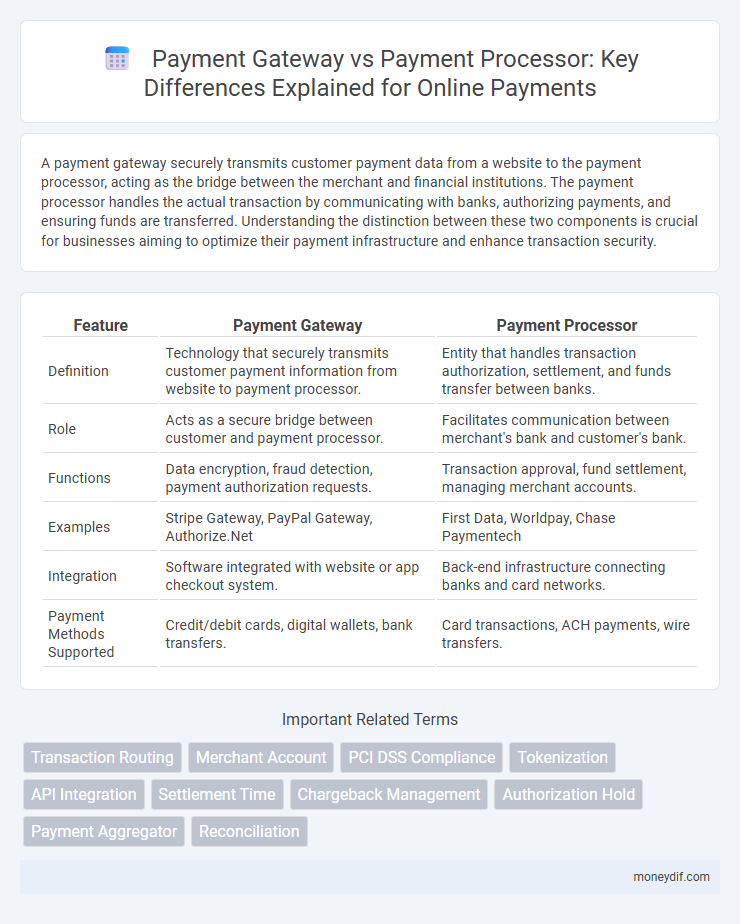

A payment gateway securely transmits customer payment data from a website to the payment processor, acting as the bridge between the merchant and financial institutions. The payment processor handles the actual transaction by communicating with banks, authorizing payments, and ensuring funds are transferred. Understanding the distinction between these two components is crucial for businesses aiming to optimize their payment infrastructure and enhance transaction security.

Table of Comparison

| Feature | Payment Gateway | Payment Processor |

|---|---|---|

| Definition | Technology that securely transmits customer payment information from website to payment processor. | Entity that handles transaction authorization, settlement, and funds transfer between banks. |

| Role | Acts as a secure bridge between customer and payment processor. | Facilitates communication between merchant's bank and customer's bank. |

| Functions | Data encryption, fraud detection, payment authorization requests. | Transaction approval, fund settlement, managing merchant accounts. |

| Examples | Stripe Gateway, PayPal Gateway, Authorize.Net | First Data, Worldpay, Chase Paymentech |

| Integration | Software integrated with website or app checkout system. | Back-end infrastructure connecting banks and card networks. |

| Payment Methods Supported | Credit/debit cards, digital wallets, bank transfers. | Card transactions, ACH payments, wire transfers. |

Understanding Payment Gateways

Payment gateways securely transmit customer payment information from a website or app to the payment processor, acting as the intermediary that authorizes transactions. They encrypt sensitive data to protect it during transmission, ensuring compliance with PCI DSS standards and reducing the risk of fraud. Understanding the role of payment gateways highlights their critical function in enabling seamless, secure online payments.

What is a Payment Processor?

A payment processor is a company or service that handles the transmission of transaction data between the merchant, card networks, and banks to complete electronic payments. It ensures secure authorization, processing, and settlement of credit card or debit card transactions in real-time. Key players in payment processing include Visa, Mastercard, and third-party providers like Stripe or Square that facilitate seamless payment experiences for online and in-store purchases.

Key Differences Between Payment Gateways and Payment Processors

Payment gateways serve as the secure interface that captures and transmits customer payment information from the website to the payment processor. Payment processors handle the actual transaction by communicating with the customer's bank and the merchant's bank to authorize and settle payments. Key differences include that payment gateways encrypt and secure data while payment processors manage the transaction approval and fund transfers.

How Payment Gateways Work

Payment gateways securely transmit customer payment data from an online store to the payment processor, encrypting sensitive information to prevent fraud. They authenticate transactions by verifying card details with the issuing bank and ensure the customer's payment method is valid before approval. Acting as the middle layer between merchants and processors, payment gateways facilitate smooth, real-time communication to authorize or decline transactions instantly.

How Payment Processors Operate

Payment processors handle transactions by securely transmitting payment data between the merchant, card networks, and banks to authorize and settle payments. They verify cardholder information, check for fraud, and facilitate the transfer of funds from the customer's bank to the merchant's account. Payment processors work behind the scenes to ensure transactions are completed quickly and securely, operating as the critical infrastructure in the payment ecosystem.

