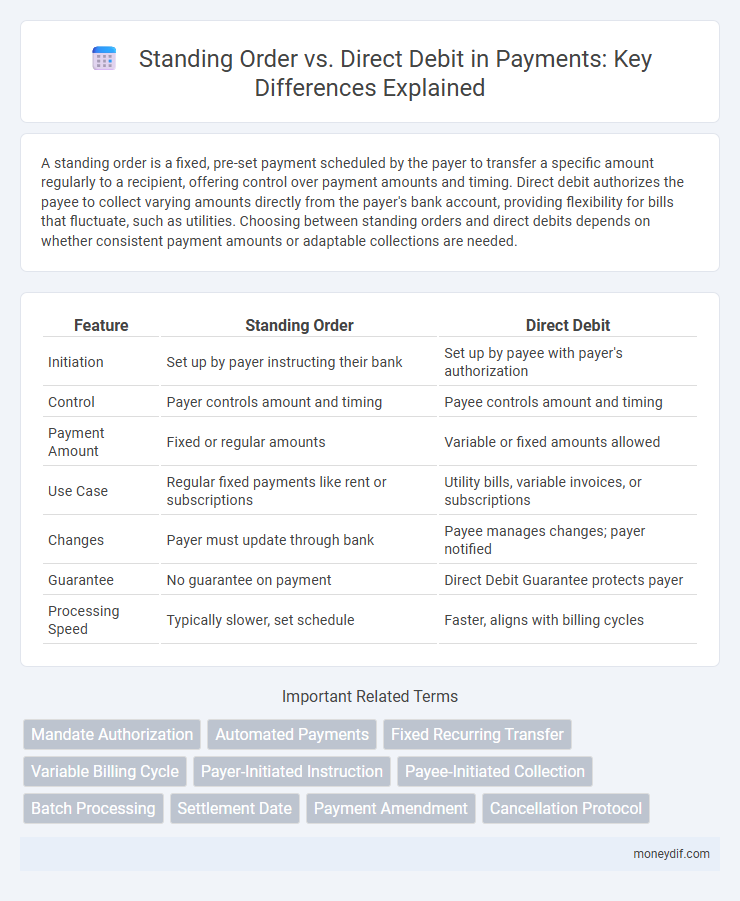

A standing order is a fixed, pre-set payment scheduled by the payer to transfer a specific amount regularly to a recipient, offering control over payment amounts and timing. Direct debit authorizes the payee to collect varying amounts directly from the payer's bank account, providing flexibility for bills that fluctuate, such as utilities. Choosing between standing orders and direct debits depends on whether consistent payment amounts or adaptable collections are needed.

Table of Comparison

| Feature | Standing Order | Direct Debit |

|---|---|---|

| Initiation | Set up by payer instructing their bank | Set up by payee with payer's authorization |

| Control | Payer controls amount and timing | Payee controls amount and timing |

| Payment Amount | Fixed or regular amounts | Variable or fixed amounts allowed |

| Use Case | Regular fixed payments like rent or subscriptions | Utility bills, variable invoices, or subscriptions |

| Changes | Payer must update through bank | Payee manages changes; payer notified |

| Guarantee | No guarantee on payment | Direct Debit Guarantee protects payer |

| Processing Speed | Typically slower, set schedule | Faster, aligns with billing cycles |

Understanding Standing Orders and Direct Debits

Standing Orders are instructions a bank account holder gives to their bank to pay a fixed amount regularly to another account, providing control over payment amounts and timing. Direct Debits allow organizations to collect varying amounts directly from the payer's account, ideal for bills with fluctuating charges, subject to payer authorization and guarantee schemes. Understanding these differences helps individuals manage recurring payments effectively and avoid missed or incorrect transactions.

Key Differences Between Standing Order and Direct Debit

Standing orders are fixed payment instructions set up by the payer to transfer a specified amount at regular intervals, whereas direct debits allow the payee to collect varying amounts with the payer's authorization. Standing orders give the payer full control over payment dates and amounts, while direct debits provide flexibility for the payee to adjust payment amounts as bills fluctuate. Direct debits often include guarantees protecting payers against unauthorized or incorrect payments, unlike standing orders where the payer must manage cancellations and changes.

How Standing Orders Work

Standing orders are instructions a bank account holder gives to their bank to pay a fixed amount at regular intervals to another account. They operate on pre-set dates and amounts, ensuring consistent payments without needing authorization each time. Standing orders are ideal for fixed, regular payments like rent or subscriptions.

How Direct Debits Operate

Direct Debits operate by authorizing a company or organization to collect varying amounts directly from a customer's bank account, enabling flexible payment schedules tied to actual bills. This automatic collection requires a formal mandate and is commonly used for utilities, subscriptions, and loan repayments. The system ensures payments are adjusted based on the owed amount, providing convenience and reducing missed payments.

Pros and Cons of Standing Orders

Standing orders offer control and predictability by allowing fixed, regular payments for bills or subscriptions, enhancing budgeting efficiency. However, they lack flexibility because payment amounts and dates must be manually adjusted if changes occur, potentially leading to missed or incorrect payments. Unlike direct debits, standing orders require payer initiation for any modifications, which can delay updates and reduce convenience for variable payments.

