Reconciliation ensures that payment records match between the sender and receiver, verifying all transactions accurately reflect in their respective accounts. Settlement is the actual transfer of funds from the payer's bank to the payee's bank, finalizing the payment process. Effective payment management requires both reconciliation to detect discrepancies and settlement to complete financial obligations.

Table of Comparison

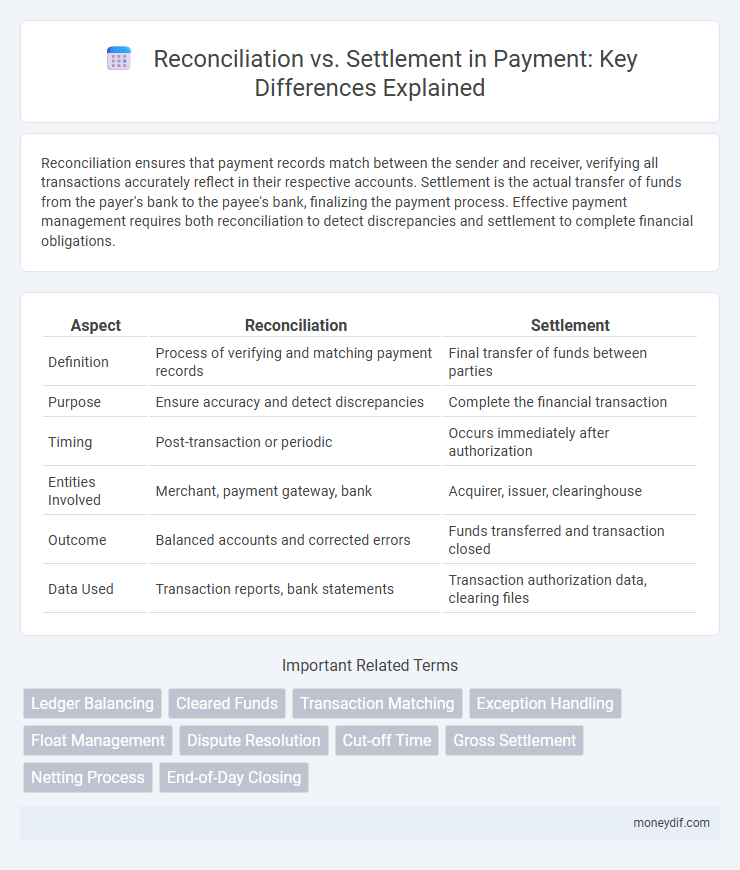

| Aspect | Reconciliation | Settlement |

|---|---|---|

| Definition | Process of verifying and matching payment records | Final transfer of funds between parties |

| Purpose | Ensure accuracy and detect discrepancies | Complete the financial transaction |

| Timing | Post-transaction or periodic | Occurs immediately after authorization |

| Entities Involved | Merchant, payment gateway, bank | Acquirer, issuer, clearinghouse |

| Outcome | Balanced accounts and corrected errors | Funds transferred and transaction closed |

| Data Used | Transaction reports, bank statements | Transaction authorization data, clearing files |

Understanding Payment Reconciliation and Settlement

Payment reconciliation involves matching payment transactions between internal records and external statements to ensure accuracy and completeness. Settlement refers to the final transfer of funds between financial institutions, completing the payment process and updating account balances. Accurate reconciliation prevents errors and discrepancies, while timely settlement confirms the successful completion of transactions in payment systems.

Key Differences Between Reconciliation and Settlement

Reconciliation involves verifying and matching payment transactions to ensure accuracy and consistency between internal records and external statements, while settlement refers to the actual transfer of funds between parties following a transaction. Reconciliation is an ongoing process aimed at identifying discrepancies or errors, whereas settlement completes the financial exchange by settling outstanding balances. Key differences include timing--reconciliation occurs post-transaction to validate data, whereas settlement happens to finalize the payment--and purpose, with reconciliation focused on accuracy and settlement focused on fulfillment of payment obligations.

The Role of Reconciliation in Payment Processing

Reconciliation in payment processing ensures that transactions recorded across different systems match accurately, preventing discrepancies and potential fraud. It involves verifying payment details between merchants, banks, and payment gateways to confirm that funds received align with sales data. Effective reconciliation enhances financial accuracy, reduces errors, and supports timely settlement of payments within the transaction lifecycle.