Security Features: Payment Gateway vs Payment Processor

Payment gateways provide robust security features such as SSL encryption, tokenization, and fraud detection to ensure safe data transmission during online transactions. Payment processors focus on securely handling transaction authorization, settlement, and compliance with PCI DSS standards to protect sensitive cardholder information. Both systems work together to reduce fraud risk and maintain the integrity of payment data throughout the payment lifecycle.

Integration Considerations for Businesses

Choosing between a payment gateway and a payment processor hinges on a business's integration needs, as payment gateways act as the interface between a website and payment networks, requiring seamless API integration for smooth online transactions. Payment processors handle the authorization and settlement of payments, necessitating compatibility with existing point-of-sale systems and backend infrastructure. Businesses must evaluate factors such as transaction speed, security protocols like PCI DSS compliance, and support for multiple payment methods to ensure efficient and secure payment processing.

Cost Comparison: Payment Gateway vs Payment Processor

Payment gateways typically charge a setup fee ranging from $0 to $200 and a monthly fee between $10 and $30, plus transaction fees around 0.1% to 0.3% per transaction. Payment processors usually impose transaction fees of 1.5% to 3.5% per sale, with some charging monthly account fees or minimums, resulting in potentially higher overall costs depending on sales volume. Comparing both, businesses with lower transaction volumes may favor payment gateways for cost efficiency, while high-volume sellers might benefit from payment processors due to lower per-transaction fees.

Choosing the Right Solution for Your Business

Selecting the right payment gateway or payment processor depends on your business needs, transaction volume, and security requirements. Payment gateways facilitate the authorization of payments by connecting your online store to the payment network, while payment processors handle the backend transaction data and fund transfers. Evaluating factors such as integration ease, fees, supported payment methods, and fraud prevention capabilities ensures optimal payment solutions tailored for your business growth.

Future Trends in Online Payments

Payment gateways and payment processors will increasingly integrate artificial intelligence and blockchain technologies to enhance security and transaction speed in online payments. Emerging trends include seamless cross-border payments and the adoption of decentralized finance (DeFi), which aim to reduce fees and processing times. Real-time payment settlements and biometric authentication methods are set to become standard, improving user experience and fraud prevention.

Important Terms

Transaction Routing

Transaction routing optimizes payment flows by directing transactions through the most efficient path between payment gateways and payment processors, ensuring lower fees and faster authorization times. Payment gateways securely capture and transmit customer payment data, while payment processors handle the actual transaction settlement and fund transfers with banks.

Merchant Account

A merchant account acts as a holding space for funds collected from credit and debit card transactions, while a payment gateway securely captures and transmits payment information from customers to the payment processor. The payment processor then communicates with banks and card networks to authorize payments and transfer funds to the merchant account, enabling seamless transaction completion.

PCI DSS Compliance

PCI DSS compliance ensures that both payment gateways and payment processors maintain secure handling of cardholder data, reducing the risk of breaches and fraud. Payment gateways facilitate the authorization of card transactions, while payment processors manage the actual transfer of funds, both requiring stringent adherence to PCI DSS standards for data protection.

Tokenization

Tokenization in payment systems replaces sensitive card details with unique tokens to enhance security and reduce fraud risks during transactions. Payment gateways utilize tokenization to securely transmit transaction data, while payment processors use these tokens to authenticate and settle payments without exposing actual card information.

API Integration

API integration enables seamless communication between a payment gateway and other software systems, ensuring secure transaction data transfer and real-time payment authorization. While a payment gateway acts as the interface for processing customer payment details, the payment processor handles the actual transaction by communicating with banks and credit card networks to complete the payment.

Settlement Time

Settlement time for payment gateways typically ranges from a few seconds to a couple of hours, enabling near-instant authorization and customer notification, whereas payment processors often require 1 to 3 business days to complete fund transfers to merchant accounts due to backend banking protocols and batch processing cycles. Efficient coordination between the payment gateway's authorization phase and the payment processor's settlement phase is crucial for minimizing delays and ensuring timely merchant payouts.

Chargeback Management

Chargeback management involves handling disputes and refunds initiated by customers, crucial for both payment gateways and payment processors to mitigate financial losses and maintain transaction integrity. Payment gateways facilitate the authorization and routing of transactions, while payment processors handle the actual transfer of funds and bear greater responsibility for chargeback resolution and compliance with payment network regulations.

Authorization Hold

Authorization hold temporarily reserves funds on a customer's payment method during a transaction, ensuring the Payment Gateway securely transmits authorization requests to the issuing bank. The Payment Processor completes the transaction by settling the funds once the hold converts to a charge, bridging the communication between the Payment Gateway and the merchant's acquiring bank.

Payment Aggregator

A Payment Aggregator simplifies online transactions by allowing merchants to accept payments without a dedicated merchant account, contrasting with Payment Gateways that securely transmit payment information between the customer and the payment processor. Payment Processors handle the actual transaction authorization and settlement, making them crucial for transferring funds between banks after the Payment Gateway facilitates the communication.

Reconciliation

Reconciliation in the context of payment gateways and payment processors involves matching transaction records from both systems to ensure accuracy and detect discrepancies in payments. Effective reconciliation reduces fraud risk, improves financial reporting, and enhances cash flow management by aligning data from payment gateways (which handle customer authorization) with payment processors (which execute fund transfers).

Payment Gateway vs Payment Processor Infographic

moneydif.com

moneydif.com