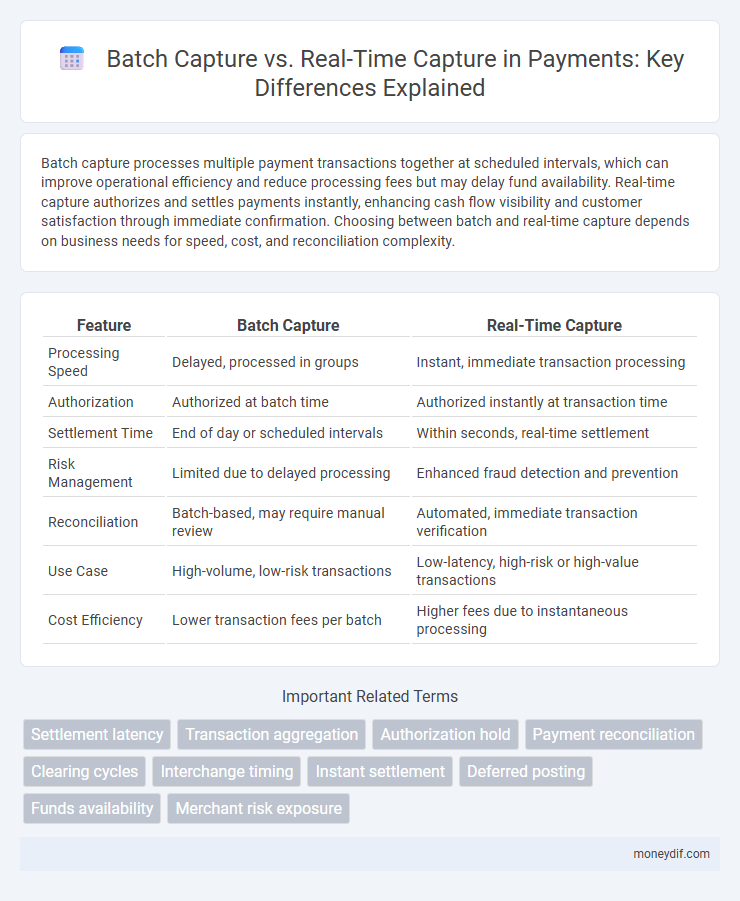

Batch capture processes multiple payment transactions together at scheduled intervals, which can improve operational efficiency and reduce processing fees but may delay fund availability. Real-time capture authorizes and settles payments instantly, enhancing cash flow visibility and customer satisfaction through immediate confirmation. Choosing between batch and real-time capture depends on business needs for speed, cost, and reconciliation complexity.

Table of Comparison

| Feature | Batch Capture | Real-Time Capture |

|---|---|---|

| Processing Speed | Delayed, processed in groups | Instant, immediate transaction processing |

| Authorization | Authorized at batch time | Authorized instantly at transaction time |

| Settlement Time | End of day or scheduled intervals | Within seconds, real-time settlement |

| Risk Management | Limited due to delayed processing | Enhanced fraud detection and prevention |

| Reconciliation | Batch-based, may require manual review | Automated, immediate transaction verification |

| Use Case | High-volume, low-risk transactions | Low-latency, high-risk or high-value transactions |

| Cost Efficiency | Lower transaction fees per batch | Higher fees due to instantaneous processing |

Understanding Batch Capture in Payment Processing

Batch capture in payment processing involves collecting multiple payment transactions and processing them together at a scheduled time, typically at the end of a business day. This method reduces transaction fees and simplifies reconciliation by aggregating payments before submission to the payment gateway or processor. Batch capture contrasts with real-time capture, which processes each transaction individually and immediately, offering faster fund availability but often incurring higher costs.

What Is Real-Time Capture in Payment Systems?

Real-time capture in payment systems refers to the immediate authorization and settlement of a transaction at the point of sale, ensuring instant confirmation and fund transfer. This method reduces the risk of declined or fraudulent transactions by validating payment details instantly with issuing banks. Merchants benefit from improved cash flow and enhanced customer experience through faster transaction processing and immediate fund availability.

Key Differences: Batch Capture vs. Real-Time Capture

Batch capture consolidates multiple transactions for processing at scheduled intervals, improving efficiency in high-volume payment environments but introducing settlement delays. Real-time capture processes each transaction immediately, enabling instant authorization and faster fund availability, crucial for time-sensitive sales. Key differences include processing speed, settlement timing, and impact on cash flow management.

Advantages of Batch Capture for Merchants

Batch capture allows merchants to process multiple transactions simultaneously, reducing processing fees and minimizing the need for constant system monitoring. This method enhances cash flow predictability by consolidating payments into a single deposit, simplifying accounting and reconciliation. Merchants benefit from lower operational costs and improved efficiency, especially in high-volume environments where real-time capture could cause system bottlenecks.

Benefits of Real-Time Capture for Customers

Real-time capture improves customer experience by providing instant transaction confirmation and reducing payment errors, enhancing transparency and trust. It enables quicker access to funds, which increases cash flow efficiency for both consumers and businesses. Immediate authorization and settlement decrease the likelihood of disputes and chargebacks, fostering greater payment security.

