Interchange fees are charges paid by the merchant's bank to the cardholder's bank for processing a card transaction, typically set by card networks to compensate issuers. Scheme fees, on the other hand, are fees imposed by payment schemes or networks for using their platform, covering network management, security, and technology infrastructure. Understanding the distinctions between interchange and scheme fees is crucial for businesses to manage their payment processing costs effectively.

Table of Comparison

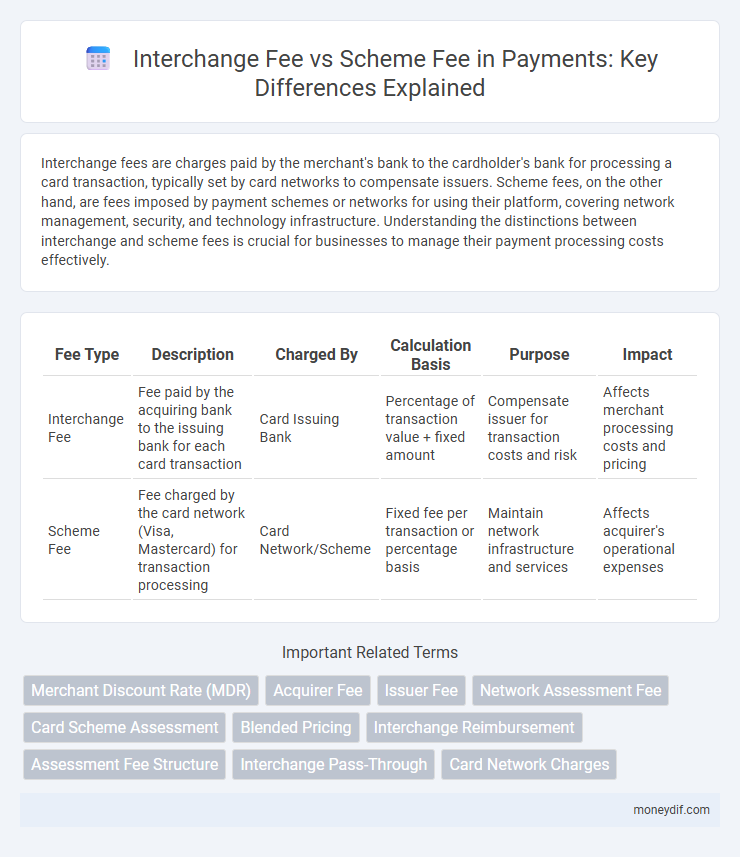

| Fee Type | Description | Charged By | Calculation Basis | Purpose | Impact |

|---|---|---|---|---|---|

| Interchange Fee | Fee paid by the acquiring bank to the issuing bank for each card transaction | Card Issuing Bank | Percentage of transaction value + fixed amount | Compensate issuer for transaction costs and risk | Affects merchant processing costs and pricing |

| Scheme Fee | Fee charged by the card network (Visa, Mastercard) for transaction processing | Card Network/Scheme | Fixed fee per transaction or percentage basis | Maintain network infrastructure and services | Affects acquirer's operational expenses |

Understanding Interchange Fees in Payment Processing

Interchange fees are transaction-based charges paid by the acquiring bank to the issuing bank, covering the cost of handling and authorizing card payments, and are set by card networks like Visa or Mastercard. Scheme fees, on the other hand, are fixed charges paid to card schemes for access to their payment networks and services. Understanding interchange fees is crucial for merchants, as they typically represent the largest component of the total cost of card acceptance in payment processing.

What Are Scheme Fees and How Do They Work?

Scheme fees are charges imposed by card networks like Visa, MasterCard, or American Express for processing card transactions, covering activities such as authorization, clearing, and settlement. These fees help maintain the network infrastructure, support fraud prevention systems, and ensure interoperability between issuing and acquiring banks. Unlike interchange fees paid to issuing banks, scheme fees are collected by the card schemes themselves as part of the overall transaction cost.

Key Differences Between Interchange Fee and Scheme Fee

Interchange fees are charged by the card-issuing bank to the merchant acquirer for processing card transactions, typically representing a percentage of the transaction value and serving as compensation to issuers for transaction risks and costs. Scheme fees, on the other hand, are fixed or variable fees charged by card networks such as Visa or Mastercard for using their payment infrastructure and branding, covering network maintenance, security, and operational expenses. The primary difference lies in interchange fees being paid between banks within the payment ecosystem, while scheme fees are charged by card schemes to acquirers or issuers to support network services and protocols.

How Interchange Fees Impact Merchants and Consumers

Interchange fees, charged by card-issuing banks to merchants' acquiring banks, directly affect merchants by increasing transaction costs, which often leads to higher prices for consumers. These fees represent a substantial portion of total card payment expenses, influencing merchant pricing strategies and potentially limiting acceptance of certain payment types. Unlike scheme fees, which are fixed charges paid to network operators, interchange fees vary by transaction type and contribute significantly to the overall cost structure in payment ecosystems.

The Role of Card Schemes in Setting Scheme Fees

Card schemes play a crucial role in setting scheme fees, which are charges levied on merchants for processing card transactions within their network. These fees fund the operational infrastructure, security protocols, and technological innovations that enable seamless payment processing. Scheme fees differ from interchange fees, as the latter are paid to issuing banks, while scheme fees are collected by card networks to maintain and enhance the payment ecosystem.

Interchange Fee Regulation: Global Perspectives

Interchange fee regulation varies globally, with regions like the European Union capping fees to promote fair competition and reduce costs for merchants. In contrast, the United States adopts a more market-driven approach, allowing interchange fees to be set by card networks and issuers. These differing regulatory frameworks impact the balance between interchange fees and scheme fees, influencing overall payment processing expenses worldwide.

