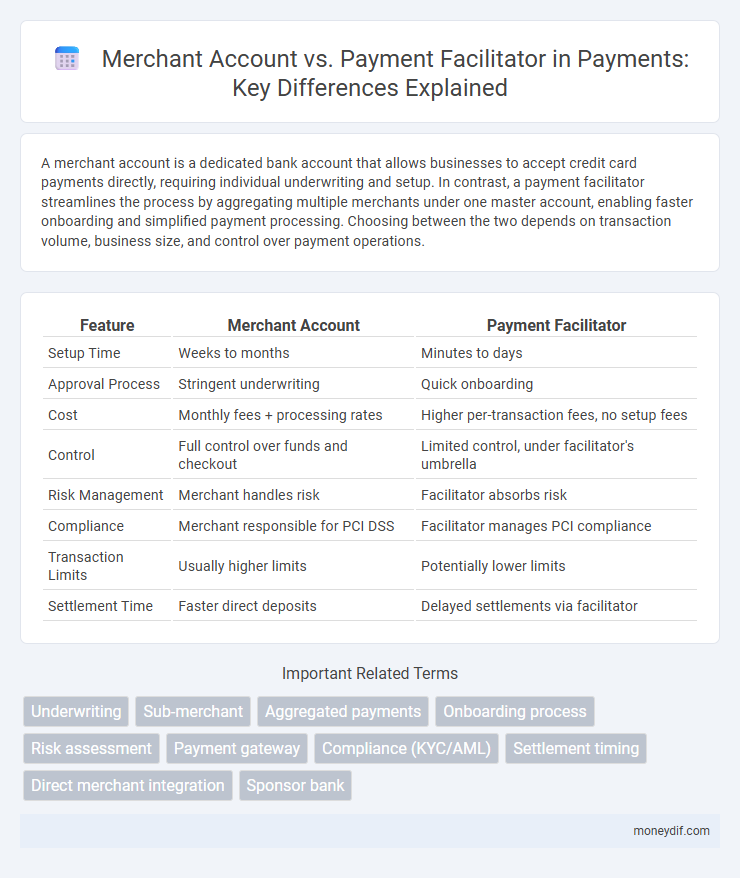

A merchant account is a dedicated bank account that allows businesses to accept credit card payments directly, requiring individual underwriting and setup. In contrast, a payment facilitator streamlines the process by aggregating multiple merchants under one master account, enabling faster onboarding and simplified payment processing. Choosing between the two depends on transaction volume, business size, and control over payment operations.

Table of Comparison

| Feature | Merchant Account | Payment Facilitator |

|---|---|---|

| Setup Time | Weeks to months | Minutes to days |

| Approval Process | Stringent underwriting | Quick onboarding |

| Cost | Monthly fees + processing rates | Higher per-transaction fees, no setup fees |

| Control | Full control over funds and checkout | Limited control, under facilitator's umbrella |

| Risk Management | Merchant handles risk | Facilitator absorbs risk |

| Compliance | Merchant responsible for PCI DSS | Facilitator manages PCI compliance |

| Transaction Limits | Usually higher limits | Potentially lower limits |

| Settlement Time | Faster direct deposits | Delayed settlements via facilitator |

Introduction to Merchant Accounts and Payment Facilitators

A merchant account is a specialized bank account that allows businesses to accept and process credit card payments directly, providing control over transaction processes and funds settlement. Payment facilitators act as intermediaries by aggregating multiple merchants under a single master merchant account, simplifying onboarding and payment acceptance without requiring individual merchant accounts. Businesses often choose payment facilitators for faster setup and lower upfront costs, while merchant accounts offer greater customization and control over payment operations.

What is a Merchant Account?

A merchant account is a specialized bank account that allows businesses to accept and process electronic payment transactions, including credit and debit card payments. It serves as an intermediary holding account where funds from customer transactions are temporarily stored before being transferred to the business's main operating account. Establishing a merchant account typically involves underwriting and risk assessment by a bank or payment processor, ensuring the business meets security and compliance standards for payment processing.

What is a Payment Facilitator?

A payment facilitator (PayFac) is a service provider that enables merchants to accept electronic payments by acting as a master merchant under a single merchant account, simplifying the onboarding process. Unlike traditional merchant accounts that require individual underwriting and setup for each business, PayFacs aggregate multiple sub-merchants under one account, allowing faster approval and streamlined payment processing. Payment facilitators handle compliance, risk management, and payment settlement, making them ideal for platforms or marketplaces with multiple sellers.

Core Differences: Merchant Account vs Payment Facilitator

A merchant account is a dedicated bank account enabling businesses to accept card payments directly, requiring individual underwriting and compliance processes. In contrast, a payment facilitator aggregates multiple merchants under a single master account, simplifying onboarding but sharing underwriting responsibility and risk management. The core difference lies in control and liability: merchants with their own accounts have greater autonomy and direct settlement, while payment facilitators offer faster setup with centralized processing and pooled risk exposure.

Onboarding Process Comparison

Merchant accounts require businesses to undergo a thorough underwriting process involving credit checks, financial documentation, and risk assessments before approval. Payment facilitators streamline onboarding by allowing sub-merchants to quickly register under a master account, minimizing paperwork and approval time. This model significantly accelerates time-to-market for businesses compared to the traditional merchant account setup.

