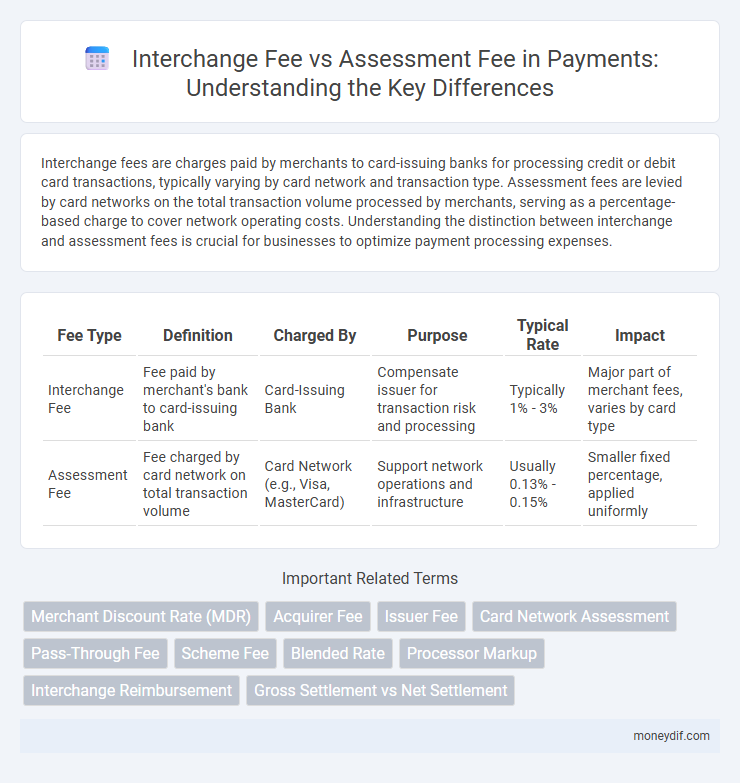

Interchange fees are charges paid by merchants to card-issuing banks for processing credit or debit card transactions, typically varying by card network and transaction type. Assessment fees are levied by card networks on the total transaction volume processed by merchants, serving as a percentage-based charge to cover network operating costs. Understanding the distinction between interchange and assessment fees is crucial for businesses to optimize payment processing expenses.

Table of Comparison

| Fee Type | Definition | Charged By | Purpose | Typical Rate | Impact |

|---|---|---|---|---|---|

| Interchange Fee | Fee paid by merchant's bank to card-issuing bank | Card-Issuing Bank | Compensate issuer for transaction risk and processing | Typically 1% - 3% | Major part of merchant fees, varies by card type |

| Assessment Fee | Fee charged by card network on total transaction volume | Card Network (e.g., Visa, MasterCard) | Support network operations and infrastructure | Usually 0.13% - 0.15% | Smaller fixed percentage, applied uniformly |

Understanding Interchange Fees in Payment Processing

Interchange fees are transaction fees paid by merchants to card-issuing banks whenever a consumer uses a credit or debit card, typically representing the largest portion of payment processing costs. These fees vary based on card type, transaction method, and merchant category, influencing overall merchant fees and pricing strategies. Understanding interchange fees is essential for merchants optimizing payment processing expenses and negotiating better terms with payment processors.

What Are Assessment Fees?

Assessment fees are charges imposed by card networks like Visa and MasterCard on each transaction, calculated as a percentage of the transaction amount. These fees fund the operation, maintenance, and improvements of the card network infrastructure. Unlike interchange fees paid to issuing banks, assessment fees are retained by the card networks themselves to support network services and security.

Key Differences Between Interchange Fees and Assessment Fees

Interchange fees are charges paid by the merchant's bank to the cardholder's issuing bank for each transaction, primarily determined by card type and transaction method. Assessment fees are fixed percentages or flat fees that the card network, such as Visa or Mastercard, charges the merchant's acquiring bank to cover network maintenance and operations. The key difference lies in interchange fees compensating issuing banks for transaction risk and costs, while assessment fees fund the card network infrastructure.

How Interchange Fees Are Determined

Interchange fees are determined by card networks based on factors such as the type of card used, the transaction amount, and the merchant's industry category, reflecting the risk and processing cost associated with each transaction. These fees are set to compensate issuing banks for fraud risk, credit costs, and handling expenses. Assessment fees, by contrast, are charged by the card network itself as a small percentage of the transaction volume to cover operational costs and network maintenance.

The Role of Card Networks in Assessment Fees

Card networks such as Visa and Mastercard play a crucial role in assessment fees by charging merchants a percentage of each transaction to cover the cost of maintaining and operating the payment network infrastructure. Unlike interchange fees, which are paid directly to card-issuing banks, assessment fees provide card networks with revenue to support security, processing systems, and innovation. These fees typically represent a smaller portion of the total transaction cost but are essential for ensuring the smooth functioning and reliability of the payment ecosystem.

Impact of Interchange and Assessment Fees on Merchants

Interchange fees, charged by card-issuing banks, directly affect merchants by increasing the cost of each card transaction, often making up the largest portion of processing fees. Assessment fees, imposed by card networks, add an additional percentage-based cost on total transaction volume, further impacting merchant profitability. Together, these fees influence pricing strategies, profit margins, and the overall cost structure for businesses accepting card payments.

