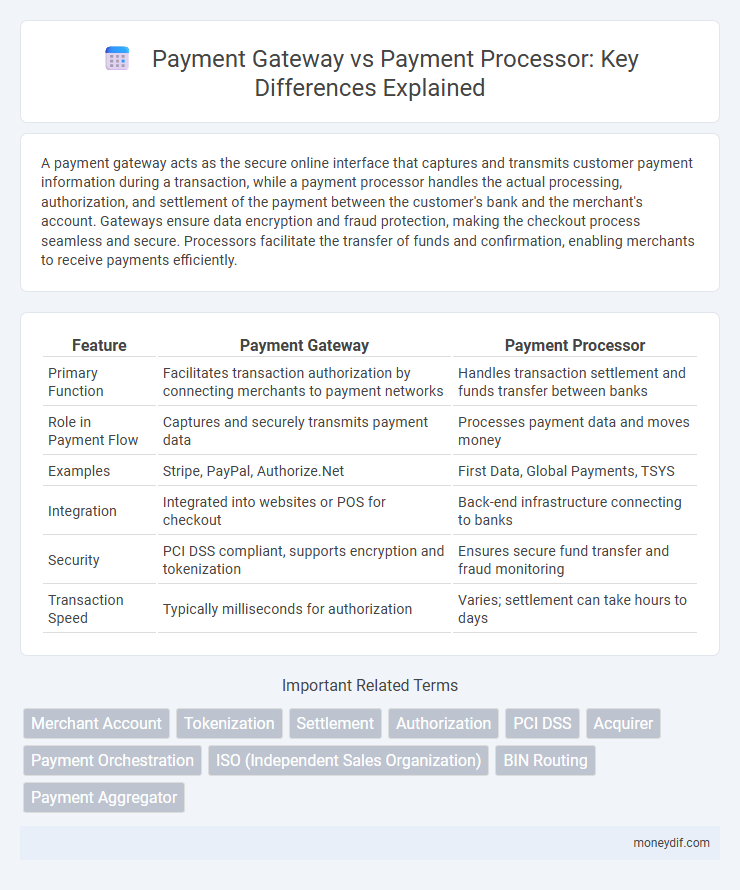

A payment gateway acts as the secure online interface that captures and transmits customer payment information during a transaction, while a payment processor handles the actual processing, authorization, and settlement of the payment between the customer's bank and the merchant's account. Gateways ensure data encryption and fraud protection, making the checkout process seamless and secure. Processors facilitate the transfer of funds and confirmation, enabling merchants to receive payments efficiently.

Table of Comparison

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Primary Function | Facilitates transaction authorization by connecting merchants to payment networks | Handles transaction settlement and funds transfer between banks |

| Role in Payment Flow | Captures and securely transmits payment data | Processes payment data and moves money |

| Examples | Stripe, PayPal, Authorize.Net | First Data, Global Payments, TSYS |

| Integration | Integrated into websites or POS for checkout | Back-end infrastructure connecting to banks |

| Security | PCI DSS compliant, supports encryption and tokenization | Ensures secure fund transfer and fraud monitoring |

| Transaction Speed | Typically milliseconds for authorization | Varies; settlement can take hours to days |

Introduction to Payment Gateways and Processors

Payment gateways securely transmit transaction data between customers, merchants, and financial institutions, encrypting sensitive information to prevent fraud. Payment processors handle the authorization, settlement, and fund transfer from the customer's bank to the merchant's account, ensuring transactions are completed efficiently. Both components are essential in the payment ecosystem, with gateways acting as the communication bridge and processors managing the actual movement of funds.

What is a Payment Gateway?

A payment gateway is a technology that securely authorizes and facilitates online payment transactions between customers and merchants by encrypting sensitive information. It acts as the intermediary that captures payment data, processes it, and communicates with the payment processor and financial institutions to confirm transaction approval. Payment gateways ensure secure data transmission, fraud protection, and compliance with industry standards like PCI DSS.

What is a Payment Processor?

A payment processor is a company or service that handles the transaction process by transmitting payment data between the merchant, card networks, and banks to authorize and complete payments. It ensures secure communication and verification of card details, funds availability, and transaction approval. Payment processors play a critical role in enabling merchants to accept credit or debit card payments efficiently and securely.

Key Differences Between Gateway and Processor

Payment gateways act as the secure interface that captures and transmits customer payment information from websites or apps to the payment processor. Payment processors handle the backend transaction by communicating with banks, authorizing payments, and settling funds into merchant accounts. Key differences include gateways managing data encryption and customer authentication, while processors focus on transaction approval and fund transfer logistics.

