFT

NACHA offers a streamlined user experience through its Automated Clearing House (ACH) system, enabling fast and cost-effective domestic payments with straightforward integration for businesses and consumers. SWIFT, designed for global financial messaging, provides extensive network connectivity but often involves more complex interfaces and higher costs, impacting ease of use for non-institutional users. The simplicity of NACHA's ACH network contrasts with SWIFT's comprehensive, multi-currency capabilities, making NACHA preferable for domestic payments, while SWIFT remains essential for international transactions despite a steeper learning curve.

Supported Currencies and Regions: Nacha vs SWIFT

NACHA primarily supports transactions in US dollars within the United States banking system, focusing on ACH payments domestically. SWIFT enables international payments with support for multiple currencies across over 200 countries, facilitating global bank-to-bank communication. The regional reach of SWIFT vastly exceeds NACHA's domestic scope, making SWIFT essential for cross-border transactions.

Integration with Banks and Financial Institutions

NACHA operates primarily within the United States, offering automated clearing house (ACH) network integration that enables seamless electronic payments between banks and financial institutions domestically. SWIFT provides a global messaging network facilitating secure and standardized communication for cross-border transactions, connecting over 11,000 financial institutions worldwide. Banks often integrate NACHA for efficient domestic payments, while SWIFT is utilized for international settlements, emphasizing compatibility and adherence to different regulatory standards across jurisdictions.

Use Cases: When to Choose Nacha or SWIFT

Nacha payments are ideal for domestic transactions within the United States, particularly for ACH transfers such as payroll, bill payments, and direct deposits due to their cost-effectiveness and speed. SWIFT is preferred for international wire transfers, cross-border payments, and high-value transactions requiring global reach and secure messaging between financial institutions. Organizations choose Nacha for low-cost, batch-processed payments in local banking networks, whereas SWIFT suits complex, multinational financial operations demanding standardized and reliable communication.

Important Terms

ACH Network

The ACH Network, governed by Nacha, facilitates domestic electronic payments in the U.S., while SWIFT primarily manages international financial messaging and cross-border transactions.

ISO 20022

ISO 20022 enables standardized, richer financial messaging that enhances interoperability between Nacha's ACH network and Swift's global payment system.

Fedwire

Fedwire provides real-time gross settlement within the U.S. banking system, while Nacha governs ACH payments for batch processing and SWIFT enables international financial messaging across global banks.

Cross-border payments

Nacha enables real-time, cost-effective ACH transfers primarily within the U.S., while SWIFT facilitates global cross-border payments through secure messaging between international banks.

Settlement finality

Settlement finality in Nacha payments ensures irrevocable funds transfer within one to two business days, whereas SWIFT enables near-instant global settlement finality through its real-time gross settlement messaging standards.

Batch processing

Batch processing in financial transactions optimizes efficiency by handling multiple payments simultaneously, with Nacha primarily used for ACH payments in the U.S. while SWIFT facilitates international wire transfers through standardized messaging.

Real-time gross settlement (RTGS)

Real-time gross settlement (RTGS) enables instant high-value payments, contrasting Nacha's ACH network which processes batch transactions and SWIFT's cross-border messaging system that facilitates international fund transfers.

Payment messaging standards

Nacha payment messaging standards primarily focus on ACH transactions within the U.S., while SWIFT standards enable secure international financial messaging across global banking networks.

Bank identifier codes (BIC/SWIFT codes)

Bank Identifier Codes (BIC/SWIFT) facilitate international financial transactions, while NACHA governs the standardized electronic payments system within the United States, emphasizing ACH transfer protocols.

Domestic clearing systems

NACHA governs the US domestic ACH clearing network facilitating electronic payments and transfers, while SWIFT provides a global messaging system for secure cross-border financial transactions between banks.

Nacha vs Swift Infographic

moneydif.com

moneydif.com