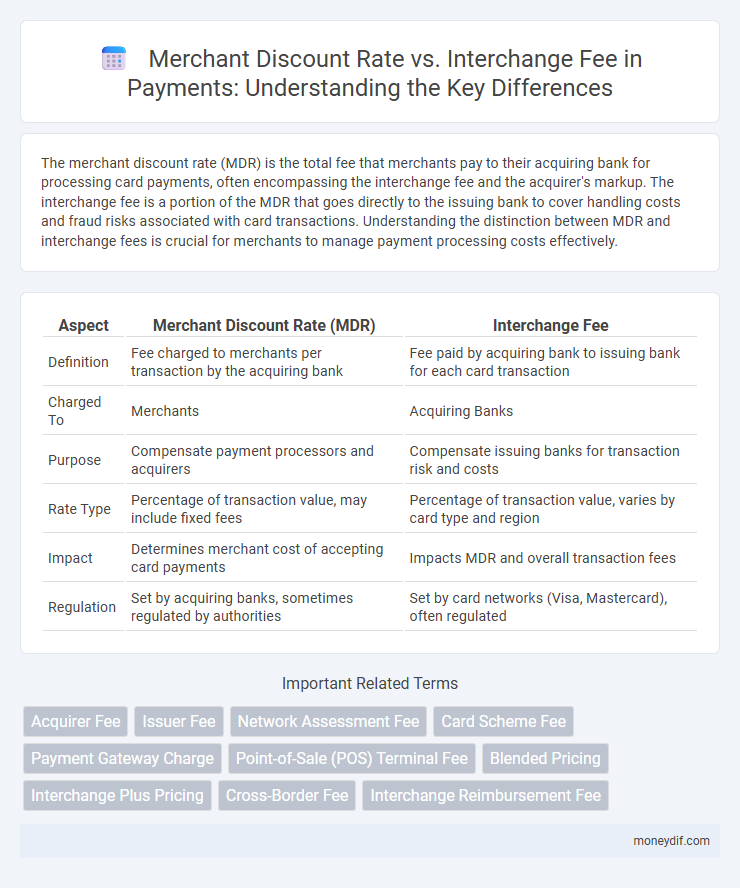

The merchant discount rate (MDR) is the total fee that merchants pay to their acquiring bank for processing card payments, often encompassing the interchange fee and the acquirer's markup. The interchange fee is a portion of the MDR that goes directly to the issuing bank to cover handling costs and fraud risks associated with card transactions. Understanding the distinction between MDR and interchange fees is crucial for merchants to manage payment processing costs effectively.

Table of Comparison

| Aspect | Merchant Discount Rate (MDR) | Interchange Fee |

|---|---|---|

| Definition | Fee charged to merchants per transaction by the acquiring bank | Fee paid by acquiring bank to issuing bank for each card transaction |

| Charged To | Merchants | Acquiring Banks |

| Purpose | Compensate payment processors and acquirers | Compensate issuing banks for transaction risk and costs |

| Rate Type | Percentage of transaction value, may include fixed fees | Percentage of transaction value, varies by card type and region |

| Impact | Determines merchant cost of accepting card payments | Impacts MDR and overall transaction fees |

| Regulation | Set by acquiring banks, sometimes regulated by authorities | Set by card networks (Visa, Mastercard), often regulated |

Introduction to Merchant Discount Rate and Interchange Fee

Merchant Discount Rate (MDR) is the percentage fee that merchants incur for processing card payments, which covers the cost charged by banks and payment processors. Interchange Fee is a component of the MDR, representing the fee paid by the acquiring bank to the issuing bank for each card transaction. Understanding the difference between MDR and Interchange Fee is essential for merchants to manage transaction costs effectively.

Defining Merchant Discount Rate

Merchant Discount Rate (MDR) is the fee merchants pay to payment processors for handling card transactions, typically expressed as a percentage of the transaction value plus a fixed amount. MDR encompasses the interchange fee, which is the portion paid to the card-issuing bank, along with additional fees charged by the payment processor and network. Understanding MDR is crucial for merchants to evaluate the total cost of accepting card payments and negotiate better rates.

Understanding Interchange Fees

Interchange fees are charges set by credit card networks and paid by merchants' banks to card-issuing banks for processing transactions. These fees compensate issuers for risks and costs related to fraud prevention, transaction authorization, and customer rewards programs. Understanding interchange fees is crucial for merchants seeking to manage payment processing costs and negotiate fair Merchant Discount Rates (MDR).

Key Differences: Merchant Discount Rate vs Interchange Fee

The Merchant Discount Rate (MDR) is the total fee a merchant pays to the acquiring bank for processing card transactions, typically expressed as a percentage of the transaction value. The Interchange Fee is a portion of the MDR, set by card networks, that is paid to the issuing bank to cover handling costs, fraud, and credit risk. Key differences include that MDR is the overall cost to the merchant, while Interchange Fee specifically compensates the card issuer, with the remaining amount covering acquirer fees and payment processor charges.

