Omni-channel payment systems provide a seamless and integrated customer experience across all sales channels, enabling consistent transaction processing whether online, in-store, or via mobile apps. Multi-channel payment methods operate independently across different platforms, which can lead to fragmented customer interactions and inconsistencies in payment data. Businesses leveraging omni-channel strategies benefit from improved customer satisfaction and streamlined operations, while multi-channel approaches may require separate management for each channel.

Table of Comparison

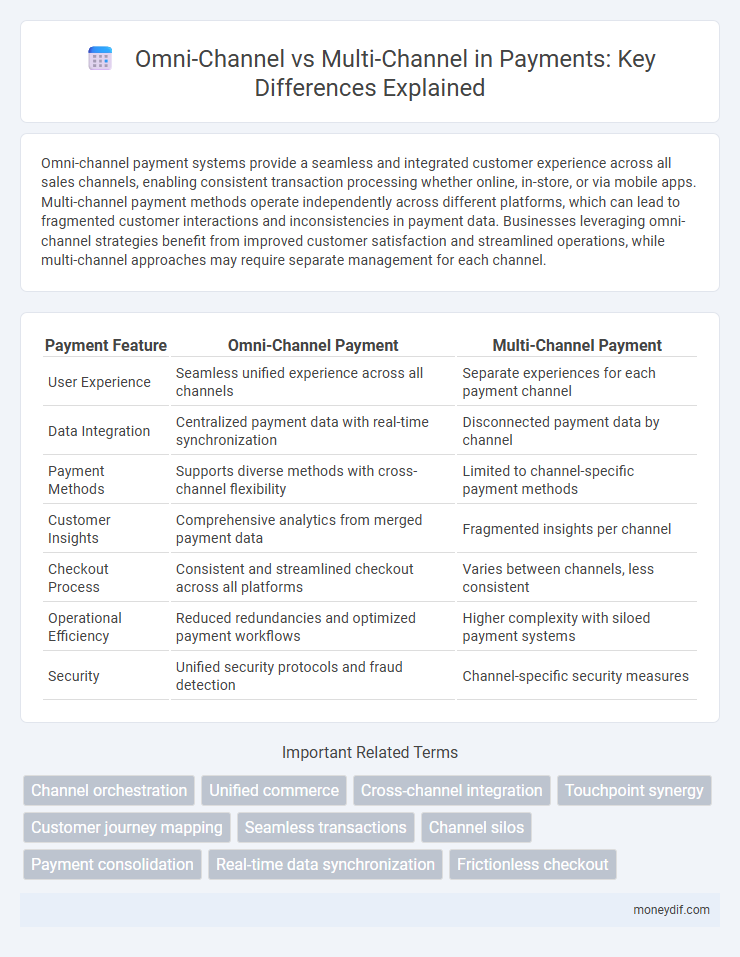

| Payment Feature | Omni-Channel Payment | Multi-Channel Payment |

|---|---|---|

| User Experience | Seamless unified experience across all channels | Separate experiences for each payment channel |

| Data Integration | Centralized payment data with real-time synchronization | Disconnected payment data by channel |

| Payment Methods | Supports diverse methods with cross-channel flexibility | Limited to channel-specific payment methods |

| Customer Insights | Comprehensive analytics from merged payment data | Fragmented insights per channel |

| Checkout Process | Consistent and streamlined checkout across all platforms | Varies between channels, less consistent |

| Operational Efficiency | Reduced redundancies and optimized payment workflows | Higher complexity with siloed payment systems |

| Security | Unified security protocols and fraud detection | Channel-specific security measures |

Understanding Omni-Channel Payments

Omni-channel payments integrate seamless transaction experiences across online, mobile, in-store, and social media platforms, ensuring consistent customer data and payment methods regardless of the interaction channel. This approach enhances payment security by centralizing fraud detection and offers unified reporting, unlike multi-channel systems that operate independently across separate platforms. Businesses leveraging omni-channel payment solutions benefit from increased customer lifetime value through personalized promotions and frictionless checkout experiences.

What are Multi-Channel Payment Solutions?

Multi-channel payment solutions enable businesses to accept payments through various independent channels such as in-store, online, mobile apps, and call centers, providing customers with multiple distinct options. These solutions operate separately without integrated data sharing, often requiring businesses to manage different payment systems and reconciliations for each channel. Multi-channel payment solutions enhance customer convenience by offering diverse payment methods but lack the unified experience and centralized management found in omni-channel payment systems.

Key Differences Between Omni-Channel and Multi-Channel Payments

Omni-channel payments integrate multiple payment methods across all customer touchpoints, providing a seamless and consistent transaction experience whether online, in-store, or via mobile app. Multi-channel payments operate across several platforms but function independently, often resulting in fragmented customer data and inconsistent payment flows. Key differences lie in data synchronization and customer experience, with omni-channel enabling unified payment history and personalized service, unlike the isolated channels of multi-channel systems.

Customer Experience: Omni-Channel vs Multi-Channel

Omni-channel payment systems create a seamless customer experience by integrating multiple platforms, allowing users to start transactions on one channel and complete them on another without disruption. Multi-channel payment methods provide various separate options but lack unified interaction, often causing inconsistent service and fragmented user data. Customers benefit from omni-channel approaches through enhanced convenience, personalized service, and smoother payment processes across all touchpoints.

Integration of Payment Systems in Both Models

Omni-channel payment systems provide seamless integration across all platforms, enabling unified transaction processing regardless of the customer's chosen channel. Multi-channel payment systems tend to operate independently across different channels, resulting in fragmented payment experiences and inconsistent data synchronization. Integrated omni-channel payments enhance customer convenience, improve data accuracy, and streamline reconciliation processes for businesses.

