Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes both categorize businesses but serve different purposes in payment processing and industry analysis. MCC codes are primarily used by credit card networks to identify the type of business for transaction processing and rewards programs, while SIC codes classify industries for government statistical reporting and regulatory purposes. Understanding the distinction between MCC and SIC codes ensures accurate payment categorization and compliance across financial and regulatory frameworks.

Table of Comparison

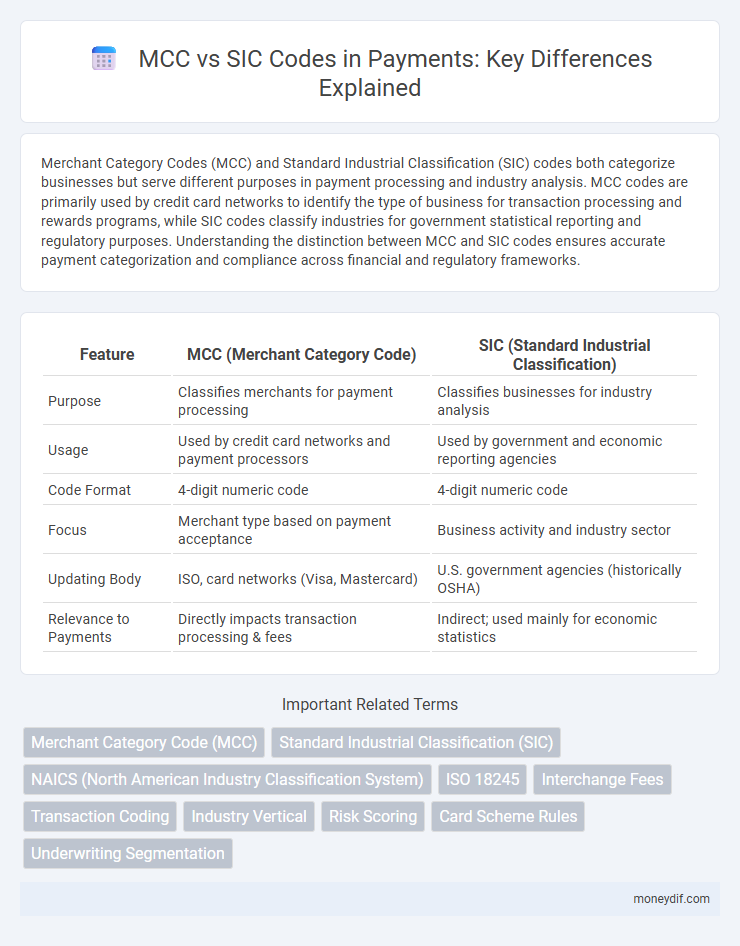

| Feature | MCC (Merchant Category Code) | SIC (Standard Industrial Classification) |

|---|---|---|

| Purpose | Classifies merchants for payment processing | Classifies businesses for industry analysis |

| Usage | Used by credit card networks and payment processors | Used by government and economic reporting agencies |

| Code Format | 4-digit numeric code | 4-digit numeric code |

| Focus | Merchant type based on payment acceptance | Business activity and industry sector |

| Updating Body | ISO, card networks (Visa, Mastercard) | U.S. government agencies (historically OSHA) |

| Relevance to Payments | Directly impacts transaction processing & fees | Indirect; used mainly for economic statistics |

Understanding MCC and SIC Codes in Payment Processing

Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes are essential for accurately categorizing businesses in payment processing. MCC codes, assigned by payment networks like Visa and Mastercard, facilitate transaction routing, risk assessment, and fee determination, while SIC codes, developed by the U.S. government, classify industries for statistical and regulatory purposes. Understanding the differences and applications of MCC and SIC codes enhances fraud detection and compliance in payment systems.

Key Differences Between MCC and SIC Codes

MCC (Merchant Category Codes) classify businesses based on the type of goods or services they provide, primarily used in payment processing and credit card transactions, while SIC (Standard Industrial Classification) codes categorize industries for statistical and regulatory purposes. MCC codes are four-digit numbers assigned by payment networks like Visa and Mastercard to streamline transaction routing and fraud detection, whereas SIC codes are four-digit codes developed by the U.S. government to analyze economic data and industry trends. The key difference lies in their application: MCC focuses on transaction classification in the payment ecosystem, while SIC serves broader industry categorization and regulatory reporting functions.

Why MCC Codes Matter for Merchant Transactions

MCC codes categorize merchant transactions to ensure accurate processing and reporting within payment networks. These codes influence interchange fees, fraud detection, and compliance with card brand regulations. Merchants benefit from properly assigned MCC codes through optimized transaction routing and eligibility for specific rewards or benefits.

How SIC Codes Are Used in Payment Systems

SIC codes classify businesses based on their primary activities, enabling payment systems to identify merchant types and flag high-risk transactions. Payment processors use SIC codes to apply customized fraud detection algorithms and determine transaction fees accurately. These codes also support compliance with regulatory requirements by categorizing merchants during payment routing and settlement processes.

Impacts of MCC and SIC Codes on Interchange Fees

MCC (Merchant Category Codes) and SIC (Standard Industrial Classification) codes directly influence interchange fees by categorizing merchant types and transaction types, which payment processors use to determine risk and fee structures. MCC codes have a more significant impact on interchange rates because they are standardized by card networks and associated with specific merchant categories, while SIC codes are broader industry classifications that may not align precisely with payment processing models. Transactions under higher-risk MCC categories often incur increased interchange fees, affecting overall payment costs for merchants and financial institutions.

