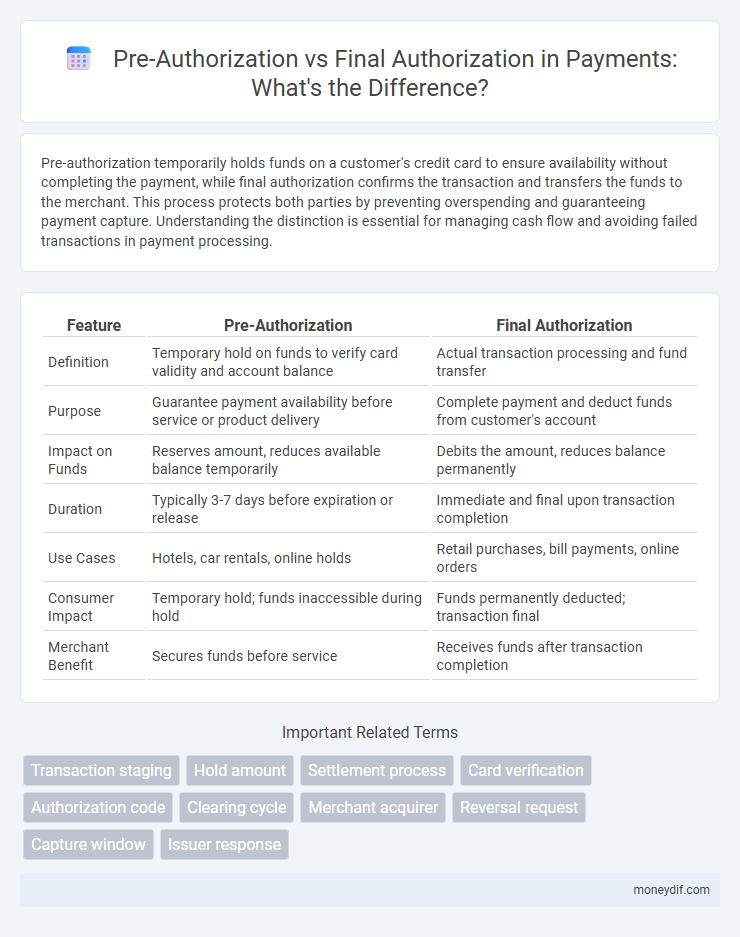

Pre-authorization temporarily holds funds on a customer's credit card to ensure availability without completing the payment, while final authorization confirms the transaction and transfers the funds to the merchant. This process protects both parties by preventing overspending and guaranteeing payment capture. Understanding the distinction is essential for managing cash flow and avoiding failed transactions in payment processing.

Table of Comparison

| Feature | Pre-Authorization | Final Authorization |

|---|---|---|

| Definition | Temporary hold on funds to verify card validity and account balance | Actual transaction processing and fund transfer |

| Purpose | Guarantee payment availability before service or product delivery | Complete payment and deduct funds from customer's account |

| Impact on Funds | Reserves amount, reduces available balance temporarily | Debits the amount, reduces balance permanently |

| Duration | Typically 3-7 days before expiration or release | Immediate and final upon transaction completion |

| Use Cases | Hotels, car rentals, online holds | Retail purchases, bill payments, online orders |

| Consumer Impact | Temporary hold; funds inaccessible during hold | Funds permanently deducted; transaction final |

| Merchant Benefit | Secures funds before service | Receives funds after transaction completion |

Understanding Pre-Authorization in Payment Processing

Pre-authorization in payment processing temporarily holds funds on a customer's credit or debit card to ensure availability without completing the transaction immediately. This practice safeguards merchants by securing payment before goods or services are delivered, reducing the risk of declined payments or chargebacks. Final authorization captures the held funds, completing the transaction once the purchase is confirmed or the service is provided.

What is Final Authorization?

Final authorization is the process where a merchant confirms and captures the transaction amount from the cardholder's account, completing the payment after a pre-authorization hold. This step guarantees the transfer of funds, ensuring the merchant receives the exact amount for the goods or services provided. It is a critical stage in payment processing that converts the pre-authorized hold into a settled transaction on the card issuer's ledger.

Key Differences Between Pre-Authorization and Final Authorization

Pre-authorization reserves funds on a customer's payment method but does not immediately transfer money to the merchant, ensuring availability without completing the transaction. Final authorization confirms the actual transfer of funds, completing the payment process and updating the merchant's account balance. Key differences include timing of fund capture, impact on customer's available balance, and transaction finality in payment processing.

Benefits of Using Pre-Authorization

Pre-authorization secures funds on a customer's card, reducing the risk of declined transactions during final purchase, which enhances cash flow reliability for merchants. It enables businesses like hotels and car rentals to verify card validity and available credit before providing services, minimizing fraud and chargebacks. This process improves customer trust by ensuring transparent payment handling without immediately capturing funds.

Common Use Cases for Pre-Authorization

Pre-authorization is commonly used in industries such as hospitality and car rentals to temporarily hold funds on a customer's credit card before the final transaction amount is determined. This process ensures the availability of funds and reduces the risk of payment failure during final authorization. Retailers also utilize pre-authorization during online purchases to verify card validity and prevent fraud before completing the sale.