How Payment Gateways Work in Online Transactions

Payment gateways securely transmit customer payment information from an online store to the payment processor by encrypting sensitive data during checkout. They authorize transactions by communicating with the issuing bank to verify availability of funds without storing card details, ensuring PCI compliance. This real-time validation facilitates seamless approval or decline responses, enabling smooth online payment processing.

How Payment Processors Handle Transactions

Payment processors handle transactions by securely transmitting payment information from the merchant to the acquiring bank and then to the card networks, ensuring authorization from the issuing bank. They manage the communication between all parties involved to approve or decline the transaction in real-time. The processor also facilitates settlement by transferring funds to the merchant's account after the transaction is completed.

Security Considerations: Gateway vs Processor

Payment gateways prioritize encryption protocols like TLS and PCI DSS compliance to secure transaction data during transmission, minimizing interception risks. Payment processors implement fraud detection algorithms and tokenization to safeguard sensitive cardholder information within their systems. Both entities must maintain robust cybersecurity measures, but gateways focus on secure data transfer while processors emphasize internal data protection and transaction verification.

Choosing the Right Solution for Your Business

Selecting the right payment solution depends on business size, transaction volume, and integration needs; payment gateways securely transmit transaction data while processors handle fund transfers from customer to merchant accounts. For businesses seeking simple online transactions, a reliable payment gateway with fraud protection ensures smooth checkout experiences, whereas high-volume retailers may benefit from advanced processors offering customizable payment options and faster settlements. Evaluating fees, security features, and compatibility with existing systems is crucial to maximize efficiency and customer trust in payment processing.

Integration and Compatibility: Gateway vs Processor

Payment gateways provide seamless integration with e-commerce platforms, shopping carts, and multiple payment methods, enabling smooth transaction initiation and authorization. Payment processors handle the backend communication with financial institutions, often requiring compatibility with payment gateways and merchant accounts to complete transaction settlements. Choosing a gateway versus a processor depends on the level of integration needed for checkout customization and the supported payment ecosystems.

Cost and Fee Structures: Comparing Gateway and Processor

Payment gateways typically charge setup fees, monthly fees, and a per-transaction fee, often ranging from 0.5% to 3% plus a small fixed amount, depending on volume and service level. Payment processors usually apply interchange fees set by card networks, which average around 1.5% to 2.9% per transaction, plus a flat fee, with costs varying based on card type and transaction method. Understanding the distinction in fee structures helps businesses optimize expenses by selecting the right combination of gateway and processor tailored to transaction volume and payment methods.

Important Terms

Merchant Account

A merchant account connects businesses to payment processors who authorize transactions, while the gateway securely transmits payment data between the merchant and the processor.

Tokenization

Tokenization enhances payment security by replacing sensitive card data with unique tokens, which gateways transmit for authorization while processors handle transaction settlement and fund transfers.

Settlement

Settlement involves the final transfer of funds between a payment processor and a merchant's bank, with the gateway facilitating transaction authorization but not directly handling the settlement of funds.

Authorization

Authorization in payment systems determines transaction approval and authorization gateways act as intermediaries transmitting transaction data to payment processors for validation and funds allocation.

PCI DSS

PCI DSS compliance requirements differ between payment gateways and processors, with gateways focusing on secure transmission of cardholder data and processors emphasizing data storage and transaction processing security.

Acquirer

An acquirer is a financial institution that processes credit and debit card payments by connecting merchants to payment gateways, which serve as the technology interface, while processors handle the transaction authorization and settlement.

Payment Orchestration

Payment orchestration centralizes transaction routing by integrating multiple payment gateways and processors to optimize authorization rates, reduce decline rates, and streamline settlement processes.

ISO (Independent Sales Organization)

An Independent Sales Organization (ISO) partners with payment gateways and processors to facilitate credit card transactions by managing merchant accounts and streamlining payment authorization and settlement processes.

BIN Routing

BIN routing determines transaction flow by directing payment data through either the gateway or processor based on the Bank Identification Number for optimized authorization efficiency.

Payment Aggregator

A Payment Aggregator simplifies merchant transactions by pooling multiple payment methods through a single gateway, whereas a Payment Processor handles the direct authorization and settlement of individual payment transactions.

Gateway vs Processor Infographic

moneydif.com

moneydif.com