Choosing the Right Code: MCC vs SIC for Businesses

Choosing the right code for business transactions significantly impacts payment processing and compliance, with MCC (Merchant Category Code) primarily used in credit card networks to categorize merchants by business type, while SIC (Standard Industrial Classification) codes classify industries for statistical purposes. MCC codes influence transaction fees and reward eligibility, making them critical for optimizing payment acceptance strategies. Selecting the appropriate code ensures accurate reporting, regulatory adherence, and streamlined payment processing tailored to specific business operations.

Regulatory Implications of MCC and SIC Codes

MCC (Merchant Category Codes) and SIC (Standard Industrial Classification) codes both classify business types but MCC codes are primarily used in payment processing to determine transaction type for regulatory compliance such as AML (Anti-Money Laundering) and PCI DSS (Payment Card Industry Data Security Standard). Regulatory frameworks rely on MCC codes to enforce restrictions on payment acceptance, fraud detection, and risk management while SIC codes are mostly used for business reporting and statistical analysis by government agencies. Accurate MCC classification is critical for financial institutions to adhere to Payment Card Network rules and ensure proper transaction routing and compliance monitoring.

Common Mistakes in MCC and SIC Code Assignment

Common mistakes in MCC (Merchant Category Code) and SIC (Standard Industrial Classification) code assignment often arise from confusing the distinct classification purposes and criteria of each system, leading to inaccurate merchant identification and transaction categorization. Misclassification can result in incorrect processing fees, compliance issues, and reporting errors, impacting both merchants and payment processors. Ensuring precise code assignment requires thorough understanding of industry-specific guidelines and regular updates aligning with evolving business activities and merchant profiles.

Optimizing Payment Processing with Correct Codes

Optimizing payment processing relies on accurately using Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes to categorize transactions. MCC codes enhance credit card network routing and fraud detection, while SIC codes provide detailed industry classification vital for regulatory compliance and reporting. Using the correct codes minimizes processing errors, reduces chargebacks, and ensures smoother transaction approvals.

Future Trends: Evolution of MCC and SIC in Payments

Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes are evolving to support more granular transaction data in payment processing, enhancing fraud detection and personalized marketing. The integration of AI and machine learning is driving the dynamic updating of MCC and SIC codes, enabling real-time classification and improved risk management. Future trends indicate a convergence toward standardized, globally interoperable coding systems that facilitate seamless cross-border payments and regulatory compliance.

Important Terms

Merchant Category Code (MCC)

Merchant Category Code (MCC) is a four-digit number assigned by credit card companies to classify businesses by the type of goods or services they provide, while Standard Industrial Classification (SIC) codes are four-digit codes used by government agencies to categorize industries for statistical purposes. MCC focuses on transaction categorization for payment processing and fraud prevention, whereas SIC serves broader economic analysis and regulatory compliance.

Standard Industrial Classification (SIC)

The Standard Industrial Classification (SIC) system categorizes industries using four-digit codes to standardize data collection and analysis across economic sectors, while Merchant Category Codes (MCC) classify businesses based on transaction types for payment processing and fraud prevention. SIC codes focus on broader industrial activities, whereas MCCs are tailored for identifying merchant types in credit card transactions.

NAICS (North American Industry Classification System)

The North American Industry Classification System (NAICS) offers a more detailed and updated framework for classifying business establishments compared to the Standard Industrial Classification (SIC) system, allowing for better alignment with modern economic activities. Merchant Category Codes (MCC) differ significantly as they categorize payment processing transactions for credit card networks rather than industry types, making MCC more relevant for financial institutions and payment acceptance rather than economic data analysis.

ISO 18245

ISO 18245 establishes a global standard for Merchant Category Codes (MCC), facilitating uniform classification of merchants for payment processing. Unlike Standard Industrial Classification (SIC) codes, which categorize businesses primarily for statistical purposes, MCCs focus specifically on transaction-based merchant categorization to enhance credit card authorization and reporting accuracy.

Interchange Fees

Interchange fees vary depending on the Merchant Category Code (MCC) assigned to a business, which categorizes merchants based on their primary line of business, influencing the fee structure set by card networks. Standard Industrial Classification (SIC) codes, while similar, are less commonly used in payment processing but can impact risk assessment and fee negotiation by financial institutions.

Transaction Coding

Transaction coding involves categorizing financial transactions using standardized systems like Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes, each serving specific purposes in payment processing and industry classification. MCC codes are primarily used by credit card networks to identify merchant types during transactions, while SIC codes classify businesses by industry for statistical analysis and regulatory compliance.

Industry Vertical

Industry verticals are often classified using standardized codes such as Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes, each serving distinct purposes in business categorization and regulatory compliance. MCC codes primarily facilitate transaction processing and fraud detection in payment systems, while SIC codes offer a broader framework for analyzing economic activities and statistical reporting across various sectors.

Risk Scoring

Risk scoring models that integrate Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes enhance fraud detection accuracy by leveraging detailed industry-specific transaction patterns. Utilizing MCC provides real-time categorization of merchant transactions, while SIC codes offer historical and regulatory context, enabling more precise risk assessments in financial and retail sectors.

Card Scheme Rules

Card Scheme Rules establish specific guidelines that differentiate Merchant Category Codes (MCC) from Standard Industrial Classification (SIC) codes, where MCCs categorize merchants for payment processing based on transaction types while SIC codes classify businesses by industry for statistical analysis. Compliance with these rules ensures accurate transaction routing, fraud prevention, and tailored risk management within payment networks.

Underwriting Segmentation

Underwriting segmentation utilizes Merchant Category Codes (MCC) and Standard Industrial Classification (SIC) codes to categorize businesses by industry, enabling risk-based pricing and tailored insurance solutions. MCC codes provide granular transaction-level insights, while SIC codes offer broader industry classifications, together enhancing accuracy in risk assessment for underwriting decisions.

MCC vs SIC Infographic

moneydif.com

moneydif.com