How Settlement Works in Payment Systems

Settlement in payment systems refers to the process where funds are transferred from the payer's bank to the payee's bank, finalizing the transaction and ensuring the payee receives the money. This process typically involves the clearinghouse or payment processor facilitating the exchange of payment instructions and confirming that sufficient funds are available. Settlement concludes when the net transfer of funds is completed between financial institutions, distinguishing it from reconciliation, which is the post-settlement verification of transaction accuracy.

Common Challenges in Payment Reconciliation

Common challenges in payment reconciliation include discrepancies in transaction data, delayed payment confirmations, and mismatched payment references that hinder accurate record-keeping. Complexities arise from diverse payment methods, currency differences, and inconsistent data formats between merchants, banks, and payment processors. These issues frequently result in increased manual intervention, reconciliation errors, and delayed financial reporting.

Settlement Cycles: What You Need to Know

Settlement cycles determine the timeframe in which funds from payment transactions are transferred from the acquiring bank to the merchant's account, ranging from same-day to several days depending on the payment network and financial institution involved. Understanding settlement cycles is crucial for cash flow management and ensuring timely availability of funds after transaction approval. Unlike reconciliation, which involves verifying and matching transaction records, settlement focuses on the actual transfer of money to complete the payment process.

Importance of Accurate Reconciliation for Businesses

Accurate reconciliation verifies transactions by matching payment records with bank statements, ensuring fraud detection and financial accuracy. It reduces errors, prevents duplicate payments, and maintains clear audit trails vital for regulatory compliance. Efficient reconciliation supports timely settlement, improving cash flow management and overall business financial health.

Technologies Transforming Payment Settlement

Technologies transforming payment settlement include blockchain, which ensures secure, transparent transaction records and accelerates fund transfers. Artificial intelligence optimizes reconciliation by automating matching of payments with invoices, reducing errors and processing time. Real-time payment systems enhance settlement speed, enabling instant clearance and improving cash flow management for businesses.

Best Practices for Efficient Payment Reconciliation

Accurate reconciliation requires matching transactions with payment records to identify discrepancies and ensure financial integrity. Utilizing automated tools with real-time data feeds enhances efficiency by reducing manual errors and accelerating the reconciliation process. Implementing standardized processes and regular reconciliation schedules supports timely detection of anomalies and improves overall payment accuracy.

Choosing the Right Tools for Reconciliation and Settlement

Selecting the right tools for reconciliation and settlement significantly streamlines payment processing by automating transaction matching and error detection. Advanced software solutions offer real-time visibility into discrepancies, enhancing accuracy and reducing manual workload. Integrating these tools with existing payment systems ensures faster settlement cycles and improved financial reporting.

Important Terms

Ledger Balancing

Ledger balancing ensures accurate financial records by verifying that transaction reconciliations match settlements, thereby preventing discrepancies and maintaining accounting integrity.

Cleared Funds

Cleared funds represent fully settled transactions in reconciliation processes, ensuring accurate matching of payments and receipts before final settlement completion.

Transaction Matching

Transaction matching ensures accurate reconciliation by systematically pairing transactions to confirm that settlements reflect authorized and recorded financial activities.

Exception Handling

Exception handling in reconciliation involves identifying and resolving discrepancies between transaction records before the final settlement process ensures accurate financial reporting.

Float Management

Float management optimizes cash flow by monitoring the timing differences between reconciliation, which verifies transaction accuracy, and settlement, the actual transfer of funds.

Dispute Resolution

Dispute resolution involves reconciliation as a collaborative process aimed at restoring relationships, while settlement focuses on legally resolving conflicts through negotiated agreements.

Cut-off Time

The cut-off time for reconciliation is the deadline for matching and verifying transactions, while the cut-off time for settlement is the final point by which funds must be transferred to complete the payment process.

Gross Settlement

Gross settlement processes finalize individual transactions independently, enhancing reconciliation accuracy by reducing aggregation errors compared to net settlement methods.

Netting Process

The netting process reduces the number and value of transactions to be settled by offsetting mutual obligations between parties, streamlining the reconciliation of accounts and minimizing settlement risk. Effective reconciliation ensures accuracy in recording netted amounts, facilitating smoother settlement by confirming that all transactions align before final payment execution.

End-of-Day Closing

End-of-Day Closing ensures accurate financial records by performing Reconciliation to verify transaction consistency before finalizing Settlement for fund transfers.

Reconciliation vs Settlement Infographic

moneydif.com

moneydif.com