BIN (Bank Identification Number) and IIN (Issuer Identification Number) both refer to the initial digits of a payment card that identify the issuing bank or institution. The terms are often used interchangeably; however, IIN is the more modern and accurate term reflecting the card issuer rather than just the bank. Understanding the distinction improves payment processing accuracy and fraud prevention in electronic transactions.

Table of Comparison

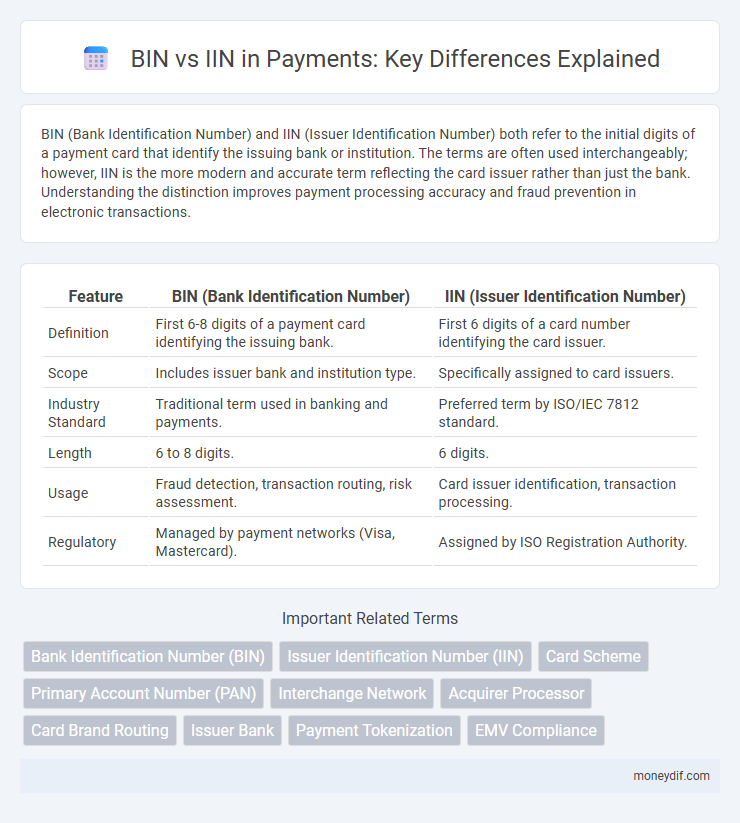

| Feature | BIN (Bank Identification Number) | IIN (Issuer Identification Number) |

|---|---|---|

| Definition | First 6-8 digits of a payment card identifying the issuing bank. | First 6 digits of a card number identifying the card issuer. |

| Scope | Includes issuer bank and institution type. | Specifically assigned to card issuers. |

| Industry Standard | Traditional term used in banking and payments. | Preferred term by ISO/IEC 7812 standard. |

| Length | 6 to 8 digits. | 6 digits. |

| Usage | Fraud detection, transaction routing, risk assessment. | Card issuer identification, transaction processing. |

| Regulatory | Managed by payment networks (Visa, Mastercard). | Assigned by ISO Registration Authority. |

Understanding BIN and IIN: Key Definitions

BIN (Bank Identification Number) and IIN (Issuer Identification Number) are crucial components in payment card processing, identifying the issuing bank or institution of a credit or debit card. Both BIN and IIN typically consist of the first six digits of a card number, serving the same function in routing transactions and preventing fraud. Understanding these identifiers enhances transaction security and accuracy within the payment ecosystem.

BIN vs IIN: What’s the Difference?

BIN (Bank Identification Number) and IIN (Issuer Identification Number) both refer to the first six digits of a payment card number used to identify the issuing institution. While BIN originally described bank-issued cards, IIN is a broader term encompassing all card issuers, including banks, credit unions, and other financial entities. The shift from BIN to IIN reflects industry changes to cover a wider variety of payment methods and issuer types without altering the fundamental identification process.

The Role of BIN and IIN in Payment Processing

Bank Identification Number (BIN) and Issuer Identification Number (IIN) both serve as crucial elements in payment processing by identifying the institution that issued a payment card. BIN typically refers to the first six digits of a card number and helps payment networks route transactions to the correct issuer for authorization and fraud prevention. IIN is synonymous with BIN, encompassing the same digits and playing a key role in verifying card details and ensuring secure transaction handling across global payment systems.

How BIN and IIN Improve Transaction Security

BIN (Bank Identification Number) and IIN (Issuer Identification Number) enhance transaction security by accurately identifying the issuing bank or institution during payment processing, reducing fraud risk. Both BIN and IIN enable real-time verification of card authenticity, helping to detect suspicious activities and prevent unauthorized transactions. Their integration in payment gateways strengthens authorization protocols and supports compliance with security standards like PCI DSS.

