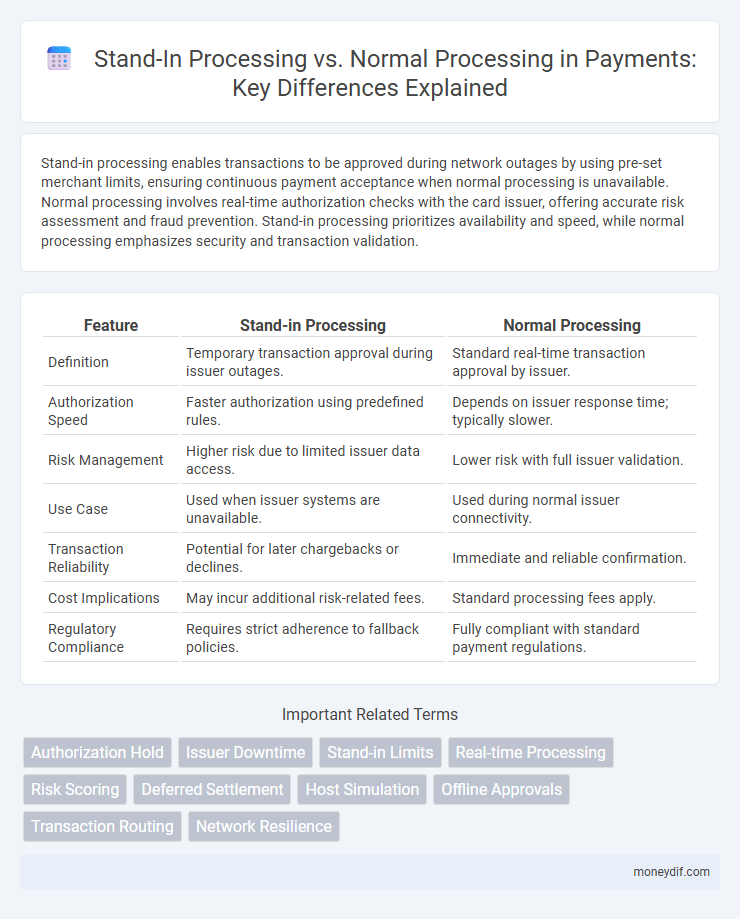

Stand-in processing enables transactions to be approved during network outages by using pre-set merchant limits, ensuring continuous payment acceptance when normal processing is unavailable. Normal processing involves real-time authorization checks with the card issuer, offering accurate risk assessment and fraud prevention. Stand-in processing prioritizes availability and speed, while normal processing emphasizes security and transaction validation.

Table of Comparison

| Feature | Stand-in Processing | Normal Processing |

|---|---|---|

| Definition | Temporary transaction approval during issuer outages. | Standard real-time transaction approval by issuer. |

| Authorization Speed | Faster authorization using predefined rules. | Depends on issuer response time; typically slower. |

| Risk Management | Higher risk due to limited issuer data access. | Lower risk with full issuer validation. |

| Use Case | Used when issuer systems are unavailable. | Used during normal issuer connectivity. |

| Transaction Reliability | Potential for later chargebacks or declines. | Immediate and reliable confirmation. |

| Cost Implications | May incur additional risk-related fees. | Standard processing fees apply. |

| Regulatory Compliance | Requires strict adherence to fallback policies. | Fully compliant with standard payment regulations. |

Understanding Stand-In Processing in Payment Systems

Stand-in processing allows acquirers to approve transactions when the issuer is unavailable, reducing declines and improving customer experience. It relies on predefined rules and risk parameters to authorize payments without real-time issuer verification. This method enhances transaction continuity during network outages or issuer downtime, ensuring smoother payment operations.

What is Normal Processing in Payment Transactions?

Normal processing in payment transactions refers to the standard procedure where transaction data is sent directly to the card issuer for authorization and settlement without intermediate intervention. This process ensures real-time verification of cardholder details, available funds, and fraud checks, enabling secure and efficient payment completion. It contrasts with stand-in processing, which temporarily authorizes transactions when the issuer systems are unavailable, relying on predefined criteria for approval.

Key Differences Between Stand-In and Normal Processing

Stand-in processing occurs when the issuer is offline or unavailable, allowing the acquirer or payment network to authorize transactions based on preset risk criteria, whereas normal processing involves real-time communication with the issuer for transaction approval. Stand-in processing enables quicker authorization decisions and reduces transaction declines during connectivity issues but carries higher risk due to the lack of issuer verification. Normal processing provides enhanced security and fraud detection through direct issuer verification, ensuring accurate transaction approvals based on up-to-date account information.

Benefits of Stand-In Processing for Payment Continuity

Stand-in processing ensures uninterrupted payment authorization during issuer downtime by using predefined risk parameters to approve transactions. This method reduces transaction declines and enhances customer satisfaction by maintaining seamless payment acceptance even when the issuer's systems are unavailable. It also mitigates revenue loss for merchants by minimizing payment disruptions and supporting continuous transaction flow.

Challenges and Risks of Stand-In Payment Processing

Stand-in payment processing introduces challenges such as increased exposure to fraud and chargebacks due to the absence of real-time cardholder authentication. Merchants face heightened risks from transaction disputes and regulatory compliance issues, as stand-in processing often bypasses issuer validations. The reliance on pre-set risk parameters rather than dynamic issuer decisions can lead to elevated processing costs and potential financial losses.