Security Considerations: Omni-Channel and Multi-Channel

Omni-channel payment systems integrate security protocols across all touchpoints, providing a unified defense against fraud by leveraging centralized data analytics and real-time monitoring. Multi-channel payments operate independently, which can create vulnerabilities due to fragmented security measures and inconsistent encryption standards. Ensuring end-to-end encryption and implementing tokenization across omni-channel platforms significantly reduces the risk of data breaches compared to isolated multi-channel approaches.

Payment Data Synchronization and Accessibility

Omni-channel payment systems ensure seamless data synchronization across all platforms, providing real-time accessibility to transaction information, which enhances customer experience and reduces reconciliation errors. Multi-channel payment setups often operate in silos, leading to fragmented payment data and delayed access to critical transaction details. Synchronizing payment data in an omni-channel environment supports unified reporting and improved fraud detection through consolidated analytics.

Scalability and Flexibility in Payment Methods

Omni-channel payment systems offer superior scalability by seamlessly integrating multiple payment methods across various platforms, enabling consistent customer experiences regardless of the channel used. Unlike multi-channel setups that operate independently, omni-channel solutions provide flexibility through centralized management, allowing businesses to quickly adapt to emerging payment technologies and consumer preferences. This unified approach reduces friction in transactions and supports growth by accommodating a diverse range of payment options including mobile wallets, credit cards, and contactless payments.

Challenges in Implementing Omni-Channel and Multi-Channel Payments

Implementing omni-channel payments faces challenges such as integrating disparate payment systems across physical stores, online platforms, and mobile apps to create a seamless customer experience. Multi-channel payment systems struggle with data fragmentation and inconsistent transaction records, leading to difficulties in unified reconciliation and fraud detection. Security compliance and real-time processing are critical hurdles in both approaches, requiring advanced technology and coordinated backend infrastructure.

Future Trends in Payment Channels: What to Expect

Future payment channels will prioritize seamless integration across omni-channel platforms, enabling customers to switch effortlessly between in-store, online, and mobile payments with unified experiences. Advanced technologies like AI-driven personalization and biometric authentication will enhance security and convenience within omni-channel payment ecosystems. Multi-channel approaches will evolve toward deeper connectivity and real-time data synchronization to meet increasing consumer demand for flexibility and speed.

Important Terms

Channel orchestration

Channel orchestration integrates multiple customer touchpoints into a unified experience, optimizing engagement across all communication platforms in contrast to multi-channel strategies that operate channels independently. Effective channel orchestration leverages data analytics and real-time customer insights to deliver seamless interactions, enhancing brand consistency and increasing conversion rates in omni-channel environments.

Unified commerce

Unified commerce integrates all customer touchpoints and sales channels into a single, cohesive platform, ensuring consistent inventory, data, and customer experience across online and offline environments. Unlike multi-channel approaches that treat channels independently, unified commerce enables real-time synchronization and seamless engagement, driving higher operational efficiency and customer satisfaction.

Cross-channel integration

Cross-channel integration unifies customer interactions across multiple channels into a seamless experience, enhancing consistency and engagement compared to multi-channel strategies where channels operate independently. Omni-channel approaches leverage cross-channel integration to synchronize marketing, sales, and support touchpoints, driving improved customer satisfaction and loyalty.

Touchpoint synergy

Touchpoint synergy in omni-channel strategies ensures seamless customer experiences by integrating all communication channels into a unified system, enhancing engagement and data consistency across platforms. In contrast, multi-channel approaches operate channels independently, leading to fragmented customer interactions and missed opportunities for holistic insight and personalized marketing.

Customer journey mapping

Customer journey mapping reveals that omni-channel strategies provide a seamless and integrated customer experience across multiple platforms, unlike multi-channel approaches which often operate in silos, leading to inconsistent engagements. By aligning touchpoints and data in an omni-channel framework, businesses enhance personalization and customer satisfaction throughout each interaction stage.

Seamless transactions

Seamless transactions in omni-channel retail integrate customer interactions across all digital and physical touchpoints, ensuring consistent inventory updates, unified payment processing, and personalized experiences that drive higher customer satisfaction and retention. Multi-channel approaches, while offering multiple platforms for purchase, lack the interconnected backend systems of omni-channel strategies, often resulting in fragmented data and inconsistent transaction flows.

Channel silos

Channel silos occur when communication and customer data are isolated within individual channels, limiting the seamless experience essential in omni-channel strategies compared to multi-channel approaches. Omni-channel integration breaks down these silos by unifying customer interactions across all platforms, enhancing personalization and consistent engagement.

Payment consolidation

Payment consolidation streamlines transactions across omni-channel retail by integrating various payment methods into a unified platform, enhancing customer experience and operational efficiency. Unlike multi-channel approaches that manage payments separately per channel, omni-channel consolidation provides seamless financial reconciliation and real-time data synchronization.

Real-time data synchronization

Real-time data synchronization ensures consistent customer experiences by instantly updating information across all touchpoints in an omni-channel strategy, unlike multi-channel approaches where data often remains siloed, leading to fragmented interactions. This seamless integration of data across devices and platforms enhances personalization, inventory management, and decision-making in omni-channel retail environments.

Frictionless checkout

Frictionless checkout enhances the omni-channel experience by seamlessly integrating multiple sales channels into a unified customer journey, reducing cart abandonment and boosting conversion rates. Unlike multi-channel approaches that operate channels independently, omni-channel frictionless checkout synchronizes inventory and payment systems to provide a consistent, efficient transaction process across all touchpoints.

omni-channel vs multi-channel Infographic

moneydif.com

moneydif.com