Scheme Fees Breakdown: Types and Calculation Methods

Scheme fees in payment processing typically include assessment fees, transaction fees, and network fees, each calculated based on transaction volume, value, or fixed rates set by card schemes such as Visa or Mastercard. Assessment fees are generally a percentage of the transaction value, while transaction fees may be a fixed amount per transaction, influencing the total cost borne by merchants and acquirers. Understanding the breakdown and calculation methods of scheme fees helps businesses optimize payment processing costs and enhance pricing strategies.

Comparing Interchange and Scheme Fees Across Payment Networks

Interchange fees are compensation paid by merchants to card-issuing banks for transaction processing, typically varying by payment network and card type, while scheme fees are charged by card networks like Visa or Mastercard for using their infrastructure. Comparing fees across networks reveals that interchange fees often represent a larger portion of merchant costs, influenced by factors such as transaction volume, region, and card rewards programs. Scheme fees remain more stable and predictable but can differ based on network policies and additional services provided.

Strategies for Merchants to Manage Payment Fees

Merchants can reduce payment costs by negotiating lower interchange fees, which are set by card networks and typically form the largest portion of transaction fees. Implementing payment routing strategies enables merchants to select the most cost-effective payment scheme, balancing interchange fees and scheme fees to optimize overall expenses. Analyzing transaction data and choosing preferred card types or payment methods also allows merchants to minimize fees while maintaining customer convenience.

Future Trends: The Evolution of Interchange and Scheme Fees

Interchange fees and scheme fees are evolving as payment networks adapt to regulatory changes and technological advancements, aiming to balance cost efficiency with enhanced security. Future trends indicate a shift toward dynamic fee structures that leverage real-time data analytics and machine learning to optimize transaction costs and improve merchant and issuer profitability. The integration of blockchain technology and open banking frameworks is expected to further transform fee assessments, promoting transparency and fostering competitive pricing models in the payments ecosystem.

Important Terms

Merchant Discount Rate (MDR)

Merchant Discount Rate (MDR) comprises fees charged to merchants per transaction, primarily divided into Interchange Fee paid to card-issuing banks and Scheme Fee collected by card network operators like Visa or Mastercard; Interchange Fee typically represents the larger portion of MDR, reflecting risk and handling costs while Scheme Fee covers network services and infrastructure. Understanding the balance between these fees is crucial for merchants to optimize transaction costs and negotiate favorable terms with payment service providers.

Acquirer Fee

Acquirer fee typically encompasses both interchange fee and scheme fee, where the interchange fee is paid to the card-issuing bank for processing transactions, and the scheme fee is charged by the card network for maintaining the payment infrastructure. The acquirer fee is a crucial revenue component for acquiring banks, combining these costs to ensure transaction authorization, clearing, and settlement across payment schemes like Visa and Mastercard.

Issuer Fee

Issuer Fee, a component of card payment processing, is charged by the card-issuing bank and is influenced by the Interchange Fee, which compensates the issuer for transaction risks and operational costs. Scheme Fee, paid to the card network (e.g., Visa, Mastercard), covers network infrastructure and rule enforcement, distinguishing it from the Issuer Fee that directly benefits the issuing institution.

Network Assessment Fee

Network Assessment Fee represents the charges imposed by payment networks to evaluate transaction routing and processing, differing from Interchange Fees, which are paid to card-issuing banks for each transaction authorization. Scheme Fees are fixed costs levied by card schemes to manage network operations and compliance, distinct from variable Network Assessment Fees that reflect usage-based network infrastructure expenses.

Card Scheme Assessment

Card scheme assessment involves evaluating the financial impact and operational roles of interchange fees and scheme fees on card transactions; interchange fees are paid by the acquiring bank to the issuing bank for each transaction, incentivizing issuance and acceptance of cards, while scheme fees are charged by the card network to cover branding, infrastructure, and regulatory compliance. Understanding the balance between interchange fees and scheme fees is crucial for optimizing transaction costs, maintaining competitive pricing, and ensuring the sustainability of card payment ecosystems.

Blended Pricing

Blended pricing combines interchange fees and scheme fees into a single rate for merchants, simplifying cost management while potentially obscuring individual fee components. This model can lead to less transparency compared to separately itemized interchange fees, which vary by card type and transaction, versus fixed scheme fees set by card networks.

Interchange Reimbursement

Interchange reimbursement involves the payment from the acquiring bank to the issuing bank based on the interchange fee, which compensates the issuer for transaction risks and processing costs; this fee is distinct from the scheme fee charged by card networks for maintaining payment infrastructure and facilitating transaction authorization. Understanding the differentiation between interchange fees and scheme fees is crucial for merchants and financial institutions to accurately assess cost structures in card payment processing.

Assessment Fee Structure

Assessment fees are typically calculated as a percentage of the transaction value, directly influencing the cost merchants incur, whereas interchange fees are fixed or variable charges paid to the card-issuing banks for transaction authorization and risk management. Scheme fees, on the other hand, are set by card networks and cover operational costs, network maintenance, and brand usage, making them distinct from interchange fees but collectively impacting the overall merchant service charges.

Interchange Pass-Through

Interchange pass-through occurs when merchants absorb the interchange fee, a percentage-based charge set by card networks paid to the issuing bank, rather than the fixed scheme fee that covers processing and network costs. This approach directly links merchant fees to interchange rates, enabling clearer cost transparency and potentially variable expenses compared to the typically stable scheme fee.

Card Network Charges

Card network charges primarily consist of interchange fees paid by merchants to card-issuing banks and scheme fees collected by card networks like Visa and Mastercard to cover operational costs. Interchange fees vary based on transaction type and region, while scheme fees are fixed or percentage-based charges that support network infrastructure and security.

Interchange Fee vs Scheme Fee Infographic

moneydif.com

moneydif.com