Components of Merchant Discount Rate

The Merchant Discount Rate (MDR) comprises several key components, primarily the interchange fee, the acquirer fee, and network fees, each contributing to the total cost merchants incur per transaction. The interchange fee is paid to the card-issuing bank and usually represents the largest portion of the MDR, reflecting risk and processing costs. Acquirer fees and network fees cover transaction processing, fraud prevention, and the operational expenses of payment networks like Visa or MasterCard.

How Interchange Fees Are Calculated

Interchange fees are calculated as a percentage of the transaction amount plus a fixed fee, set by the card networks to compensate card-issuing banks. These fees vary based on factors such as card type, transaction method (e.g., in-person or online), and merchant category code, reflecting the risk and cost associated with each transaction. Understanding the detailed fee structure helps merchants anticipate costs beyond the Merchant Discount Rate, which includes additional processing fees charged by payment processors.

Impact on Merchants’ Bottom Line

Merchant Discount Rate (MDR) directly affects merchants' bottom line as it represents the total fee deducted from each transaction, encompassing both the Interchange Fee paid to card-issuing banks and the acquirer's markup. Interchange Fees, set by card networks, are a significant component of MDR and vary by card type and transaction method, influencing overall processing costs for merchants. Higher MDR reduces net sales revenue, emphasizing the need for merchants to negotiate favorable rates or optimize payment acceptance strategies to safeguard profitability.

Regulatory Perspectives: MDR vs Interchange

Regulatory frameworks often distinguish between Merchant Discount Rate (MDR) and Interchange Fee due to their different roles in payment processing. MDR is a fee charged by acquiring banks to merchants and is typically regulated to protect businesses from excessive charges. Interchange Fees, paid by acquirers to issuing banks, are subject to caps or limits imposed by regulators to promote fair competition and reduce overall transaction costs.

Industry Examples and Case Studies

Merchant Discount Rate (MDR) represents the total fee merchants pay to payment processors for card transactions, while Interchange Fee is the portion paid to the issuing banks. In the retail industry, major players like Amazon and Walmart negotiate lower MDRs to minimize costs, reflecting their high transaction volumes and bargaining power, whereas small businesses often face higher MDRs, impacting profit margins. Case studies from the European payments market show how regulatory caps on Interchange Fees, such as the EU's Payment Services Directive, have reduced overall MDRs, benefiting both merchants and consumers by fostering competitive pricing.

Future Trends in Payment Processing Fees

Merchant discount rates (MDR) and interchange fees will evolve significantly as digital and contactless payments gain dominance, pushing payment processors to balance cost-efficiency with enhanced security protocols. Emerging technologies like blockchain and AI-driven fraud detection are expected to reduce processing fees and increase transparency in fee structures. Regulatory pressures and competitive dynamics will further drive the shift toward lower MDR and interchange fees, benefiting merchants and consumers alike.

Important Terms

Acquirer Fee

Acquirer fees typically represent the portion of the Merchant Discount Rate (MDR) retained by the acquiring bank after paying the interchange fee to the issuing bank.

Issuer Fee

Issuer Fee typically represents the portion of the Merchant Discount Rate allocated to the card-issuing bank, distinct from the Interchange Fee which is the fixed fee paid between acquiring and issuing banks.

Network Assessment Fee

Network Assessment Fee directly impacts the Merchant Discount Rate by covering the costs associated with the Interchange Fee charged to merchants during card transaction processing.

Card Scheme Fee

Card Scheme Fee influences the overall Merchant Discount Rate (MDR) by covering network operational costs and brand usage, while the Interchange Fee, set by card-issuing banks, constitutes the largest portion of the MDR and compensates for transaction risks and processing expenses. Merchants often experience a combined impact where the Interchange Fee drives cost variability based on transaction type, and the Card Scheme Fee ensures consistent revenue for card networks like Visa and Mastercard.

Payment Gateway Charge

Payment gateway charges directly impact the Merchant Discount Rate, which includes the interchange fee paid to card-issuing banks during transaction processing.

Point-of-Sale (POS) Terminal Fee

The Point-of-Sale (POS) Terminal Fee is a charge imposed on merchants, influenced by the Merchant Discount Rate (MDR) which covers processing costs, while the Interchange Fee is a component of MDR paid to card-issuing banks for transaction authorization and risk management.

Blended Pricing

Blended pricing combines the Merchant Discount Rate and Interchange Fee into a single rate, simplifying payment processing costs for merchants by averaging fixed and variable fees.

Interchange Plus Pricing

Interchange Plus Pricing transparently separates the Merchant Discount Rate into the fixed Interchange Fee set by card networks and a small markup, enabling merchants to understand and control their true processing costs.

Cross-Border Fee

Cross-border fees increase overall transaction costs as merchants pay higher Merchant Discount Rates (MDR) due to elevated Interchange Fees imposed on international card payments.

Interchange Reimbursement Fee

The Interchange Reimbursement Fee directly influences the Merchant Discount Rate, as merchants pay this fee to card-issuing banks for transaction processing. While the Merchant Discount Rate encompasses the Interchange Fee plus additional costs such as assessment and processor fees, the Interchange Fee remains the largest component driving overall cost.

Merchant Discount Rate vs Interchange Fee Infographic

moneydif.com

moneydif.com