When is Stand-In Processing Triggered?

Stand-in processing is triggered when the issuer's authorization system is unavailable or slow to respond, such as during network outages, technical failures, or system maintenance. It allows the acquirer to approve transactions based on predefined risk parameters without real-time issuer approval. This ensures uninterrupted payment acceptance, minimizing declined transactions and enhancing customer experience despite temporary issuer system disruptions.

Security Considerations in Stand-In vs Normal Processing

Stand-in processing enhances transaction continuity by authorizing payments during issuer downtime, but it relies on predetermined risk parameters that may increase exposure to fraudulent activities compared to normal processing. Normal processing provides real-time issuer verification, ensuring higher security through updated fraud detection and authenticated cardholder data. Balancing availability and risk mitigation requires robust algorithms and continuous monitoring to minimize potential security vulnerabilities inherent in stand-in authorization.

Impact on Merchant and Cardholder Experience

Stand-in processing enables merchants to approve transactions during system outages by using stored card data, reducing payment disruptions and maintaining sales continuity. Normal processing relies on real-time authorization from the card issuer, which can lead to declined transactions if network issues occur, negatively affecting both merchants and cardholders. Stand-in processing enhances the cardholder experience by minimizing declined transactions and ensuring smooth payment acceptance despite connectivity problems.

Real-World Examples of Stand-In and Normal Payment Processing

Stand-in processing allowed a major airline to complete ticket purchases during a network outage by authorizing payments through the card issuer's backup system, preventing revenue loss. In contrast, normal processing relies on the cardholder's bank responding in real time, as seen in typical retail transactions where authorization and settlement happen seamlessly under regular network conditions. Retailers often benefit from stand-in processing during peak sales or technical failures, maintaining transaction flow without waiting for standard issuer approval.

Future Trends in Payment Processing: Stand-In Innovations

Future trends in payment processing highlight stand-in processing innovations that enable merchants to approve transactions during network outages by relying on pre-set risk criteria. This technology leverages machine learning algorithms to optimize authorization decisions, ensuring seamless payment acceptance and reducing transaction declines. Enhanced security protocols and real-time data analytics further improve the reliability and efficiency of stand-in processing in evolving payment ecosystems.

Important Terms

Authorization Hold

Authorization hold temporarily reserves funds on a card during stand-in processing, enabling transactions to proceed even when the issuer is unavailable. Normal processing confirms fund availability and finalizes the hold through direct issuer authorization in real-time.

Issuer Downtime

Issuer downtime occurs when an issuer's systems are unavailable, causing transactions to fail real-time authorization. Stand-in processing enables acquirers or payment networks to approve transactions temporarily by using predefined risk parameters, ensuring continuity, while normal processing requires live issuer verification for transaction approval.

Stand-in Limits

Stand-in limits define the maximum allowable authorization amounts during stand-in processing, where transactions are authorized by the issuer's substitute system instead of the issuer's real-time system. Normal processing relies on direct issuer approval, while stand-in processing enables continued transaction flow when issuer systems are unavailable, ensuring seamless payment acceptance within predefined stand-in limits.

Real-time Processing

Real-time processing ensures immediate data processing with minimal latency, crucial for applications like live streaming and financial trading, whereas stand-in processing temporarily handles data during system failures to maintain continuity without full real-time speed. Normal processing typically operates on batch or scheduled intervals, lacking the instantaneous response required in time-critical environments.

Risk Scoring

Risk scoring in stand-in processing utilizes predefined criteria and historical transaction data to assess fraud likelihood when normal authorization channels are unavailable, ensuring seamless transaction approval. In contrast, normal processing relies on real-time data communication with issuing banks for dynamic risk evaluation, offering higher accuracy but potential delays during communication failures.

Deferred Settlement

Deferred settlement in stand-in processing allows transactions to be authorized immediately by a substitute system when the issuer is unavailable, with final settlement occurring later, reducing declined transactions and enhancing customer experience. In contrast, normal processing requires real-time issuer authorization, which can lead to declined transactions or delays if the issuer's system is unreachable during the transaction time.

Host Simulation

Host simulation enhances system testing by replicating real-time environments, enabling stand-in processing to substitute actual hardware or software components, which reduces cost and risk. Unlike normal processing that relies on live systems, stand-in processing uses virtual models to validate functionality and performance before deployment, ensuring accuracy and reliability in complex integrations.

Offline Approvals

Offline approvals enable transaction authorization without immediate connectivity to central systems, facilitating stand-in processing when normal online processing is unavailable. Stand-in processing relies on preset risk parameters and issuer guidelines to approve transactions offline, ensuring continued service and reducing declines during network outages or system disruptions.

Transaction Routing

Transaction routing in payment systems determines whether a transaction undergoes stand-in processing or normal processing based on issuer availability and authorization criteria. Stand-in processing enables the acquirer to approve or decline transactions when the issuer is unavailable, ensuring continuous transaction flow and minimizing declined payments, whereas normal processing relies on real-time issuer authorization.

Network Resilience

Stand-in processing enhances network resilience by enabling continued service during central node failures through temporary local data handling, while normal processing relies on central control for all operations, risking complete disruption. This decentralized approach minimizes downtime and maintains communication integrity under network stress or outages.

stand-in processing vs normal processing Infographic

moneydif.com

moneydif.com