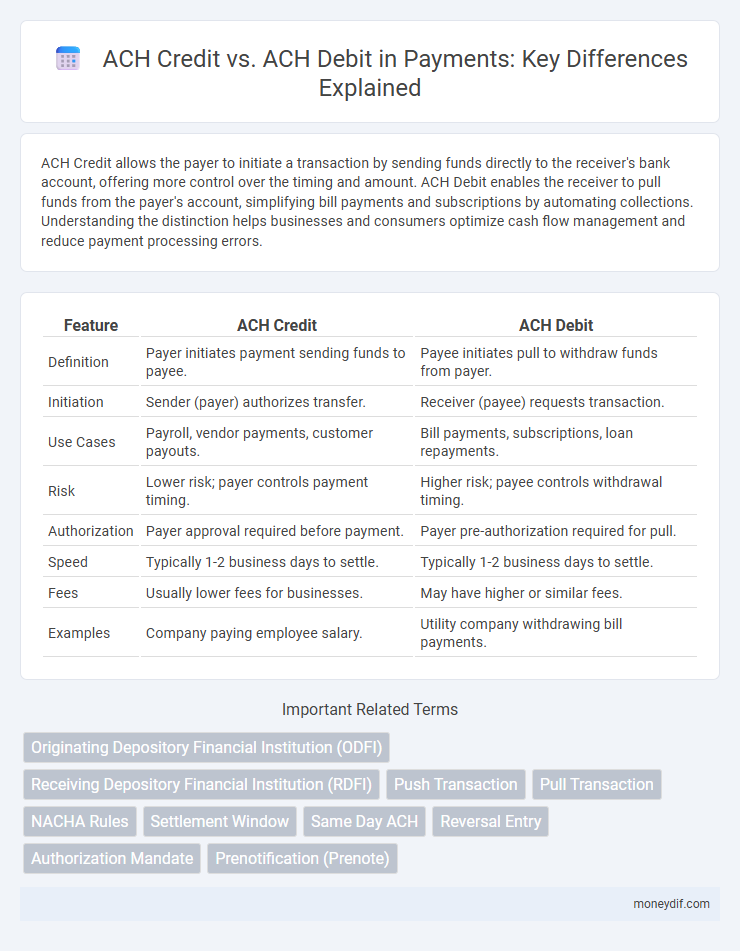

ACH Credit allows the payer to initiate a transaction by sending funds directly to the receiver's bank account, offering more control over the timing and amount. ACH Debit enables the receiver to pull funds from the payer's account, simplifying bill payments and subscriptions by automating collections. Understanding the distinction helps businesses and consumers optimize cash flow management and reduce payment processing errors.

Table of Comparison

| Feature | ACH Credit | ACH Debit |

|---|---|---|

| Definition | Payer initiates payment sending funds to payee. | Payee initiates pull to withdraw funds from payer. |

| Initiation | Sender (payer) authorizes transfer. | Receiver (payee) requests transaction. |

| Use Cases | Payroll, vendor payments, customer payouts. | Bill payments, subscriptions, loan repayments. |

| Risk | Lower risk; payer controls payment timing. | Higher risk; payee controls withdrawal timing. |

| Authorization | Payer approval required before payment. | Payer pre-authorization required for pull. |

| Speed | Typically 1-2 business days to settle. | Typically 1-2 business days to settle. |

| Fees | Usually lower fees for businesses. | May have higher or similar fees. |

| Examples | Company paying employee salary. | Utility company withdrawing bill payments. |

Understanding ACH Credit and ACH Debit

ACH Credit initiates payments from the payer's account by pushing funds directly to the recipient's account, often used for direct deposits and vendor payments. ACH Debit enables the payee to pull funds from the payer's account with prior authorization, commonly utilized for bill payments and subscriptions. Understanding the operational flow and authorization mechanisms of ACH Credit and ACH Debit is essential for managing electronic payments securely and efficiently.

Key Differences Between ACH Credit and ACH Debit

ACH Credit involves the payer initiating a transfer by pushing funds from their bank account to the recipient's account, commonly used for payroll and vendor payments. ACH Debit allows the payee to pull funds directly from the payer's account with authorization, frequently employed in automatic bill payments and subscription services. The primary difference lies in who initiates the transaction and controls the timing of the funds transfer.

How ACH Credit Works

ACH Credit initiates payments when the payer instructs their bank to push funds directly to the recipient's account, enhancing control over transaction timing. This method relies on electronic fund transfers through the Automated Clearing House network, ensuring secure and efficient processing. Businesses frequently employ ACH Credit for payroll disbursements and vendor payments due to its reliability and reduced processing costs.

How ACH Debit Works

ACH Debit initiates payment requests by authorizing funds to be withdrawn directly from the payer's bank account, typically for recurring bills or one-time transactions. The payer provides prior consent to the merchant or service provider, who then submits the debit transaction through the Automated Clearing House network. This process ensures secure and efficient fund transfers, often used for utilities, subscriptions, and loan payments.

Pros and Cons of ACH Credit

ACH Credit offers businesses greater control over payment timing and reduces the risk of overdrafts by allowing the sender to initiate transfers, enhancing cash flow management. It provides faster processing times compared to ACH Debit, lowering the chances of payment errors and disputes. However, ACH Credit requires the sender to have sufficient funds and may involve higher fees, making it less suitable for recurring billing or when the payee prefers automated collections.