Reducing Interchange and Assessment Costs

Reducing interchange and assessment fees requires optimizing transaction routing by leveraging lower-cost card networks and implementing efficient payment processing strategies. Merchants can negotiate with payment processors to obtain better rates and adopt technologies like tokenization to minimize fraud-related charges. Monitoring transaction data helps identify high-cost payment methods, enabling targeted cost reduction without compromising payment acceptance.

Common Misconceptions About Payment Processing Fees

Interchange fees are charged by card-issuing banks for each transaction and represent the largest portion of payment processing costs, while assessment fees are smaller charges levied by card networks for network maintenance. Many merchants mistakenly conflate these fees, believing assessment fees to be variable or negotiable like interchange fees, which is incorrect since assessment fees are generally fixed percentages set by card networks. Understanding the distinct roles and structures of interchange and assessment fees helps businesses accurately manage and optimize their payment processing expenses.

Interchange Fee vs. Assessment Fee: Who Sets the Rates?

Interchange fees are set by credit card networks and paid to the card-issuing banks to compensate for handling transaction risks and costs. Assessment fees are determined by the card networks themselves and are charged as a percentage of the transaction amount to cover network operation costs. Understanding the distinction between interchange and assessment fees is crucial for merchants managing their payment processing expenses.

Future Trends in Interchange and Assessment Fee Structures

Interchange fees, typically set by card networks and paid to issuing banks, and assessment fees, charged by payment networks for transaction processing, are evolving as digital payment adoption grows globally. Future trends indicate a shift towards more transparent, usage-based fee models driven by regulatory pressure and the rise of real-time payment systems. Innovations in blockchain and AI-powered analytics are expected to optimize fee structures, enhancing cost-efficiency and enabling dynamic adjustments aligned with transaction risk and volume.

Important Terms

Merchant Discount Rate (MDR)

Merchant Discount Rate (MDR) represents the total fee merchants pay for card transactions, comprising two key components: the Interchange Fee, which is paid to the issuing bank as compensation for transaction risks and costs, and the Assessment Fee, charged by the card network for processing and infrastructure services. Understanding the balance between Interchange Fees and Assessment Fees is crucial for merchants aiming to optimize payment processing costs and negotiate better terms with payment providers.

Acquirer Fee

Acquirer Fee typically encompasses both Interchange Fee and Assessment Fee, where the Interchange Fee is paid to the issuing bank as compensation for processing transactions, and the Assessment Fee is charged by the card network for maintaining the payment infrastructure. Understanding the distinction between these fees is crucial for merchants, as the Interchange Fee varies by card type and transaction, while the Assessment Fee is usually a fixed percentage applied to the transaction volume.

Issuer Fee

Issuer fees represent the portion of transaction costs paid to the card-issuing bank, primarily derived from interchange fees set by payment networks, which compensate issuers for managing cardholder accounts and fraud risk. Assessment fees are separate charges imposed by the card networks as a percentage of the transaction volume, covering network operational costs and infrastructure, distinct from the issuer-focused interchange fees.

Card Network Assessment

Card network assessment fees are charges imposed by payment networks like Visa or Mastercard to cover the operational costs of running the network, while interchange fees are paid by merchants' banks to cardholders' banks as a compensation for transaction risks and costs. Understanding the distinction between interchange fees, which affect merchant pricing, and assessment fees, which support network infrastructure, is crucial for optimizing payment processing expenses.

Pass-Through Fee

Pass-through fees typically encompass both interchange fees, which are set by card networks and paid to issuing banks as compensation for transaction risks and rewards, and assessment fees, which are charged by card networks for processing transactions. Merchants usually see interchange fees as variable costs tied to transaction volume, while assessment fees are fixed percentages levied on total sales, making the pass-through fee a combined expense reflecting both components.

Scheme Fee

Scheme fees are charges imposed by card networks on transactions, typically divided into interchange fees paid to issuing banks and assessment fees retained by the card network for processing. Interchange fees vary based on card type and transaction method, while assessment fees are usually a fixed percentage of the transaction volume to cover network operational costs.

Blended Rate

The blended rate combines interchange fees and assessment fees into a single cost metric for processing card transactions, reflecting the total percentage charged by card networks and issuing banks. This rate simplifies merchant fee structures by merging the variable interchange fee, paid to card issuers, with the fixed assessment fee, collected by card networks, providing a comprehensive overview of transaction costs.

Processor Markup

Processor markup refers to the additional fee that payment processors add on top of the interchange fee, which is the amount paid to card-issuing banks during credit and debit card transactions. This markup, combined with the assessment fee charged by card networks, contributes to the total cost merchants incur for processing electronic payments.

Interchange Reimbursement

Interchange reimbursement involves compensating the issuing bank for costs related to transaction processing, typically represented by the interchange fee, which varies based on card type, merchant category, and transaction method. Assessment fees, charged by card networks like Visa or Mastercard, are separate from interchange fees and cover network operation costs, calculated as a percentage of the total transaction volume processed by the merchant.

Gross Settlement vs Net Settlement

Gross settlement requires full transaction amounts to be settled individually, impacting interchange fees paid per transaction, while net settlement aggregates multiple transactions, reducing the frequency and thus potentially lowering total assessment fees levied on the net amount. Interchange fees are typically merchant-specific charges passed on per transaction, whereas assessment fees are calculated as a percentage of the total volume settled, making net settlement more cost-efficient in terms of assessment fee calculation.

Interchange Fee vs Assessment Fee Infographic

moneydif.com

moneydif.com