BIN/IIN Identification: Why It Matters for Merchants

BIN (Bank Identification Number) and IIN (Issuer Identification Number) are crucial for merchants as they identify the issuing institution of a payment card, enabling accurate transaction routing and fraud prevention. Effective BIN/IIN identification helps merchants validate card legitimacy, tailor payment acceptance strategies, and minimize chargebacks. Leveraging comprehensive BIN/IIN databases enhances transaction security and optimizes payment processing efficiency across various card networks.

Common Uses of BIN and IIN in Modern Payments

Bank Identification Number (BIN) and Issuer Identification Number (IIN) are crucial for identifying the issuing financial institution in payment transactions. BIN is commonly used by merchants and payment processors to authorize credit card payments, detect fraud, and route transactions to the correct issuer. IIN, a more current term interchangeable with BIN, is applied in tokenization, card verification, and transaction tracking within modern payment systems.

BIN and IIN in Fraud Prevention Strategies

BIN (Bank Identification Number) and IIN (Issuer Identification Number) are critical components in payment fraud prevention strategies, enabling the identification of the card-issuing institution to verify transaction legitimacy. BIN helps detect suspicious activity by cross-referencing transaction data with known fraud patterns associated with specific issuers. Implementing IIN/BIN checks allows payment processors to enhance authentication protocols and reduce unauthorized transactions.

Regulatory Standards for BIN and IIN Management

Regulatory standards for BIN (Bank Identification Number) and IIN (Issuer Identification Number) management ensure financial institutions comply with international payment systems and secure transaction processing. These standards mandate strict data handling protocols, regular audits, and adherence to PCI DSS (Payment Card Industry Data Security Standard) guidelines to prevent fraud and protect cardholder information. Compliance with EMVCo and ISO/IEC specifications facilitates interoperability and enhances global payment system security.

Technological Advances Shaping BIN and IIN Usage

Technological advances in payment processing have enhanced the accuracy and speed of BIN (Bank Identification Number) and IIN (Issuer Identification Number) recognition, enabling real-time fraud detection and seamless transaction routing. The integration of machine learning algorithms with BIN/IIN databases allows payment systems to dynamically update issuer profiles, improving authorization efficiency and security. Innovations in tokenization and encryption further reinforce the trustworthiness of BIN and IIN usage within digital wallets and mobile payment platforms.

Choosing the Right BIN/IIN Solution for Your Business

Selecting the appropriate BIN (Bank Identification Number) or IIN (Issuer Identification Number) solution enhances transaction accuracy and fraud prevention by identifying the card issuer promptly. Businesses benefit from tailored BIN/IIN services that align with their payment processing volume, geographic reach, and compliance requirements, ensuring seamless card acceptance and improved customer experience. Integrating advanced BIN/IIN databases supports efficient authorization, risk management, and regulatory adherence, optimizing payment workflows and reducing operational costs.

Important Terms

Bank Identification Number (BIN)

Bank Identification Number (BIN) and Issuer Identification Number (IIN) both refer to the initial six digits of a payment card that uniquely identify the issuing bank or institution for transaction processing and fraud prevention.

Issuer Identification Number (IIN)

Issuer Identification Number (IIN) is a six-digit code that uniquely identifies a card issuer, often used interchangeably with Bank Identification Number (BIN) although IIN is the more current and accurate term in payment industry standards.

Card Scheme

Card schemes define BIN (Bank Identification Number) and IIN (Issuer Identification Number) as interchangeable terms identifying the first 6 to 8 digits of a card number that specify the issuing bank or institution.

Primary Account Number (PAN)

The Primary Account Number (PAN) uniquely identifies a payment card and begins with the Issuer Identification Number (IIN), formerly known as the Bank Identification Number (BIN), which represents the institution that issued the card. While BIN traditionally referred to the first six digits of the PAN, modern standards use IIN to encompass these digits for identifying card networks, issuing banks, and card types.

Interchange Network

Interchange Network processes transactions using Bank Identification Numbers (BINs), now often referred to as Issuer Identification Numbers (IINs), to accurately route payment card data between issuing banks and merchants.

Acquirer Processor

An Acquirer Processor uses the Bank Identification Number (BIN) and Issuer Identification Number (IIN) interchangeably to identify the card-issuing institution during payment processing.

Card Brand Routing

Card brand routing optimizes transaction processing by using BIN (Bank Identification Number) or IIN (Issuer Identification Number) to accurately identify the card issuer and route payments through the correct network.

Issuer Bank

The Issuer Bank is identified by the Bank Identification Number (BIN), which has evolved to the Issuer Identification Number (IIN) standard to enhance global transaction security and accurately link cardholder accounts to specific financial institutions.

Payment Tokenization

Payment tokenization replaces sensitive card data with a secure token, where BIN (Bank Identification Number) and IIN (Issuer Identification Number) both refer to the first six digits used to identify the issuing bank during transaction authorization.

EMV Compliance

EMV compliance requires accurate BIN (Bank Identification Number) and IIN (Issuer Identification Number) recognition to ensure secure payment card transactions and prevent fraud.

BIN vs IIN Infographic

moneydif.com

moneydif.com