Pros and Cons of ACH Debit

ACH Debit enables businesses to initiate payments directly from a customer's bank account, offering reduced risk of failed transactions and enhanced cash flow predictability. However, it requires prior authorization and can lead to customer disputes or chargebacks, increasing administrative overhead. This payment method also imposes limits on transaction reversals compared to ACH Credit, potentially complicating error resolution.

Security Considerations for ACH Transactions

ACH credit transactions generally offer enhanced security by requiring the payer to initiate payment, reducing the risk of unauthorized debits. In contrast, ACH debit transactions carry higher fraud risks as they allow payees to pull funds directly, making it essential to implement strong authorization and verification processes. Employing multi-factor authentication and real-time transaction monitoring significantly mitigates security threats in both ACH credit and debit payments.

Business Use Cases: ACH Credit vs ACH Debit

ACH Credit enables businesses to send payments directly to vendors or employees, improving cash flow management and reducing manual processing errors. ACH Debit is commonly used for automatic bill payments and subscription services, allowing companies to collect funds securely and efficiently from customers. Organizations leveraging ACH Credit benefit from controlled disbursements, whereas ACH Debit streamlines receivables and enhances payment collection reliability.

ACH Credit vs ACH Debit: Which to Choose?

ACH Credit transfers initiate payments from the payer's account to the recipient, offering greater control and security for sending funds, while ACH Debit transactions pull funds from the payer's account upon authorization, making them ideal for recurring payments and bill collections. Choosing between ACH Credit and ACH Debit depends on business needs: ACH Credit suits scenarios needing payer-driven transactions like payroll or supplier payments, whereas ACH Debit is preferred for automated debt collection or subscription billing due to its convenience and efficiency. Evaluating payment authorization control, transaction timing, and risk factors guides the selection of ACH Credit versus ACH Debit for optimized cash flow management.

Future Trends in ACH Payment Methods

ACH credit transactions are gaining momentum due to their ability to expedite direct payments and reduce processing costs for businesses. Emerging trends in ACH payment methods include increased adoption of same-day processing and enhanced security protocols driven by AI and machine learning. These innovations are set to redefine the efficiency and reliability of ACH credit and debit transactions in the near future.

Important Terms

Originating Depository Financial Institution (ODFI)

Originating Depository Financial Institution (ODFI) initiates ACH credit transactions by sending funds on behalf of the originator to the Receiving Depository Financial Institution (RDFI), while for ACH debit transactions, the ODFI submits debit entries to withdraw funds from the receiver's account. The ODFI plays a crucial role in verifying authorization and ensuring compliance with NACHA rules for both ACH credit and debit payments.

Receiving Depository Financial Institution (RDFI)

A Receiving Depository Financial Institution (RDFI) processes both ACH Credit and ACH Debit transactions, where ACH Credit involves funds being pushed into the recipient's account, and ACH Debit allows funds to be pulled from the payer's account. RDFIs verify account details and ensure compliance with NACHA operating rules to facilitate secure and efficient electronic fund transfers within the Automated Clearing House (ACH) network.

Push Transaction

Push transactions in ACH credit involve the originator initiating the transfer by pushing funds directly into the recipient's bank account, enhancing control and reducing payment delays. ACH debit, conversely, allows the recipient to pull funds by authorizing the originator to withdraw from their account, often used for recurring payments or bill collections.

Pull Transaction

Pull transactions in ACH networks involve the originator initiating a debit from the receiver's bank account, commonly referred to as ACH Debit, where funds are drawn out. Conversely, ACH Credit transactions involve the originator pushing funds into the receiver's account, representing a deposit rather than a withdrawal.

NACHA Rules

NACHA Rules govern the processing standards for ACH Credit and ACH Debit transactions, ensuring secure and timely electronic payments between banks and businesses. ACH Credits push funds into a recipient's account, commonly used for payroll or vendor payments, while ACH Debits pull funds out, typically for bill payments or recurring subscriptions.

Settlement Window

The Settlement Window for ACH Credit transactions typically occurs when the sender initiates the payment, and funds are transferred from their bank to the receiver's account within one to two business days. ACH Debit Settlement Windows involve the receiver authorizing the withdrawal of funds from the sender's account, often resulting in a faster settlement process due to direct debit authorization and bank processing timelines.

Same Day ACH

Same Day ACH enables faster processing of ACH Credit and ACH Debit transactions, allowing funds to be transferred or received within the same business day, enhancing cash flow efficiency. ACH Credit initiates payments from the originator to the recipient's bank account, whereas ACH Debit allows the originator to pull funds directly from the recipient's account, both benefiting from accelerated settlement times under Same Day ACH rules.

Reversal Entry

A reversal entry in ACH transactions corrects errors by counteracting a prior ACH credit or ACH debit, restoring accurate account balances. ACH credits transfer funds into an account, while ACH debits withdraw funds, making reversal entries essential for resolving mistaken payments or duplicate transactions.

Authorization Mandate

Authorization mandates for ACH transactions specify whether a payee has the right to initiate ACH debit or credit entries to a payer's account, ensuring compliance with NACHA operating rules. ACH credits require payer authorization to send funds, while ACH debits mandate explicit consent for withdrawals, minimizing fraud and facilitating smooth transaction processing.

Prenotification (Prenote)

Prenotification (Prenote) is a zero-dollar test transaction used in ACH Credit and ACH Debit processes to verify banking information before actual funds transfer; in ACH Credit, the payer initiates payments to the recipient's account, while in ACH Debit, the payee authorizes withdrawals from the payer's account. Effective use of Prenotes minimizes errors and reduces transaction failures by confirming account and routing numbers within NACHA network guidelines.

ACH Credit vs ACH Debit Infographic

moneydif.com

moneydif.com