How Final Authorization Completes a Transaction

Final authorization confirms the completion of a payment by validating the pre-authorized amount against available funds and merchant requirements. It updates the payment status, enabling the merchant to capture the funds and finalize the sale. This step ensures funds are securely transferred from the cardholder to the merchant, completing the transaction lifecycle.

Risks and Challenges: Pre-Auth vs Final Auth

Pre-authorization holds funds temporarily, reducing buyer fraud risk but exposing merchants to potential fund expiration or partial capture losses. Final authorization confirms the transaction amount, securing payment but increasing risk of chargebacks if fulfillment issues arise. Managing the timing and accuracy between pre-authorization and final authorization is critical to minimize financial risks and maintain customer trust.

Impact on Cardholder Experience

Pre-authorization holds a specified amount on the cardholder's credit limit without immediate charge, providing transparency and control over pending transactions, which can enhance trust and reduce disputes. Final authorization completes the payment by capturing the held amount, ensuring the cardholder's balance reflects the accurate spend and preventing multiple holds that might confuse or inconvenience them. Efficient management of both pre-authorization and final authorization processes reduces declined transactions and improves overall cardholder satisfaction by providing clarity and reliability in payment experiences.

Best Practices for Managing Payment Authorizations

Effective management of payment authorizations involves obtaining pre-authorization to verify cardholder funds and reduce fraud risk, followed by final authorization to capture the exact transaction amount. Best practices include setting appropriate expiration times for pre-authorizations to prevent declined final captures and using transaction data consistency to avoid mismatches. Monitoring authorization holds and promptly releasing unused pre-authorizations improves customer experience and optimizes cash flow.

Choosing the Right Authorization Method for Your Business

Pre-authorization holds funds temporarily to confirm cardholder validity and sufficient balance without finalizing the transaction, ideal for businesses requiring reservation or fraud prevention. Final authorization completes the payment by capturing funds, suitable for immediate sales where goods or services are delivered at once. Selecting the right authorization method depends on business model, transaction risk, and cash flow needs, ensuring optimal security and customer experience.

Important Terms

Transaction staging

Transaction staging involves temporarily holding funds during pre-authorization to ensure availability without completing the payment, while final authorization confirms and captures the exact amount, completing the transaction. Effective management of these stages minimizes payment declines and optimizes cash flow for merchants.

Hold amount

The hold amount in pre-authorization temporarily reserves funds on a cardholder's account without completing the transaction, ensuring availability for the final authorization, which is the actual capture and settlement of payment. Pre-authorization holds reduce the available credit limit, while the final authorization finalizes the charge and updates the merchant's account with the exact transaction amount.

Settlement process

The settlement process involves converting a pre-authorization hold on funds into a final authorization, confirming the actual transaction amount for payment completion. Pre-authorization temporarily reserves funds, while final authorization captures the exact charge, ensuring accurate billing and fund transfer.

Card verification

Card verification involves validating cardholder information during pre-authorization to ensure funds availability without immediate charge, while final authorization confirms and completes the transaction, capturing the exact amount for settlement. Pre-authorization holds a specific amount temporarily to reduce fraud risk, with final authorization converting this hold into a charge upon service completion or product delivery.

Authorization code

Authorization code is a unique identifier generated during the pre-authorization process, confirming the cardholder's funds availability without completing the transaction. Final authorization occurs when the merchant submits the transaction for settlement, validating the funds and converting the pre-authorization code into a completed payment.

Clearing cycle

The clearing cycle involves the transition from pre-authorization, which holds funds temporarily during a transaction, to final authorization that completes the payment by confirming and settling the exact amount. This process ensures accurate fund capture, reducing the risk of declined transactions and financial discrepancies between merchants and cardholders.

Merchant acquirer

Merchant acquirers handle the authorization process by first obtaining pre-authorization to verify the availability of funds without capturing the payment, ensuring transaction validity and reducing fraud risks. Final authorization completes the payment by capturing the funds, allowing the merchant to settle the transaction and receive funds from the issuing bank.

Reversal request

A reversal request occurs when a pre-authorization hold on a payment is released before the final authorization or settlement is completed, ensuring funds are not captured unnecessarily. This process differs from final authorization, which confirms the actual transaction amount to be charged and initiates fund transfer from the cardholder to the merchant.

Capture window

Capture window defines the timeframe between pre-authorization and final authorization during which a merchant must submit the capture request to secure funds for a transaction. This window ensures the pre-authorized amount remains valid before being finalized, typically spanning from 3 to 30 days depending on card issuer or payment gateway policies.

Issuer response

Issuer response during pre-authorization typically involves a temporary hold on funds, confirming cardholder's credit availability without finalizing the transaction. Final authorization triggers the actual transfer of funds, where the issuer approves or declines the payment based on current account status and fraud checks.

pre-authorization vs final authorization Infographic

moneydif.com

moneydif.com