Pros and Cons of Direct Debits

Direct Debits offer businesses automated and flexible payment collection, reducing administrative overhead and ensuring timely receipt of funds. Consumers benefit from convenience and the ability to handle variable payments, though there is a risk of unauthorized transactions requiring careful monitoring and dispute resolution. Unlike standing orders, Direct Debits provide greater adaptability but depend heavily on accurate bank processing to prevent payment errors.

Security and Control: Standing Order vs Direct Debit

Standing orders provide greater control and security as the payer sets and manages fixed payment amounts and schedules directly with their bank, reducing third-party involvement. Direct debits offer convenience and flexibility but require trust in the payee to collect variable amounts, increasing the risk of unauthorized transactions, though protections like the Direct Debit Guarantee help mitigate this. Overall, standing orders grant payers more autonomy and predictable payments, while direct debits emphasize ease of use with built-in safeguards.

Best Use Cases for Standing Orders

Standing orders are ideal for fixed, recurring payments such as rent, mortgage installments, or subscription fees, where the payment amount and frequency remain constant. They provide account holders with full control over payment dates and amounts, reducing the risk of unexpected withdrawals. Businesses and individuals benefit from standing orders when predictable cash flow management and budget planning are priorities.

Best Use Cases for Direct Debits

Direct debits are ideal for recurring payments with variable amounts, such as utility bills or subscription services, where authorized automatic withdrawals align with fluctuating charges. They offer consumers flexibility and businesses guaranteed timely payments without manual intervention. This method reduces administrative overhead and ensures consistent cash flow for organizations managing variable payment schedules.

Choosing the Right Payment Method for Your Needs

Standing orders provide fixed-amount payments scheduled regularly by the payer, ideal for consistent bills like rent or subscriptions. Direct debits offer variable payment amounts controlled by the payee, suitable for fluctuating expenses such as utility bills or credit card payments. Selecting between a standing order and direct debit depends on payment flexibility, control preferences, and the nature of the recurring transaction.

Important Terms

Mandate Authorization

Mandate authorization is a formal approval allowing a bank to process payments automatically, distinguishing standing orders, which instruct fixed regular payments set by the payer, from direct debits where the payee initiates variable amounts under the mandate. Standing orders provide predictable, recurring payments, while direct debits offer flexibility for billers to collect differing sums according to agreed terms.

Automated Payments

Automated payments streamline recurring transactions by enabling automated fund transfers through Standing Orders or Direct Debits, where Standing Orders involve fixed regular payments set up by the payer, and Direct Debits allow the payee to collect varying amounts with prior authorization. Businesses often prefer Direct Debits for greater flexibility and control over payment amounts, while consumers benefit from Standing Orders for predictable, consistent billing.

Fixed Recurring Transfer

Fixed Recurring Transfer involves scheduled payments set up by the account holder, similar to Standing Orders that instruct banks to transfer a fixed amount regularly to a beneficiary. Direct Debit, however, allows the payee to collect varying amounts directly from the payer's account with prior authorization, offering more flexibility compared to the predictable nature of Fixed Recurring Transfers and Standing Orders.

Variable Billing Cycle

Variable billing cycles in standing orders allow payments on flexible dates and amounts, contrasting with direct debits that auto-deduct fixed sums on predetermined schedules. This flexibility benefits customers needing adaptable payment timing but may require more active management compared to the automated consistency of direct debits.

Payer-Initiated Instruction

Payer-Initiated Instruction allows customers to authorize payments directly to a payee, offering greater control compared to Direct Debit, where the payee initiates the transaction under a Standing Order's fixed schedule. Unlike Standing Orders that execute fixed amounts at set intervals, Payer-Initiated Instructions enable flexible payments varying in amount and frequency based on the payer's authorization.

Payee-Initiated Collection

Payee-Initiated Collection enables a payee to request payment directly from the payer's bank account, commonly facilitated through Direct Debit, which allows variable amounts and flexible payment dates. Standing Orders, in contrast, are payer-initiated instructions for fixed, regular payments, offering less flexibility but greater control over payment amounts and schedules.

Batch Processing

Batch processing enables efficient handling of multiple Standing Orders or Direct Debit transactions by grouping payments for collective authorization and settlement, reducing processing time and operational costs. Standing Orders automate fixed, recurring payments at set intervals, while Direct Debits allow variable amounts to be collected by the creditor with payer authorization, both benefiting from batch processing's streamlined transaction management.

Settlement Date

The settlement date for Standing Orders is typically fixed by the payer and occurs on predetermined intervals, ensuring consistent payment processing without requiring further authorization. Direct Debit settlement dates vary based on the creditor's instruction and can be adjusted according to payment schedules, allowing for flexible and automated fund collection.

Payment Amendment

Payment amendments for Standing Orders involve changing fixed regular payments set by the payer, whereas Direct Debit amendments require authorization updates with the payee's bank to adjust variable payment amounts. Standing Orders provide predictable payment schedules, while Direct Debits offer flexibility but necessitate explicit consent for each change.

Cancellation Protocol

Cancellation protocols for Standing Orders require customers to notify their bank directly to stop payments, whereas Direct Debit cancellations involve instructing the beneficiary and informing the bank, ensuring both parties are aware. Standing Orders offer fixed, recurring payments controlled solely by the payer, while Direct Debits allow the payee to collect varying amounts, necessitating stricter cancellation oversight to prevent unauthorized withdrawals.

Standing Order vs Direct Debit Infographic

moneydif.com

moneydif.com