Fee Structures: Merchant Account vs Payment Facilitator

Merchant accounts typically involve fixed monthly fees, transaction fees ranging from 1.5% to 3.5%, and setup costs depending on the provider, making them cost-effective for high-volume merchants. Payment facilitators charge a flat-rate fee per transaction, often between 2.5% and 3.5%, with minimal or no setup fees, providing greater flexibility for small to medium businesses. Understanding the fee structure differences is crucial for merchants to optimize payment processing costs based on sales volume and business model.

Risk Management and Security Considerations

Merchant accounts require businesses to independently manage risk assessment, fraud prevention, and compliance with PCI DSS standards, placing significant responsibility on the merchant for security controls. Payment facilitators centralize risk management by underwriting sub-merchants and monitoring transactions in real time, leveraging advanced security protocols and fraud detection tools to mitigate risk across multiple merchants. Both structures demand robust encryption, tokenization, and adherence to regulatory requirements, but payment facilitators benefit from shared resources that enhance overall security posture.

Settlement Times and Fund Availability

Merchant accounts typically offer faster settlement times by directly processing transactions through the acquiring bank, leading to quicker fund availability, often within 24 to 48 hours. Payment facilitators aggregate multiple sub-merchants under a single master account, which can extend settlement times to 3 to 5 business days due to pooled processing and additional risk management. Businesses requiring rapid access to funds often prefer merchant accounts, while those prioritizing ease of onboarding may opt for payment facilitators despite longer fund availability periods.

Scalability for Growing Businesses

Merchant accounts provide businesses with direct access to payment processing, offering control but requiring significant setup and underwriting time. Payment facilitators streamline onboarding by allowing businesses to operate under a master account, enabling rapid scalability with reduced administrative overhead. For growing businesses, leveraging a payment facilitator accelerates market entry and supports high-volume transactions without the complexities of maintaining individual merchant accounts.

Choosing the Right Solution for Your Business

Selecting the appropriate payment solution depends on your business size, transaction volume, and control needs. Merchant accounts offer direct underwriting and can reduce per-transaction fees, ideal for established businesses with high sales. Payment facilitators simplify onboarding and management by aggregating multiple merchants under one master account, best suited for startups and small businesses seeking quick access to payment processing.

Important Terms

Underwriting

Underwriting for merchant accounts involves a detailed risk assessment of the individual business, including credit history, sales volume, and industry type, whereas payment facilitators conduct underwriting on behalf of multiple sub-merchants, streamlining the onboarding process by aggregating risk at the facilitator level. This distinction significantly affects approval speed, compliance requirements, and liability distribution between the merchant and the payment facilitator.

Sub-merchant

A sub-merchant operates under a payment facilitator's master merchant account, enabling expedited onboarding and simplified compliance compared to individual merchant accounts. This structure allows sub-merchants to process transactions without securing their own merchant account, leveraging the payment facilitator's underwriting and risk management.

Aggregated payments

Aggregated payments involve processing transactions through a payment facilitator that pools multiple merchants under a single master merchant account, simplifying onboarding and reducing individual merchant compliance burdens. Merchant accounts, on the other hand, require each business to have a unique account with the payment processor, providing greater control and customized terms but increased complexity and setup time.

Onboarding process

The onboarding process for merchant accounts involves individual underwriting, where each merchant is separately evaluated for risk and compliance by the acquiring bank. In contrast, payment facilitators streamline onboarding by underwriting merchants under their master merchant account, enabling faster activation and simplified risk management.

Risk assessment

Risk assessment for merchant accounts involves evaluating the individual business's financial stability, transaction history, and potential for fraud, while payment facilitators conduct aggregated risk assessments across multiple sub-merchants, leveraging real-time data analytics and advanced fraud detection tools to mitigate collective exposure. Payment facilitators generally face higher regulatory scrutiny and must implement robust onboarding processes and continuous risk monitoring protocols to manage the increased volume and variety of transactions processed under their umbrella.

Payment gateway

A payment gateway securely transmits transaction data between merchants and payment processors, playing a crucial role in e-commerce payment authorization. Unlike merchant accounts that require individual underwriting for each business, payment facilitators streamline the process by aggregating multiple merchants under a single master merchant account, accelerating onboarding and simplifying compliance.

Compliance (KYC/AML)

Compliance in KYC/AML for merchant accounts requires rigorous verification of individual merchants to prevent fraud and money laundering, whereas payment facilitators handle aggregated compliance responsibilities by onboarding multiple sub-merchants under a single master account. Payment facilitators streamline risk management processes but must maintain robust monitoring systems to ensure ongoing compliance across all sub-merchant activities.

Settlement timing

Settlement timing for merchant accounts typically ranges from 1 to 3 business days as funds are processed directly through the acquiring bank, while payment facilitators often provide faster settlement, sometimes within 24 hours, by aggregating payments across multiple sub-merchants and streamlining fund distribution. Payment facilitators leverage their intermediary role to expedite cash flow, whereas traditional merchant accounts follow standard banking protocols that can delay fund availability.

Direct merchant integration

Direct merchant integration requires a merchant account, enabling businesses to process payments independently while maintaining full control over transaction data. In contrast, payment facilitators simplify onboarding by aggregating multiple sub-merchants under a single master account, accelerating payments acceptance but often with less control over customer and transaction information.

Sponsor bank

Sponsor banks enable payment facilitators to underwrite and manage merchant accounts, allowing sub-merchants to process payments under the facilitator's master account. Unlike traditional merchant accounts where businesses hold individual agreements with banks, payment facilitators streamline onboarding and risk management through the sponsor bank's infrastructure.

merchant account vs payment facilitator Infographic

moneydif.com

moneydif.com