Security Implications in Batch vs. Real-Time Capture

Batch capture processes multiple payment transactions collectively at scheduled intervals, increasing exposure to potential data breaches due to prolonged storage of sensitive information. Real-time capture reduces security risks by instantly authorizing and transmitting payment data, minimizing the window for interception or fraudulent access. PCI-DSS compliance is more straightforward with real-time capture as it limits the retention of cardholder data compared to batch processing environments.

Transaction Speed: Batch vs. Real-Time Payment Capture

Real-time payment capture processes transactions instantly, significantly reducing payment settlement times and enhancing cash flow management for businesses. Batch capture groups multiple transactions, processing them collectively at scheduled intervals, which may delay transaction settlements but can improve operational efficiency for high-volume merchants. Choosing between batch and real-time capture depends on balancing the need for immediate transaction speed against the benefits of streamlined processing and cost optimization.

Cost Comparison: Batch Capture and Real-Time Capture

Batch capture reduces processing fees by consolidating multiple transactions into a single submission, lowering per-transaction costs and minimizing interchange fees. Real-time capture incurs higher costs due to immediate authorization and settlement, requiring more robust infrastructure and increasing network fees. Merchants weighing cost efficiency prioritize batch capture for lower operational expenses, while real-time capture incurs premium charges for speed and improved cash flow.

Use Cases: When to Choose Batch or Real-Time Capture

Batch capture is ideal for businesses processing large volumes of transactions, such as retail chains or subscription services, where consolidating payments reduces processing fees and simplifies reconciliation. Real-time capture suits high-risk or high-value transactions like online purchases or service bookings, enabling immediate fraud detection and authorization to enhance security and customer experience. Selecting between batch and real-time capture depends on transaction volume, risk tolerance, and the need for immediate payment confirmation.

Future Trends in Payment Capture Technologies

Future trends in payment capture technologies emphasize the integration of AI-driven batch capture systems that enhance processing speed and accuracy by analyzing large transaction volumes simultaneously. Real-time capture solutions are evolving with advanced machine learning algorithms to provide instantaneous fraud detection and dynamic risk assessment during transactions. The convergence of these technologies is expected to optimize payment workflows, reduce operational costs, and improve overall transaction security in emerging digital payment ecosystems.

Important Terms

Settlement latency

Settlement latency significantly decreases with real-time capture by processing transactions instantly, whereas batch capture introduces delays due to accumulation and periodic processing of multiple payments. Efficient real-time settlement systems enhance cash flow management and reduce counterparty risk compared to traditional batch-based settlement methods.

Transaction aggregation

Transaction aggregation enhances payment processing efficiency by consolidating multiple transactions into a single batch, reducing processing fees and minimizing network load compared to real-time capture, which individually processes each transaction immediately for faster settlement and improved cash flow visibility. Batch capture is commonly used in industries with large transaction volumes like retail and hospitality, while real-time capture suits high-risk or time-sensitive sectors such as e-commerce and financial services.

Authorization hold

Authorization hold temporarily reserves funds on a customer's credit card during a transaction, ensuring payment availability without immediate charge. Batch capture processes settlements in grouped intervals, potentially delaying fund transfer, while real-time capture immediately charges the card, reducing risk and improving cash flow efficiency.

Payment reconciliation

Payment reconciliation involves matching batch capture transactions, which are grouped and processed at scheduled intervals, against real-time capture where transactions are authorized and settled instantly. Real-time capture enhances cash flow visibility and accuracy in reconciliation by reducing discrepancies and settlement delays commonly associated with batch processing.

Clearing cycles

Clearing cycles determine the timing and frequency of transaction settlements, where batch capture processes accumulate transactions for periodic clearing, optimizing operational efficiency but increasing settlement delay; real-time capture enables immediate transaction processing and clearing, enhancing cash flow and reducing counterparty risk. Financial institutions balance clearing cycle selection based on transaction volume, settlement speed requirements, and risk management objectives.

Interchange timing

Interchange timing significantly influences transaction processing efficiency, with batch capture aggregating multiple transactions for periodic processing, reducing immediate network load but increasing settlement delay. Real-time capture processes each transaction instantaneously, enhancing fund availability and fraud detection while demanding robust infrastructure to handle high transaction volumes continuously.

Instant settlement

Instant settlement accelerates transaction finalization by enabling real-time capture, reducing the delay inherent in batch capture which processes payments in scheduled groups. Real-time capture ensures immediate fund authorization and transfer, enhancing cash flow and minimizing settlement risk compared to batch processing's end-of-day reconciliations.

Deferred posting

Deferred posting enables financial institutions to process batch capture transactions collectively at a later time, optimizing operational efficiency and reducing transaction costs. Real-time capture, in contrast, records and posts each transaction instantly, enhancing transaction accuracy and providing immediate account updates.

Funds availability

Batch capture processes transactions in groups at scheduled intervals, resulting in delayed funds availability, whereas real-time capture authorizes and settles payments immediately, ensuring faster access to funds. Financial institutions often prefer real-time capture for improved cash flow and reduced credit risk.

Merchant risk exposure

Merchant risk exposure varies significantly between batch capture and real-time capture methods, with batch capture heightening the risk of chargebacks and fraud due to delayed transaction processing and limited fraud screening. Real-time capture enhances fraud detection and reduces financial risks by enabling immediate authorization, verification, and transaction validation at the point of sale.

batch capture vs real-time capture Infographic

moneydif.com

moneydif.com